What is a pension supplement?

The first time they started talking about surcharges was back in 2010. The government decided to support pensioners who worked during the Soviet period. To receive a payment, you must meet a number of conditions. Before submitting documents to the Pension Fund, you must carefully study all the requirements. Let's talk about this.

Important!

Additional payment is due to everyone who worked at least one day in the period before January 1, 2002.

Categories of citizens who have received the following types of pension benefits can count on payment:

- according to the age;

- for loss of a breadwinner;

- on disability.

There will be no increase if the person receives a social or state pension.

In order to receive an additional payment, you do not need to go to the Pension Fund and write an application. Everything is carried out automatically; specialists of the Pension Fund of the Russian Federation check who is entitled to additional benefits. payments according to its database, which stores information about all recipients of various types of pensions. The pensioner may not even know that he is already receiving such an allowance.

Important!

If you have doubts about the calculation of your pension, it is better to contact the Pension Fund and check the accruals.

How to apply

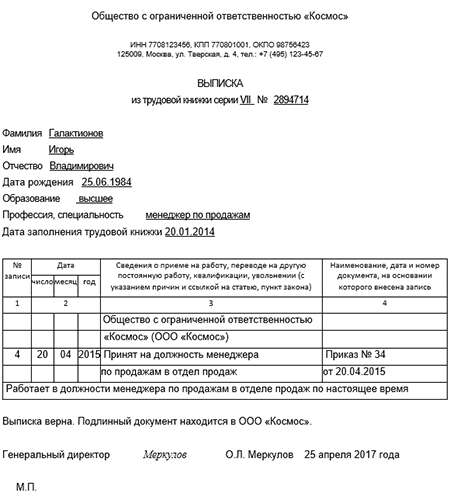

To confirm your length of service and receive privileges, you will have to provide a package of documents to the Pension Fund of the Russian Federation. Basic set:

- Passport of a citizen of the Russian Federation;

- Pensioner ID;

- SNILS;

- A work book or a set of employment contracts - papers on the right to benefits.

After submitting the papers, employees of the Pension Fund of the Russian Federation will check them and issue a verdict. If the applicant for benefits really has the right to this, then from the next month an increase will be accrued.

If for some reason a pensioner cannot be included in the program, pension fund employees are required to issue a detailed written response.

If a citizen who has received the right to a pension continues to work, then benefits will be accrued automatically based on the information received by the Pension Fund from the employer. The adjustment occurs every year on August 1st. The amount of additional payment directly depends on the official salary.

Legislative regulation of the issue of assigning additional payments to pensions

In the following sequence, changes occurred in legislation directly related to the issue of increasing the pension benefits of citizens who worked during Soviet times:

- Article 30 of Federal Law No. 173 of December 17, 2001 - a law was adopted that sets out the formula for calculating the amount of pension capital.

- Art. 30.1. Federal Law No. 173 of 01/01/2010 - additional information was introduced into the mentioned legislative act. A term such as valorization was introduced.

- In 2020, information on the assessment of “Soviet experience” was updated and amendments were introduced into the calculations.

Who can count on receiving insurance payments under the new law?

The following categories of citizens can apply for an insurance pension for whom all three of the following statements are true:

- There is a work book and a pension certificate.

- He has accumulated insurance experience of more than 15 years.

- Earned 30 pension points (the official name is IPC - individual pension coefficients, popularly called points).

The number of points directly depends on the length of service and the amount of contributions to compulsory pension insurance that were deposited into the citizen’s personalized account of his employers (if the citizen was an individual entrepreneur, then he made the deductions “for himself” throughout the entire period of business activity). More details about the accrual in the following table:

| Year | Conditions of insurance period | Minimum number of pension points | Maximum score per year | |

| To form the insurance part of the pension | To form the funded and insurance part of the pension | |||

| 2015 | 6 | 6,6 | 7,39 | 4,62 |

| 2016 | 7 | 9 | 7,83 | 4,89 |

| 2017 | 8 | 11,4 | 8,26 | 5,16 |

| 2018 | 9 | 13,8 | 8,7 | 5,43 |

| 2019 | 10 | 16,2 | 9,13 | 5,71 |

| 2020 | 11 | 18,6 | 9,57 | 5,98 |

| 2021 | 12 | 21 | 10 | 6,25 |

| 2022 | 13 | 23,4 | 10 | 6,25 |

| 2023 | 14 | 25,8 | 10 | 6,25 |

| 2024 | 15 | 28,2 | 10 | 6,25 |

| 2025 | 15 | 30 | 10 | 6,25 |

What additional payments are due to pensioners for work experience of more than 35 years?

