Features of pension recalculation after 40 years of work experience

A citizen of the country can apply for an increase in pension payments after receiving 40 years of service. In government agencies, re-registration occurs without problems, but a number of conditions must be met.

Accrual occurs according to the formula. Capital indicators, the number of months for which the calculation is taken, and the entered volume rate are taken into account. Pension Fund employees calculate the amount of additional payment for each specific case separately.

The procedure for registering content in the Samara region

Assigning a pension benefit is an important step for a citizen. It should be taken seriously. The algorithm for contacting a government agency is as follows:

- Collect required documents and make copies of them. They are:

- passport;

- SNILS;

- work record book (all if there are several of them);

- contracts with employers, if the periods are not included in the Labor Code;

- official information on earnings for 60 consecutive months;

- Additionally, you may need (if available): a certificate from a medical and social examination about the disability group;

- information about the presence of dependents and their identity documents;

- death certificate of the breadwinner and confirmation of family ties.

- Take the documents to the territorial Pension Fund office.

- Fill out the application form on site, carefully entering all the data.

- Get expert advice.

- Bring the necessary papers (if required).

- Select the appropriate method of receiving funds:

- by mail;

- to a bank account.

- Withdraw money after the transfer. If a pensioner does not receive funds within six months, then accruals will be suspended.

Hint: it is advisable to bring all the papers to the Pension Fund for verification in advance. You will probably need to confirm some entries in the TC with certificates.

Where to contact

| Address | Telephone | Working hours with the public |

| st. Sadovaya, 175 | +7 | from 8.30 to 17.30 (on Friday until 16-30) |

| st. Moskovskoe highway, 278A | +7 | |

| st. Chernorechenskaya, 21 | +7 | from 9.00 to 16.00 (on Friday until 12.00) |

| st. Lazo, 2A | +7 | from 9.00 to 16.00 (on Friday until 15.00) |

| Metallurgov Ave., 10 | + | |

| st. Revolutionary, 127 | +7 | from 9.00 to 17.00 |

| st. Sanfirova, 95 | + | from 9.00 to 18.00 |

| st. Lieutenant Schmidt, 21A | + | from 8.30 to 17.30 |

Hint: government agencies shorten the working day by one hour before the holidays.

What to do when moving to another city

Pension benefits are assigned and paid according to federal laws throughout the Russian Federation. When changing your place of residence, you need to do the following:

- Register at a new address.

- Go to the Foundation branch at the new address with your passport.

- Write an application requesting the transfer of the case to a new address.

- Don't forget to indicate a convenient way to receive funds.

Hint: when traveling abroad for more than six months, you should inform the Fund’s specialists about the temporary impossibility of withdrawing funds.

What is included in the experience?

The total work experience is calculated depending on the specific specialization. But you don’t have to work continuously for 40 years. The law provides that certain life periods may also be included in the amount.

The following must be taken into account:

- maternity leave;

- service in the Russian army.

Women count on maternity leave, which can be a maximum of five years, but not more than one and a half years per child.

Military service is taken into account entirely by both sexes. Time spent studying in educational institutions, including the military department of state higher educational institutions, is not taken into account. Important! Military personnel who serve under a contract are provided with bonuses depending on their length of service. For example, if the service time was more than 25 years, then this is 40 percent.

Legal regulation

Russian legislation in the field of insurance pension accruals consists of a number of regulations. The main norms are laid down by Laws No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” and No. 400-FZ “On Insurance Pensions”. The regulations regarding pensions financed by the federal budget are prescribed by 167-FZ; for military personnel (including employees of the Ministry of Internal Affairs), the provisions of Law No. 4468-1 apply.

The mandatory indexation of pension benefits is provided for by Law No. 400-FZ, and the cost of one individual pension plan is adjusted annually by a separate law approving the pension fund budget. Additional benefits for veterans of all groups are established by a special legal act - Law on Veterans No. 5-FZ, which, among other things, introduces the term length of service to create preferential pension conditions.

