Existing legislation requires all entrepreneurs to submit various reports to the Pension Fund. Some reports must be filed monthly, while others must be filed quarterly or annually. However, no mistakes should be made in these documents. To help specialists quickly and successfully submit all required reports, online services for checking PFR reporting have been developed. Let's look at the nuances of their work in this material.

Often, errors in reports are associated with inattention or insufficient practice of a specialist in filling out forms. In this case, existing legislation provides for penalties.

What reports are submitted to the Pension Fund?

Currently, organizations are required to submit reports to the Pension Fund in the following forms:

- SZV-M;

- DSV-Z;

- ADV-6-2;

- SPV-1 and others.

In total there are about fifteen different types of reporting. Most entrepreneurs and organizations only need to prepare a few of them. For example, SZV-M and DSV-Z. SZV-M is a monthly form containing information about insured persons working at the enterprise. And for payers of additional contributions, a quarterly form DSV-3 is provided. Depending on the number of employees, reporting can be prepared electronically or in paper form. Since the listed types of documents are submitted most often, errors during preparation usually occur in them.

Checking PFR reports

23.09.2020

Added declaration on water tax (knd 1151072)

02.09.2020

Accounting. Added import of invoices from the Market Light program

15.06.2020

In declarations on transport tax, land tax and corporate property tax, as well as in the calculation of insurance premiums for the 2nd quarter of 2020, the possibility of applying tariffs and benefits in accordance with Federal Law No. 172-FZ dated 06/08/2020 has been implemented.

15.06.2020

In declarations on transport tax, land tax and corporate property tax, as well as in the calculation of insurance premiums for the 2nd quarter of 2020, the possibility of applying tariffs and benefits in accordance with Federal Law No. 172-FZ dated 06/08/2020 has been implemented.

10.06.2020

The form and format for submitting the consent of the taxpayer, fee payer, insurance premium payer, tax agent to inform about the presence of arrears and (or) debt for penalties, fines, interest in electronic form have been implemented. Menu: Reporting; Messages, requests and statements

08.06.2020

A new exchange format with client bank systems has been implemented (version 1.03). The new format came into force on 06/01/2020

27.05.2020

Section Reporting of the Federal Financial Markets (340-FZ) has been brought into compliance with the new reporting format (5.03)

22.05.2020

The Application for the provision of subsidies to small and medium-sized businesses operating in sectors of the Russian economy that were most affected by the worsening situation as a result of the spread of the new coronavirus infection has been implemented (Section: Reporting - Messages, requests and statements)

06.05.2020

The ability to generate an Application for confirmation of the main type of economic activity in electronic form has been implemented for submission to the Social Insurance Fund through electronic document management operators, the government services portal or the policyholder’s personal account on the Social Insurance Fund portal.

22.04.2020

A new document has been added (menu item in the purchase and sale section) - “Invoice for the transfer of finished products to storage locations.” The document can be used to document a product release operation (per shift, day or other period)

20.04.2020

Group issuance of acts for services rendered to individuals with automatic calculation of the amount of receivables.

15.04.2020

The calculation of insurance premiums has been implemented in accordance with Article 5 and Article 6 of the Federal Law of April 1, 2020 No. 102-FZ (Reduced tariff of insurance premiums for small and medium-sized businesses (SMEs)).

10.04.2020

New functionality has been implemented: Group (batch) issuance of documents (act or UPD) for the provision of similar services to counterparties at regular intervals

Check using CheckXML program

The Pension Fund has developed special free programs for checking statements - CheckXML and CheckPFR. When creating them, the developers relied on the Decree of the UPFR dated July 31, 2006 No. 192p “On the forms of documents for individual (personalized) registration in the compulsory pension insurance system and instructions for filling them out.” The essence of the programs is approximately the same. It consists of a format-logical verification of the information provided in the reports. That is, the distribution checks the specified data for compliance with the required format, the presence of typos, and extra characters. For example, the correctness of TIN, SNILS, addresses, compliance of digital data with control numbers, and so on.

Both programs are designed to check reports prepared in xml format. They can check the following files:

- personal data;

- statements of payment of insurance premiums;

- information about length of service and earnings in the forms SZV-6-1, SZV-6-2, SZV-6-3, SZV-4-1, SZV-4-2, ADV-6-3;

- forms for voluntary insurance contributions (DSV-1, DSV-3);

- death certificates;

- applications for exchange and issuance of a duplicate insurance certificate;

- RSV-2, RSV-3;

- SPV-1, SPV-2.

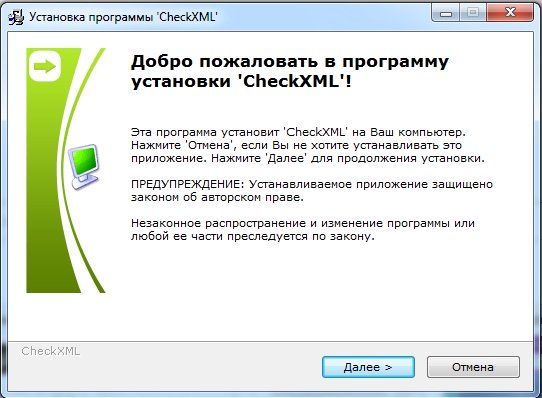

To work with the CheckXML program, you need to perform a simple installation procedure. The current version of the installation file can be downloaded from the official website of the Pension Fund.

After downloading, you need to open the archive and run the file highlighted in the figure below.

The installation will then start. In the first window that appears, you must click the “Next” button.

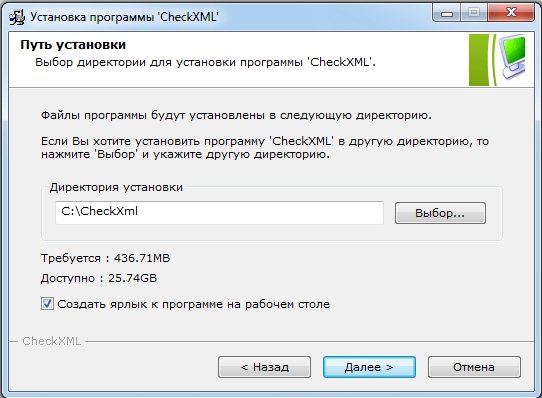

In the second window, you need to select the location where the program will be installed and click the “Next” button.

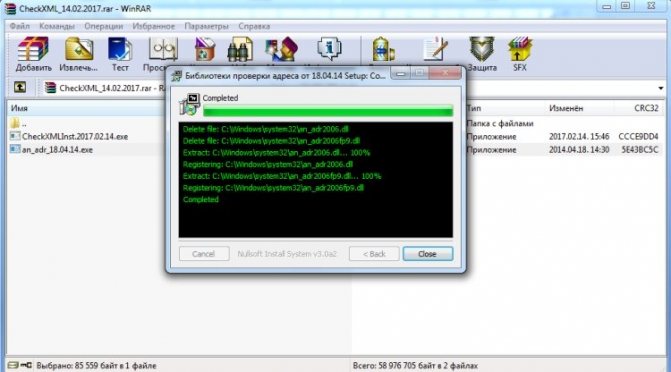

After installation is complete, you need to run the second file located in the archive. It stores the address verification library.

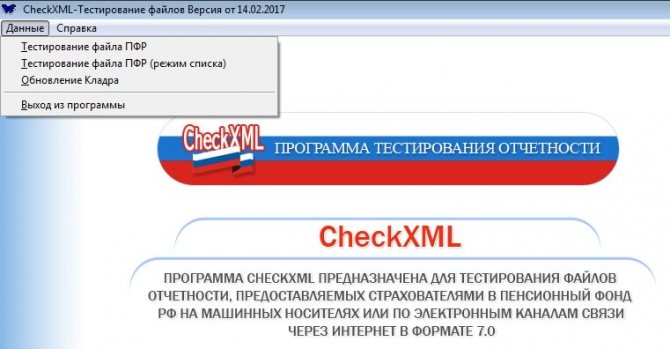

To get started, you need to launch the program, select the “Data” section and click the “Test PFR file” button.

