What is preferential service?

Pension standards are defined in the following regulatory documents:

- Federal Law No. 173 “On labor pensions in the Russian Federation” dated December 17, 2001.

- PPRF N 516 “Rules for calculating periods of work giving the right to early assignment of an old-age labor pension...” dated 06/11/2002.

- Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013.

This term refers to the worked period of work that allows one to retire before the maximum retirement age. In individual types of activities, a multiplying factor is used in the calculation. Thus, after working for a calendar year, a specialist receives additional days of service and retires before reaching the general age limit.

Preferential conditions may be provided for several reasons:

- For harmful or difficult working conditions (according to the list of dangerous and harmful professions). The basis is the characteristics of the work.

- For social characteristics (for example, due to health or family circumstances). The basis will be the characteristics of the employee.

The lists of preferential professions were approved back in 1991 and include all types of employment under special working conditions. They are divided into:

- a list of professions with particularly difficult and particularly harmful conditions;

- list of professions with difficult and harmful conditions.

IMPORTANT! A separate list contains categories of citizens working and living in the territories of the Far North.

Summary

- My grandfather is 80 years old, a miner with 30 years of underground experience. Is he entitled to an additional pension?

- 8 years of underground experience in the far north, when can I retire?

- Underground experience is 14 years, 3 months. At what age can I receive a pension?

- I want to know how much underground experience is needed to retire on the second list.

- I am 52 years old. 9 years of underground experience. At what age can I retire?

- Do you have underground experience and as a driller, will there be a preferential pension?

- Underground work experience

- Total underground experience

- Underground preferential experience

- A month of underground experience

- Underground pension

By what rules is preferential service considered?

To obtain the right to early retirement, a person must work the number of years that he is entitled to by law. At the same time, his age at this moment does not matter.

Calculation rules:

- Determine which preferential category a particular profession belongs to.

- Correlate the type of activity with the size of the increasing coefficient. Depending on working conditions, one calendar year can be equal to 1 year 3 months of experience, 1 year 6 months, 1 year 9 months, two years.

- According to the entries in the work book, calculate the period during which work was carried out on preferential terms.

- Based on all calculations, preferential length of service is calculated.

The fact of carrying out labor activity must be documented in the labor document. If there is no entry in the book, you can contact the human resources department of the institution for a certificate.

IMPORTANT! In some cases, if it is impossible to document the fact that a person works in an organization (for example, during the liquidation of a company), the testimony of two or more witnesses is accepted. But the very nature of the activity is not confirmed by witnesses.

What are the periods of service?

To receive benefits in the pension sector, the following periods are taken into account:

- annual basic and paid vacations;

- sick leave and periods of temporary disability, including sick leave for pregnancy and childbirth;

- time for advanced training, retraining in accordance with the student agreement;

- if a pregnant woman is transferred from a hazardous occupation to a job without unfavorable conditions, then the period of work in the new place is also considered preferential;

- if a pregnant woman is indicated to be transferred to a safe place, and management is not able to immediately provide her with new working conditions, then the waiting period is also included in the length of service;

- The probationary period during employment is counted into the grace period, regardless of whether the candidate passed it or not.

IMPORTANT! The main condition for obtaining a preferential pension is the fact that during the period of service tax contributions were made to the Pension Fund of the Russian Federation.

What periods are not taken into account?

The calculation does not include the following time periods:

- when an employee was removed from duty due to intoxication;

- when the employee has not undergone training and certification in labor protection;

- if the person has not passed a mandatory medical examination;

- if, after passing a medical examination, the employee was not allowed to work for medical reasons;

- when a person did not perform labor activity at the request of authorities and officials;

- hours of downtime (due to the fault of management or the employee himself).

IMPORTANT! Preferential length of service includes forced paid absenteeism in case of illegal dismissal, as well as in case of transfer to another job and subsequent reinstatement in the same place.

General rules for calculating preferential length of service

Calculation rules for all categories of beneficiaries:

- the employee performed his work full time, or at a reduced rate, if this is in accordance with the employment contract;

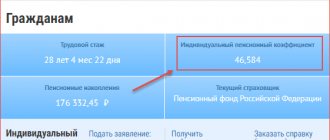

- citizens applying for a pension must be registered in the pension insurance system;

- Shift service, which allows you to receive early retirement, includes work at the site, rest time between shifts, travel time from the collection point to the place of production and back;

- If an employee has reached the retirement age limit and has not yet accumulated the benefit period, then he has the opportunity to complete the missing number of years.

IMPORTANT! If the professional activity was carried out part-time, but full-time, due to a decrease in production, then the actual time worked is included in the length of service.

Law on preferential retirement age for men with 42 years of service

On January 1, 2020, Federal Law No. 350-FZ of October 3, 2018 came into force, amending Law No. 400-FZ, which guides the authorities of the Pension Fund of Russia when assigning old-age insurance pensions.

In Part 1 of Art. 8 of this law sets the retirement age for men at 65 years, taking into account the transitional provisions for the gradual introduction of such a norm. Article 8 has been supplemented with clause 1.2, which states that a man has the right to apply for an old-age pension 24 months earlier than the specified age under the following conditions:

- having 42 years of insurance experience at the time of application;

- reaching 60 years of age.

