Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

All organizations and individual employers must pay contributions for pension insurance to the Pension Fund of Russia at their place of location or residence. The territorial department of the Pension Fund receives information from the Federal Tax Service about the state registration of the company and registers it within five days. Individual entrepreneurs register with the fund themselves after hiring their first employee. In this case, each person is assigned a PFR registration number.

The number consists of twelve digits, which are divided into three blocks:

- The first three digits are the code of the region of registration of the payer according to the Pension Fund of Russia classifier. These region codes do not match the classifiers used by other government agencies. The codes of all regions are presented in the letter of the Pension Fund of the Russian Federation dated June 30, 2006 No. AK-15-266863 (Table No. 6). For example, Moscow has a code - 087, Moscow region - 060.

- The second three digits are the city or area code. They are needed to clarify the place of registration within the region.

- The last six digits are the registered person's unique number.

How can a legal entity find out the registration number in the Pension Fund by TIN?

Each organization has its own number in the Pension Fund of Russia, which is assigned during the process of its state registration as a legal entity.

You can find out the registration number by contacting the Pension Fund, for example, by calling or visiting this institution. In addition, the registration number of the Pension Fund can be found in the extract from the Unified State Register of Legal Entities. The Federal Tax Service, when entering data about a new legal entity into the state register, simultaneously informs the Pension Fund of the Russian Federation about this and requests from it an individual number for the corresponding legal entity. Subsequently, it is included in the Unified State Register of Legal Entities. This document can be requested from the tax authorities in paper form, having paid the state fee in advance. But there is a more convenient option - find out the PFR registration number by TIN online. In order to find out the number in the Pension Fund of the Russian Federation using the TIN of a legal entity, you must:

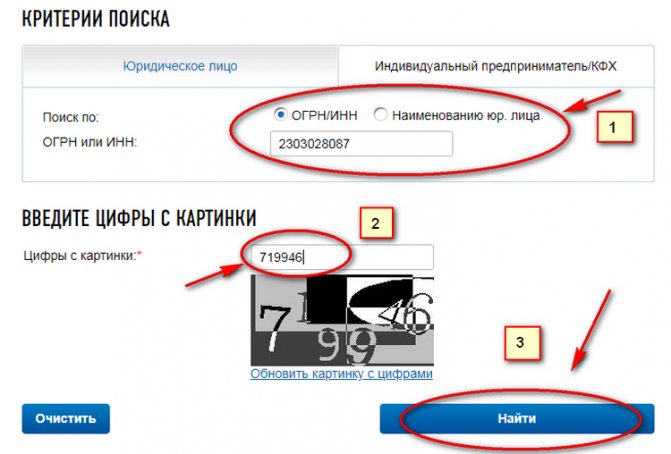

- Go to the tax service website - www.nalog.ru.

- Find “Electronic services” and follow the link “Business risks: check yourself and your counterparty.”

- A checkbox is automatically displayed to search for a company by INN or OGRN. But the system allows you to find information by the name of the legal entity.

- Enter the TIN and captcha in the appropriate field and click the “Find” button.

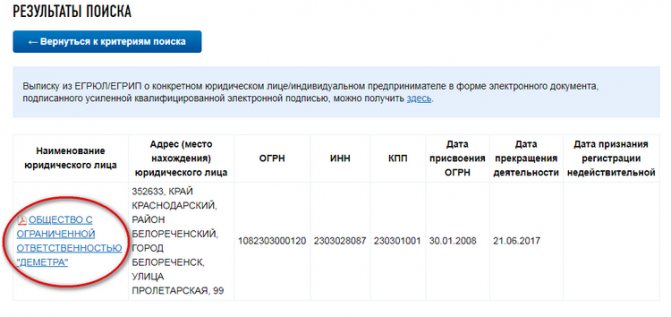

- The system produces a PDF file that can be downloaded by left-clicking.

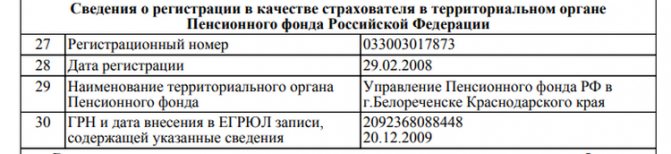

- In the downloaded file we find “Information about the policyholder in the Pension Fund”

Following this algorithm, it is quite simple to find out the registration number in the Pension Fund of the Russian Federation using the TIN.

