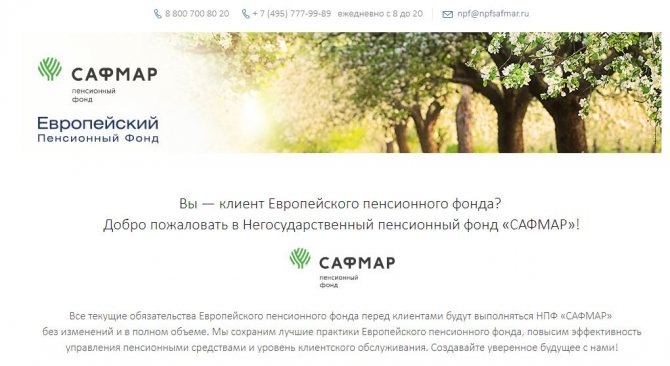

In 2020, the European Pension Fund joined NPF SAFMAR, thereby becoming part of the SAFMAR Financial Group. The purpose of the reorganization is to create a large and reliable fund operating in the field of compulsory pension insurance (MPI) and non-state pension provision. After the merger, all obligations, including the personal account of the European Pension Fund and its services, were transferred to the disposal of NPF SAFMAR.

Personal account features

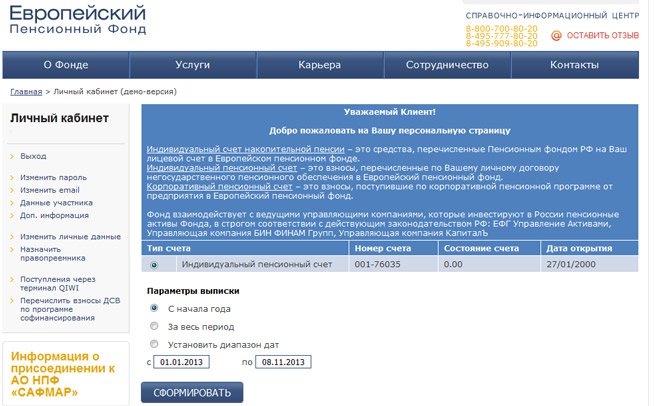

In the PFU personal account, the user can:

- Get information about personal and corporate accounts.

- Read the electronic version of the document on non-state pension provision.

- Submit a notification to the insurance company.

- Keep confidential information up to date.

- Receive a pension account statement for any period of time.

- See the history of replenishment of the savings part.

- View your total funds.

The service is available both on the website and in the mobile application.

Service functionality

The user account is a service that allows the fund’s client access to certain information. The functions of the personal account of NPF "European" are as follows:

- Obtaining detailed information about the timing of concluding an agreement on pension provision or compulsory pension insurance, as well as the details of the document;

- Monitoring the status of your personal account and reserves;

- Studying interest accrued as income;

- Preparation of a personal account statement for any selected period;

- Registration of notifications to insured persons in accordance with the established procedure;

- Checking the accuracy of personal information and making adjustments if they change.

The user can change the password for the service, the email address associated with the account, and independently determine the frequency of notifications by email.

How to register in the system

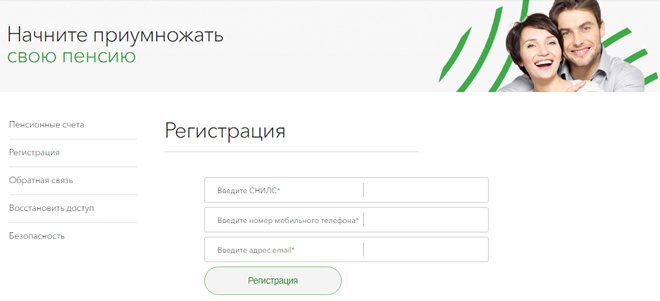

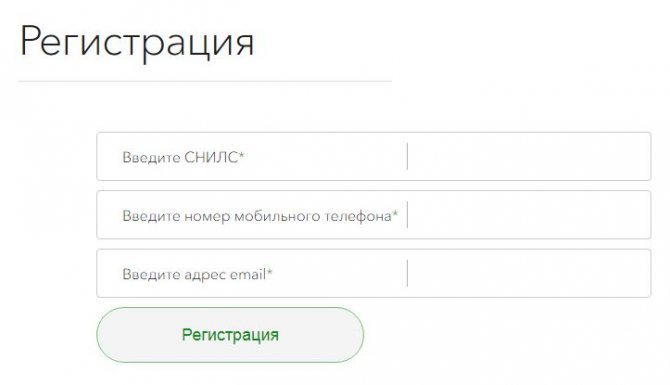

The non-state European Pension Fund offers a fairly simple registration of a personal account for individuals. You will need:

- SNILS number;

- Mobile phone number;

- Email.

Important! At the moment, registration is available for clients under compulsory pension insurance.

www.europf.com login to your personal account – European Pension Fund

www.europf.com is the official website of the European Pension Fund, whose current obligations to clients have been transferred to another fund - SAFMAR.

www.europf.com

In this regard, if you want to log into your personal account www.europf.com, you can do this on the web resource of NPF “SAFMAR” - a fund that is part of one of the largest industrial and financial groups in Russia.

To gain access to all the features of your personal account, you must go through the registration procedure, which will require filling out a standard form.

Registration

So, during registration you will need to indicate SNILS - Insurance number of an individual personal account, mobile phone number, and email address. Once all the necessary information is specified, you should click on the “Registration” button,

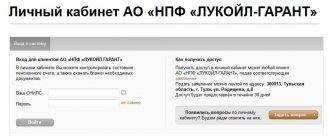

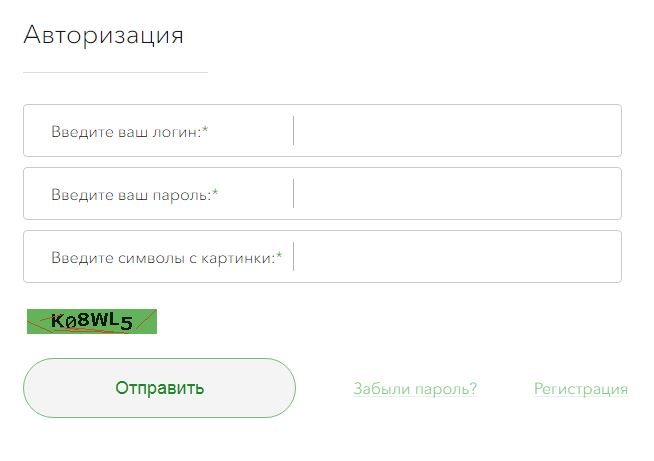

After completing the corresponding procedure, you will be able to log into your personal account at any time convenient for you, that is, log in to the site. To do this, you will need to specify your login and password, as well as the characters from the proposed picture, and then click on the “Submit” button.

Login to your personal account

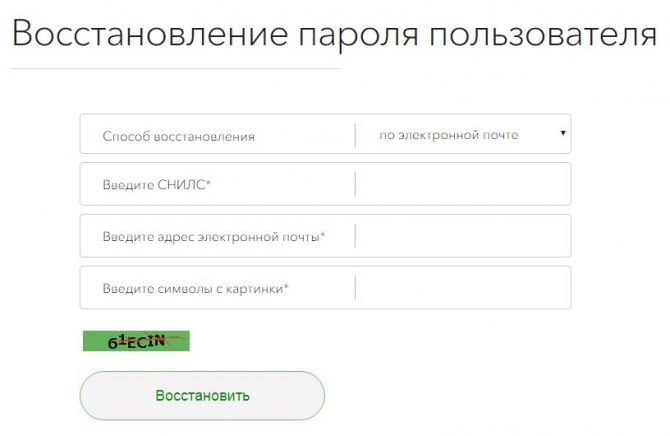

If you do not remember the password required to log in, you should use the option to recover it. This procedure is available via the link “Forgot your password?” on the login page.

To recover the user password, you must select the appropriate method for the corresponding procedure. So, recovery is possible by email or phone number. In addition to the e-mail or phone number that was specified during registration, you will need to enter SNILS and the symbols from the proposed picture, then click on the “Restore” button.

Password recovery

If you were previously registered on the website of the European Pension Fund www.europf.com, then you do not need to go through the registration procedure again. To log into your personal account, you just need to indicate your existing login and password.

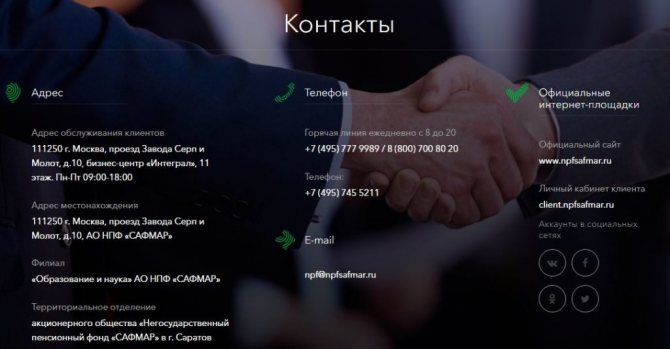

If you have any questions while logging in, you can contact the phone number provided on the website or send a message to the email address.

Contacts

A personal account of a pension fund is an opportunity to view available pension programs at any time convenient for you and choose the most suitable ones for yourself. Here you can also view the accruals on your account. Here you can also ask questions and get answers to them as quickly as possible.

Particular attention should be paid to safety when working with the office. Thus, you should familiarize yourself with the security recommendations presented on the pension fund website.

Security Recommendations

Among other things, information about the charity event is available in the “Personal Account” section, which anyone can join. The campaign is to support lonely elderly people. You can find out more about the campaign and also make donations using the link provided on the official website of NPF SAFMAR.

In general, the www.europf.com account is a simple and convenient service with which you can view your existing savings, as well as get acquainted with lucrative offers, and seek help from specialists. Moreover, all this is available at any time and place convenient for you.

If we talk not only about the advantages of the service, but also the SAFMAR pension fund itself, it should be noted that it has a number of advantages. Among these are the trust of over two million clients, a high position in terms of the volume of pension savings under management, as well as one of the leading positions in terms of the size of the average account among the 10 largest non-state pension funds in terms of pension savings.

Benefits of the fund

The fund's advantages also include many years of successful experience in the pension market and participation in the system of guaranteeing the rights of insured persons. In addition, NPF SAFMAR is part of one of the largest industrial and financial groups in the country, which includes industrial, financial and banking assets, as well as assets in the field of commercial real estate, construction and development.

To obtain the most complete information about the activities of the fund, its advantages and opportunities that open up for clients, you should contact the official website of the NPF.

Official website of fonla

Those who are also interested in the activities of a Russian company such as Morton, which is engaged in the construction of residential real estate, should contact the UpravDom Morton personal account service.

www.europf.com login to your personal account - client.npfsafmar.ru

What to do if you have problems logging in

Safmar has detailed instructions on how to log into the European Pension Fund through your personal account if certain problems arise.

Important! If the client does not remember the email, then it is required to fill out an application “On making changes to personal data” and take it to the branches of PFU or the partner bank of JSC Raiffeisenbank with a Russian passport and SNILS. Another way to send: via mail. To do this, you will need “Consent” and photocopies of the pages of the Russian passport, on each page of which a signature and the mark “Copy is correct” are placed.

Important! If you lose your password, you need to click on “Forgot your password?”, and you will receive instructions on how to recover your data by email.

About NPF

The foundation has been operating since 1994. Until 2010, it was called NPF “Pension Fund” and primarily served corporate clients. In 2010, the Fund was renamed the NPF “European Pension Fund” and, taking into account the development of pension reform in Russia, intensified its work in the retail market for compulsory pension insurance (OPI).

As part of the federal regional development program, launched at the end of June 2011, the European Pension Fund opened its first regional divisions. An agreement was signed on interaction and cooperation in the field of comprehensive pension provision for employees of the Chelyabinsk Pipe Rolling Plant (ChTPZ) group of companies. The European Bank for Reconstruction and Development (EBRD) and the European Pension Fund NPF signed an agreement under which the EBRD acquired a 26.7% stake in the capital of the European Pension Fund NPF holding.

The transaction became the Bank's first direct investment in the Russian pension market and the third in the pension sector in Eastern Europe. In 2012, the EBRD's share increased to 30%.

Personal account mobile application

PF "European" was the first Fund to develop a mobile application for providing pension services.

This includes:

- Information about the nearest branches, addresses and telephone numbers.

- Information on topics of financial support for old age.

- Up-to-date mailbox support.

- The ability to send messages directly from the application to the Contact Center.

- Checking your retirement account.

The developers focus on modern methods of protecting confidential information. The application is available in Play Market and Apple Store.

Customer support via account

On the official website in the “Feedback” section, the client can ask any question, including technical problems.

“European Pension Fund” also responds on social networks.

NPF European hotline

The company operates a Hotline for 12 hours from 8 am. Contact numbers and 8 (800) 700 80 20.

Email for letters

How to disable your personal account

The account is linked to the validity of the contract. If the client refuses to provide services and terminates it, the personal account ceases to be active.

Thus, the “European Pension Fund” provides a wide range of services and supports customer service on mobile devices using an application. The website has a feedback form and a hotline, where Foundation employees will provide answers to questions. PFE ensures that all clients receive quality service.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below: