01 Sep 2020 Irina Chaikovskaya All authors

The other day, the head of a company that is a partner in our “Savings Growth” project approached us with a request to help understand the charges to his account in the NPF “Future”. Let's call him Petrov P.P. A common story that many who have entrusted their savings to non-state pension funds have probably encountered or will encounter.

So, according to the fund’s statement, at the beginning of 2020 there were 128,920 rubles in Petrov’s savings account, and as of June 14, 2020 - 125,000 rubles (the amounts are given conditionally). There is a decrease in funds. How can this happen? Is this reduction legal? The correspondence with the representative of the fund did not satisfy Petrov; rather, it led him to bewilderment and a complete lack of understanding of what was happening. We figured out the situation and deciphered the answers of the fund representative both for Petrov and all our readers.

Here are the questions that were asked to the fund (hereinafter referred to as the author’s vocabulary and spelling): 1. As of January 2020, the amount was 128,920 rubles. As of June 14, 2020, the amount is 125,000 rubles. How can it be that the amount of my savings is DECREASING?!?2. What is the average annual yield in% at the NPF “Future” at the moment? What was the percentage at the end of 2020? What was the percentage at the end of 2020?

3. “The legislation provides for a guaranteed replenishment of pension contributions, preventing them from decreasing below the amount established by law.” How does this affect my case: “As of January 2020, the amount was 128,920 rubles. As of June 14, 2020, the amount is 125,000 rubles.”?

Simply put, Petrov was interested in why the funds in his savings account at NPF Future had decreased. Is this legal? How can he avoid this in the future?

After receiving answers from the foundation Petrov P.P. contacted us for clarification. Please help me figure it out:

- what do they really want to tell me?

- Can I really make up for what I lost? And is this the norm?

Below we have provided fairly comprehensive, with reference to current legislation, but difficult to understand, answers from a representative of the fund with our explanations (or rather, with translation into human language).

Illegal transfer to NPF

Illegal transfer to a non-state pension fund without the consent of the owner is a serious violation of the law. There are several actions to help keep your savings safe and sound:

- You cannot show your documents to strangers.

- Under no circumstances should you enter into agreements with suspicious agents of unfamiliar funds.

- You can contact the Pension Fund with a request to leave your savings unchanged for the next year. If there is such a statement, the savings will not be transferred under any circumstances.

Conditions and procedure for transferring the funded part of the pension

In accordance with pension reforms, citizens have the opportunity to independently manage their pensions.

One of the options for managing your funds is to transfer them to the Non-State Pension Fund.

Since 2014, the Pension Fund of the Russian Federation has stopped forming pension savings. All contributions are automatically transferred to insurance . The amount of savings contributions will be an increase in your pension.

Until 2014, these funds were accumulated in the state pension fund. After changes in legislation were adopted, citizens had the opportunity to transfer their funds to NPFs.

In addition, citizens can independently influence the amount of savings by depositing additional funds into the account . Non-state pension funds provide the opportunity to transfer savings by inheritance. NPFs themselves directly depend on how citizens’ savings will grow. Organizations manage funds without access to accounts. They can invest it in various projects.

There is no mandatory requirement in the law to transfer money to NPFs. But this choice provides citizens with many advantages :

- Non-State Pension Funds provide an opportunity to significantly increase savings compared to the State Pension Fund.

- Account holders can independently monitor the movement of funds. Most organizations provide this opportunity online.

- The contract is concluded only once. The conditions must remain unchanged throughout the entire period.

- All funds in the accounts are insured. In the event of bankruptcy of the organization, all money will be returned to citizens.

If the applicant is not satisfied with the chosen fund, he can at any time write an application to transfer from one organization to another.

It is not recommended to constantly change NPF. Not all citizens know what the consequences of such transitions may be. In case of early termination, the citizen loses the amount of investment income.

How scammers deceive

There are cases when agents go around apartments and conclude contracts fraudulently. By introducing themselves as an employee of a pension fund, they gain the trust of a person who thinks that they are representatives of a state fund. After all, in fact, you can’t undermine here: the NPF is also a pension fund, but a non-state one.

Must remember! Fraudsters only need your personal data to conclude a new contract. By gaining access to them and forging signatures, unscrupulous agents give the contracts to the pension fund. The investor will learn about this only after 2 - 3 months.

The largest non-state pension funds were accused of siphoning off pension money from Russians

In 2014, almost 15 thousand Russians contacted the unified telephone service of the Pension Fund of Russia with complaints about the unlawful transfer of their pension savings to non-state pension funds (NPFs). Izvestia was told about this by the press service of the Russian Pension Fund (PFR). Among the funds that receive many complaints is even Sberbank Non-State Pension Fund. Citizens, in particular, complain that when receiving services from Sberbank, they were also given an agreement to transfer the funded part of their pension to a non-state pension fund controlled by the bank in a common stack of papers for signature. Clients of the state bank learned about this only after a while, for example, from SMS messages from funds: “Thank you for choosing NPF <name>!”

According to representatives of the Pension Fund of the Russian Federation, in addition to the NPF Sberbank (in which 75% plus 1 share belongs to Sberbank, which, in turn, is controlled by the Central Bank of the Russian Federation), complaints are also received regarding such leading funds as Rosgosstrakh, Russian Standard, “Renaissance Life and Pensions”, “First Russian”, “KITFinance”, “Lukoil-Garant”, “Consent”, “Promagrofond”. The scale of the flow of complaints can also be judged from the PFR page on the social network VKontakte - it has a topic with 1.5 thousand messages from dissatisfied clients (“Cheating when transferring to a non-state pension fund”, vk.com/topic-37475973_26804378) .

The overwhelming majority of citizens who contacted the Pension Fund with a complaint about the unlawful transfer of their savings demanded that the funds be returned back to the Pension Fund, that is, under the management of Vnesheconombank (those who did not dispose of their savings otherwise are called silent; this is the bulk of the owners of pension savings).

“I came to Sberbank to change my salary card,” Polina Pozhilova wrote on the PFR page on social networks, “the operator handed me a paper, which I signed.” Then it turned out that this was an agreement on transfer to Sberbank NPF.

Other clients in their complaints emphasize that in the general folder of papers, only the last sheet of the agreement on the transfer of pension savings to a bank-controlled NPF is placed for signature (“They didn’t give the entire agreement for signature, but only the last sheet, everything is very small. They said it was simple to confirm the details. I signed"). Still others complain that the agreement on transferring pension savings to Sberbank NPF was “slipped at work when receiving a Sberbank card.” The requirement to transfer pension savings to NPFs affiliated with banks (NPFs may have corresponding agreements with the bank) is presented openly, as a condition for obtaining a loan from a particular bank or at a retail outlet (phone shops, various stores).

In their appeals to the Pension Fund of the Russian Federation, citizens also point out pressure when applying for a job: when applying for a job, applicants are offered to transfer pension savings to an affiliated non-state pension fund or are given a corresponding agreement among other documents - and then sometimes they are not hired. Another scheme is that NPF agents often mislead them, for example, by coming home and introducing themselves as “employees of a pension fund,” without specifying which one. Russians often perceive them as representatives of the Pension Fund and sign the proposed documents.

The state management company Vnesheconombank manages 1.9 trillion rubles, and 1.1 trillion rubles have been accumulated in non-state pension funds (according to data on the Central Bank website for the first 9 months of 2014). Of these, NPF Sberbank has 74.4 billion rubles, Rosgosstrakh - 68.9 billion, Russian Standard - 3.2 billion, Renaissance Life and Pensions - 33.6 billion, First Russian - 6 billion, KITFinance - 65.2 billion, Lukoil-Garant - 145.6 billion, Soglasie - 5 billion, Promagrofond - 56 billion rubles.

The mentioned non-state pension funds were unable to provide prompt comments, with the exception of the NPF "Renaissance Life and Pensions" (since January 14, it is referred to as JSC NPF "Sun. Life. Pension"). The fund reported that in 2014, four oral complaints were received from individuals, each of which was promptly resolved by fund employees. The press service of Sberbank reported that in its activities it “always strictly adheres not only to the current legislation, but also to the standards of professional and commercial ethics”

“Our policy in working with clients is to provide a detailed explanation of their rights and the content of the documents they sign,” the bank emphasized.

This is not the first time that the Pension Fund has encountered a wave of complaints from Russians about the illegal transfer of their pension savings. In 2009, the Pension Fund began to receive en masse requests from citizens regarding the transfer of pension funds to one or another non-state pension fund without their consent. Then, as law enforcement agencies found out, most of these cases were related to the illegal use of citizens’ personal data, that is, to the falsification of contracts (marker.ru/news/496357). This became possible due to the fact that at that time it was possible to submit an application for the transfer of savings through the Pension Fund, and through the Non-State Pension Fund, and through its agents. Unscrupulous agents, having obtained a citizen’s data, could, without his knowledge, enter it into the contract and send it to the Pension Fund.