Thus, starting from this year, a man who turns 60 and has the necessary length of service has the right to receive a well-deserved pension. But during the transition period (the first years of reform) it will not be 24 months earlier, but for fewer years.

Who has the right to retire on preferential terms?

List of professions and activities that give the right to receive a preferential pension:

- work in hot shops;

- in hazardous production, with negative factors;

- underground and mining works;

- work in difficult physical conditions;

- expeditionary work;

- forestry activities;

- locomotive crews;

- temporarily or permanently working in the Far North;

- liquidators of the consequences of a radiation disaster;

- civil aviation pilots;

- miners and mines;

- metallurgists;

- members of the crew on ships;

- drivers of city vehicles;

- female machinists;

- employees of the Ministry of Emergency Situations;

- military personnel;

- teachers;

- medical workers;

- employees of institutions executing criminal penalties in the form of imprisonment.

People eligible for early exit based on social indicators:

- women raising 5 or more children, the youngest of whom should be no more than eight years old at the time of the mother’s retirement;

- one of the parents raising a disabled child;

- a person who has received a disability due to the performance of official duties.

The increasing coefficient, as well as the number of years for preferential length of service, differs for different types of professional activity. In addition to early retirement, beneficiaries are entitled to additional social benefits.

Is it possible to double the retirement age?

Some employees may qualify for a reduction in age requirements for several reasons. However, you can apply for benefits if several conditions are met:

- The man worked for 15 years in the Far North.

- The employee managed to gain the necessary experience in a profession that is included in the preferential list.

As an example, consider the following situation. An elderly man worked in Arkhangelsk (living conditions in the city are equivalent to the regions of the Far North) for 22 years. After that, he moved to Moscow and got a job in a profession included in list No. 2.

Thanks to working in the Far North, the employee achieved a reduction in the retirement age by 5 years. But this is not all the privileges entitled to the employee. An elderly person can apply for an additional reduction in the retirement age by another 5 years, since the specialty belongs to list No. 2. With the help of preferential length of service, the applicant can receive early payments at the age of 50 years.

How to calculate underground experience for a pension in Ukraine

Consequently, even if the enterprise or organization where the employee worked has already ceased its activities, the right to a preferential pension is easily confirmed by an entry in the work book, which corresponds to the name of one of the professions indicated in the required list. If the job title indicated in the work book does not correspond to the classifier given in the list, and the workplace actually involved exposure to harmful factors, additional evidence must be provided. The most common is a certificate from the employer stating that the employee actually performed work, the period of which is counted as harmful work experience and gives grounds to apply for early registration of pension benefits.

Social factor

Here you need to pay attention to the fact that “North” not only makes it possible to retire early, but also affects its size. If you have a salary certificate with an increased coefficient (for at least one month), the amount will be higher. In addition, the “northern” benefit is calculated in proportion to the length of service if 7.5 years or more have been worked. Returning to the example with the BelAZ driver, we can conclude that work as a driver (“small lists”) can be added to the existing “Northern” period and as a result, the right to reduce the age by five years is acquired. Which pension is more profitable with “mixed” service? It often happens that a person has different preferential length of service, including enough time to retire early for several reasons. For example, a man worked 10 years underground and has the right to a pension according to List No. 1 at 50 years old.

If the listed categories of workers have at least half of the specified special length of service (men - at least 5 years, women - at least 3 years 9 months), and their insurance length is 20 years (for men) and 15 years (for women), then an early retirement pension for old age is assigned to them with a reduction in the generally established retirement age (60 and 55 years) - by 1 year for each full year of such work. For clarity, let us present the dependence of the age of entry into early labor pension in old age from special length of service in the following table: special work experience (according to List No. 1) age of entry into early labor pension in old age for men age of entry into early labor pension in old age for women 3 years 9 months - 52 years 4 years - 51 years 5 years 55 years 50 years 6 years 54 years 49 years 7 years 53 years 48 years 7 years 6 months - 45 years 8 years 52 years 9 years 51 years .

Calculation of pensions for law enforcement officers

Employees of the Ministry of Internal Affairs belong to a separate category of recipients of early pensions. In addition, the calculation of the amount of pension payments cannot be performed using the above formula or a pension calculator. To determine the time of retirement age and the size of the pension, length of service is taken as the determining value.

The right to a pension for employees of the Ministry of Internal Affairs is established upon reaching the age of 45 years and having at least 20 years of experience in the structures of the Ministry of Internal Affairs. The size of pension payments is determined by the number of years of service and the amount of salary.

The minimum pension level will be 50% of allowance if the length of service does not exceed 20 years. If 20 years of service are exceeded, the calculation is made at 3% for each year of service, but not more than 85%.

For those who have served for more than 25 years, a payment of 50% of the salary plus 1% for each additional year is provided.

Additionally, pensioners of the Ministry of Internal Affairs can count on additional payments for injuries received during service or disability. The amount of such additional payments is determined individually.

Supplements are provided for certain categories of pensioners:

- in the amount of 100% for pensioners aged 80 years and above;

- if there are non-working dependents, 32% is paid extra for each person, and if the number of dependents exceeds 3, then 100%.