The brightest among them is Absolut Bank, which the fund bought for very decent money, and now it would be happy to “merge”, but it can’t find buyers for it. Karma. After all, from the very beginning, the purchase of Absolut was accompanied by scandals. Then analysts pointed out the lack of any logic in the purchase. Starting from the price (officially - 12, unofficially - more than 20 billion rubles) and ending with a violation of the principles of liquidity for investing pension funds. At the same time, the advantage of NPFs over the state pension fund was at one time explained precisely by the flexibility of financial management, which pensioners (both current and future) entrust to professionals from NPFs. In fact, it turned out that the fund did not think much about liquidity: the money went into shares that are not listed on the stock exchange. Moreover, in order to circumvent legislative restrictions, the fund acquired the bank through the usual scheme with 11 management companies.

Features of your personal account

The developers of the personal account on the official portal https://npfb.ru took into account that its users will be elderly people, many of whom do not have high computer literacy. Therefore, the service interface is made extremely simple and understandable, all the elements are quite large, and their purpose is easy to guess.

The personal account provides the user with a number of useful functions:

- receiving advice on pension issues;

- obtaining information about the current balance of a personal account;

- familiarization with company news, new opportunities and services;

- notification of all changes;

- sending requests for various documents, certificates, downloading forms.

Creating a personal account

To get a personal account on the website of NPF Blagosostoyanie, you must fulfill 2 conditions. First of all, the client should sign an agreement with the fund, which must come into force. This means that at least 1 payment will be made to the personal account.

You also need to submit an application to the pension fund to provide remote access to your personal account. It is on the basis of this document that the client is provided with a personal account. You can submit your application in one of three possible ways:

- application on the official website of the fund, fill it out, print it and send it by mail to NPF Blagosostoyanie.

- Visit a branch or branch of NPF Blagosostoy to submit an application. You need to have an identification document (for example, a passport) and SNILS with you.

- Current and former employees of Russian Railways can go to the human resources department at their place of work to submit an application.

NPF Blagosostoyanie: registration form

Online registration of a personal account on the company’s website is not provided. Based on the received application, fund employees will provide the client with a password for their personal account. If the client visits the fund branch in person, the password will be issued to him immediately. If the application is sent by mail or submitted to the personnel department, you will need to wait until NPF Blagosostoy receives it. The password will be sent by email, the address of which the client must indicate in the application. Therefore, when entering it, you need to be extremely careful. SNILS will be used as a login to enter your personal account.

NPF "welfare"

Otkritie's activities are concentrated in Russia and focused on cities such as Moscow, St. Petersburg, Yekaterinburg, Khanty-Mansiysk, Tyumen, Novosibirsk and Khabarovsk. In addition, Otkritie is successfully developing its business in the USA and Great Britain. The investment division of Otkritie is one of the leading Russian companies on the London Stock Exchange and in the TOP 3 largest investment companies by turnover on the main markets of the Moscow Exchange. The largest shareholders of Otkritie are: Vadim Belyaev, IFD Capital Group, VTB Bank, shareholders of the ICT group, Ruben Aganbegyan, NPF Lukoil-Garant and Alexander Mamut. 3. Investment company O1 Group: FUTURE of NPF JSC; URALSIB NPF CJSC; StalFond NPF OJSC; Telecom-Soyuz NPF OJSC; EDUCATION OF NPF JSC. Also, the O1 group is currently in the process of purchasing Russian Standard NPF CJSC from the bank of the same name. Market share 14.36%.

Holdings included in the group: OJSC NK RussNeft; Group "Chaika"; TradeVest LLC. Other companies included in the group: CJSC PFK BIN; PLC "Northern Domodedovo".

An equally active presence in the market of non-state pension funds of the same name is large financial and insurance corporations, which are subsidiaries and also occupy large shares of the pension market. Such NPFs include: 1. Sberbank NPF JSC. Part of the Sberbank group.

The share of the pension market of Sberbank NPF JSC is 14.15%. Sberbank is the largest bank in Central and Eastern Europe.

The active and dynamic development of Sberbank’s foreign network is one of the key vectors of its strategy. The geographic presence of Sberbank covers 22 countries, and the number of its clients outside Russia has reached 10 million.

The share of international business is 14% of total assets.

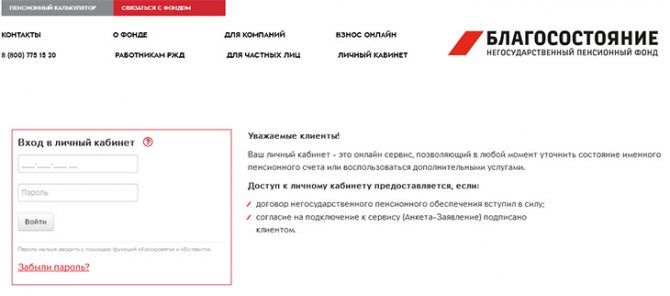

Login to your personal account

To log in to your personal account, you need to follow the appropriate link, which is available on the main page of the official website. In the form that opens you need to enter:

- login, that is, SNILS of the user;

- password provided by the foundation. It is best to immediately change it to something more user-friendly.

Login to your personal account of NPF Blagosostoyanie

Access to the email indicated in the application must be maintained, since only with its help will it be possible to obtain a new password if the old one is lost. In the authorization form there is a link “Forgot your password?”, clicking on which you need to enter SNILS and email address. An email will be sent to you with instructions on how to set a new password.

Non-state pension fund welfare payment days on New Year holidays

And you are a participant. To give an answer, you need to look at the terms of this agreement and the pension rules to it, including the procedure for receiving the redemption amount by a participant in the agreement.

Attention, did I understand correctly that the father can retroactively return the tax and for what period can he receive it? What period must be indicated in the application?

Hello He can receive the funded part of his pension; for this he needs to apply to his pension fund. Thank you for your contact to our website, good luck to you and all the best.

I receive a pension from the Blagosostoyanie fund. When I receive it, I am charged 13%.

I receive it through Sberbank online.

Will I be able to get a refund through the IRS and what do I need to do? Thank you. Sincerely, Toropygin A.M. Hello, Anatoly They don’t just return taxes to anyone.

They will be returned if you apply for a tax deduction for real estate, for children, for treatment, etc. I wish you good luck and all the best!

The most important thing about NPF Future (Welfare)

The site has developed a convenient navigation system that allows you to find all the necessary information in a few seconds. The address of the main office is Moscow, Malaya Dmitrovka street, building 10. In order to find out the amount of accumulated funds, you can use one of the following methods:

- Pension Fund. You must contact your local Pension Fund office. You should have your passport and SNILS card with you. The application form can be filled out directly at the Pension Fund branch. Account data will be provided for the previous year.

The printout can be collected 5 days after submitting the application.

Postal address – Moscow, Novaya Basmannaya street, building 2. INN – 7710180174. Checkpoint – 770701001. Contact phone number –. Hotline number –. The company's charter can be studied on the website. In 2014, the fund was renamed NPF “Future”!

- Sberbank. Initially, you should register in the general Sberbank database.

Checking pension savings

The personal account allows each user to find out the status of their own pension savings in the NPF Blagosostoy at any time. But fund clients have other ways to obtain such information:

- go to the nearest branch of the fund. Here you will receive an account statement upon presentation of your passport;

- send a postal request to NPF Blagosostoyanie using the services of Russian Post. At the same time, in the request it is important to note the fact that the client’s residential address does not coincide with the address specified in the contract (if such a discrepancy exists).

Funded pension amount

The organization does not work with pension savings programs as a component of compulsory state insurance. Rice. 6. Individual approach to each client The main activities of the NPF:

- individual programs;

- corporate programs;

- programs for Russian Railways.

The full version of the pension rules can be found on the official fund website. Individual provision An individual pension agreement gives the fund’s clients the opportunity not only to provide themselves with additional income after retirement, but also the opportunity to:

- receiving a tax deduction of 13%;

- accrual of investment income;

- withdraw funds early without loss;

- appoint an heir/successor.

Download the full presentation of individual programs.

Deactivation of your personal account

Your personal account remains active until:

- the contract will not be terminated;

- obligations under the contract will not be fulfilled in full.

The user cannot close his account on his own. If he wants to close his personal account on his own initiative, he can contact the company with a corresponding request. Current legislation allows you to do this. The client can write a letter to NPF Blagosostyanie, in which he demands that all his personal data be deleted from the system. However, if cooperation with the fund is still ongoing and the obligations have not yet been fully fulfilled, closing the account is not recommended.

Ipc-zvezda.ru

Important

UMMC-Perspective" The first in the top 5 most profitable pension funds is UMMC-Perspective, a non-state pension fund founded more than ten years ago by large metallurgical enterprises of the Urals. As one can assume, the bulk of his clients were workers of this same metallurgical industry, mainly living in the “capital of the Urals” - Yekaterinburg.

Info

Since 2006, when UMMC-Perspective began working in the field of compulsory pension insurance, there have been fat years (for example, 2009, when the company showed an impressive profitability of 47.40%), and there have been “hungry” years (as in 2008, completed with zero profitability). As of September 2020, Perspective showed a profitability of 11.2%.

4. “Rostvertol” NPF “Rostvertol” was created in 1994.

Personal account security

To prevent attackers from gaining access to the user’s personal account, you need to keep your authorization data secret. And if it is not so difficult to obtain the SNILS number of any person, then stealing the password, if it is securely stored, will become a difficult task. Still, scammers can hack into email and steal personal information. If a client suspects that unauthorized persons have accessed his account, he must immediately change his password using the “Forgot your password?” link. from the authorization form. It is also useful to change your email password.

Customer support

The user’s personal account allows him to contact the fund’s support service and get answers to questions that arise during the work process. There is also a free hotline at number 8 . Its specialists will be happy to advise clients of the fund or those who are just planning to become one.

You can contact support directly from the main page of the official website. At the top there is a “Contact the Fund” button. It allows you to read answers to frequently asked questions, order a call back from the fund, or write a letter to the support service.

Official site:

https://npfb.ru

Personal Area:

https://online.npfb.ru

Hotline phone number:

How to find out your wealth savings

Source: npfb.ru, cbr.ru Guided by the principles of safety, profitability and information transparency, the fund invests client funds in various profitable areas of activity. Rice. 3. Investments of NPF “VOZROZhDENIE”. Source: official website npfb.ru Funds are invested in:

- financial market;

- road maintenance;

- railway industry;

- real estate market;

- energy;

- social infrastructure.

This approach made it possible to ensure:

- 9% average return for the period 2003-2016;

- 10% yield, based on the results of 2020, 2020;

- 229.7% accumulated return for 2003-2016.

Schedule. 3. Cumulative return for 2003–2016. Source: npfb.ru Awards and ratings The Fund has repeatedly received and confirmed high positions in the ratings of national agencies.