In the Russian Federation, the number of low-income citizens includes pensioners. Retirement benefits are often low, and older people, especially those who are unable to work due to frailty or health problems, have difficulty making ends meet.

The financial situation worsens when one of the spouses passes away and the widow is left without financial support. The law establishes that a woman can transfer to her husband’s pension after his death, which implies receiving compensation in connection with the loss of a breadwinner.

In addition to transferring to the husband's pension, disabled close relatives have the right to funds that were not issued to the pensioner during his lifetime. You can not receive money in all cases, but only if certain conditions are met, the procedure for submitting an application and the relevant documents.

Does the pension payment go to the spouse?

Speaking about the possibility of a woman to claim the pension of her deceased spouse, it should be noted that the concept of “transferring to her husband’s pension after his death” is only a philistine common expression. The current Russian legislation does not contain such a term and, moreover, does not regulate the procedure for its implementation.

What is called the transfer to the husband's pension, from the point of view of the law, is the registration of a survivor's pension.

Important! Many people believe that only minor children of the deceased can receive benefits for the loss of a breadwinner. However, it is not. Any person who was dependent on him, including his spouse, can count on receiving such a pension.

Current legislation establishes three forms of pension assignment, the basis for the calculation of which is the death of the financially supporting person.

Insurance

The insurance benefit is paid if the husband has a certain length of service. At the same time, his work activity must be of an official nature, that is, employment occurs in strict accordance with the norms of the Labor Code of the Russian Federation. At the same time, there are no strict requirements for the duration of the insurance period itself.

Social

A social pension for the loss of a breadwinner is paid in cases where the deceased citizen did not work at all.

The length of service includes only periods of official employment. Carrying out labor activities without proper registration is not counted towards the period for assigning a pension.

State

This type of financial support is paid to the dependents of a deceased breadwinner who was a military personnel or employee of structures equivalent to the army. Also, persons who were supported by a civil servant can apply for a state pension.

Who can use this method and under what conditions?

Many people have heard about the possibility of transferring to a deceased husband's pension, but not everyone understands the rules of this process. Only the man's shortfall, which was accrued during the citizen's lifetime, is provided.

Therefore, women most often choose simply a survivor’s pension, which is often larger than the usual insurance payment from the Pension Fund.

Only spouses who are pensioners or have some type of disability can use this method. This is due to the fact that they are then disabled.

In what cases does a spouse receive the deceased husband’s pension?

Registration of this type of pension does not occur automatically. For this, the spouse must have certain grounds.

They should be considered in more detail.

- Proven fact of disability. To receive this type of pension, the spouse must herself have pensioner status, which is assigned to her by age or disability. If a woman has other sources of income other than a pension, then she will be denied transfer to her husband’s pension.

- Giving up your own pension. The spouse of the deceased will not be able to receive his pension and survivor benefits at the same time. She must choose what type of pension she will receive in the future.

- Being dependent on a spouse. It should be noted that only spouses who were in a marriage officially registered with the registry office can count on this type of security. In this case, the fact that the husband provides materially for his wife is also important.

Attention! If a woman remarries before her husband's pension, she loses the corresponding right.

Conditions for re-registration

Transferring to the pension of a deceased husband or wife is possible at any time, if the widow (widower) has not entered into a new marriage. The same applies to returning to your own pension. The number of transitions is not limited by law.

In what cases is a widow entitled to a pension under the SPC?

The spouse of the deceased has the right to switch to a survivor's pension if she (Article 10 of the Federal Law No. 400 of December 28, 2013):

- She was dependent on him and:

- reached the age of disability - 55 years (clause 3, part 2);

- has a disability (clause 3, part 2);

- Without taking into account the fact of dependency:

- provides care for the relatives of the deceased who are under 14 years of age and have the right to the specified payments (clause 2, part 2);

- lost her job or other source of income, regardless of the period that has passed since the date of death (Part 5).

The unknown absence of a husband, officially established in court, is equivalent to his death. If the husband’s death occurred as a result of the wife’s intentional actions, she loses the right to receive payments under the SPC.

What happens when you remarry?

After registering a new marriage, the widow loses the opportunity to switch to a survivor's pension. However, a transfer made before remarriage is not annulled. Accordingly, in the event of a return to her own pension, the woman will no longer be able to re-register her for benefits under the SPC.

How to calculate the amount a widow can receive

The concept of “transition to the husband’s pension” is also fundamentally incorrect in this regard, in that it mistakenly means that the widow will be able to receive her husband’s payments in full. Actually this is not true. The payments due to the widow will be less than what her deceased husband received.

It should be noted that the amount of payments to the spouse will depend on many factors, such as:

- the size of the husband’s salary and his insurance period, since the size of the pension depends on these factors;

- number of dependents other than wife;

- whether the spouse was one of the military personnel or other persons entitled to state pension provision.

In practice, transferring to the husband's pension can only be justified if the deceased spouse's pension was really large. If the amount of his pension provision did not differ much from the payments due to his wife, then it may turn out that the pension after the transition will be even less.

Thus, the calculation of the amount that a widow can claim largely depends on individual factors. In this regard, it is recommended to contact employees of the state pension fund for additional clarification.

Separately , it should be noted that the wife can receive her husband's funded pension . This is only possible if the citizen participated in its formation, but died before he reached retirement age.

In this case, pension savings become part of the inheritance estate. If there is no will, then, in accordance with the provisions of the Civil Code of the Russian Federation, heirs of the first priority will be able to claim them, including, in addition to the spouse, the children and parents of the testator, between whom they will be divided in equal shares.

