Home > Pension insurance subjects > Working pensioners > Indexation of pension after dismissal

7 585

The indexation of insurance pensions for working pensioners has been canceled since 2020. But if a pensioner quits and becomes unemployed, his pension will be recalculated. In this case, all missed indexations will be taken into account during the time the citizen worked as a pensioner.

- The recalculation is carried out with some delay, so the increased payment does not arrive immediately after dismissal. However, all allowances due during this delay must be compensated .

- In addition, a pensioner can quit and, without waiting for the recalculation, get a job again. After the established period, the pension will be indexed, and the fact that the pensioner will already be working by that time will not affect it in any way.

A pensioner can assess in advance how profitable it is for him to quit in order to recalculate his pension. This can be done by calculating the required increase yourself, or by clarifying the amount of the payment after indexation through your Personal Account on the Pension Fund website.

How and when is it better to quit in order to get your pension indexed, read the article.

The essence of the legislative act

Starting from 2020, the increase in benefits occurs only for non-working pensioners and amounts to a percentage close in size to inflation:

- 2016 - 4%;

- 2017 - 5.8%;

- 2018 - 3.7%;

- 2019 - 7.05%;

- 2020 - 6.6%.

If you add up all the values over 5 years, you get 27.15% of the bonuses that were not accrued to citizens who continue to work. The state froze this money until the dismissal. The Pension Fund indexes payments upon receipt of confirmation of termination of the employment contract.

Recalculation frequency

Pension recalculation after dismissal is done once a year on August 1. Increased benefits have been issued since January. An extraordinary review is carried out if:

- increased the IPC for the period before the beginning of 2020 due to the inclusion of non-insurance periods in the calculation;

- there are unaccounted contributions from a citizen who saved from his earnings while employed in another country;

- assigned a disability group;

- dependents appeared;

- established a regional coefficient.

Resumption of indexation upon dismissal

Due to the law adopted in 2020, the indexation of payments was frozen. While a citizen is working, the size of the pension does not change. As soon as he resigns, the state issues an increase for 5 years.

Deadlines for receiving the new amount

The procedure for recalculating benefits takes several months. This is due to the scheme for the pension fund to receive documents confirming dismissal. Therefore, it is necessary to take into account the employer’s reporting deadlines and all processes for making changes.

Actions for a pensioner to receive indexation:

- December - writing a letter of resignation;

- January - the employer will transfer information for the last month to the Pension Fund, but the citizen is still documented to be employed;

- February - the organization submits documents to the state for January, where this person does not appear, and a recalculation is launched;

- March - within a month, the Pension Fund calculates a new benefit, including interest for past years;

- April - a person receives an increased pension and a shortened amount for the quarter during which he did not work.

Thus, a new benefit after dismissal can be received after 90 days.

Terms of payment of increased pension after dismissal

When fired in 2020, a working elderly Russian can be sure that a recalculated pension will be assigned to him as early as the 1st day of the month following the month in which work was stopped.

For example, Bukashka Anna Ivanovna quit her job on February 27, 2020, therefore, starting March 1, pension income will be indexed.

The increased amount will not be paid immediately in March, but with some delay. Usually the delay is three months. Time is necessary to obtain information from the employer that the person has stopped working. In the third month, representatives of the Pension Fund of the Russian Federation are obliged to compensate for the delayed amounts of the increase and accrue payments in an increased amount. If the expected payments have not been received, you must contact the Pension Fund. There is no point in hiding the situation: if there is no announcement about the problem, then the recount may be missed.

Increasing the pension amount

A pensioner, upon resigning, receives all indexation payments for 5 years, which is about 22%. The government increases the payment once a year by the inflation rate.

Indexing process

The increase procedure is regulated by Federal Law No. 400-FZ “On Insurance Pensions”. The resolution on the increase is adopted by the Government of the Russian Federation.

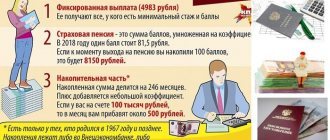

The basic and insurance components of pensions are increasing.

What factors influence the amount

The amount of the pension is affected by:

- index date;

- increase percentage;

- basic payment in state currency;

- assessment of the pension coefficient in rubles.

Calculation of the amount after dismissal

Accurate data is provided by the Pension Fund through its own website or government services portal. But you can calculate it yourself.

