The most frequently asked question among older people is the following: what will happen if I do not achieve the required period of work experience, or do not have it at all due to disability, and will I be paid a pension in these cases? Yes, many people worry that they haven't worked hard enough and think that they will most likely be denied pension benefits when they reach retirement age. But is this really so?

Let's figure out the amount of pension in the absence of work experience

This article is ready to answer all the questions asked and more, and also tell you what awaits pensioners without work experience in the current 2020 and how things are going with payments this year.

More details about the situation

Now let's take a closer look at this situation and understand the issues that have arisen. Today, there are many disputes in the pension sector regarding whether people without experience will have the opportunity to receive cash payments in the form of an old-age pension or not. The answer to this question is positive, since regardless of whether a person has work experience or not, he is entitled to minimum payments. Therefore, now you don’t have to worry about the fact that you have little or no experience; according to the law, you will receive them.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Regarding those cases when a person is disabled or cannot perform work, then in this case other types of payments are provided.

The right to a pension without work experience

First, let's look at exactly what types of pensions are available in the country.

Pensions can be divided into two types:

- Insurance;

- Social.

Now let's look at what each of them means. An insurance pension means contributions made by an employee while working. A social pension implies payments that are intended for all low-income and needy citizens.

Therefore, if you have little or no experience, then you are definitely entitled to social benefits.

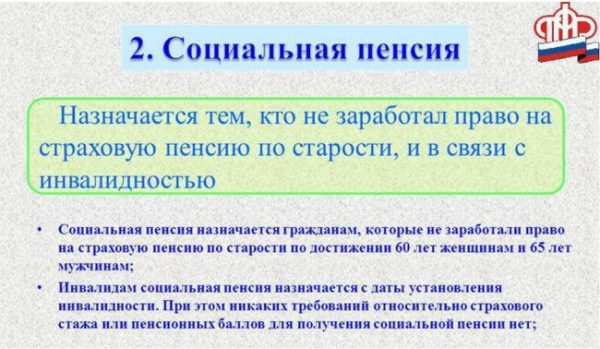

Social pension

As mentioned earlier, a social pension is a cash payment that is paid by the state to low-income, needy citizens, as well as to those who are unable to work. It is also provided to the following types of citizens:

- Upon reaching retirement age - or old age pension;

- In case of loss of ability to work – disability, both acquired and congenital;

- In the event of the loss of a family breadwinner who provided for the entire family.

It should also be noted that this type is paid to both citizens of the country and stateless persons. For the state, all people have equal rights.

Kinds

Everyone must pay a pension, even if the person has no work experience. There are two types of pensions in the Russian Federation: insurance and social. Those who do not have a work book can count on the second one, that is, it is intended exclusively for unemployed people. However, such payments will be minimal, and the citizen will face a lack of finances. And people who worked are entitled to a pension proportional to their length of service - it is called an insurance pension. Its size is calculated individually. In 2020, the conditions changed: in order to receive insurance pension payments, you only need to work for 7 years.

Not only working years are taken into account, but also the following periods.

- Emergency service for men. The year that a citizen serves in the army is counted as length of service and is used when calculating insurance.

- Mothers' maternity leave. The calculation is based on 1.5 years for each child. However, more than 6 years cannot be counted in this way.

- The period when a person is looking for work. However, he must be registered with the employment service.

- The period when a person cared for elderly (over 80 years old) and incapacitated relatives.

It was necessary to make such concessions, because otherwise people would give up more important things for the sake of good pension money. Some workers do not give birth so as not to lose seniority. In Russia, it is not profitable to receive a social pension, which is guaranteed even to those who have not worked all their lives and have no work experience. It is recommended to get an official job and work for at least a minimum period of time. But what to do if you don’t have enough experience to qualify for a pension? You will have to work a few more years to get a certain length of service, or come to terms with social pension payments. Hard-working people sometimes receive good sums for their previous work. The duration of work sometimes reaches 40 years. If a person has worked all his life, then upon reaching retirement age he can quit his job and receive good money.

Size and expected changes

The size of such pension payments as the social pension depends on several factors that directly affect its value, namely:

- Do you have a general work history;

- Having a minimum length of experience, which is also taken into account;

- If there is no experience at all, then this factor is also important.

In each specific and specific case, all factors are taken into account. Now let's look at each of them. If you have the minimum, namely 10 years, then you are entitled to a social pension in the amount of 5,686.25 rubles.

If you have no work experience in general, you will be assigned the minimum amount of the insurance pension.

Payment amount

The amount of this benefit is established by the Government of the Russian Federation.

From April 1, 2020, it was equal to 5283.84 rubles. According to the law, this benefit:

- subject to annual indexation by the amount of inflation established in the previous period;

- increases by a multiple of the corresponding regional coefficient for residents of the Far North and equivalent regions;

- cannot be lower than the previous benefit if assigned to disabled pensioners.

Due to the fact that social subsidies are small, the Government has established one more rule:

- at the request of the applicant, a federal or regional additional payment is made to him;

- its size depends on the cost of living in the corresponding territory; countrywide;

- in the recipient's region of residence;

- the largest one is selected.