A search by TIN of a legal entity can be carried out on the Federal Tax Service website. How to do this, see here.

To find out the registration number from the Pension Fund of the Russian Federation using the organization’s TIN, it is enough to have access to the Internet.

What it is

PFR is the Pension Fund of Russia. The organization is based on a government agency. Its tasks are to provide socially significant services to the population by providing benefits to citizens at retirement age.

The fund operates on the basis of government Resolution of the Supreme Council of the RSFSR No. 442-1 of December 22, 1990. It is an extra-budgetary formation despite state registration.

How the Pension Fund is built and formed:

- 8 federal level institutions - PFR departments;

- 83 branches in the subject;

- 2500 territorial regional departments;

- In total, the Pension Fund employs over 130 thousand employees.

The Executive Directorate has the prerogative to control and regulate the executive part of the Fund.

Functions of the Pension Fund:

- Manage all system tools.

- Be a participant in co-financing programs in cooperation with government agencies.

- Assign monthly pension amounts.

- Organize payments to policyholders, beneficiaries, special categories of citizens (veterans, disabled people, etc.).

- Keep records of contributions received from policyholders.

- Maintain and maintain records of the personification database - citizens employed at enterprises.

- Collect arrears of premiums from policyholders.

- Prepare and issue maternity capital certificates (hereinafter referred to as MK).

- Make cash payments based on the MK certificate.

- Administer insurance funds (since 2010).

- Establish and pay additional amounts to pensions (since 2010).

The policyholders are:

- citizens;

- employers – enterprises, organizations, etc.

The insured can be either individual individuals or any legal entity with employees. Before policyholders and other participants, pension administrations act as legal entities.

Therefore, a 12-digit code is created, where 6 digits indicate the territorial pension administrative entity, and the rest of the number refers to the policyholder or policyholder-employer (registered user of the insurance).

In the reporting documentation files, you can find out the code of the territorial body of the Pension Fund of Russia by looking at the first 6 digits:

- The first part is 3 digits. This is the encoding of the region where the tax institution (FTS) linked to the Pension Fund is located. Plus, the value 010 is necessarily added to such a code;

- The second part is 3 digits. This is the code of the district and region where the insured-employer and the Pension Fund itself are directly located.

Region codes are shown in the special Classifier of territorial entities of the Pension Fund of Russia. It can be found in Letter of the Fund No. AK-15-26/6863 dated June 30, 2006, or in Letter of the FFOMS (Federal Mandatory Medical Insurance Fund) No. 4499/91-i dated June 22, 2006.

For example, in Moscow and the region of the capital of Russia there is a Federal Tax Service code - 050, which is entered in the coding of the pension territorial entity as the first three digits. But you should always add 010 to this value.

Thus we get:

050 + 010 = 060 (first 3 digits of the code of the territorial Pension Fund of Moscow and Moscow Region).

If the Foundation changed its location in the area, then the second part of the first 6 digits of the code will be changed according to the new address. The regional combination of the first 3 digits will remain the same. Because changes took place within the region.

Typically, such a code is indicated by an enterprise accountant when filling out a database or personalized accounting documentation (SZV-M, etc.).

Codes are generated when registering an enterprise where people are employed. Labor units must be insured by the Pension Fund of Russia. When registering an enterprise with the Fund, all data on it is entered into a special journal or database. The unique legal code is also indicated there. faces.

How to find out by the TIN of an entrepreneur (IP) his reg. number in the Pension Fund online?

The method for obtaining the necessary information in this situation will be the same as in the case of searching for a number in the Pension Fund of the Russian Federation for a company. To find out the registration number in the Pension Fund by TIN, you need to follow the above link, go to the “Individual Entrepreneur/Peasant Farm” tab, and then use it in accordance with the algorithm for searching Pension Fund numbers by TIN, which we discussed above.