Citizens who became pensioners before 2020 missed 6 stages of increase:

| Month and year of indexation | % increase | Amount of stable payment, rub. | IPC, rub. |

| February 2020 | 1,04 | 4558,93 | 74,27 |

| February 2020 | 1,054 | 4805,11 | 78,28 |

| April 2020 | 1,004 | 4805,11 | 78,58 |

| January 2020 | 1,037 | 4982,90 | 81,49 |

| January 2020 | 1,0705 | 5334,19 | 87,24 |

| January 2020 | 1,066 | 5686,25 | 93 |

To calculate the amount of additional payments after the end of employment, it is necessary to take into account all increases over the past period. Calculation using the example of a pension equal to 11,524 rubles. 59 kopecks (100 IPC for 71.41 rubles and a fixed component of 4383.59 rubles):

- insurance part - 71.41 * 1.04 * 1.054 * 1.004 * 1.037 * 1.0705 * 1.066 = 9300 rubles;

- fixed - 4383.59**1.054*1.037*1.0705*1.066=5686.25 rub.;

- IPC amendment - 3 points for 3 years multiplied by 93 rubles = 837 rubles;

- we add up the calculated amounts and get the amount of the updated payment 15823.25 rubles.

Example of pension indexation

Since January 1, 2020, pensions have increased by 6.6%. The size of the increase takes into account the ratio of pension income in 2020 and the cost of living for this category:

- higher - the premium will be 6.6%;

- lower - 6.6% and last year's additional payment is added to the minimum pension.

Formula for recalculating pension after dismissal: how much will be added

Representatives of the Pension Fund of the Russian Federation use a special formula for recalculating state pensions after the dismissal of working pensioners:

Pension after recalculation = (IPK1 + IPK2) × costIPK + FD,

- IPK1 is the number of pension points that were accumulated by a person at the time of assignment of a state insurance pension;

- IPK2 - part of the pension points accumulated by the pensioner during the period of work in retirement;

- CostIPK - the cost of one pension point, established on the date of dismissal from the last place of work of a senior citizen;

- PV is a fixed additional payment to the state pension, established at the time of the recalculation of payments.

According to the regulatory regulations establishing the rules for recalculating state pensions, the maximum increase factor is determined:

- coefficient 3 applies to citizens whose pension savings have been stopped;

- a coefficient of 1.875 is applied to people whose pension savings continued to be formed.

Until 2022, when recalculating the state insurance pension, the maximum IPC value of 3.0 is applied in connection with the suspension of the formation of a funded pension at the expense of insurance contributions for compulsory pension insurance (clause 4, article 33.3 of the law of December 15, 2001 No. 167-FZ; Article 6.1 of the Law of December 4, 2013 No. 351-FZ).

The cost of the IPC 2020 is 87.24 rubles.

Fixed additional payment for 2020 - 5334.19 rubles.

In March 2020, the state pension after dismissal will be:

How much does a working pensioner lose now?

In 2020 alone, the retiree lost a 6.6% increase. With a benefit of 15 thousand rubles, the additional payment was 990 rubles. And per year the amount is 11,880 rubles.

The average income of an elderly Russian in 2020 was 12,500 rubles. Calculation for the entire period of validity of the moratorium on increasing payments to pensioners who continue to work:

| Year | Indexation size, % | Average pension per month, rub. | Losses per year, rub. |

| 2016 | 4 | 13000 | 6000 |

| 2017 | 5,4 | 13702 | 8424 |

| 2018 | 3,7 | 14208 | 6084 |

| 2019 | 7,05 | 15209 | 12019 |

| 2020 | 6,6 | 16212 | 12045 |

Losses over 5 years amount to 44,572 rubles.

When will it be possible to get a job again?

A citizen who quits his job can return after 1 calendar month. If you terminate your employment contract in December, you can get a job back in February.

Will indexing disappear?

The indexed payment amount will remain after employment. If a person wants to see a raise in January 2021, he needs to leave his job in December 2020.

In April 2021, the citizen will be given a pension increased by 6.3% and an allowance not received in the first 3 months of the year.

Calculation of pension after indexation

In 2020, pension accruals will be indexed only for those pensioners who are not officially included in employment anywhere. This also applies to the case when, after calculation, the pensioner immediately applies for social security insurance. For manual calculations, a special table is taken, which shows how much will be added to each payment amount.

To independently and quickly find the answer to what the amount of your allowance will be, you can use the pension indexation calculator posted on our portal.

This is important to know: Filling out a work book upon dismissal: sample 2020

Find out how much your pension is indexed from 2020!

Enter the amount of your pension before indexation:

Nuances of pension recalculation

The Pension Fund recalculates payments when:

- a person reaches the age of 80;

- the medical commission assigns a different disability group.

When recalculating for employed pensioners, the following are taken into account:

- profit from investments of pension savings;

- funds received that were not taken into account in the previous calculation.

Declaratory recount is used in the following cases:

- occurrence of dependent persons;

- stay in the regions of the Far North and similar territories;

- accumulation of work experience in areas with unfavorable climatic conditions.

After the 2020 pension reform, the state provides an elderly person with the right to recalculation with the addition of non-insurance length of service, including:

- maternity leave;

- time in service in the RF Armed Forces;

- caring for a disabled person of group I, a child with disabilities or a relative who has reached 80 years of age;

- stay of wives/husbands of military personnel in military service in places with no likelihood of employment;

- the presence abroad of spouses of employees sent abroad for official reasons;

- suspension of participation in the work process due to criminal prosecution, as a result of those rehabilitated;

- military service during a period when compulsory pension insurance did not apply to this category of citizens.

List of documents for the Pension Fund

When submitting an application, the interested party provides:

- identity document - passport of a citizen of the Russian Federation, international passport, service document of a citizen of the Russian Federation, diplomatic passport, etc.;

- papers and certificates proving non-insurance periods of time included in the insurance period, if they are not in the pension recipient’s payment file - birth certificate of children, etc.

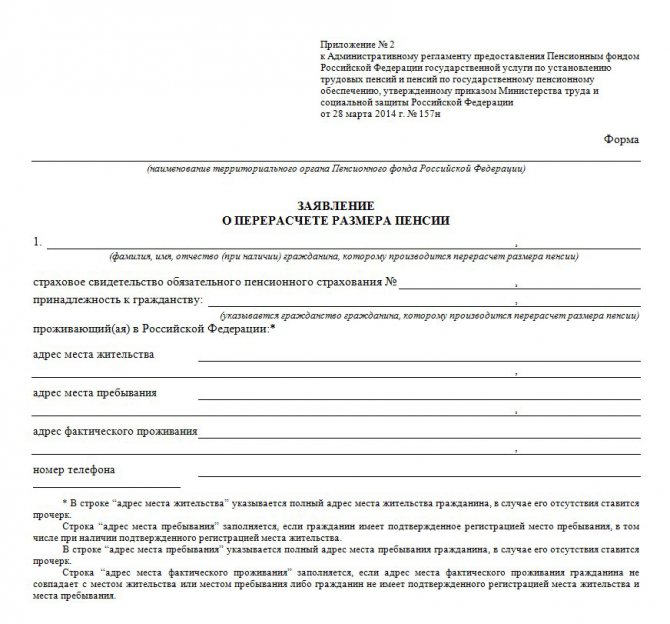

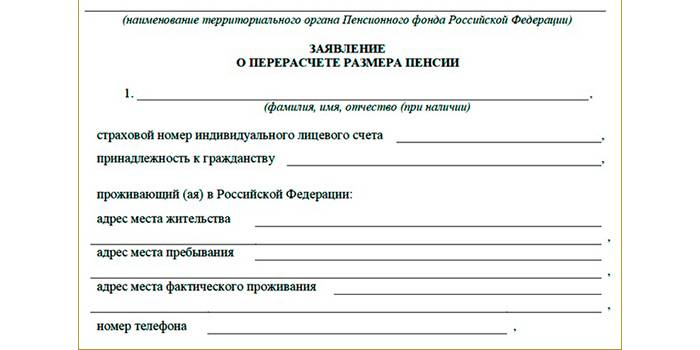

Sample application and its submission

The application can be submitted in person by coming to a branch of the Russian Pension Fund or remotely through the State Services website.

Application form:

How it works

If a pensioner does not have the opportunity to send an application to the territorial office of the Pension Fund of the Russian Federation that makes social payments, it is permissible to come to any branch. In addition, you can send an application through the official website. When registering remotely, the citizen is required to provide papers within 5 days.

The recalculation of the fixed payment amount must take place from the 1st day of the month following the submission of papers.

How long will it take for indexation to be received if documents are submitted late?

If the documents are not provided within 5 days, the Pension Fund does not consider the submitted application.

After receiving the full package of papers, the pension fund has 5 days to respond and notify the applicant. In case of a negative decision, the employee of the institution is obliged to justify the reason for such a conclusion. A pensioner can challenge an illegal refusal in court.

Responsibility for delay

From the moment of requesting additional information or documents from a government agency, as well as if there are errors in the execution or inconsistency of certificates, the applicant has 5 days. In case of failure to comply with the requirement, the fine is 1 thousand rubles.

How to find out how much your payments will increase

Using the formula, you can recalculate the pension upon dismissal of a pensioner. For example, a citizen retired in 2020 with an IPC = 150. In June 2020, he got a job, and in February 2020, he stopped working.

In this case, the recalculation will be made as follows:

- During his work, he gained 20 pension points, missed 3 indexations (by 4.1%, 7.05% and 6.6%), and the size of the fixed payment increased to 5,686.25 rubles.

- Substituting all these values into the formula, you get: PB = ((150+20) x 93 rubles + 5686.25 rubles) x 4.1% x 7.05% x 6.6% = 25536.26 rubles.

This calculation is indicative, since more indicators can be used in the calculation of the Pension Fund. For example, due to double-checking data on insurance experience, etc. To find out the pension of a working pensioner after dismissal, you need to contact the Pension Fund.

There are two options:

- Personally visit the territorial branch of the Russian Pension Fund.

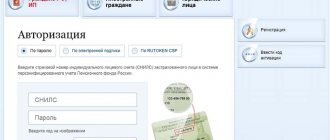

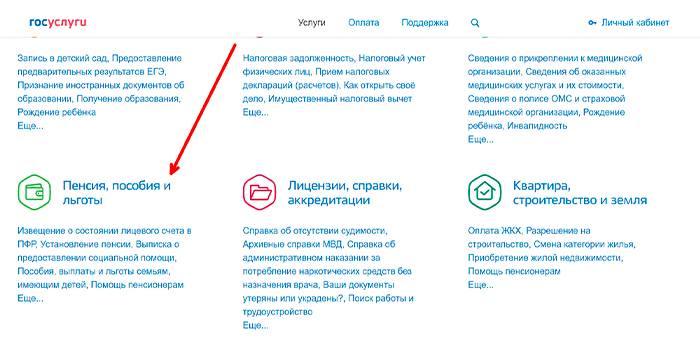

- Find out the necessary information through the government services portal. To do this, you need to have a confirmed registration on this resource.

The prepared certificate contains information:

- about the type of pension, date of registration;

- according to the structure of payments (for example, the size of the insurance and fixed parts) and the basis for calculation;

- the total amount of the pension accrued to the citizen.

Personal appeal to the Pension Fund

- Write a statement . It is drawn up in free form and contains a request to report the new amount of pension payments.

- Visit the territorial branch of the Pension Fund of Russia with a passport of a Russian citizen and an insurance certificate (SNILS).

- Contact the employee who deals with issues of the size of current pensions and submit a package of documents to him.

- Wait for the prepared certificate and it will be done immediately in front of the client.

State Services website

- Log in to your personal account, enter your login and password.

- Click on the "Pensions" tab.

- Find the list “Order a certificate (extract)”. Click on the line “About the amount of pension”.

- In the new window, click the “Request” button.

- Wait for the result. It can be viewed in the “Message History” section.

- How to plant strawberries in August

- Solar power plant - operating principle and equipment, types, advantages and disadvantages

- Cream with condensed milk

Will pensions for working people be abolished altogether?

The issue of abolishing pensions is being discussed by the Government of the Russian Federation. 32% of the population is over 60 years old, and income from employed citizens does not cover the Pension Fund budget deficit.

The State Duma is considering options:

- abolition of labor pensions and provision of targeted assistance to those in need;

- abolition of social benefits for working elderly citizens, proposed in 2020 by the Ministry of Finance;

- termination of special calculation of pensions for military personnel;

- raising the retirement age;

- increase in payments to the Pension Fund from the economically active population from 22% to 40%.

From 2020, the state increased the retirement age by 5 years. Other measures have not yet been taken by the government.

Will there be indexation of pensions for working pensioners in 2019?

On January 1, 2020, Law No. 350-FZ comes into force, according to which the retirement age for the economically active part of the population will be gradually raised in Russia. Additionally, the procedure for indexing insurance coverage will change. The revision will not take inflation into account. The basis is a fixed value established by the Government. Pensions will increase at a faster rate.

Indexation of the insurance pension for pensioners who continue to work, as before, is not provided for. The only thing that older people who continue to work can count on is a small August increase taking into account the earned PB, the number of which is legally limited to three.

If we take into account that the cost of the pension coefficient for 2020 is set at 87.24 rubles, the increase will be 261.72 rubles (for comparison: August 2020 - 244.47 rubles). The decision to refuse to index insurance pensions for working pensioners is justified by the fact that they already receive additional income. This approach will help save money in the Pension Fund budget.

- Who will get an increase in hourly wages and by how much?

- Additional payment to pension for minor children in 2020

- Braided hairstyles

Will indexing be returned?

In recent years, benefits have been increasing only for unemployed elderly citizens. The news reports the likelihood of unfreezing the indexation of payments to employed pensioners next year. No final decision has been made. But from July 1, 2020, this category of citizens will receive an increase when taken under guardianship:

- their own grandchildren if their father and mother died or were deprived of parental rights;

- adopted children;

- disabled children.

There is no final answer to the question of accruing a 6.3% increase to working pensioners in January 2021. A proven way to get indexation is to quit your job in December and get a job again in February.

What part of the pension is recalculated

The pension fund will use the amount assigned earlier, it will be the base amount and the following values:

⊕ accumulated pension points;

⊕ IPC – maximum size 3.0;

⊕ indexing;

⊕ results of investing savings;

⊕ the amount of all insurance premiums.

One or more variables will be applied, depending on the situation.