Merger of NPF Raiffeisen with Safmar

This company began its work in the 1990s. Therefore, we can say that the population of the country has managed to make sure that the organization fulfills its obligations in good faith. Over time, the quality of the services provided does not decrease; verification activities are constantly carried out to confirm professionalism.

At the beginning of 2014, this fund was reorganized , as a result of which it became part of ]Samfar[/anchor], which is also represented by a non-state pension fund.

All acts and funds, obligations of Raiffeisen, as well as clients were transferred to this organization. Then the Regionfond, the European Foundation and Education and Science joined this company.

“What, where, when” – overview and dynamics

Let's see how things were going for mutual funds managed by Raiffeisen Capital in 2020, which was so difficult and eventful. We will compile the success rating of mutual funds based on the level of profitability growth compared to 2014. This is how the places were distributed:

- Raiffeisen - Shares . The fund's specialization is shares of leading Russian companies that shape the long-term development of the national economy (these are not only companies in the mining sector, but also in the financial and consumer sectors). A fairly diversified option in terms of risks. Despite the difficult political and economic relations in the world, mutual funds in this area showed the highest growth - 36.8%.

- Raiffeisen - Raw materials sector. This package consists of leading companies extracting and processing oil and gas, as well as those involved in metallurgy and mineral fertilizers. This may be why the increase in profitability is slightly lower - 36.3% (the portfolio is more highly specialized).

- Raiffeisen – Information technologies. In the era of the development of cyberspace and communications, this investment option can be considered a win-win, since it assumes the most favorable risk/return ratio even in an ambiguous economic situation. This turned out to be true in 2015 – 33.48% growth.

- Raiffeisen - Bonds. It is considered the most conservative mutual fund, since it is based on debt securities of companies with a high share of state participation. Most likely, thanks to the strategy “you drive slower, you will continue to move”, in terms of profitability, such a mutual fund is always among the leaders - 29.04% growth.

- Raiffeisen – Active Management Fund. The portfolio includes shares of the largest Russian and foreign companies, as well as promising foreign assets. Also a win-win option with proper diversification of investments - 27.35%.

- Raiffeisen - USA. The fund for investors who have no doubts about the success and steadfastness of the world's largest economy has shown quite good results. The case when “the record book works for the student” – 27.34% increase.

- Raiffeisen - Industrial. The portfolio is based on companies in the metallurgical sector, as well as companies in related industries: construction, mechanical engineering and the chemical industry. An unexpectedly good result in the conditions of the “crisis” – 24.41%.

- Raiffeisen - Consumer sector. Even despite the crisis, which primarily affects companies in the consumer sector due to the decrease in the purchasing power of the population, the mutual fund showed an increase of 23.08%.

- Raiffeisen - MICEX blue chip index. The fund is in the “passive management” category, as it follows the dynamics of the MICEX index. Growth – 23.07%.

- Raiffeisen – Debt markets of developed countries. The portfolio consists of corporate debt assets of the largest American and European companies with high credit quality - 19.99%.

- Raiffeisen - Europe. The mutual fund also belongs to the “passive” category, as it follows the dynamics of the MSCI EMU index (formed from shares of the largest European companies that are members of the Economic and Monetary Union) – 18.35%.

- Raiffeisen - Balanced. As the name suggests, the mutual fund's strategy is a combination of debt and property securities of the largest international companies - 14.17%.

- Raiffeisen - Gold. Historically, it is considered the most stable investment, especially during the period of depreciation of the ruble - 12.86%.

- Raiffeisen - Treasury. The lion's share is made up of government securities of the Russian Federation. Like gold, this is also an investment with the lowest degree of risk, and therefore one should not expect a high level of return - 11.42%.

- Raiffeisen - Electric Power Industry. The bet on companies in the electricity sector in 2020 can be considered not very successful - only 10.28% growth. Raiffeisen - Emerging Markets. Investments in developing economies this year have not met expectations - only 7.23% annual growth.

- Raiffeisen - Precious metals. A clear outsider, since he was the only one who “reached the finish line” with a negative result: – 6.04%.

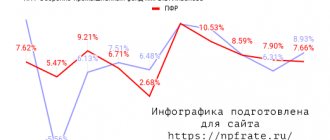

Reliability rating as part of Sofmar

In 2012, the Raiffeisen fund was assigned a positive degree of reliability, which indicates trust from users. As a result, the company's profitability increased. In 2013, experts recognized the level of the company’s activities as reliable and gave it a high rating.

In addition to the fact that the organization in question pursues the goal of preserving funds, it strives to adhere to a minimum level of risks and ensure increased income. Therefore, savings are invested on an ongoing basis, and reserve savings are used.

Step-by-step instructions for transferring a pension to another bank

A minimum of action is required from a person to transfer pension payments from one bank to another, because the main work is done by the financial institution itself in tandem with the pension fund and government agencies. The whole procedure is carried out in three stages:

- First stage. Visit the bank office and select the appropriate tariff. You need to come to a financial institution and say “I want to receive my pension on your bank card.” Then choose a tariff from the many offered.

- Second phase. Opening a free current account, which is issued on the terms chosen by the pensioner.

- Third stage. Writing an application for pension transfer (it will be sent to the Pension Fund at the place of registration of the person). Difficulties may arise when filling out, and a bank employee will help you sort them out.

After this, all that remains is to wait for government agencies to approve the bank chosen by the pensioner, which will then issue a plastic card to receive social benefits. No further action is required.

Best income cards 2020

№1 Ultra

Eastern Bank

Debit card

- 5% on balance

- up to 7% cashback

- 0₽ for service

More details

IT'S TIME

UBRD

Debit card

- 6% on balance

- up to 6% cashback

- 0₽ for service

More details

Profit

Uralsib

Debit card

- 5.25% on balance

- up to 3% cashback

- 0₽ for service

More details

Non-state pension fund programs

A mandatory condition for the organization in question is pension insurance. Therefore, Raffeisen offers its clients, at their own discretion, to manage their assets that have accumulated in the account. Due to the fact that the pensioner makes a contribution to the organization, he manages finances and plans for future activities.

The amount of the funded part of the pension will depend on how much money is constantly transferred to the fund. If a citizen wants to become a client of Raiffeisen, he will need to contact NPF Samfar, since these institutions have merged. Citizens are served at a Raiffeisenbank branch.

Certain categories of citizens can take advantage of savings programs:

- persons born in 1967 and later. In this case, the contribution amount is about 6% of income. Savings are formed from contributions made by the company where the citizen works;

- participants in a program that provides co-financing of a pension;

- owners of maternal capital funds.

The program of this fund assumes that funds will be accumulated in an account opened with a banking organization. At the same time, the contribution has some positive aspects.

Including:

- opening is made in rubles;

- with the use of a co-financing program it is possible to increase income;

- funds can be transferred to heirs;

- ability to manage money.

Reference! The program is selected individually, depending on the citizen’s income level.

RCMX General Terms

The fund tracks the MRBCTR index - Moscow Exchange Total Return Index 15. Specially created for this BPIF. Information on the index is available on the Moscow Exchange website, in the custom indices section.

Total return means that all dividends received are reinvested within the fund.

It is planned that the share of each company in the index will not exceed 9%. Review of composition and shares (rebalancing) - once a quarter.

The investor's total expenses when owning RCMX are 1% per year:

- 0.5% — management fee;

- 0.4% - depository;

- 0.1% - others.

The commission is “average for the hospital.” Most traded equity funds ask for about the same amount (range from 0.65 - 2.5%).

Traded only in rubles.

I recommend: Real commissions of BPIF and ETF on the Moscow Exchange in one table

Official website of the company

The company in question has developed its own website, which is designed for the convenience of clients.

It consists of the following:

- the opportunity to obtain information about programs at NPFs;

- placement of contact information on the portal, which helps to know where to go to resolve the issue;

- registration in your personal account.

Having an account in your personal account allows a person to always be up to date with his funds.

Is it possible to create a personal account and how to do it

Only those citizens who have entered into agreements with the fund can use the service in question. Therefore, you do not need to register on the NPF portal; it is enough to use the login data that will be provided by a company employee when concluding an agreement.

If a person forgets his password, he can recover it himself by using the “Forgot Password” button. The system will ask you to enter an email address that is associated with the agreement. A letter is sent to this address containing a link that you need to follow to recover.

Attention! If a citizen did not indicate an email when concluding an agreement, he will need to contact the fund’s branch to do this. In addition, information can be sent by mail.

Personal account functions

The personal account is designed to provide clients with convenient use of NPF services. A citizen has the opportunity to carry out transactions related to a funded pension around the clock and using any device with Internet access.

Including, information is provided about:

- the state of the citizen’s current account;

- information about transactions carried out on the account;

- personal data verification;

- alteration;

- contact support service.

In addition, the ability to generate a pension account statement or set up notifications can be used.

Which card can I transfer my pension to?

A person has the right to receive a pension in another bank if he is not satisfied with the conditions of service in the current one. The main thing is that the organization provides such an opportunity. The choice of cards is large - preferential, platinum, credit, debit, and so on. A special pension bank card is provided specifically for transfers from the Pension Fund.

You can transfer your pension to any bank that works with the Pension Fund of the Russian Federation:

- UniCredit Bank;

- Sovcombank;

- Svyaz-Bank;

- Bank "Russia";

- Raiffeisen Bank;

- Promsvyazbank;

- Post Bank;

- OTP Bank;

- Credit Bank of Moscow;

- Gazprombank and others.

These banking structures can work with pensioners in accordance with Government Decree No. 761, developed in 2006, since the listed organizations meet the requirements specified therein.