Find out how to determine the code of the territorial body of the Pension Fund of Russia in ConsultantPlus. If you do not have access to the legal reference system, get temporary demo access to K+ for free.

Where do I need to indicate the PFR code for SZV-M?

When sending a SZV-M report using a new form in the form of an electronic document, the file name is the following combination of data (see Appendix to the Resolution of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p “On approval of the information format for maintaining individual (personalized) accounting (SZV form -M)":

PFR_[registration number]_[TO PFR code]_SZV-M_[file generation date]_[GUID].xml

Example file name:

PFR_087-010-001458_087010_SZV-M_20191102_b26caf26-0c3c-4cf1-b101-1f65f4540df0.xml

The structural element [PFR TO code] means the code of the territorial body of the PFR for SZV-M. This information is a required part of the file name after the enterprise registration number. If the code is specified incorrectly or is not entered into the program, the territorial office of the Pension Fund of Russia will reject the report file.

Also find out why the file may not correspond to the SZV-M XSD schema.

You can find a line-by-line algorithm and a sample of filling out the SZV-M form in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Results

It is easy to find out the registration number from the Pension Fund of Russia using the TIN of the company or individual entrepreneur.

To do this, you need to use the tax office website, namely the “Electronic Services” section. After filling in the appropriate fields, the system will issue an extract from the state register, in which you can find not only the registration number in the Pension Fund of Russia, but also other information about the organization or individual entrepreneur. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to do it

The procedure for registering legal entities obliges them to register in the Unified Register even when they are created. The same applies to individual entrepreneurs (small or medium-level businessmen).

After the procedure, the company receives its own unique number. And using the registration number, it will be possible to check the code of the territorial location of the Pension Fund to which it is linked.

To register a company, you must follow the following procedure:

- First, the name of the future organization is invented.

- The status is established - commercial or non-profit will be a legal entity. face.

- Decide on a legal address.

- Select the OKVED code for the type of activity for which the license will be issued (or several codes based on several licenses).

- Calculate the amount of authorized capital, but not less than 10 thousand rubles.

- Draw up documents on the founders and the elected general director.

- Issue the Charter of the emerging LLC.

- Fill out the application form, which is submitted to the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurship. Form form No. P11001.

- Pay the state fee. In 2020, the fee for registering a legal entity is: persons – 4000 rub.

- Make a separate package of papers for the transition to the simplified taxation system (Simplified Taxation System), if necessary.

After the necessary papers for the enterprise are prepared, they are submitted to the registration authority (Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs), as well as to the Federal Tax Service, its territorial division at the place of registration of the company or non-profit organization.

If there are no errors in the application or documentation, the company will be registered within 3 working days, maximum. After registration, a certificate and an extract will be issued. In these documents, immediately below the name, there is a registration code, the combination of numbers of which also includes the Fund’s code.

How to identify your tax office

Every individual entrepreneur in the Russian Federation or legal entity is required to go through the state registration procedure. Only after this is it possible to interact with tax authorities and various funds located at the organization’s place of work. In a situation where such bodies operate in a populated area in several areas, it is necessary to determine which specific territorial branches need to be assigned.

For all operating branches of the tax inspectorate on the territory of the Russian Federation, you can clarify information regarding the address, contact phone number, directions, and all payment details.

Such information for all inspection branches in the Russian Federation can be obtained on the main website of the tax department.

Tax office

If there is a single inspection in the locality or the number of the required one is known. This option will be suitable if you need to determine contact information, clarify your work schedule, or make an appointment at the territorial office of the Federal Tax Service, having previously found out its number.

In the regions it is much easier to deal with such issues. There are more than a dozen such inspections operating in St. Petersburg and Moscow. For the most part, there are several addresses, so it is impossible to do without clarification. The name of the inspection and the required number must be specified in the OGRN certificate if such an organization has already been registered.

First of all, you need to visit the Federal Tax Service website. After this, you need to specify the region indicated in the drop-down list at the top of the page. Then you will need to open a tab called “Contacts, requests, addresses.” You need to find your inspection in the list that appears. The link will display all the data for a specific territorial office:

- code

- number

- Full name of the manager and main specialists

- visiting days as well as management hours

- all details of the Federal Tax Service

- driving directions

- address, contact numbers

- schedule of windows and departments

Anyone can determine the branch of the Federal Tax Service without much difficulty.

Advantages of EDI

Electronic documents are information presented in the form of a set of characters, stored on digital media (hard drive, USB drive, cloud server, etc.).

The system for the organized exchange of such documents is called electronic document management (EDF).

If an organization decides to send reports electronically, it receives the following benefits:

Using electronic document management, the policyholder, without leaving his workplace, sends the necessary information to the Pension Fund.

Attention! Documents need to be checked by a program (available on the PFR website) for errors, after which the fund will send a verification protocol.

How to obtain, replace and restore SNILS

The Russian Pension Fund recommends that all adult citizens who, for various reasons, do not yet have one, receive SNILS. These are, as a rule, military personnel and law enforcement officers without civilian experience who will receive or are already receiving a pension through their department, as well as citizens who do not have insurance experience. For example, housewives.

You must present your passport and fill out a form. When applying to the Pension Fund of Russia, registration in the compulsory pension insurance system and issuance of an insurance certificate is carried out online. If you contact the MFC, obtaining an insurance certificate with SNILS takes five days. The same procedure goes through those who voluntarily make contributions to their future pension to the Russian Pension Fund for themselves or for another person.

26 Jun 2020 glavurist 2381

Share this post

- Related Posts

- What Documents Are Needed for Selling a House With Land in a Village

- Sberbank online does not find the index of the tax payment document

- Find out your duty from bailiffs by last name in Abakan

- How much to pay for gas in an apartment if no one is registered

Come for an appointment at the Pension Fund or the Federal Tax Service

If you do not have the opportunity to call or as a result of the conversation you did not receive all the necessary information, you can contact the Pension Fund in person.

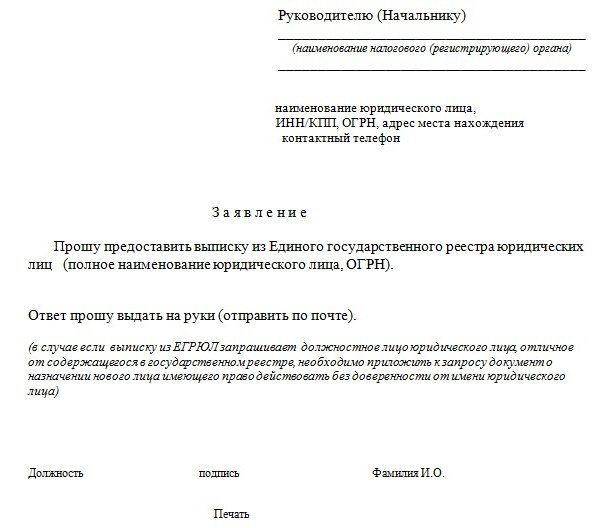

Of course, in such a situation you will have to spend time on the road and stand in line. But at the same time, you can not only find out your Pension Fund number, but also clarify all the points that interest you. Well, the last option that we will consider is to order an extract from the Unified State Register of Legal Entities. This can be done at the regional inspectorate of the Federal Tax Service. You need to personally contact the department and write an application for the release of information.

To complete the application, you will need your passport data, tax identification number, and stamp. In addition, a sample of your signature is also required. It will take from one to 5 days to receive a response.

EDI in the Pension Fund

The Pension Fund of Russia is trying to convince its clients of the need to switch to electronic document management. Already about 80% of all collaborating organizations provide reporting electronically. The list of documents to be sent includes:

Who is required to send digital reports?

In 2020, the policyholder himself decided in what form to send the information. At the beginning of 2020, the Pension Fund obligated employers with 25 or more employees to send reports exclusively in electronic form.

In 2020, the Pension Fund requirements did not change:

- Individual entrepreneurs and organizations with a staff of 25 people submit reports electronically. If this requirement is ignored and paper documentation is provided, the latter will not be accepted. The policyholder will receive a fine;

- If the organization employs no more than 24 employees, the reporting form is chosen by the employer. Despite the fact that the Pension Fund of Russia will accept paper information, it recommends that everyone, without exception, switch to EDI.