- How to pickle mushrooms: recipes with photos

- Sugaring - what kind of procedure is it? How to properly do sugar depilation at home

- Nano SIM card for smartphone. How to cut a regular or micro SIM card for nano SIM format

Allowances for length of service

The funded pension payment is fixed across the country. In 2020, it was set by the Pension Fund in the amount of 4,805 rubles. This is a minimum amount, but often retired Russians receive a lot of money. The fact is that allowances are made depending on years of experience. They are equal to the sum of points earned, and the parameter is multiplied by the cost of one point. The cost is not a fixed value; it is changed by the citizen of the country independently. It is calculated depending on what payments a person makes to the government agency. The more he pays, the more his point becomes worth. Consequently, the size of the pension payment increases.

Points are awarded in the following quantities:

- 1 coefficient if a woman’s work experience reaches 30 years, and a man’s work experience reaches 35 years;

- 5 coefficients if a woman has worked for 40 years and a man has worked for 45 years.

The Government of the Russian Federation has set the size of one point at 93.00 . According to the state program developed until 2025, the size of the point will increase annually. There is no exact data on the increase, since the amount is affected by the level of inflation in the country.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Those citizens who have 50 years of continuous work experience at the enterprise receive additional payments. The amount is fixed, paid in addition to the main one. That is, points are not recalculated. In [year] the amount of this payment will be 1063 rubles per month.

What will be the amount of payments after 40 years of work?

As noted earlier, with 40 years of experience, citizens increase the amount of social benefits by 5 points. Pension payments are calculated taking into account real earnings and total length of service.

Reference! People who do not have work experience fall into a special category, because the calculation of a labor pension is impossible in the absence of a period when the employee was engaged in labor activity.

Amount of payments to working pensioners

Even those pensioners who, even after retirement, continue to work can recalculate social payments. The fact is that their employers continue to make contributions to the Pension Fund.

The increase after 40 years of service is calculated taking into account the earnings of a working pensioner and the amount of insurance contributions. The size of the increase is also influenced by the age of the pensioner. During recalculations, points will be awarded, which will then be converted into cash equivalent. On average, the increase in pension is 222 rubles.

Where can I apply for additional payments?

Recalculation of the amount of payments upon reaching forty years of service occurs automatically. A person does not need to contact the authorities. But there are situations, especially when it comes to small towns or cities with a large number of pensioners, when recalculation does not occur. Therefore, you need to apply yourself.

If the recalculation does not occur and the Russian receives the same amount, then he should immediately contact the authorities and demand an explanation of the situation. The social protection authorities are dealing with the issue.

What will you need?

Please note that in 90 percent of cases there is no need to apply for recalculation. The process happens automatically. But if for some reason this does not happen, then contact the government agency. To re-register a pension if you have reached 50 years of service, you must apply yourself - there is no automatic calculation.

The pensioner is not required to take any action other than telling the authority employee what question he is asking about and presenting the necessary package of documentation. Copies remain with the public protection authorities.

Required documents

You will need to present the following documents:

- passport;

- pensioner's ID;

- work book;

- documents confirming pension insurance.

Attention! If you do not have a work book, you will need to present a certificate from the company, which states the hours of work. If there are no supporting documents, then employees will not be able to complete the registration.

Step by Step Actions

After presenting the package of papers, all that remains is to wait. As a rule, payments are transferred in the next pension. If the accruals should have been much earlier than the circulation period, then a person can receive the maximum only in the last six months. That is, if you forgot to apply, and payments based on length of service could have been given for more than 6 months, then after applying you will receive only the last 6.

Those who keep savings in a bank account additionally provide its number.

General issues of pension provision in the Samara region

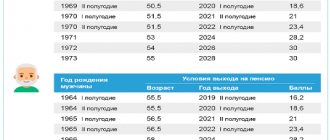

Persons who meet the following criteria are entitled to pensions in the Samara region in 2020:

- Insurance:

- those who have reached a certain age: a woman’s 55th birthday;

- man's 60th birthday;

- otherwise if there are preferential grounds;

- disabled people of groups 1-3;

- who have accumulated the following minimum indicators on their personal insurance account:

- 9 years of work experience;

- 13.8 points.

- Social benefits are awarded to those who do not have the required length of service and points:

- women over 60 years of age;

- men who have celebrated their 65th birthday;

- disabled people who have worked for at least one working day;

- disabled people who have lost their breadwinner.

- According to state support, it is due to military personnel and equivalent persons who have sufficient length of service.

- The accumulative amount is paid according to the agreement on an individual basis.

Hint: some categories of citizens have the right to receive two pensions. For example, retired military personnel, subject to employment “in civilian life”.

Components of software for pensioners

According to the accrual formula used in 2020, they consist of several fundamental parts:

- Basic — RUB 4,805.11. It is the same for everyone. In addition, it increases annually by the level of inflation recorded for the previous period.

- Insurance. This component is calculated individually based on the length of service and accumulated points.

- Various types of surcharges.

Hint: points are calculated based on the amount of contributions made by the employer for the worker. The more there are, the higher the savings, and therefore the pension provision.

Advice for future retirees

In order not to live in poverty in old age, you need to comply with two important conditions in your younger years:

- Apply for employment only officially. Then the employer will make contributions for the employee, forming his maintenance in old age.

- Receive a white salary. The contribution is calculated from the amount that is carried out monthly by the accounting department on the worker’s personal account.

Hint: if the employment is formalized by a contract, then you should save it until the date of application to the Pension Fund office.

Indicators of pension provision for residents of Samara and the region for 2018

The government carefully monitors the level of well-being of the population. Its task is to prevent the population's income from falling below the established subsistence level (ML).

The following statistical data were recorded for the Samara region:

| Index | Size | Explanations |

| Average content of pensioners | RUB 13,620.0 | Calculated taking into account all recipients |

| Minimum | RUR 8,200.0 | Monitored to prevent a decline in people's living standards |

| Minimum wage (minimum wage) | RUB 7,800.0 | Affects the filling of the Pension Fund budget |

| PM by region | RUB 7,910.0 | Affects the accrual of surcharges |

| PM by country | RUB 8,506.0 | |

| Number of recipients | 970 481 | Find out for planning budget expenses |

For information: the minimum wage increases regularly based on the decision of the Government of the Russian Federation. The last time it was raised was 07/01/17.

About surcharges

The calculation formula currently used leads to the fact that the pensions of most citizens are small. The problem has become so widespread that it had to be resolved at the legal level. The accepted rule is as follows:

- the income of a non-working pensioner cannot be below the minimum monthly wage: by region;

- around the country;

- a larger value is selected.

Thus, each recipient of maintenance from the Pension Fund budget receives the right to establish an allowance. Moreover, the law states that he can choose one:

- federal;

- regional.

In practice, the statement indicates the one that is larger. In the Samara region, the PM is lower than in Russia. Consequently, citizens receive an additional payment up to the minimum wage in the country. There is only one condition for such an increase in pay: the absence of official employment.

In addition, the law establishes a number of additional payments to the pensions of such persons:

- having awards: state;

- for participation in the World or European Championships;

- for prizes in the Olympics and Paralympics;

- disabled people of group 1;

For information: allowances are also given to those who have dependents. For example, minor children.

What does forty years of service give to those who have already retired?

Recalculation is required, but there are conditions for it to begin. Pensioners have the right to apply for it:

- whose age has reached 80 years;

- with a disability.

Those who have worked in the North of the country should take other criteria into account. 50% of the established norm is added after 20 years of experience for women and 25 for men. Disabled people of the third group cannot receive a double bonus.

Second pension for military pensioners

Pensioners who served in the military before retirement have the right to count not only on an old-age pension, but also on pensions associated with the assignment of a disability group or length of service.

The insurance part of the pension will be provided only to those citizens of retirement age who have not quit their jobs in a civilian institution and continue to receive military benefits. An additional pension payment is assigned if:

- the citizen’s employer has regularly made insurance contributions for at least 5 years;

- the person has reached retirement age (55 years for women, 60 years for men).

To apply for a second pension, you will need to collect the following documents:

| Document | Where to get it |

| Russian passport with a stamp indicating registration in the region where the application is submitted | Ministry of Internal Affairs of the Russian Federation |

| Certificate of pension insurance | Pension Fund of the Russian Federation |

| Work book with records of places of employment | From last place of work |

| Certificate of average monthly income for 5 years of continuous activity | Federal Migration Service of the Russian Federation or accounting department at the place of work |

| Certificate of marriage, divorce, change of name (if last name or first name has changed) | Civil registry offices |

| A certificate indicating the position, duration of service, which was taken into account when calculating the state. benefits for long service or disability | Relevant law enforcement agency |

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

Benefits and allowances for pensioners by region in 2020

The powers of the constituent entities of the Russian Federation establish their own standards for supporting pensioners. Local administrations have the right to assign additional payments from their own budgets, taking into account the financial situation in the region. The following entities are ready to provide support in the Russian Federation in 2020 for people of retirement age:

- Volgograd region - determined monthly in addition to the additional payment at the federal level of pension in the amount of 558 to 804 rubles, depending on the duration of activity.

- Irkutsk — Compensation for the cost of a home telephone.

- Kemerovo — Social cards are issued on preferential terms. They can be used to pay for medicines and food in special stores.

- Krasnodar - monthly supplement of 550 rubles.

- Crimea - monthly payment of 500 rubles.

- Moscow - 5% discount on sugar, bread, milk and eggs.

- Novosibirsk - 50% discount on the purchase of a hearing aid.

- Perm - no land tax for up to 6 days.

- Sevastopol - Allocation of gardens is provided free of charge for the construction of villas and houses.

- Khabarovsk Territory - part of the cost of sanatorium treatment.

How is it happening?

The recalculation is carried out by representatives of the Pension Fund , but for this the pensioner himself must submit a corresponding application. This process must be initiated by the recipient of the payments; for this, he will also need to take care to provide documents confirming his words. Based on this, recalculation will be made.

It is important for pensioners to understand that any changes that occur to him, for example, he went to work, decided to continue working, or vice versa, decided to stop working and go on a well-deserved rest, all these facts must be reported to the Pension Fund within a certain time frame, which you They will tell you when you apply for payments.

Not only the pensioner, but also the Government can initiate recalculation.

A striking example is the recalculation that is carried out every year before August 1. This applies to those pensioners who continue to work; such a recalculation is a positive thing for them, since the result is an increase in pension payments.

Order

The procedure for recalculating pensions is described in Federal Law No. 400 dated December 28, 2013 “On insurance pensions” . It depends on the basis and method by which the recalculation is made. There are two options here - by application from the pensioner or automatically.

The second method does not require the intervention of the recipient of pension payments, since this is carried out at the initiative of the Government; such recalculations are applied to working pensioners. So, let's consider the order depending on the method of recalculation.

If there is a change that is a prerequisite for making calculations that will change the amount of payments, then it will look like this:

- The applicant collects the necessary documents.

- Writes a statement.

- Submits documents to the Pension Fund for review.

- The decision is made within five working days from the date of submission of all documents or from the date of submission of the last of them.

- The accrual will be received the following month from the date of application.

In accordance with the rule described in Federal Law No. 210 of July 27, 2010, the Pension Fund can request from citizens only those documents that cannot be obtained by them through a single information database.

If we talk about automatic recalculation, then nothing is required from the citizen. On August 1, the pension amount is recalculated .

Example

In order to better understand the recalculation method, let's consider an illustrative example.

Inna Valerievna retired, but continues to work at her previous place of work. Like all working pensioners, she is entitled to an automatic recalculation of her pension on August 1. To do this, you need to know the level of her average monthly salary last year. It amounted to 16,500 rubles.

At the moment, her salary is at the level of 23,000 rubles. The employer pays contributions for its employees in the amount of 22% of the salary. A citizen receives only an insurance pension, that is, 16% goes towards it.

Let's calculate the annual salary of a pensioner: 16,500 * 12 = 198,000 rubles.

The amount of pension contributions will be equal to: 198,000 * 0.16 = 31,680 rubles.

Let's calculate the pension coefficient of a potential pensioner: 31,680,127,360 * 10 = 2.487, where 127,360 is 16% of the maximum tax base.

Thus, we will recalculate the citizen’s pension. Pension after transfer = 16,500 + (2.487 + 74.27) = 16,576.76 rubles, where 74.27 is the cost of one point.

Read about how to correctly calculate pension points for Soviet service here.

Benefits for 50 years of experience in the Moscow region

As a rule, information about the applicant is repeated here, including year of birth, passport data, and also contains a request for the assignment of a title and the issuance of the appropriate certificate. It is also necessary to indicate the reasons for acquiring this status with reference to supporting documents.

“Can I recalculate my pension? "

On a note! We have already spoken above about the possibility of receiving financial benefits for pensioners based on the period worked. How is the size of the benefit determined taking into account standard pensions? Initially, we determine that as of the year the amount of the standard part is rubles. The additional payment for pension points is added to them, and it determines the second part of the pension. The additional payment is formed by multiplying the number of points by the cost of one coefficient. The Pension Fund of the Russian Federation establishes pensions assigned in accordance with Russian legislation for certain categories of citizens.

We recommend reading: How to find out the debt for major repairs on a personal account in Moscow

Currently, the Pension Fund is updating lists of citizens with long work experience. To determine the right to receive an early pension, individual work is carried out with each future pensioner. If a short period of work is missing from the required length of service, citizens are invited to customer services with documents to clarify whether all periods of work have been taken into account. An extract from your personal account with information about your length of service can also be obtained from the Pension Fund client services and multifunctional centers. If a citizen discovers that the personal account does not contain information about a certain period of work, supporting documents must be submitted to the Pension Fund so that this information is taken into account when assigning a pension.

How does a pension depend on length of service?

According to the new pension legislation, new rules for calculating pension subsidies have been adopted since January 1, 2015.

To assign state payments, you must have a minimum of work experience (9 years in 2020), reach a specified age and achieve a pension coefficient, or a number of points equal to 13.8 by 2020.

The value of points increases annually due to indexation. The benefit consists of a funded and insurance part. Recalculation of pension based on length of service is issued if the following conditions are met:

- The applicant has a Labor Veteran certificate.

- There is new documentary evidence of length of service that was not previously taken into account when assigning state subsidies.

- The citizen’s work activity continues. Pensioners can count on annual (August 1) indexation of state benefits.

- Pickled eggplants

- 7 ways to save on rent

- Due to coronavirus, all weddings and divorces are canceled in Russia

How to register a labor veteran to receive additional payments in 2020

An additional benefit for persons with labor veteran status is the payment of benefits. You need to get a special status:

- address someone/sth. Pension Fund and receive an old-age pension;

- apply to the Department of Social Protection of the Population for assignment of the title of labor veteran and payment of amounts due in connection with the assignment of the status of labor veteran, as well as other benefits.

Important: The issuance of a veteran's certificate is not automatic. It is necessary to submit a written application to the competent authorities accompanied by supporting documents. To register payments in the social insurance system, you must present a citizen's passport. Russian Federation and veteran's rights.

The application review period is 30 working days from the date of submission of the full package of documents.

The level of pension provision is increased annually by indexing pensions in accordance with the level of inflation.

Important: If a pensioner falls into several categories, for example, working in agriculture in the Far North, he has the right to choose a system of additional payments - either by providing a monthly subsidy, or by paying additional payments to the debit of the Pension Fund of the Russian Federation.