Recently, information has been spreading on the Internet that citizens are entitled to recalculate their pensions after 35 years of work experience. Its essence is to increase the IPC by 1 pension point. Please note that current legislation does not provide for this possibility.

An increase in pension in 2020 is possible if the pensioner continues to work. In this case, on August 1, an undeclared recalculation of the insurance pension provision is carried out, taking into account the pension points accumulated over the previous year.

An additional payment to the pension for work experience of more than 35 years in 2020 can only be accrued to a woman when awarded the title “Veteran of Labor”. To obtain status, you must apply not to the Pension Fund, but to the local social security department. The title is awarded not at the federal level, but in accordance with regional legislation. Only after receiving such status is a bonus awarded for work experience of more than 35 years.

For unaccounted experience

If there is documentary evidence of unaccounted service (extracts from orders, contracts, certificates), the pensioner has the right to recalculate pension payments upward by including periods in the insurance or work experience. To do this, you need to submit an application to the Pension Fund or the Multifunctional Center (MFC). Recalculation will be made based on the number of pension points accrued during this time.

For “non-insurance periods” pension points are accrued using a different method. For each year, 1.8 points are awarded. An exception is the time of caring for a newborn until he is 1.5 years old:

- for the first child – 1.8 points/year;

- for the second – 3.6 points/year;

- for the third – 5.4 points/year.

Recalculation of pensions for working pensioners

Seniority bonuses for length of continuous work are provided only to pensioners who continue to work after entering a well-deserved retirement. They are not entitled to annual indexation of pension provision, which since 2020 has been carried out since January by a percentage predetermined by the Government of the Russian Federation.

The pension is recalculated upward by increasing the number of pension points, the maximum number of which is limited to three.

From January 2020, the cost of one point is 87.24 rubles. Based on this, the amount of additional payment will be a maximum of 261.72 rubles. A full recalculation of the pension, taking into account all previously made indexations, is due to the citizen only after dismissal.

- Okroshka with mineral water and kefir - how to cook according to step-by-step recipes with photos

- Mistakes when using antiseptic

- How personality traits influence the risk of developing dementia

Labor veterans

Currently, the status of “labor veteran” is assigned in accordance with regional legislation. Residents of Moscow are given honorary status if they, as minors, began working during the Great Patriotic War, and have 35 years of experience or more (for women) and at least 40 years (for men).

In 2020, Muscovites can also receive the title for long-term work (it is necessary to confirm their place of residence), who have an insurance record of 25 years or more (men) or at least 20 years (women) or the length of service necessary to assign a long-service pension, and in this case they meet one of the following conditions:

- awarded medals or orders;

- awarded honorary titles of Russia or the USSR;

- awarded certificates of honor or received gratitude from the President of the Russian Federation;

- awarded departmental insignia for merit in labor (service) and long-term work (service) of 15 years or more in a certain field of activity.

How much will the pension for Moscow labor veterans be increased?

The additional payment to the pension in Moscow for labor veterans is 1 thousand rubles. The application is considered within 10 working days from the date of submission of the application and provision of the entire package of documents.

The city pension supplement is calculated from the 1st day of the month following the month of application.

Who is eligible for pension recalculation in 2020?

Pensions this year will be recalculated for the following categories of citizens:

- Persons who have reached retirement age in accordance with the new rules (this refers to the recent pension reform in Russia, as a result of which the retirement age of women and men was increased). They must submit an application to the Pension Fund for registration of a pension. If there are supporting documents “for Soviet” experience, then the “young pensioner” will be recalculated automatically.

- Already retired people who have found papers confirming their work experience from the time they worked in the USSR. The pensioner must submit an application to the nearest PFR branch at the place of registration. Employees will recalculate and the monthly pension will increase.

Calculation rules and types of surcharges

Pension payments are considered to be calculated according to the following rules:

- Insurance component;

- Accumulation part.

The calculations take into account not only the duration of work, but also the amount of wages. If a Russian citizen has worked for more than 30 years (for women) or more than 35 years (for men), then the state provides additional accruals.

