NPF website

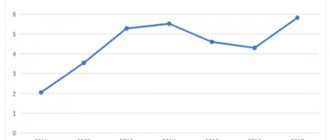

The official website of NPF "Future" futurenpf.ru provides information for corporate clients and individuals. A special section is dedicated to OPS. Here you can calculate the size of your future pension, taking into account your personal data:

- Paula.

- Age.

- The size of the current salary.

- The amount of funds accumulated until the end of 2020.

The result obtained is approximate; the income from investing pension savings may be higher or lower. However, the obtained figures allow us to get an idea of the possibility of increasing the pension, as well as to compare the performance of different funds and Pension Funds.

Helpful information! You can increase your funded pension using the state co-financing program.

It is valid for ten years for those Russians who submitted the corresponding application before the end of 2014 and made the first payment before December 31, 2020. In this case, the state doubles the amount of contributions, and the NPF accrues investment income for the double amount.

Registration in the personal account of NPF "Future"

To create an account in Personal Account, an existing client of “Future” will need to open the official website of the fund, click on the link to “Personal Account” located in the “header” of the initial page of the resource and go to the “Registration” section. On the page that appears you will need to enter:

- SNILS number;

- series and number of the passport of a citizen of the Russian Federation;

- last name, first name and patronymic;

- Mobile phone number;

- E-mail address.

To register an account in the system, you can use not only the passport of a citizen of the Russian Federation, but also any other document confirming the identity of the depositor. Also, before creating an account, you will need to accept the privacy policy and enter the symbols located on the anti-spam picture. The password for your personal account will be sent to the email address specified in the registration form. If desired, the user can subscribe to the newsletter from a private pension fund and activate e-mail notifications.

pension plan

On the official website of NPF “Future” you can learn about the features of the pension plan. The benefits of PPI include:

- Independent determination of the size and frequency of contributions.

- Accrual of investment income on savings.

- Investment of funds by management companies in income-generating instruments.

- Receipt of the accumulated amount from the date of retirement plus income from investments.

For amounts up to 120 thousand rubles per year, a social tax deduction of 13% applies. The first payment can be increased up to 40%.

Important! Savings are protected from taxation, they are not subject to collection at the request of third parties, and they are not part of the jointly acquired property during the marriage. The amounts accumulated in the pension account go to the heirs.

Users of the NPF Future website can use a calculator to calculate PPI indicators. You can make a contribution through the accounting department of your enterprise, a Sberbank branch, Internet banking, or online.

If you wish, you can choose a personal savings strategy. If you make larger contributions, future payments will also be higher. To develop an IPP, just fill out an application on the website.

[edit] Litigation

NPF Future in October 2020 filed a claim against Trust Bank for 12.55 billion rubles. The fund demands compensation for losses due to the fact that it was not presented with a mandatory, according to the position of the NPF, offer to repurchase shares of Otkritie Bank. Having acquired 13% of Otkritie from NPF RGS, NPF Electric Power Industry and Lukoil-Garant, Trust (including securities owned by its affiliates) became the owner of 75% of the bank’s shares and, accordingly, had to send a public offer to the remaining shareholders about acquisition of FC Otkritie securities from them, believes NPF Future [15][16].

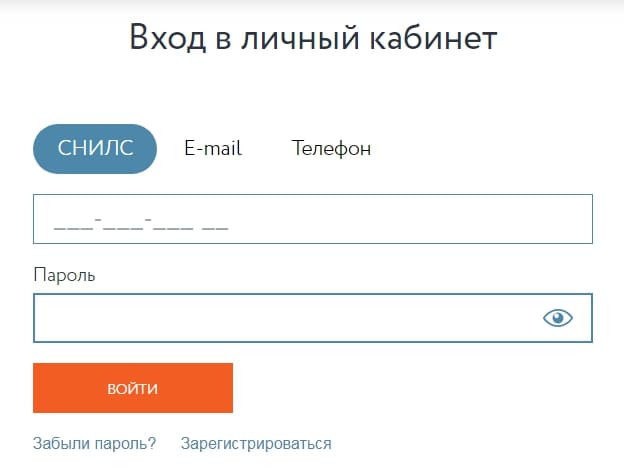

How to find out the amount of savings

Many citizens are interested in the question of how to find out their savings in the NPF “Future”. For this purpose, there is a user account on the site; you can register it after authorization.