To protect Russians from such cases, from January 1, 2014, the procedure for transferring pension savings has changed. Now, first, a citizen must enter into an agreement with the selected NPF, and then, with this document, come to any Pension Fund office and personally confirm his choice by writing a corresponding statement. As a result, by now NPFs have become more persistent and a significant number of abuses are committed by their employees and partners. If in 2011 the Prosecutor General's Office, speaking about the “massive nature” of cases of unlawful transfer, indicated that over 2.5 years (from 2009 to mid-2011) the Pension Fund of the Russian Federation received over 11.7 thousand citizen complaints about this problem, Now, in 2014 alone, the number of such requests has reached almost 15 thousand.

Partner Roman Terekhin pointed out that in 2010–2011, responsibility for illegal actions was usually assigned to unscrupulous employees, who were brought to criminal liability - but in most cases conditionally. When the number of complaints against the same NPF began to indicate a massive violation of the rights of citizens, the Pension Fund of the Russian Federation began to terminate contracts with such NPFs, that is, to deprive them of the opportunity to attract funds from the funded part of the pension.

According to Terekhin, in a number of cases described in citizens’ complaints, the citizen’s consent in fact is absent, and signatures on documents on the transfer of funds were obtained by misleading them. Such actions, according to the expert, are criminal offenses under Art. 159 (“Fraud”) and Part 3 of Art. 327 of the Criminal Code (“Use of a knowingly forged document”). Such offenses can result in up to 6 years in prison.

At the same time, as Tatyana Manakova, head of the legal department of the Padva and Epshtein legal bureau, noted, the law “On Non-State Pension Funds” establishes the grounds for revoking the license of a non-state pension fund. But the situations described are not directly included among them.

— If the court establishes violations committed when concluding an agreement with citizens, this may be the basis for issuing an order to eliminate these violations. And in case of failure to comply with such an order, the license may be revoked. But it will be necessary to prove the facts of intentional misleading or deception of citizens in each specific case; the process of proof here will have significant difficulties.

Lawyer of the National Legal Service Alexander Kozhevnikov agrees that it is difficult to prove such cases and, at most, everything is limited to a specific manager, and not to a group of people or a violation on the part of the organization.

— Bank employees will probably receive bonuses depending on the number of clients attracted to the NPF controlled by the bank, the motive is obvious. Even if an employee received a direct instruction from management, it was, of course, given orally, so it is extremely difficult to take the manager by the throat and hold a bank or non-state pension fund accountable,” Kozhevnikov believes.

Fund return

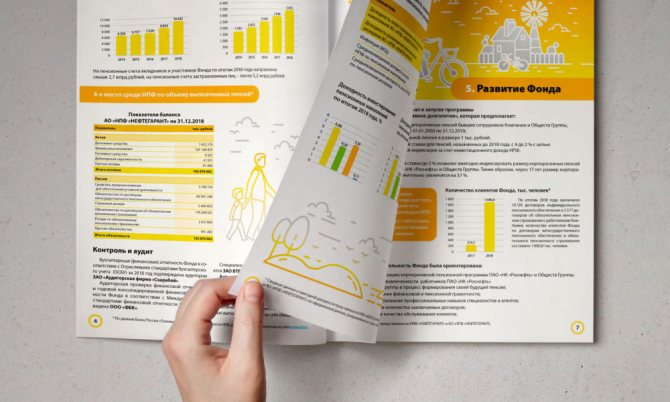

Every future retiree wonders how much money the company's management will be able to earn for investors in the foreseeable future. The answer to this can be found by studying the profitability ratings of NPF Neftegarant for past periods. They are worth looking for on financial websites, for example, here. Based on the published information, this year the fund shows a return of more than 11.6%, taking 6th place with this result in the all-Russian rating of non-state pension funds.

In terms of the volume of pension savings, the company is in 7th place (RUB 123.1 billion). Unlike other NPFs, the pension reserves of the Neftegarant fund are growing steadily. Now their volume exceeds 80.4 billion rubles. The company also holds 7th place in terms of the number of insured persons (more than 1.47 million people).

The reliability rating of NPF Neftegarant JSC, according to experts, is stable with excellent prospects:

- National rating agency – AAA.pf;

- Expert RA – ruAAA.

There is every reason to believe that the profitability of JSC NPF Neftegarant will remain at this level or increase in the coming years. The company guarantees reliable protection of deposits from inflation and undertakes to invest funds in accordance with the regulatory requirements of the Central Bank of the Russian Federation, so fund investors do not have to worry about the safety of pension savings.

What is NPF “Doverie”?

Application for a cash loan on our website Fill out

This organization was founded in 1997. With its help, you can save a certain amount of money and receive an increase in your official pension. Such services have been provided since the founding of the fund, while no one was talking about pension reforms.

So the company is all-Russian. It is present in 40 constituent entities of the Russian Federation. And the number of its offices is in the hundreds. At the same time, this brand includes Region-Svyaz. This is also a fairly large private pension fund.

In addition, this company works with and is managed by BIN FINAM Group Management Company LLC. This indicates the large scale of the company's work.

Information about the Neftegarant fund

Before making a decision to transfer a pension to a non-state pension fund, you need to carry out serious preparatory work: study public information about the organization, read its ratings, read customer reviews about the quality of service in the company. Getting acquainted with the non-state pension fund Neftegarant, the telephone number of which can be found on the official portal of the company or on the website of the Central Bank of the Russian Federation, should begin with studying the history of its existence.

Like many other funds, NPF Neftegarant recently underwent a rebranding procedure: on August 22, 2019, it changed its name to NPF Evolution. In this regard, the current license of the foundation was reissued. However, the main shareholders of the organization have not changed: they remain Concern ROSSIUM LLC and RN-Pension Reserves LLC (a company included in the perimeter of Rosneft PJSC).

The company's management explains the decision to change the name by the need to implement a new development strategy and improve the quality of service. Now the emphasis is on a young audience, for whom it is planned to develop modern communication channels and new pension programs. You can find out about all changes in the fund’s product line by calling the contact number of JSC NPF Neftegarant –.

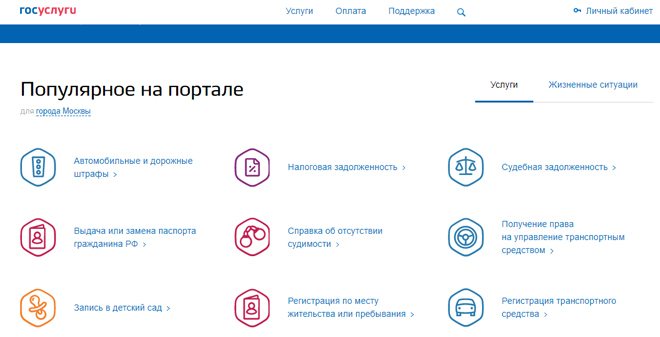

Nothing has changed for existing fund investors; they continue to be served as usual. There is no need to renew an already concluded contract. If you need to find out details about renaming the fund and the features of your pension scheme, use the NPF Neftegarant hotline. You can also log into your personal account through the government services portal or using SNILS (follow this link) to ask a question via the feedback form.

Should the fund be trusted?

Everyone makes financial decisions, including those related to future pensions, independently. You should not rely only on customer reviews about the Neftegarant fund: they are not always objective and honest. It is reasonable to study in detail all the available information - about ratings, profitability, reliability, quality of service - and only then decide whether you will trust the NPF with your pension savings.

Sometimes there are posts on the Internet that investors’ money is transferred from one NPF to another without their consent. This is obvious fraud, and if such facts are discovered, it is necessary to write complaints to the supervisory authorities: the prosecutor's office, the Ministry of Labor and Social Protection, the Central Bank of the Russian Federation.

If the information contained in the citizen’s complaint is confirmed, his pension savings will be returned to the fund from which they were withdrawn as a result of fraud. In cases where the previous NPF has ceased to exist, you have the right to transfer the money to the Pension Fund under the supervision of the state or leave it in the fund where it already ended up.

Reviews from company employees

daria_m: “I worked for 1.5 years at Lukoil Garant, now I’ve been on maternity leave for 9 months, I can’t wait to get back soon! I decided to write a review out of nostalgia. The work keeps you on your toes, you feel truly needed! Yes, there are also negative aspects - after all, working with people is not always pleasant. But there were definitely more advantages - a new huge office, a workplace according to all the rules, a fairly friendly team. I had to move around the city a lot, but that’s what I like - I hate sitting still.”

Pavel Nikitin: “I have not been working at NPF Lukoil Garant for long, I am writing a review for future employees, so that if you are new to this business or have never worked in an office, do not be afraid. After the interview, you will be given a series of trainings, then you will be sent for certification. This is where many people get confused, but both you and the company understand whether you need this job or not. From experience, I will say that the most important thing in this matter is stress resistance. The work is very difficult, but when you get involved, the work becomes much more interesting. Come, you will be welcome here!”

Checking the safety of savings

To avoid illegal actions, you need to periodically check whether your NPF has been changed. To do this, register on the official website of government services and create a personal account, from where you can find out all the necessary information about the status of your account.

What should I do if my savings were transferred to a non-state pension fund without my knowledge? If you encounter fraud, you should file a complaint with the NPF, Pension Fund and the Central Bank. To return savings, you must submit an application to the judicial authorities. The court recognizes the invalidity of the contract, and the funds will be returned within up to one month.

( 1 ratings, average: 5.00 out of 5)