Since 2001, Federal Law No. 400 came into force, which regulates the procedure for additional payments to persons whose work experience is more than 30-35 years. In accordance with this act, the following rules were introduced:

- Employees working over 30 (for women) and 35 years (for men) are entitled to additional points for each extra year;

- If the total experience exceeded 40 and 45 years (according to gender), an additional 5 points are awarded.

In addition to standard work, the following will be counted in the length of service: • Maternity leave (up to 4.5 years); • Military service in the ranks of the RF Armed Forces.

Important: the period of study at universities is not considered work activity.

It should be understood that pensions are calculated based on the official (“white”) salary.

Accrual rule: if a pensioner is entitled to additional accruals, they will begin to be paid from the next month after he submits the application.

Information: the title of labor veteran, combined with more than 50 years of experience, will allow a citizen to receive additional compensation and benefits.

The amount of additional payments is determined by officials of each region separately. The size depends on the cost of living, which is accepted in a particular area.

How to make additional payments for length of service to a pensioner in 2020

If a person has work experience that was obtained before 2002, he is entitled to a bonus of 10% of the received pension capital.

Plus, for each year of such experience, the Pension Fund will add another one percent.

Important!

Payments will be calculated based on the entire amount of pension capital. In this case, the size of the pension is not taken into account.

To understand everything, you need to try to make the calculations yourself. For example, let’s calculate the payment for 3 pensioners with different conditions for calculating pension payments.

Example 1. Calculation of additional payment for work experience during the Soviet period (several years of Soviet experience accumulated)

The initial data for calculating the amount of additional payment to the pension of a citizen with Soviet work experience are given below:

- pensioner experience – 36 years and 4 months;

- Moreover, 20 years is for the Soviet period of work until 1991;

- the amount of additional payment as an incentive for having Soviet experience during this time is 1% for each year of experience;

- adding another 10% additional payment to the pension for the very fact of having Soviet experience.

Let's calculate the total percentage of the bonus to the pension contribution:

20% (1% each for all 20 years of Soviet experience) + 10% (for having such experience) = 30%

A Pension Fund employee will calculate the amount of pension capital and calculate 30% of the amount received.

Example 2. Calculation of payment for a working period in Soviet times (there are several days of Soviet experience)

The citizen did not work for a single year during Soviet times. But there are still several days of Soviet experience, which was proven by archival certificates. The pensioner is entitled to 10% of the amount of the pension capital of the pension as an additional payment to the benefit. But she will not be accrued a percentage for each length of service worked during Soviet times (since not a single full year was worked during Soviet times). But if a citizen had worked for at least a year during the USSR, they would have added another percentage.

As a result, the pension capital will be checked, and 10% will be calculated from it. This will be the size of the bonus for work during Soviet times.

Example 3. Calculation of payment for working time in the USSR (a woman started working later than 2002)

Let’s say a woman belongs to the category of “young pensioners”. She began her career in 2002. She is not entitled to any additional payments, since she has no work experience during the Soviet era.

Soviet period of pension calculation

Fewer and fewer pensioners who apply for pensions now can demonstrate a significant period of work activity before 1991, but even 10-15 years of work during the decline of the Soviet Union and perestroika can significantly increase the final amount of payments. When calculating pension points, an employee’s entire career path is divided into 4 stages:

- until 1991, during this period the length of service is confirmed only by documents;

- 1991-2001, this time is taken into account when valorizing payments;

- 2002-2014, data on wages and the amount of contributions to the pension fund are already in the electronic database;

- From 2020 to the present, when the pension points system began to operate.

The calculation of the length of service of the Soviet period ends in 1991, in December of which the USSR ceased to exist. Since 2001, the Pension Fund has been keeping records of pension savings; from 1991 to 2001, length of service is calculated in the form of a certain coefficient applied to wages paid during that period. It is very difficult to correctly calculate all the nuances, since many enterprises and organizations of this era ceased to exist and even in the archives it is sometimes difficult to find evidence of labor relations. Service in the Armed Forces will also have to be confirmed; this period is also included in the length of service during Soviet times .

What is pension capital?

Previously, a funded system was used when calculating pensions. Instead, in 2020, individual pension capital will be used.

It represents the contribution of each citizen individually to the personal account of the Pension Fund of the Russian Federation

. The Pension Fund opens an account into which the employee deposits 6% of his salary independently. These funds accumulate on the deposit of the future pensioner.

Disputes are still going on whether citizens will transfer money to the Pension Fund account voluntarily, or whether this will become a mandatory measure.

Pension capital is mentioned in Art. 30 Federal Law No. 173. The calculation used to be carried out according to a certain formula, which consists of the following indicators:

- coefficient for work experience;

- payment period;

- wage ratio.

The formula for calculations looks like this:

PC= ((SK*ZR/ZP*SZP)-450 rub.)*T, where

- PC is the size of the pension capital;

- SC – indicators for length of service;

- ZR – average monthly salary;

- SWP - the amount of the monthly salary approved by the Government of Russia. It was 1,671 rubles as of January 1, 2002;

- 450 rub. – the basis of the old-age labor pension, which was assigned on January 1, 2002;

- T is the expected payment period by age for the pension.

It is not possible to calculate the amount of pension capital on your own. For example, pensioners who worked during Soviet times have the same length of service, but their wages are different. As a result, the premium for work from 1971 to 1991 will not be the same.

Important!

To make an accurate calculation, you will need the help of a specialist from the Russian Pension Fund.

Calculation of length of service: which working periods are taken into account

One of the incentive measures for hard-working citizens is the assignment of the honorary status of “Veteran of Labor.”

But if in the USSR this title did not provide any material benefits, then in the Russian Federation things are completely different. Veteran workers are entitled to all kinds of benefits and additional payments. But life gets more expensive every year, so veterans are constantly worried about whether their monthly allowance will increase.

In this article, we will look at what indexation awaits retired labor veterans in 2020.

A monthly supplement to the pension of labor veterans is assigned from the regional budget based on local regulations. Accordingly, its size in each region may vary.

Since Soviet times, the title “Veteran of Labor” has been awarded to people who have shown special zeal in the labor field; they were awarded a medal of the same name. To receive it, the employee must have had an impressive work history.

Sergei Sobyanin approved an increase in the minimum amount of pensions and benefits in the capital. The corresponding resolution was adopted at a meeting of the Presidium of the Moscow Government.

“Today we must make a decision on a significant increase in social payments. We are talking, first of all, about increasing the minimum pension for Moscow pensioners - from 14.5 thousand to 17.5 thousand rubles. We are also talking about increasing social payments to low-income families with children. The monthly payments themselves are increasing three to five times,” said the Moscow Mayor.

According to him, monthly benefits for large families will double. Most other social payments will also increase by two or more times.

The decision to significantly increase social benefits was made due to the improving economic situation. “The city’s economy has been gaining momentum recently, and we see a positive trend.

Real incomes of Muscovites began to grow,” noted Sergei Sobyanin.

From January 1, 2020, the city social standard for the minimum income of non-working pensioners will increase by 21 percent - from 14.5 to 17.5 thousand rubles.

The increase in the size of social payments will affect almost one million 400 thousand Moscow pensioners, said the Minister of the Moscow Government, head of the Department of Labor and Social Protection of the City Vladimir Petrosyan. For 43 thousand of them, additional payments will be established for the first time.

- In addition, from the beginning of next year, increased one-time and monthly social payments will be received by:

- — low-income families with children, raising over 263 thousand children;

- — large families with more than 320 thousand children;

- — families raising disabled children (36 thousand recipients);

- - veterans of the Great Patriotic War and participants in the defense of Moscow (11.7 thousand people), home front workers (11.4 thousand people), labor veterans (860 thousand people) and rehabilitated citizens (12.3 thousand people), as well as heroes of the Soviet Union and Russia, full holders of the Order of Glory, heroes of Socialist Labor, Heroes of Labor of Russia and full holders of the Order of Labor Glory, their widows and parents;

- — anniversaries of married life (15 thousand couples annually);

- - centenarians aged 101 years and older;

- - honorary citizens of Moscow.

For example, the amount of monthly child benefit from January 1 will be from four thousand to 15 thousand rubles. Depending on the age and category of children, it will increase by two to 6.25 times.

Single mothers and wives of conscripted military personnel with children under three years of age will especially notice the increase in payments. Benefits for children whose parents evade paying child support have also been increased. At the same time, unified benefits are being introduced for children aged from birth to one and a half years and from one and a half to three years.

“Today in Moscow there are 250 thousand children who are brought up in low-income families, and 325 thousand who are brought up in large families. All payments to large families will also be doubled,” Vladimir Petrosyan said.