In the upper right corner of the page you need to click the “Personal Account” button; to log in you will need SNILS, phone number or email address that was specified during registration. You must also provide your password. Next, select the “Pension Savings” tab and indicate the date of the last transaction performed.

You can obtain information about the amount of accumulated funds directly from the fund's branches. You will have to take your SNILS and passport with you.

NPF "Future": login to your personal account

The authorization process involves manually entering the password and login from your personal account. The first identifier is sent by email, and as the second you can use:

- SNILS number;

- personal email;

- Mobile phone number.

Although the identifier options listed above are equivalent, it is recommended to select and use one login for authorization. The personal data entered when entering the account must match those specified when creating the account: you cannot, for example, use an e-mail that belongs to the client, but is not registered in the private pension fund database.

Profitability and investment policy

According to the Central Bank, the profitability of NPF "Future" 2020 for OPS was 3.38%, for NPOs - 4.82%. The minimum figure was recorded during the crisis in 2011, it was 0.91%. At the end of 2020, the yield was equal to 4.08%, in 2020 it was 5.58%.

NPF "Future" implements a clear and transparent investment policy. Pension savings are transferred to the client’s personal account and then transferred to management companies for investment. Money is invested only in reliable and proven instruments that have passed numerous tests.

Investments are made in shares of large companies in the country, bank deposits, government securities, and infrastructure projects. There is a special depository to control investments.

Income received from investment is credited to client accounts annually. Savings and the amount of future payments increase, and with the onset of retirement age, a person simultaneously receives guaranteed insurance payments from the Pension Fund and a non-state pension from savings.

The basic principles of the investment policy of NPF “Future” are as follows:

- safety of funds that clients have entrusted to the organization;

- reliability and high profitability of investment portfolios;

- information openness;

- professional investment management.

When investing, a comprehensive risk management system is implemented. NPF does not seek to obtain high income in a short time by risking client money. Long-term assets with a high level of reliability are selected for investment.

Profitability of non-state pension fund by year

Profitability is the main component necessary for choosing a suitable pension fund in which it is recommended to invest your money.

Since the more the organization earns, the higher the participant’s pension level will be in the future. So when choosing a fund, always check detailed profitability statistics over several years of the organization’s existence. Profitability of the non-state pension fund "Future" from 2014 to 2020:

- As of 2014, the profitability of the non-state pension fund "Future" was 1.47%, which is 1.21% less than the profitability of the Pension Fund.

- In 2020, the profitability increased significantly and amounted to 5.58%. However, this profit is almost 3 times less than the profit of the Pension Fund for the same period.

- In 2020, the organization’s profitability decreased and amounted to 3.87%.

Features of termination of the contract

If you need to terminate the contract with the Future Fund, you should carefully study all the provisions of this document. If there are no special conditions for terminating the contractual relationship, it is sufficient to notify the organization of your decision. In addition, you need to write a corresponding statement.

In such a statement, the NPF client must indicate where to transfer the accumulated funds. The money can be transferred to a bank account or to another fund, including the Pension Fund. Three months are allotted for the transfer.

Upon termination of the contract, the client loses:

- Profit from profitability for the current period.

- 13% tax on pension savings.

- Money that covers transaction costs.

Important! If the accumulated amounts are transferred to another fund, the 13% tax is not charged.

Customer reviews about NPF Stalfond

- Marina, Norilsk. I became a client of this NPF quite by accident. I feel like I was hypnotized by the gypsies, because I can’t find any other explanation. Employees of this NPF came from their educational activities, talked for a long time about how good their company is, etc. And they offered me introductory information in a printed version and for some reason demanded SNILS and a passport. At that moment I was so overwhelmed with my problems (my father was about to have an operation) that I somehow mechanically provided them with these documents and signed the paper. I was sure that I was signing something like “yes, I listened to them and read the information, I’ll think about it, etc.” As it turned out later, while sorting through a pile of papers on my desk, I discovered an agreement between me and this fund. To say that I was stunned is to say nothing. I started calling this madam, who so kindly told me about the advantages of the company that time, but her phone number was unreachable for several days. I called the hotline 8–800…. There they told me that in order to terminate the contract with them, I need to sign a new one with another pension fund. I did just that, ran to the Pension Fund of the Russian Federation. I do not recommend this “company” to anyone. Some scammers!

- Vitaly, 58 years old. There is absolutely nothing left before retirement, so I decided to enter into an agreement with a non-state fund in order to receive more in the end. I chose Stalfond. The company is reliable, with good conditions. My son showed me how to check my savings on the website. I check it regularly and print out the information to make sure everything is in order. No problem. All I have to do is wait until I retire to make sure that everything is fine. A work colleague is already retired and also entered into an agreement with Stalfond. Everything is stable for him, he receives money on time, and a good amount when compared with what is given to his peers with the same experience.

- Elena, Omsk. Words cannot describe, except perhaps swear words, my experience. After reading the reviews, I came to the conclusion that their cunning, unscrupulous agents like to take people by surprise precisely when they are most, so to speak, vulnerable and have poor understanding. So I am one of them. I’m on maternity leave with my seven-month-old daughter and hardly leave the house. An agent of this company knocked on our door and started talking about some form from the Russian Pension Fund that was supposed to come to me and I had to fill it out. I didn’t understand what the Russian pension fund had to do with it if they were non-state, but I didn’t have the nerve to send him and send him away, so I had to listen to the rest. And the child was capricious and did not allow him to properly concentrate on the information. Then he got me a form, asked for my information, wrote it down, asked me to put 3 signatures, left me these papers and left. Only a couple of days later I discovered that I had not signed a questionnaire, but an agreement with this company. I ran to another reliable and familiar NPF so that they could help me. I entered into an agreement with them. I don’t even want to hear about this company.

- Renat, 24 years old. The conditions are good, the reviews are positive. The company representative charmed me. Signed a contract. Retirement is still a long way off, but I’m sure it will be worthy.

Video about the merger of NPF “StalFond” and NPF “FUTURE”:

Useful articles:

Vacancies in the fund

For citizens who are interested in vacancies at NPF “Future”, there is a special section on the website. The terms of cooperation with partners are presented here, as well as the conditions for training agents. It is possible to search for vacancies in a specific city. Those interested can submit their resume using the online form.

Potential employees are promised decent and stable wages, professional growth through participation in seminars and trainings, and career development. There is a bonus system for employees.

Reviews about the institution

Customer reviews are quite contradictory. You can often hear information about illegal ways of concluding a contract. Often, NPF representatives do not clearly explain to people the conditions for transferring funds to the fund. Such costs are associated with insufficient competence and conscientiousness of agents. In general, the fund fulfills its obligations and provides funds on time. This is confirmed by successful long-term work in the market and fairly high positions in the ranking.

Contact Information

All necessary information about the conclusion and termination of the contract, as well as other nuances related to the activities of the fund, can be obtained by calling the hotline number. The call throughout Russia is free. The organization can be contacted by email

In Moscow, the NPF office is located on Tsvetnoy Boulevard, 2, checkpoint D. The website has a complete list of representative offices and offices in different cities. This means that residents of any region can contact the nearest representative office.

( 34 ratings, average: 2.65 out of 5)

Complaints and reviews

“Not a fund, but a disappointment.” It is difficult to hope that the arrival of a new director in February 2020 (from the civil service to a non-governmental institution) will improve the situation.