To determine the amount of salary and pension, the length of service of military personnel is calculated. When calculating, you need to know current legislation or use a calculator that will help you find out important information in a few minutes.

When calculating length of service, special length of service is taken into account, which is used under special conditions of activity, mainly in law enforcement agencies:

- Border troops, PSS, PSO, Airborne Forces.

- Educational military institutions that train future Airborne Forces personnel.

- Reconnaissance air assault groups belonging to the ground forces of the Russian Federation.

- Civil Defense Troops, individual positions available on the staff of naval vessels for combat purposes.

According to Art. 13 Federal Law No. 4468-1, military personnel have the right to pension provision if they have 20 years of regular service or preferential length of service for military personnel for pension. Before retiring, you should use the military length of service calculator - this will simplify the calculation procedure and allow you to find out the terms included in the length of service, as well as the number of full years worked. We previously talked about the long-service bonus for military personnel in this article.

It is worth noting that the online calculator of a serviceman’s length of service works on the basis of data from current regulations of the Russian Federation.

You can also find a military pension calculator on the Internet to calculate its value.

How to use the calculator?

By analogy with the military and police, pensioners of the drug control service of the Russian Federation, employees of the Federal Penitentiary Service also have a similar system for calculating pensions. However, she differs from civilians. This calculator is designed to help roughly estimate the size of your future pension. For accurate calculations, you should contact the Pension Fund directly.

Attention! If you find any error, have a question, addition or request for improvement, feel free to write in the comments. We will try to help! And by helping you, we will help other people too. You won’t be able to keep up with all the changes, so we will be grateful for prompt information.

Information about changes

Before making payments, contract employees should prepare in advance all the necessary information: military rank, full name, date of birth; beginning and end of calendar service periods; periods of study in civilian educational institutions; preferential stages subject to enrollment.

To indicate service periods, you may need orders from the commander to be sent to “hot spots”, a work book and other documents, which usually contain all the data necessary for independent calculations.

Let us indicate that any programs are developed taking into account the current legislative acts regulating this issue, and you need to focus on them when carrying out independent calculations:

- Federal Law “On the status of military personnel.”

- Federal Law “On pension provision for persons...”.

- Order of the Ministry of Defense No. 200 dated June 30, 2006.

- Order of the Ministry of Defense No. 555 of November 10, 2008.

To calculate bonuses and total length of service, the Rules approved by Decree of the Government of the Russian Federation of December 21, 2014 No. 1074 are applied. According to them, the total period includes the following periods:

- Service in the Armed Forces of the Russian Federation and the USSR, as well as in formations organized during combat operations.

- Employment of Russian citizens in the armed forces of the CIS countries.

- The presence of military personnel in units and other subdivisions of the former USSR republics that were not part of the CIS before 1995.

- Serving in formations of various countries with which there is an international agreement.

- Temporary suspension of service in the Army for the period of election as a deputy to the State Duma and other representative or legislative bodies of power.

- Unknown absence, being held captive, being in custody, unjustified dismissal until the circumstances are clarified.

- Serving in the criminal correctional system, the Federal Drug Control Service, the prosecutor's office, the tax police, customs, the Investigative Committee of the Russian Federation, the National Guard troops, the Ministry of Internal Affairs, the State Fire Service of the Ministry of Emergency Situations of the Russian Federation, the FSB.

For employees of the Airborne Forces, educational organizations for training military personnel, the Navy, PSS, and aviation, 1 month of service is counted as 1.5. Also, the length of service calculator for military personnel equates 12 months to two years of work for military pilots, parachute and catapult testers. The full list of positions with preferential calculation of length of service is indicated in Government Decree No. 1074.

The above rules apply to calculate the length of service of working pensioners, as well as upon retirement. In addition, according to the procedure for calculating length of service, upon termination of a contract and its subsequent conclusion, it is not subject to recalculation.

Formula

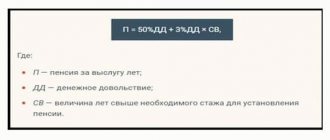

Traditionally, we present the formula for calculating the FSIN pension. It is similar to any paramilitary structures:

Pension = DS*PK*KK*RK

Where DS is the monetary allowance, PC is the reduction coefficient, KK is the correction coefficient, RK is the regional coefficient.

DS consists of the salary for your position and rank, as well as a bonus for length of service. PC is consistent at 72.23% this year. QC depends on your insurance experience. The Republic of Kazakhstan looks at each region separately.

Let's go over each point in more detail to clarify the nuances.

How is the pension calculated?

The pension for FSIN employees will be calculated in accordance with its type and benefits that the employee is entitled to.

The pension calculator for FSIN employees in calculations, as well as when calculating in real mode, takes into account the following indicators:

- Work experience directly in the Federal Penitentiary Service must be at least 20 years (it is planned to increase it to 25). If he was dismissed before this time, then, in any case, he can apply for a long-service pension if his total work experience is 25 years, and his time of work in the penitentiary authorities is at least 12 and a half years (it is planned to increase it to 15 years);

- the amount of payments will depend on the salary the employee receives, various additional payments for rank, awards, etc.

Are lump sum payments possible upon retirement?

A similar thing happened in 2020, when the planned indexing did not happen. The amount was 5,000 rubles, but in 2020 military pensions were indexed by 4%, so there is no need for a lump sum payment.

“The indexation carried out is not the only one planned, because the President of the Russian Federation announced at the end of last year that the government’s plans include two more indexations of 4% in 2020 and 2020.”

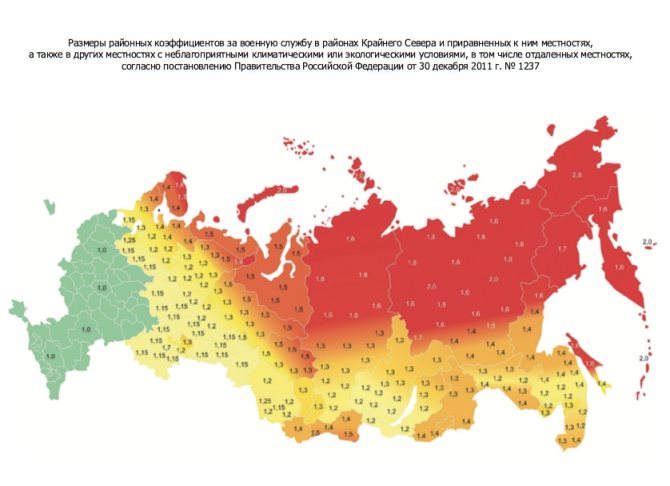

Regional coefficient

Expert opinion

Makarov Mikhail Yurievich

Legal consultant with 10 years of experience. Specializes in criminal law. Extensive experience in protecting legal interests.

Depending on the place of service, the final pension amount may be increased. For a specific region, it is better to look separately for the current coefficient in the search. Below we offer a picture with the general picture for Russia.

Required documents

To apply for state benefits, you must provide the following documents to employees of the pension department:

- application for a pension (specify type);

- identification;

- documents confirming experience;

- award insignia, titles (if available).

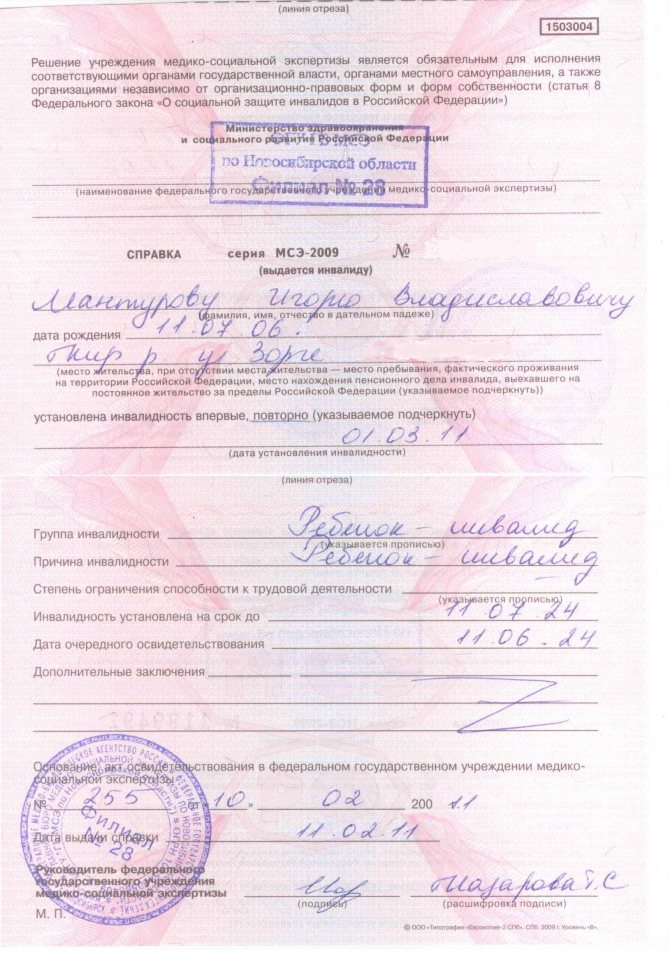

For disabled citizens, I attach the ITU conclusion to the documents. Dependents provide a document of relationship confirming the status of a relative (marriage certificate, birth certificate).

Citizens submitting an application through an intermediary sign a power of attorney in his name. The authorized representative provides a notarized permit and identification card to an employee of the pension department of the Federal Penitentiary Service. Persons retiring into the old-age reserves enclose a notice of dismissal with the main package.

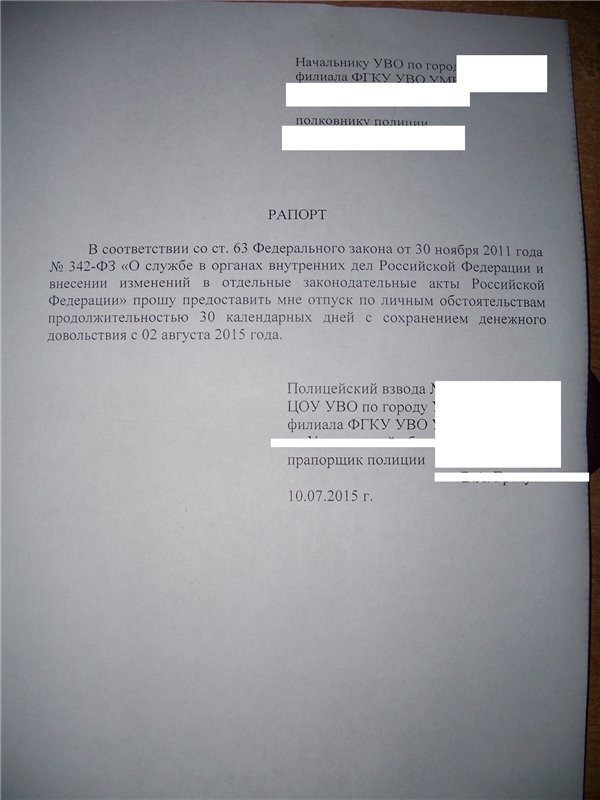

Report and its sample

An employee of the Federal Penitentiary Service notifies his superiors of his dismissal at least 3 days before submitting the report. The document is drawn up in accordance with all requirements.

If desired, the employee has the right to be reinstated in service and continue working in the rank in which he left the position.

Sample report

A report on dismissal from the Federal Penitentiary Service is drawn up in writing.

The report does not have a clearly established form, but there are some general rules for writing this document:

- submitted to the head of the unit, indicating the position, surname and initials of this head;

- references are provided to relevant legislative acts;

- clearly indicate the grounds for dismissal and the date of termination of employment;

- put the date and personal signature at the bottom;

- if there are attachments, list these documents.

Expert opinion

Irina Vasilyeva

Civil law expert

There must be a period of exactly 30 days between the date from which the employee asks to be dismissed and the day the report is submitted. A reasonable step would be to involve an experienced lawyer in preparing such a report so that the dismissal is considered justified.

Who can apply for insurance coverage?

The article has already mentioned brief conditions for receiving a salary under insurance, but it would not hurt to consider this point in more detail. If an employee of the correctional service has reached retirement age at his main job, then he receives a pension from the relevant law enforcement agency.

However, at the age of 45, not every citizen decides to just sit at home, so many former employees continue to work in another industry. Of course, we should not forget that the second job must also be official in order for monthly contributions to the Pension Fund of the Russian Federation to be made.

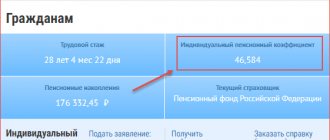

Thus, the subject accumulates insurance coverage, but in order to receive it, a number of conditions must be met that apply to all categories of citizens:

- Pass the generally accepted pension threshold, which in 2018 is equal to 55 years for the female part of the population and 60 years for the male part;

- Accumulate nine years of work experience that is in no way connected with law enforcement agencies;

- Accumulate the minimum number of pension points, the amount of which is equal to 13.8.

All these thresholds are relevant only for the rest of the current year, because the country has already approved reforms that gradually increase all the thresholds. All these rules will also apply to former employees of law enforcement agencies. If we consider not only the insurance content, then the age threshold for employees of various law enforcement agencies will also gradually increase.

It is also worth paying attention to the fact that the insurance pension is no longer paid by the penitentiary service, but by the Pension Fund of the Russian Federation.

Additional benefits for FSIN pensioners

In addition to the assigned pension payments, a former FSIN employee retains the right to a number of benefits , namely:

- Additional compensation if there are dependents in the amount of 32% of the amount of assigned pension payments (per dependent). This increase is paid if disabled relatives do not receive their own pension.

- Free medical care in specialized medical institutions.

- Receiving medicines free of charge.

- Providing vouchers to a sanatorium and health complex, including free travel to the vacation spot.

- Refunds for paid taxes on land and real estate.

- Financial assistance in difficult life situations.

- Payment for transportation of items not exceeding 20 tons.

Indexation of pensions for FSIN employees

The amount of pension payments is increased every year, taking into account inflation and the legislation of the Russian Federation. From January 1, 2020, there was an increase in cash support for the military by 4% and for non-working pensioners by 3.7 percent. For all recipients of the insurance part, the cost of one pension coefficient is 93.00

Another increase is planned for all categories of pensioners and all types of pensions in April.

An increase in monetary security for FSIN employees is ensured by a long service life (more than 20 years) and late application for registration. The amount of salary, bonus and accrual percentage depends on these conditions.

What types of pensions exist for FSIN employees?

According to document No. 4468-1 dated February 12, 1993, this category of persons has the right to receive three types of cash support:

- over a service period of about 20 years;

- on disability;

- old age insurance pension.

In the event of the death of a person serving in the Federal Penitentiary Service or who is on a long-service pension, relatives (minor children) are entitled to a survivor's pension.

Attention! All funds for monetary support are transferred from the federal budget, and not from the Pension Fund. Payment is made through the Federal Penitentiary Service.

Old-age or long-service pension

Cash support is accrued to persons of this category in case of service duration of up to 20 years. If former employees are reinstated to their previous place of work or to another military location, the payment stops until the subsequent submission of the report. If the pensioner gets a different civilian job, the payment of cash support continues in the same amount.

Incapacity (disability) pension

The amount of monetary support depends on the disability group and the period of confirmation of disability. The condition is determined by a medical and social examination during the period of service, three months after filing a report or after this period due to an injury or illness received during service.

The period of disability is assigned during the examination. Disability will need to be confirmed periodically. For women (up to 55 years old) and men (60 years old), disability is assigned for life.

Survivor's pension

Cash support is assigned to a disabled parent or spouse, minor children who had the only income - the salary of the deceased person. Children have the right to receive money until they reach 18 years of age or until they complete full-time studies at a university.

Old age insurance pension

Persons who have worked under an employment contract until retirement age, with at least 9 years of experience and accumulated 13.8 pension points, are entitled to receive the insurance portion. Payments are made by the Pension Fund.