Example

In 2020, two people applied for social benefits due to their 70th birthday:

- Ivankov, living in the capital;

- Petrov, resident of the Altai Republic.

Both citizens asked for additional payments due by law.

To determine the amounts, it is necessary to compare the cost of living indicators:

- in general for the Russian Federation it is established by the Law of the Russian Federation dated November 29, 2018 No. 459-FZ: 8846 rubles. for pensioners;

Thus, pensioners will be assigned the following additional payments:

- Ivankov: 12115 rub. — 5283.84 rub. = 6831.16 rub.

- 8712 rub. — 5283.84 rub. = 3428.16 rub.

Download for viewing and printing:

Decree of the Government of the Russian Federation of December 1, 2016 N 1275 “On establishing the minimum subsistence level...”

Indexing order

The pension sector is constantly changing, and its payments are growing and growing every year. This is due to the fact that the country is experiencing inflation, which directly affects all prices and salaries, thereby making them insignificant. For this reason, the state does not stop thinking about its citizens and tries to index pensions as often as possible. Indexation is an increase in pension payments that are assigned to each pensioner on a monthly basis. This procedure also applies to insurance, which is provided for disadvantaged people. Its size is currently 5,686.25 rubles, but this year it is planned to increase. It is not yet known how much it will increase, since indexation will be carried out in 2020 in April.

How much will the pension be if the minimum length of service is not enough?

Expert opinion

Mikhailov Ivan Leonidovich

Legal consultant with 10 years of experience. Specialization: criminal law. Member of the Bar Association.

The main criterion by which a citizen will be accrued a pension in the future is the insurance period. This is the period during which the Pension Fund received funds for the citizen’s pension provision.

If he works unofficially, which implies the absence of transfers, then the length of service in question is not counted . Accordingly, the right to receive a pension (insurance) also does not arise.

Does this mean that unemployed citizens will remain in old age without financial support? The answer to this question is not affirmative, since persons who do not have insurance experience have the right to count on a social pension.

Social pension for the unemployed

A social pension should be understood as cash payments that elderly people who do not have sufficient work experience are entitled to count on.

By the same analogy, financial assistance is paid for the disabled and people who have lost their breadwinner. This is only true if the disabled citizen (deceased) was never officially killed.

Are people without official experience entitled to an insurance pension?

Official length of service should be understood as periods when the employer paid insurance premiums for the employee. If this did not happen, then there are no grounds for calculating an insurance pension.

What pension will they pay?

The social pension, unlike the insurance pension, has a fixed amount. In 2020 it is 5283.85 rubles. For persons who worked unofficially, the amount of wages paid to them does not matter, since contributions from it are not received by the Pension Fund.

It is important to note that the amount of social pension is not static and is subject to periodic indexation. At the same time, its size is relatively small and in 2020 amounted to only 2%.

In addition, there are supplements to the old-age social benefit due to the fact that older people cannot receive material support that is less than the minimum subsistence level calculated for pensioners in the region of their residence.

Thus, the size of the social benefit is equal to the minimum calculated amount that an elderly person needs to satisfy his basic needs.

In addition, for citizens who live in northern areas, premiums are provided at the expense of regional coefficients.

The requirements for the IPC and minimum length of service are becoming more stringent every year, and in this regard, the number of refusals by the Pension Fund to grant an old-age insurance pension due to an insufficient number of points or years of service is also growing. Those citizens who do not have the necessary values of the above parameters also have the right to count only on a social pension.

At the same time, its size is not affected by the number of years officially worked and the size of transfers.

Thus, the current legislation equalizes the pension rights of persons who have never worked and those who, although they worked officially, are deprived of the opportunity to count on insurance payments due to a lack of pension points and the required length of service.

Conditions and requirements for receiving

In order to receive this pension, there are a number of conditions and requirements that must be met - this is the provision of the required documents, without which your application will not be considered. They are as follows:

- Your application, written according to the required template;

- Passport – original and copy;

- Certificate confirming incapacity;

- Document confirming the presence of disability (if any).

If you provide all the necessary documents, your application will be reviewed and you will receive an official response within a few weeks.

Social benefits like a second pension

Social payments can also be assigned not only as the main type of payment, but also as an additional one . In this case, you will be paid two types, which are assigned on a monthly basis. This type of pension is also intended for military citizens who previously worked in this field. They have the right to receive both a military pension and a social pension at the same time. They receive the specified pensions either for the acquisition of disability or for old age.

At what age can people without experience retire?

Expert opinion

Mikhailov Ivan Leonidovich

Legal consultant with 10 years of experience. Specialization: criminal law. Member of the Bar Association.

The law provides that payments under social pension security are assigned 5 years later than the generally established age. It turns out that in 2020, women will begin to receive social payments at 60.5 years old and men at 65.5 years old.

However, this age is subject to increase every year. Thus, by the time the reform of the pension system is completed, the age for starting to receive social benefits will be 65 years for females and 70 years for the male part of the population.

Let's sum it up

Regardless of whether you have work experience or not, or whether you have not accumulated the required period of work experience throughout your entire working career, you are still entitled to old-age pension payments. The state tries to do everything for its citizens and takes care of everyone without exception.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below: