According to the new law, the retirement age for civil servants was increased. A civil servant's pension is a benefit that he will receive for long work in one of the state federal positions.

A federal employee is a person who works in a federal service position and who receives a monetary benefit from the state budget for this.

Who are considered government employees?

A civil servant is a person who works in civil authorities, for example the following structures:

- Office of the President;

- Local government bodies;

- Prosecutor's Office;

- Court;

- Ministry;

- Various government corporations.

A distinctive feature of a civil servant is the fact that he receives wages from the country’s budget.

Medical and social examination ->

Medical and social examination My relative, who works in the bailiff service (investigator), will have to establish the 3rd disability group. She was operated on in December with a hernia in serious condition. I have been on sick leave since the operation for the 5th month.

If a third group is established, will they not be dismissed from the civil service?

Disability of the 3rd group corresponds to the presence of a 1st degree limitation in the patient’s ability to work. - continue working in your previous profession while reducing the severity, tension and (or) reducing the volume of work; - work in another profession, with lower qualifications.

Usually in such cases, disabled people of the 3rd group continue to work in their previous profession of mental work

Raising the retirement age for civil servants in 2020

Despite their seemingly privileged position in society, civil servants are people like everyone else. Therefore, they were also affected by the issue of raising the retirement age.

In agreement with higher authorities, the official can extend the service life to 70 years.

A gradual increase occurs in periods every six months. In 2020, the retirement age of civil servants will be:

- 62 years for men.

- 57 years for women.

Over time, these figures will become equal to the general criteria for Russia. The gradual increase in the retirement age will last until 2028 for men and 2034 for women.

Information about people with disabilities

1 answer to a question from lawyers 9111.ru They won’t fire you, but they can raise questions about disability if the medical board recognizes you as healthy and fit for work. Thank you!

Well, one more clarifying question: if they ask me if I have a disability, do I have the right not to say that I do?

What should a manager do when a civil servant receives group 2 disability?

Please help me figure out the following question: A civil servant fell ill and received a Group II disability, which became known to the employer’s representative from the civil servant’s sick leave. What actions should the head of a government agency take and why, if the specified civil servant occupies a position for which the civil service law establishes an irregular working day (position of the main group)?

Firstly, you need a medical report, and not just a certificate of incapacity for work, to make a decision. If necessary, the employee can be sent ahead of schedule for periodic medical examination. Based on the medical report, you will be able to make a decision either to leave the employee in the position being replaced (by setting him a shortened working day), or to transfer him, or to dismiss him.

Requirements for citizens applying for a long-service pension

To become a recipient of a long-service pension benefit, an official must have worked for at least a certain period of time by 2020.

According to the new law, starting from 2020, the service pension for civil servants begins upon reaching 17 years of service. Of these, at least 10 must be given to service for the state.

If a civil servant meets the specified conditions, then he is assigned an additional payment for length of service. Achieving the threshold of required length of service does not give the right to early retirement, however, the length of “extra service” can greatly affect the size of the future pension benefit.

What is included in accounting for average monthly earnings

The size of the pension of civil servants is calculated based on the data received by the Pension Fund for their last year of work in the public service. Based on data on his salary and contributions that the employer made to the Pension Fund. The calculation is made by dividing all income received during the year by 12.

Average monthly earnings consist of various payments that the employer made to the relevant employee. The list of payments that are included in the average monthly salary of an employee is as follows:

- monthly salary of a civil servant (MC);

- MO in accordance with class rank;

- monthly bonus to the Ministry of Defense for length of service;

- monthly bonus to the Ministry of Defense for special working conditions;

- monthly bonus to the Ministry of Defense for working with classified data;

- monthly bonus to MO;

- bonuses for working with particularly complex tasks;

- one-time payment when going on annual leave.

What periods are counted towards the pension period?

The length of service for an official includes periods of holding any positions related to work for the government at any level. The list of such positions is enshrined in Presidential Decree No. 1574.

The following periods will also be counted towards the official’s length of service:

- Time spent acquiring the knowledge and skills necessary for the job.

- If a person worked for the government of the USSR, then this time must also be taken into account.

- The period of military service upon conscription.

This also takes into account the service life of a device that was abolished or reformed for some reason.

Who is considered a civil servant by law?

Presidential Decree (PD) No. 1141 of September 20, 2010 defined a list of positions that are classified as civil servants. This:

- Government positions (GD) of the Russian Federation.

- State Duma of the constituent entities of the Russian Federation

- Federal civil service positions approved by UP No. 1574 dated December 31, 2005.

- Civil service positions of the constituent entities of the Russian Federation, approved by their legal acts.

- State Duma, approved by UP No. 33 dated January 11, 1995.

- Positions of prosecutors.

- Military positions.

- Positions of tax police employees (federal authorities).

- Positions of employees of the customs authorities of the Russian Federation.

- Municipal positions, etc.

The entire list of positions related to civil servants is listed in UP No. 1141, which is freely available for review. There are 18 positions in total, some of which also include additional lists.

All positions that are counted as civil service entitle employees to additional benefits in receiving pensions. The calculation of pensions for civil servants starts at 45% of earnings and can be calculated up to 75% of earnings.

Calculation of pension benefits for civil government employees:

The position held by the official does not matter in the calculations. The accrual algorithms are the same for both ordinary employees of the mayor’s office and for employees of the presidential staff. These rules are established by Federal Law No. 166.

Encouraging longevity

The state values employees who are responsible for their work.

For long-term work, an official can expect the following types of incentives:

- one-time cash incentives (bonuses);

- valuable gift;

- certificate of honor;

- honorary title.

Attention! But there is a special reward that awaits a civil servant upon retirement. Upon termination of employment, an official will receive a payment equal to ten times his official salary. This type of incentive is prescribed in clause 8 of Art. 21 FZ-119.

Availability of the right to social benefits

The size of your future pension may be affected by your right to receive social benefits. This is the part of the pension benefit that is guaranteed to every person regardless of their length of service. The amount of such payment directly depends on the number of accumulated points.

Also, a civil servant with an established disability group can count on certain social benefits. The presence of a salary paid from the budget does not in any way affect the guaranteed financial assistance to a person with persistent health problems.

Old age payments

Every official, having reached a certain age, is entitled to a standard old-age pension. A person who, in addition to long-term civil service, has work experience in private organizations not associated with the state, can count on such payments.

Having crossed the 80-year mark, a pensioner can count on certain benefits from the state. And one of them is a twofold increase in the fixed part of the pension benefit.

Formula for calculations

The payment due to an official for length of service cannot be assigned while he continues his work activity.

However, upon reaching a specified age, an official can retire and become a recipient of a pension. In this case, he will be assigned a pension benefit.

Its size is calculated using a special formula:

| Designation | Decoding | Note |

| GP | State benefit | Pensions of civil servants are paid from the federal budget |

| ZS | average salary | Based on the last year (12 months) |

| P.O. | Total pension provision | Consists of the following parts:

|

| B.C. | Development of experience | Official length of service beyond length of service |

The total amount of the assigned benefit, taking into account all required additional payments and allowances, should not be more than 75% of the salary (average salary).

Features of pensions for civil servants

Civil servants have the right to receive 2 pensions at the same time:

- for length of service in accordance with Federal Law No. 166 “On State Pension Provision”;

- share of old-age insurance coverage in accordance with the Federal Law “On Insurance Pensions”.

Now only those who have worked not 15 years, but 20 years (increasing gradually) can receive the first pension.

The retirement age for them has also increased: for men it is now 65 years, and for women 63 years.

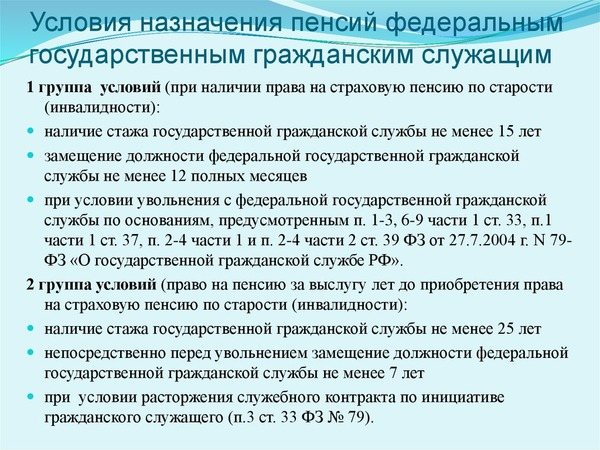

To receive the first type of pension, several conditions must be met:

- reaching above the stated age;

- continuous work experience of at least one year before retirement;

- dismissal only by agreement between the parties, for example, when changing the terms of the contract, liquidation or layoff.

A person can receive a pension at an earlier age, but then the work experience in the civil service must be at least 25 years, and a continuous period of 7 years. In the event of liquidation of a state body or reduction, it is possible to obtain security without working for a year.

Government officials have the right to count on insurance coverage after 15 years of employment, which includes length of service in the public service. It is paid only if you have the required number of points and reach the age limit.

The insurance payments include the following periods:

- all activities during which contributions to compulsory pension insurance were paid;

- civil service period;

- other terms specified in Article 12 of the Federal Law “On Insurance Pensions”.

The insurance payment is made based on the number of pension points, which are multiplied by the cost of one IPC. Government officials receive the amount without a fixed rate.

If a person continues to work after receiving support, then he is entitled to a recalculation, since he continues to pay contributions to the Russian Pension Fund.

In this case, the share of insurance coverage is subject to recalculation based on the points received, which were not previously taken into account when calculating the payment. Recalculation is carried out automatically annually in August without submitting a corresponding application.

Organizations involved in providing the service

The employer in these relations is the state of the Russian Federation or a certain region of the Russian Federation. The law determines the procedure for hiring and firing, remuneration and the specifics of financing pensioners from among former officials.

The civil service pension is calculated from the employer's fund. Federal employees are allocated funds from the state budget, and those who serve in institutions of the constituent entities of the Russian Federation are entitled to regional funding. According to Art. 10 of Law No. 58-FZ, in some cases, remuneration to local officials may also be paid from federal funds. Logos and trademarks posted on the site for informational purposes belong to their legal owners, copyright holders.

A federal civil servant is a citizen who carries out professional activities in a public service position: essentially a “state employee.” But not every public sector employee is a civil servant, but only one endowed with power, administrative and managerial functions - an employee of law enforcement and executive authorities.

Salaries of civil servants in 2020: latest news on the indexation of payments and changes in the principle of calculating salaries of officials in 2020.

This site is a non-commercial information project; it does not provide any services and has no relation to the services provided by the Pension Funds.

Recalculation is carried out every year in early August after calculating individual points that have accumulated since the accrual of collateral on the calculation date.

Citizens from among federal civil servants have the right to simultaneously receive two pensions: a state long-service pension and an old-age or disability insurance pension. In this article we will look at how to calculate the size of the state pension, in what order the pensions for civil servants are recalculated in 2020, and whether indexation of insurance pensions for civil servants is provided for.

This amount is payable after registration of the pension before the first period of recalculation, if the person continues to work in the civil service or in a commercial organization.

In 2020, for persons who have worked for 17 years or more in state or regional structures, there is an opportunity to receive an additional payment. For each excess annual period of labor, 3% of the principal amount is added.

Many consider it necessary to remain silent about their real income, as a result of which payments to the Pension Fund are received in small quantities. Experts talk about the possibility of further increasing life expectancy, which in the future could become a big problem for the economic situation in the country.

The state is extremely concerned about this problem, so this issue is being discussed at the highest level.

Calculations of the amount of payments are made based on the person’s average earnings. SZ, in turn, is determined for the last year preceding retirement or the emergence of a legal right to do so. All possible payments are taken into account - bonuses, incentives, official salary, allowances and allowances for ranks and titles.

Pension security in the Russian Federation is guaranteed to every employee upon reaching a certain age.

The pre-trial (out-of-court) appeal procedure does not exclude the possibility of appealing decisions and actions (inactions) taken (carried out) during the provision of public services in court. The pre-trial (out-of-court) appeal procedure is not mandatory for the applicant.

Calculation of pensions for medical workers

Healthcare workers become eligible for a pension after working for 30 years in urban areas or 25 years in rural areas .

Pension payments are calculated as follows:

- IPB – pension points;

- SPK – point price;

- FV – fixed payment;

- SP - the result obtained.

Example

Citizen Petrova worked for 5 years as a therapist in a village hospital, then worked in the city for 25 years as a local therapist. Her total work experience will be 31.5 years. The number of accumulated individual points is 112.

The calculation of her pension will look like this:

There is a list of medical positions (surgeons, obstetricians, anesthesiologists, etc.) for which 1 year is calculated as 1.5. And for medical workers in rural areas, the accounting period is 1.3 years (15 months).

Retirement age for northerners

Complaints against decisions and actions (inaction) of the Committee, its officials, and state civil servants are considered by the Committee.

In March 2020, civil servant Petrenko turned 61 years old, and therefore he applied for a long-service state pension.

Despite all the indignation that it is impossible to live in Russia, almost all categories of citizens of our country receive many social guarantees. Civil servants are no exception. This category of citizens has an additional social guarantee such as a long-service pension.

When assigning such a pension, neither the citizen’s age nor his ability to work are taken into account. Only actual work experience in a certain field matters.