When is it appropriate to use a transition?

Switching to a PC pension is advisable only if the payment transferred to the woman is less than this benefit.

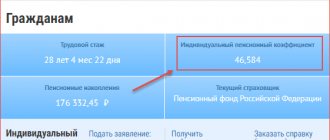

Typically, this situation arises when a woman is assigned social benefits because she does not have the required length of service and the number of points to qualify for an insurance payment.

In this case, the PC pension is much higher than the current payment received by the pensioner. This is due to the fact that the calculation of this payment is based on the amount of the deceased husband’s pension.

For example, a woman receives a pension of 10.5 thousand rubles. Her deceased husband received a payment of 17 thousand rubles. In this case, it is beneficial to apply for a PC pension. To do this, it is advisable to contact the Pension Fund branch yourself to find out about the amount of the payment provided.

How to transfer to the pension of a deceased spouse of a pensioner

As mentioned earlier, the corresponding payment is not automatically assigned to a woman, only upon the death of her spouse. To re-register, she should contact the relevant government authorities and provide a package of documents confirming her right.

Collection of documents

Before applying for an appropriate pension, the widow must collect the necessary papers, including:

- passport or other document identifying the applicant;

- a certificate confirming the death of the spouse or a corresponding court decision;

- marriage certificate;

- a document confirming that the woman is a pensioner;

- TIN;

- SNILS (if available);

- work book of the deceased breadwinner.

In addition, depending on the circumstances, other documents may be required, such as: military ID, birth certificates of children, certificate of family composition, and so on.

Where to contact

To assign security, a citizen must contact the pension fund at her place of residence. In addition, it is possible to submit documents through multifunctional centers, which is much more convenient for applicants.

If the deceased spouse was a military pensioner or received a pension from the department where he served, equivalent to military service, then his wife must contact the appropriate authorities to assign support.

It should be noted that a pension upon the death of the breadwinner must be applied for within 6 months. after this date.

Important! If the six-month period is missed, the Pension Fund will refuse to grant a pension. In this case, it will be necessary to go to court. At the same time, during the hearing, the plaintiff will have to present arguments and evidence in favor of the valid reasons why the deadline was missed.

The date of payment of the survivor's pension is directly determined by evidence of dependency

What is dependency? In this situation, dependency means the fact of receiving permanent financial support from the deceased spouse, which during the period of official marriage was the main source of livelihood for the surviving pensioner.

Regarding the rules for confirming dependency, the Pension Fund has an unequivocal position - when the income of the remaining pensioner is below the subsistence level, and that of the deceased spouse is higher, then dependency is confirmed.

In a situation where the income of both spouses was higher than the minimum monthly wage, it is problematic to convince the Pension Fund of dependency. The Pension Fund of the Russian Federation will require the submission of documents confirming cohabitation and expenses significantly exceeding the applicant’s pension income.

Documentation allows you to prove that a person could not do without financial support from his spouse. If the Pension Fund refuses, then the fact of dependency can be established in court .

If the spouse has additional benefits, are they preserved?

When transferring to the husband’s pension, or, more correctly speaking, when making payments for the loss of a breadwinner, the spouse must abandon the previous form of her financial support.

For example, if she received disability payments, she cannot count on them in the future. However, she retains in full other non-material benefits that are due to her as a person with disabilities.

The transfer to the husband's pension is not always justified, since, in essence, it should be understood as processing payments for the loss of a breadwinner. However, if the deceased spouse had a decent amount of support, then this step will improve the financial situation of the widow.

What will happen to benefits?

At the legislative level, there is a special category of widows who have the right to claim benefits even after the death of their spouses. For women who did not work in connection with the move to the place of service of their military husbands and were not able to accumulate work experience for the calculation of benefits, monetary support is considered separately.

The pension for widows for the loss of a breadwinner, whose death occurred as a result of the performance of official duty, is calculated in a different way. It is equal to approximately 40% of the payments if the deceased spouse served in the Ministry of Internal Affairs, was a military personnel or contributed to the liquidation of the Chernobyl accident.

Pension accruals for military personnel and their spouses also differ from standard labor accruals. If in general cases the spouse of the deceased does not have the right to receive benefits for her deceased husband, widows of military personnel who died in service, participants in combat operations in “hot spots” or veterans of the Great Patriotic War have similar privileges.

Thus, the state allows spouses to receive pension payments for their deceased husbands in cases where they refuse their own benefits. However, the re-registration process involves a lot of nuances associated with the calculation of pension payments and the preparation of the required documents.

Rules and terms of transition

If a woman applies for payment within 12 months after the death of her husband, and can also prove that she was dependent on him, then the pension is assigned immediately from the moment of death. To do this, the contents of the death certificate are taken into account.

If a woman cannot prove her dependency, then she will be able to apply for a personal pension only if she resigns. The fact is that usually a woman has the same income as a deceased man only if she is a working pensioner.

As soon as she quits, she can fill out an application to the Pension Fund, where she indicates that she has lost her source of income, and therefore wants to receive a survivor’s pension. This payment is assigned from the next month if there are no reasons for refusal.

Under such conditions, the woman will not be able to count on her pension, so she receives only one payment.

After the death of a spouse, any woman can apply to the Pension Fund to receive a survivor's pension. It is advisable to do this only if the husband’s income was higher than that of the woman. Under such conditions, she can be recognized as a dependent and count on a higher payment.