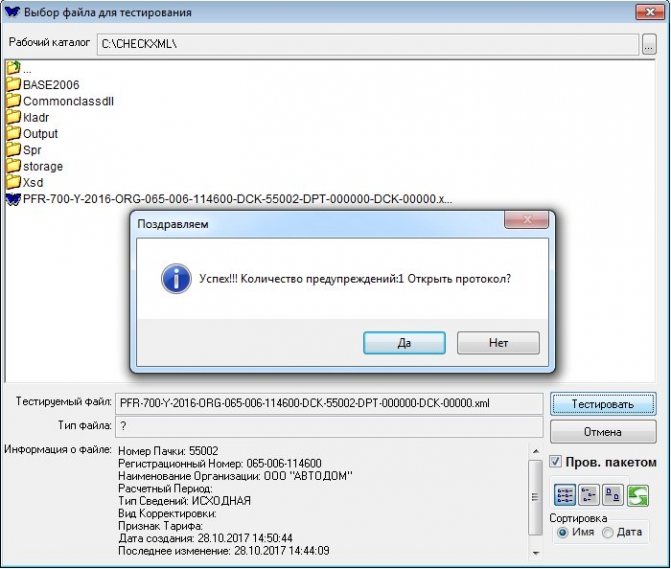

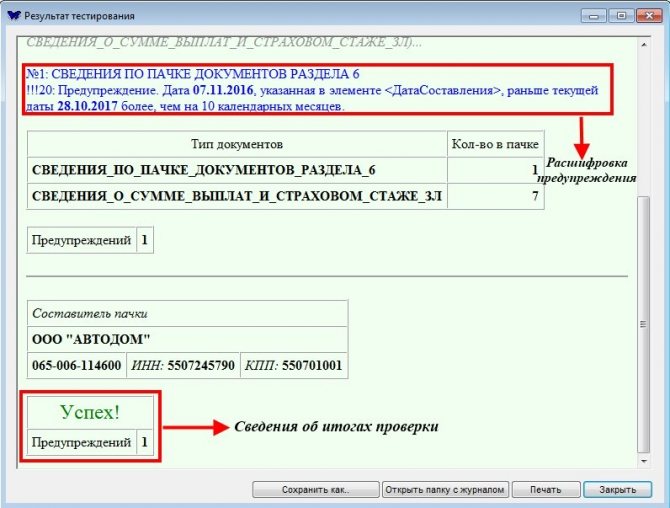

Then you need to select the reporting file on your computer and run the scan. After its completion, the result of the check will be displayed on the screen with a proposal to open the protocol.

The log contains more detailed information and explanations of the errors found.

Pension Fund database

The Pension Fund of the Russian Federation is a large government agency involved in the formation and distribution of pension accruals to the population. In addition, the functions of the Pension Fund of the Russian Federation include:

- Assignment of old-age pensions, as well as for certain categories of individuals entitled to receive payments;

- Registration of participants in the compulsory pension insurance program;

- Work with legal entities and individual entrepreneurs;

- Working with certificates for receiving maternity capital;

- Pension savings management;

- Issuance of pension certificates (SNILS);

- Consulting the population, etc.

All information about the Pension Fund's clients is contained in specialized databases. Some of them are in the public domain and can be obtained online. Data that is publicly available can be seen on the official website of the Pension Fund of the Russian Federation. To do this, you need to go to the website and select the necessary information from the list. Data located in the public domain on the site can be used for informational purposes only.

What data is contained in the Russian Pension Fund database

The most popular request in relation to the Pension Fund databases is to search for a SNILS number. You can find out in various ways, including online. To search for a SNILS number, you must enter the passport data, full name or TIN of an individual. SNILS may be required for various transactions, including employment or obtaining a loan.

Other information, such as the amount of pension contributions, the size of the pension, information about receiving maternity capital, etc., is confidential. It is impossible to obtain such data in relation to third parties.

To find out information about an individual or legal entity, you need good reasons for this. Such data can only be provided at the request of law enforcement agencies or bailiffs. Also, information contained in the database of the Pension Fund of the Russian Federation can be provided by department employees to private detectives upon presentation of a license. Such information may be required, for example, when vetting an individual entrepreneur as a potential business partner. If an entrepreneur has arrears in payments to the Pension Fund, this indirectly indicates his unprofessionalism and unreliability.

How to check financial statements in the Pension Fund online

You can check the Pension Fund report online without registration using various services available on the network. The principle of their operation is based on the use of the same programs developed by the Pension Fund. The only difference is that they do not need to be downloaded and installed, which means they can be used anywhere.

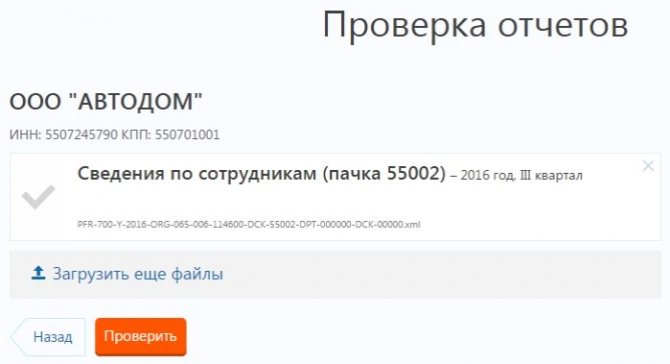

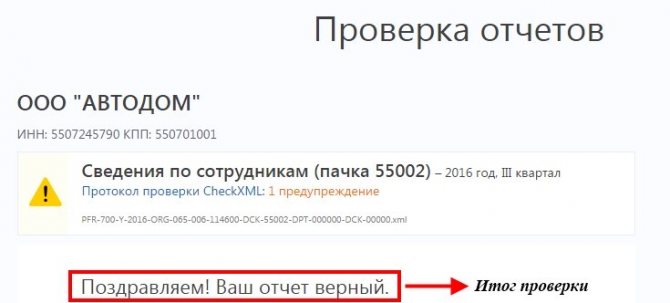

The most popular is checking the financial statements of the Pension Fund of Russia through Contour Online. To use it, just go to the website https://www.kontur-pf.ru/check, upload files to check and click the “Check” button.

Within a few seconds the system will provide the test result. In this way, checking PFR reports online is free of charge.

Online check of the report to the Pension Fund of Russia

In addition to using the CheckXML program on a personal basis, it is possible to work in the online verification service. The ability to check reports in the online service before sending them to the Pension Fund of Russia exists in specialized programs and is available to users of 1C-Reporting.

During such verification, reporting documents are transferred in encrypted form to a special server, where their format and logical control is carried out. Online verification is available for all formats of file documents sent to the Pension Fund.

It supports checking files created both in the program itself and documents uploaded using 1C-Reporting.

Pension Fund verification program +2NDFL 2014

It is impossible not to consider another program - PFR +2NDFL 2014, which allows you to simultaneously generate all the required reports and carry out a guaranteed check of the PFR and 2NDFL files. The advantage of the program is the posting of personalized reporting taking into account the requirements of 2014.

Correction of identified errors

Once errors are identified, they must be corrected. Otherwise, the Pension Fund will not accept the reports, and this may result in fines. Therefore, it is recommended that verification be carried out before sending documents to the department.

Among the most common errors are various types of typos and blots. For example, unnecessary punctuation marks, incorrect spelling of full name, inconsistency with SNILS, etc. The critical ones are:

- incorrect details;

- incorrect signature;

- incorrect file format.

In such cases, a resubmission of the report will be required. Errors related to the presence of spaces in SNILS and TIN, extra zeros in these codes, as well as hyphens and spaces when writing surnames, must be corrected. If they are found before reporting is submitted, then it is submitted with the code “output”. If errors are discovered after submission, then the corrected report must be submitted with the code “additional”. Also, supplementary reports are submitted if a discrepancy in SNILS and incorrect full names are identified.

There are errors, the correction of which is not mandatory unless other more significant errors are found in the documents. For example, the Pension Fund of Russia can forgive empty fields for recording full name and tax identification number, the use of the letter “ё”, apostrophes, brackets and Latin letters.

We emphasize that if the check fails, most likely the problem lies in the incorrect file format. You can visually determine whether the file meets existing requirements. In particular, its name should look like this: