Liquidation of NPF Strategy and its reasons

The main reason for the liquidation of the license of Perm Strategy NPF was the constant violation of the law regarding the timely provision of information about the company’s activities.

During the audit, it was found that various manipulations with securities occurred during trading, the value of assets was inflated, and inspectors and investors were misled. This fact aroused the keen interest of law enforcement agencies.

Subsequently, the DIA on the official website, according to the latest news of the NPF Strategy, was recognized as an insolvent organization and declared bankrupt.

Creditors are demanding damages in the amount of more than 5 billion rubles. The market value of the organization's fixed assets is more than 500 million rubles. During the forced liquidation of the fund, it was determined that the value of the organization’s property was insufficient to pay money to creditors, and as a result it was declared insolvent.

Some time ago it was reported that the Perm Arbitration Court fully satisfied the application for the liquidation of the Strategy fund of the NPF Perm. The latest news is on the website of the provisional administration. After the liquidation of the license, the head of Pyotr Pyankov, NPF Strategy in Perm, was arrested.

A criminal case was opened against him for fraud on an especially large scale, which was committed by a group of people. Then the citizen was released, he was under house arrest.

The former head of the company was accused of embezzling other people's funds in the amount of more than 200 million rubles, selling illegal property and providing false information to the tax authorities.

NPF Strategy Perm, the latest news today reports that a criminal case has been opened again, because previously unclear circumstances have been discovered. The investigation into the case has been ongoing for two years.

No money: the non-state pension fund “Strategy” is bankrupt

Perm, January 30, 2020, 18:07 — REGNUM On January 30, the Arbitration Court of the Perm Territory declared JSC Non-State Pension Fund Strategy bankrupt. The Deposit Insurance Agency filed an application to declare the fund insolvent, media reports.

The amount of creditors' claims is about 5.6 billion rubles. At the same time, the market value of the Strategy’s fixed assets, according to expert data, is 541.44 million rubles. In the process of forced liquidation of a non-state pension fund, it was established that the value of its property was insufficient to satisfy the claims of creditors, therefore the liquidator decided to apply to the Arbitration Court of the Perm Territory to declare the fund insolvent.

REGNUM previously reported , in the spring of 2020, the Arbitration Court of the Perm Territory granted the Central Bank’s application for the forced liquidation of NPF Strategy. Following the deprivation of the license of the non-state pension fund and its liquidation, there followed the arrest of its director, Peter P. , as part of a criminal case initiated under Part 4 of Article 159 of the Criminal Code of the Russian Federation “Fraud committed by an organized group or on an especially large scale.” He was later released under house arrest. The ex-manager was accused of misappropriation and embezzlement of 220 million rubles, legalization of illegally acquired property in the amount of 150.03 million rubles, as well as providing information about dummies to the tax service.

The media report that the preliminary investigation in the criminal case was resumed due to newly discovered circumstances. It is noteworthy that the investigation into the high-profile case has been dragging on for a year and a half.

According to data from open sources, more than 77 thousand people used compulsory pension insurance in the Perm Territory, and about 66 thousand people used voluntary non-state pension insurance.

Lenders note that they receive replies from the Deposit Insurance Agency stating that NPFs do not have funds to make settlements with creditors in full. The work done by the liquidator aimed at identifying and returning the Fund’s property allowed partial settlements with creditors of the second stage of the NPF in the amount of 8.19% of the established claims.

Further satisfaction of creditors' claims will be made as funds are received based on the results of the sale of the Fund's property, which constitutes the pension reserves. The claims of the third priority creditors will be satisfied after the demands of the second priority creditors are fully satisfied as the Fund receives the funds that make up the pension reserves. It is currently not possible to determine the timing of the continuation of settlements with creditors of the second priority, as well as the beginning of settlements with creditors of the third.

Read earlier in this story: Payments to affected depositors of NPF “Strategy” will begin in the Kama region

Actions of fund investors Strategy

Data from official sources claim that services from NPF Strategies and payments to depositors were provided to a huge number of citizens, there are more than 70,000 of them. Most of them voluntarily invested their own savings in non-state insurance.

Creditors reported that now the former organization does not have the financial capacity to pay creditors in full. A huge amount of work has been done to identify the assets of the fund and return its property in order to organize a small part of the settlements with creditors, but this amount is more than enough for full payment.

In order to fully satisfy the requirements of credit institutions, it is necessary to make calculations whenever money is received by the former financial institution, and include reserve amounts for pensions in them. However, it is now impossible to determine the time of final settlement with credit institutions.

News of Society and politics in Perm

Clients of NPF Strategy, which lost its license last week, may lose the non-state part of their pensions because the fund was not part of the all-Russian system for guaranteeing the safety of pension savings. Now the Deposit Insurance Agency will get involved in solving the problems; an analysis of the assets of the insolvent organization is ahead. For now, the Central Bank of the Russian Federation will partially respond to the obligations of the Strategy.

This is not the first year they have violated

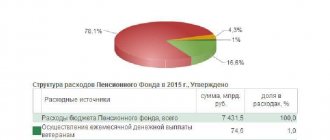

According to the latest data from the Central Bank of the Russian Federation, more than 78 thousand people were clients of the NPF “Strategy”, and more than 68 thousand were fund participants. Officially, as of the last reporting period, the structure of the company's assets was: pension reserves - 2.6 billion rubles, pension savings - 4.1 billion rubles.

The basis for the cancellation of the fund’s license was violation of the requirements of the law “On Non-State Pension Funds”, as well as repeated violations during the year of the requirements for the dissemination, provision or disclosure of information provided for by federal law. In fact, it became known that facts of manipulation of the markets of shares of the closed mutual fund "Rodnye Prostori" and bonds of LLC "Rotor", "Zhilstroy", "STP" were recorded at trading on the MICEX Stock Exchange in the period from January 2013 to April 2020. The actions were carried out with the aim of artificially inflating the value of assets on the balance sheet of the NPF “Strategy” in order to show the appearance of the organization’s successful activities and the profitability of its investments, Central Bank specialists reveal the mechanism of the scheme.

— LLC Rotor, Zhilstroy, AVK, Permtransmekhanizatsiya, TSK-1, Rentek, PJSC Promaktiv participated in transactions with securities. As part of the audit, it was established that all of the listed organizations, as well as NPF Strategy JSC, are interconnected and are part of one group of legal entities - a group controlled by several individuals who have either family or professional connections with each other - reported the Central Bank of the Russian Federation in an official press release.

Since March 16, 2020, the fund’s activities for pension provision and pension insurance have not been carried out, the powers of its executive bodies have been suspended, and the management of the activities is provided by the temporary management administration (contact details of the head of the temporary administration: 614045, Perm region, Perm, Sovetskaya St., 72. tel. 210-35-13, 218-33-22).

Typical case

Economists predicted difficulties for NPF “Strategy” several years ago. What happened now is natural, says Andrei Kabatskov, associate professor at the Perm branch of the Higher School of Economics National Research University.

— The situation with NPF “Strategy” once again shows that citizens, investors and businesses do not have an adequate response to new challenges. According to comments by the Central Bank of the Russian Federation, participants in financial manipulations were connected by family and professional interests. In other words, this group can be called a clan, where social obligations to each other were of greater importance than responsibility to investors, depositors and the law

– Kabatskov is sure.

According to the expert, the state, when embarking on financial cleansing among banks and funds, only took care of reducing “social costs”, i.e. protected citizens with small savings. This is a local measure that will not solve the key problem of trust in financial institutions, which is increasingly affecting Russian households. So far, it is mainly small and medium-sized participants in the pension savings market that are under attack, but similar stories as in the NPF “Strategy” may appear in other similar institutions. It would seem that transparent reporting (the fund almost annually showed returns at a level higher than the official inflation in the country) turned out to be a bluff. Other NPFs often use similar marketing tools. According to the portal “Pension Expert”, only last year the Central Bank of the Russian Federation had five largest funds - “Sunny Time”, “Sun. Life. Pension", "Uraloboron", "Adekta-pension". In total, they had about 50 billion rubles at their disposal.

Prospects

At the moment, the liabilities of the problem fund include insurance contributions from employers for persons born in 1967 and younger; contributions under the state co-financing program for pension savings; funds (or parts of funds) of maternity capital aimed at forming a funded pension; income received from investing the above contributions and funds.

Starting from the date of revocation of its license, the Pension Fund of Russia (PFR) will become the new insurer of victims in the compulsory pension insurance system. The nominal amount, that is, the amount of contributions paid by employers, excluding investment income, as well as funds paid under the Co-financing Program and generated from maternal (family) capital, will be sent to the Pension Fund from the Central Bank of Russia.

NPF "Strategy" did not have time to enter the mandatory all-Russian system of guaranteeing the safety of pension savings from January 1, 2016, when, in the event of revocation of the fund's license, the state corporation Deposit Insurance Agency (DIA) pays compensation to depositors, so clients of NPF "Strategy" face a three-month period liquidation of the fund.

After analyzing the financial condition of the NPF, it will become clear whether its assets will allow investors to restore lost investment income: interest accrued on the allocated funds and forming non-state pension provision. Moreover, after the sale of the Strategy’s assets, the funds received will first be used to return money to the Central Bank, pay taxes and salaries to the fund’s employees, and only then will it be possible to talk about compensation for investment losses to its clients. If “Strategy” were included in the register of funds participating in the system for guaranteeing the safety of pension savings, then after the sale of NPF assets, everything that remained above the guaranteed nominal value would be sent through the Pension Fund to the insured to compensate for lost investment income.

Settlements with Strategy investors will be carried out by the DIA at the stage of forced liquidation of the Strategy NPF. Requests for payment of pension reserve funds can be submitted in writing to the temporary administration for managing the fund at the previously specified contact address.

Practice with other problematic non-state pension funds shows that clients most often have to be content with the minimum - funds that are partially compensated by the state.

History and activities of the foundation

NPF "Strategy" is one of the oldest non-state pension funds. The institution was founded in 1993, and from that moment on it was the largest financial institution in the Urals. Since 2002, the fund began to participate in the state pension insurance program. Three years later, it underwent reform and began operating in the form of a joint stock company.

Before the license was revoked, rating agencies assessed the activities of NPF “Strategy” with a high (A+) reliability rating, which is also evidenced by the large number of fund clients throughout Russia, and not just in the Perm region.

At the end of 2014, the Strategy Fund entered the top thirty of the best non-state funds in the Russian Federation with pension savings of more than 4 billion rubles and reserves of 2.5 billion. The number of participants at that time was more than 77,000 people, and almost 30,000 people were already receiving pension payments.

All the fund’s work was aimed at accumulating and increasing the funds of depositors and insured persons, while financial information and reporting were publicly available to each client. The funds accumulated in the personal accounts of the participants were invested in business entities, bank deposits, and mutual funds. This brought good profitability, which allowed them to increase additional profits for their clients.

Despite this, on March 16 of this year, the Central Bank revoked the current license from the Strategy Fund. Among the reasons given were manipulation of the Central Bank market during trading and repeated violation of reporting deadlines. Order No. OD-871 canceled the license; accordingly, all the company’s offices were closed, and within a few days the first requests from participants appeared to receive their own money.

The Bank of Russia canceled the license of the main Perm NPF

Yesterday, the Bank of Russia canceled the license of the Perm NPF “Strategy” and appointed a temporary administration. NPF repeatedly violated the requirements for providing information established by law during the year. The regulator established the fact of manipulation of the securities market during trading on the MICEX in 2013–2015, which made it possible to inflate the value of assets and mislead investors. This fact, according to Kommersant’s interlocutors, may become a subject of interest to law enforcement agencies.

Yesterday, the Bank of Russia announced the cancellation of the license to carry out pension provision and pension insurance activities of JSC Non-State Pension Fund Strategy. A temporary administration has been appointed to the fund.

A press release from the Bank of Russia reports that the NPF violated the requirements of the law “On Non-State Pension Funds”, as well as the requirements for the dissemination, provision or disclosure of information provided for by federal laws. The Bank of Russia also reported that it had established the fact of manipulation of the markets for shares of the closed mutual fund Rodnye Prostori and bonds of Rotor LLC, Zhilstroy, STP at trading on the MICEX Stock Exchange in the period from January 2013 to April 2020. These actions were committed with the aim of artificially inflating the value of assets on the balance sheet of the NPF, and “indicate an intention to mislead investors and the regulator regarding the price and liquidity of shares and bonds in order to achieve mandatory standards by the management companies of the NPF “Strategy” by placing pension reserves and investing pension savings of NPF “Strategy” in shares and bonds.”

The Central Bank message states that Rotor LLC, Zhilstroy, AVK, Permtransmekhanizatsiya, TSK-1, Rentek, PJSC Promaktiv, as well as P. V. Romanova participated in transactions with securities and N.A. Ivanov. As part of the audit, it was established that all of the listed organizations, as well as NPF Strategy JSC, are related to each other and belong to one group of legal entities - a group controlled by several individuals. Individuals who participated in trading in shares and bonds and occupy various positions in the organizations of the Strategy Group have either family or professional connections with each other.

Measures were taken against persons who took part in market manipulation, including in accordance with the requirements of the Code of Administrative Offenses of the Russian Federation.

• NPF “Strategy” was created in 1993 on the basis of NPF “BIS-Garant”. The fund was consistently included in the Top 30 Russian NPFs. In 2015, the NPF was corporatized. As of October 1, 2020, pension reserves of NPF Strategy amounted to 2.6 billion rubles, pension savings - 4.1 billion rubles, own property - 6.9 billion rubles. Its clients were 78.2 thousand insured persons, participants - 68.7 thousand people. 75% of the shares of NPF Strategy JSC, according to SPARK-Interfax, belong to Strategy Management Company OJSC, which, in turn, is controlled by STP LLC and the relatives of Peter Pyankov. NPF "Strategy" is not included in the pension guarantee system.

Within three months, all mandatory pension savings will be transferred to the Pension Fund of the Russian Federation, and in the future its participants will be able to decide whether to transfer savings to another non-state pension fund or remain in the Pension Fund. Since NPF “Strategy” was not a participant in the pension guarantee system, mandatory pension savings will be compensated from the funds of the Bank of Russia, explains General Director Natalya Smirnova. “Everything that was additionally transferred to the NPF - within the framework of the state co-financing program or through maternity capital funds, will also be transferred to the Pension Fund. Only investment income can be lost if the NPF, after withdrawing the money, does not have property to compensate for it.”

The general director of the consulting company, Sergei Okolesnov, said that problems may arise for those pensioners to whom NPF Strategy pays a voluntary pension. After revocation of the license, the Deposit Insurance Agency determines whether the pension reserves and the Fund’s own funds are sufficient to organize payments to depositors and participants of the NPF. “It is quite likely that there will not be enough money for everyone. There was a case when the NPF “European” group (BIN group) accepted obligations to pay pensions to the NPF “Podolsky”, which had been deprived of its license, that is, it took on all the risks associated with the fact that there would not be enough money,” he explains. Mr. Okolesnov noted that this is the first time he has encountered such wording from the Central Bank: “Last year, licenses were revoked from 19 non-state pension funds, not one of them was accused of manipulation during trading on the stock exchange. It is possible that the materials of the Bank of Russia inspection will be transferred to law enforcement agencies.”

Insured persons will be able to find out what is happening with their savings from messages from the Bank of Russia, as well as in their personal account on the government services website.

Nadezhda Emelyanova