Every day more and more information appears regarding the emerging non-state pension funds, which are designed so that pensioners can invest their personal funds and earn good amounts of money from it. But many are skeptical about this kind of deposit, because they do not trust money to unknown organizations.

In fact, there is nothing to worry about if you have started investing money in the fund, because this is a good opportunity for any pensioner to receive a stable increase in their pension. Pension funds can be a very profitable and profitable business, if only you use the services of a reliable and proven fund. This is exactly what Neftegarant is. It has been on the market since 2014 and in such a short period of time has managed to provide millions of pensioners.

About the fund

The foundation in question was established in May 2000. The goal was the implementation of non-state pension provision for Rosneft employees. The activities of the fund are licensed by the Ministry of Labor and Social Development of the Russian Federation, that is, the company is authorized to act in the direction under consideration. In this case, the validity period of this act is not limited.

The creation of Neftegarant was dictated by the need to increase the level of social security for employees of the company in question after they complete their working career. Subsequently, the activities of Neftegarant began to extend to other categories of citizens, including those who are not employees of Rosneft.

Neftegarant positions itself as a company that offers the use of individual and collective programs to ensure a decent level of pension coverage for citizens who have invested in the fund.

What new name did it get?

In 2020, the non-state fund Neftegarant announced that there would be a name change. Now this organization is called “Non-state pension fund Evolution”. For this reason, adjustments were made to the company's statutory documentation.

The decision to change the name was made because a new strategy was introduced, which is necessary for the development of the fund’s activities . After making this change, there was no change in the direction of the NPF’s activities, as before, clients invest funds to ensure a decent level of pension security.

The services of the fund can be used not only by citizens who have reached retirement age, but also by the younger generation. This opportunity is provided to ensure that a citizen makes pension contributions while working and ensures that there are enough funds in the account by the time he retires.

Attention! The name change did not entail the need to re-register agreements with citizens who had previously been Neftegarant’s clients. This is due to the fact that when making adjustments, the head of the fund announced that the organization undertakes to fully fulfill the obligations assumed earlier.

Profitability and reliability rating

Depending on which organization will set the rating for NPFs, this indicator may differ. However, the position of the national rating agency is most often taken into account. This organization indicated that in October 2020, after studying the activities of the Neftegarant fund, one can come to the conclusion that the company is quite reliable and profitable.

For this reason, it is rated as AAA. This indicator is used to indicate the maximum reliability of the organization. Also in October 2020, a review of the activities of the fund in question was carried out, as a result of which it was recognized that it is a fairly reliable organization, as a result of which a maximum rating was assigned.

You also need to consider the profitability indicators of a non-governmental organization. If we take 2020 data as a basis, we can come to the conclusion that based on the results of the fund’s activities, pension accruals for citizens increased by approximately 1.39%.

At the same time, it is important to understand that the result of investing funds in the past does not determine the amount of income in the future. This suggests that there may be an increase or decrease in the amount of profitability from the activity in question. Government authorities do not inform that when investing pension funds, income may not always be obtained.

Fund returns by year

Every year the company brings more and more profitability from the placement of funds from pension reserves. You should look at the data in the table.

Indicators Profitability

| Indicators | Profitability | ||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| 4,38 | 14,11 | 9,26 | 6,51 | 6,18 | 10,90 | 8,29 | 8,31 | 9,86 | 10,41 |

You should pay close attention to the following points:

- Income when placing reserves can not only increase, but also decrease.

- Past investments cannot be decisive for calculating future income.

- The state does not guarantee profitability when placing reserves.

- When concluding an agreement, you should read the rules of the pension fund.

Programs of NPF Neftegarant

The non-governmental organization JSC Neftegarant has developed several pension schemes that can be used by a citizen when drawing up an agreement to invest funds in a company. The program data changes depending on how the payment is made, urgently or for life. In this situation, the right to choose remains with the citizen who is entering a well-deserved retirement.

The following provisions need to be taken into account:

- for how long does the citizen wish to receive contributions from the pension authority;

- the amount of the additional pension, depending on how shorter the payment period is set, the amount of income to the person’s account changes;

- the citizen has a desire for his funds remaining in the account to be inherited by relatives after death;

- it is also necessary to take into account whether the citizen wants to be able to terminate the agreement earlier than the established period.

The lifetime scheme provides that the accumulated amount will be equally distributed for calculating benefits. With urgent payment, a short period for providing money is established, after which payments are completed. With the lifetime option, you can use the option to terminate the agreement only before the pension is assigned.

In the second situation, the citizen has the right to terminate the relationship at any time convenient for him. Similar rules apply to establishing succession in relation to inheritance and changing the program under which pension payments are assigned.

Is it worth transferring your pension here?

I cannot advise anything regarding Neftegarant: responsibility for provision in old age is individual.

On the one side:

- attractive programs;

- Neftegarant's growth both in terms of clients and financial assets.

On the other hand, there is the VTB management company, known for its “shark” habits (it recently absorbed another fund). Whether NPF Neftegarant will remain an independent player or will be eaten up, time will tell.

Addresses, telephone and official website

To contact the organization in question, a citizen may need contact information.

Including:

- the address, which is designated as: Moscow city, Kosmodamianskaya embankment st., 52, building 5;

- For calls the federal number is used: 8 800 700-65-54;

- This organization works only on weekdays from 09.00 to 18.00, while on Fridays there is a shortened day until 16.45.

Weekends should be considered Saturday and Sunday.

Important! To send a letter you need to use: 115054, Moscow, Kosmodamianskaya embankment, 52, building 5

How to conclude an agreement

Currently, several options for formalizing the agreement are provided. In particular, a person has the opportunity to decide at his own discretion which method he will use:

- personal application to a non-state pension fund to draw up an act. This can be done at the location of the head office or individual divisions located in the region;

- contacting an employee of the organization where the citizen works.

The second option can be used provided that the citizen is an employee of the Rosneft company. In other situations, only the option of contacting the fund can be used.

Customer support of NPF Surgutneftegaz

Users of the pension fund’s personal account can find the answer to their question using a special section of the organization’s website: all useful information is posted on the “Question-Answer” page. For further advice you will need:

- Call number 8 . Calls to this phone number are free from any region of the Russian Federation.

- Send a message to technical support from the “Write to the Fund” section. To receive a response, the client will need to provide their name and email address, as well as a detailed description of the problem that has arisen.

- Leave a request for a call back. When the pension fund client’s phone number is indicated, all that remains is not to miss the dispatcher’s call. If the user does not have time to answer the incoming call, he will need to submit a second request to contact technical support.

Technical support staff respond to the client within a few minutes.

Personal account on the Neftegarant website

Today, the use of the Internet has become widespread; for this reason, citizens strive to obtain information about the status of their account or other important information using their personal account on the official website.

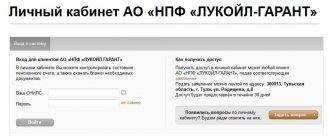

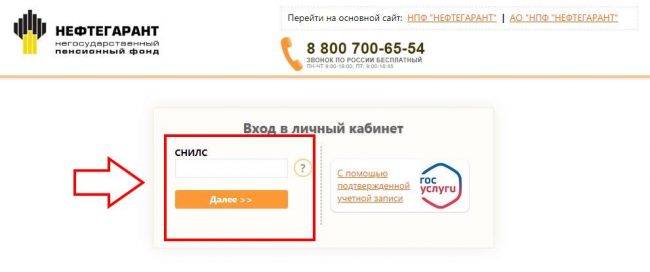

You can pass authorization using the following options:

- indication of SNILS number and password;

- confirmation of registration through State Services.

A distinctive feature is that a citizen who has previously entered into an agreement with representatives of the organization in question can use a personal account on the website of a non-state pension fund. If funds have already been transferred to the organization once, there is no need to register separately.

When used for the first time, a citizen will need to enter a password and data from the act by which his identity is verified. If the agreement has acquired legal force, then the citizen will be required to log into his personal account and change his login information. When the contract is signed, but access to the resource remains closed, you need to use the help of the support service.

The site provides the ability to recover your password, for which a special form is used. The citizen will need to press the “Forgot password” button and go through recovery when using SNILS.

Registration step by step

To register on the portal, a citizen initially needs to enter into an agreement with the fund. After this you need to perform the following steps:

- open the official website of the company;

- click on the registration button;

- enter SNILS and passport data;

- receive a temporary password via SMS;

- Log in to your personal account and change your password at your discretion.

Next, a person has the opportunity to use his personal account to obtain information about his funded pension.

Advantages and disadvantages

I will note the pros and cons of NPF Neftegarant.

In my opinion, the advantages:

- a fund large in terms of assets and population coverage;

- professional management company VTB;

- programs with private clients in Neftegarant provide for the withdrawal of funds (this is written on the website);

- the necessary information (reporting and news) is available and published on time;

- There is a personal account and a working hotline telephone.

Disadvantages of Neftegarant:

- there is a risk of absorption by VTB Group;

- the fund has attracted defrauded investors of the acquired funds (legal proceedings and payments may begin, which will affect clients’ accounts).

What information can be obtained from the LC?

There are several areas in which a citizen can find information when using the portal of the organization in question.

These include:

- constantly has access to the agreement in electronic format, if necessary, making adjustments to it;

- accounting for funds accumulated in a pension account;

- update information reflected in contracts. In this case, the citizen can fill out an application in electronic format and attach documentation to it;

- send scanned acts to the fund.

You can also find a calculator on the website that will help you calculate the amount of your future pension.

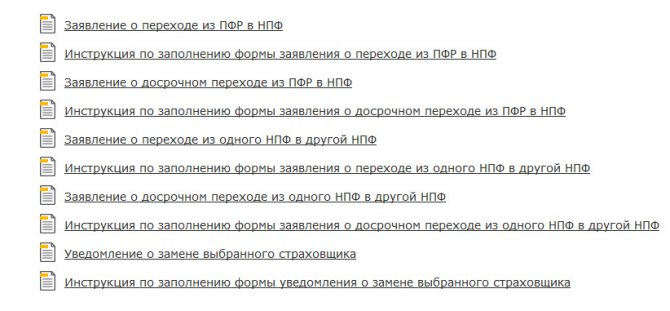

NPF Electric Power Industry personal account registration

To transfer your funded pension to the Electric Power Industry Non-State Pension Fund, you can contact a branch of the Fund that is convenient for you.

You need to have with you:

- Passport

- State pension insurance certificate (SNILS)

An agreement can only be concluded at a branch of the Fund.

You can submit an application to the Pension Fund of the Russian Federation for the transfer of pension savings:

- at the nearest Pension Fund branch;

- by mail. In this case, the application must be previously certified by a notary.

the picture is clickable