- Compensation payments to large families, families with disabled children or disabled parents, monthly payments to war veterans, home front workers, labor veterans, and rehabilitated citizens are doubled.

- For families raising disabled children, a new benefit is being introduced - an annual compensation payment in the amount of 10 thousand rubles for the purchase of a set of children's clothing (school uniform) for attending classes during the period of study.

- The increase in the one-time payment to marital celebrants will be from 10 thousand to 17 thousand rubles (up to 2.3 times).

The monthly payment to the heroes of the Soviet Union, Russia, and Labor has been increased by nine thousand rubles, and to their widows and parents by seven thousand rubles. A one-time payment to Muscovites aged 101 years and older will be 15 thousand rubles.

In addition, for the first time, social payments are being introduced for pensioners - people's and honored artists of the USSR, RSFSR and Russia. They will receive 30 thousand rubles a month.

In general, the increase in city supplements to pensions and social benefits will affect 2.2 million Muscovites.

The decision to increase the size of the city supplement to pensions and social benefits was made taking into account the proposals of the city council of veterans, as well as public associations of parents of large families.

Pension payments to the working population of the country are one of the main social payments from the state. The main condition for the assignment of old-age benefits is the achievement of the appropriate age and citizenship of the Russian Federation.

However, in order to apply for a payment and receive it regularly, it is not enough to simply live to an old age. The amount of time worked by a citizen plays an important role here. Namely, work experience. Moreover, the final pension amount that a person who has completed his professional career can count on directly depends on the latter.

In general, the requirements for work experience in the Russian Federation are quite flexible. According to Law No. 400-FZ on pensions, the minimum value that allows a citizen to apply for the calculation of a pension benefit in 2020 is only 9 years, although with subsequent annual increases. And here it should be understood that the amount of payment for such a short period of work will be extremely small, so after reaching the specified threshold it is not worth going on vacation.

When calculating professional experience, not only the stages of direct activity are taken into account, but also breaks in work associated with valid reasons. In particular, when calculating the final value, the following are taken into account:

- serving under conscription;

- caring for category 1 disabled people or disabled children;

- assistance to people over 80 years of age (official guardianship);

- service under a contractual agreement;

- maternity leave up to 1.5 years per child.

In the latter case, it is important to clarify that the total period of maternity leave (if there are several children) cannot be more than 4.5 years. If the specified threshold is exceeded, this time will not be taken into account. In addition, the years spent at the University, according to the new rules, are also not included in the work experience.

As you know, non-working pensioners in our country have only one source of income, namely state payments.

What is valorization

Translated literally from French, it means “to approach or appreciate.” In Russia, this concept first appeared in 2002. The state has taken measures to increase pensions and social benefits. Starting from this period, pensioners who had Soviet experience had their pension capital recalculated.

Actions taken to improve the quality of life of older people. When calculating valorization, the average monthly income for a citizen’s entire working time is taken into account. This amount was increased by 10%. Therefore, the size of the bonus is different for all pensioners.

Another option for calculating additional pay for experience

Let's carry out calculations using the example of the future pensioner V.I. Grigoriev. The citizen retires in 2020. Initial data for calculation:

- work experience is 26 years;

- of which, until 1991, the future pensioner worked for 15 years;

- experience indicator – 0.55;

- wage ratio coefficient – 1.2.

Knowing these data, you can calculate the estimated pension amount:

0,55*1,2*1671= 1102,86

,

where 1671 is the average salary that was set for 2002.

Now you need to do the following:

1102,86 – 450 * 228 = 148 852.08

, Where

- 450 – pension base;

- 228 – the payment period expected by law and is 19 years;

- the result obtained is the calculated pension capital.

Important!

Estimated and individual pension capital are two different concepts.

We determine the insurance part of the pension for 2020:

RUB 148,852.08 / 228 * 5.6148 = 3,665.68 rub.

, Where

5.6148 is the coefficient of the product of all indicators from 2003 to 2014. The amount received is the insurance part of the pension.

Next, we do the following: 3,665.85 / 64.10 = 57.18, where 64.10

– this is the price of a point in 2020.

It turns out that Grigoriev V.I. 57 points are added to the pension. In 2020, the cost of a point is 93 rubles. What we get as a result: 57.18*93= 5317.74

. A future pensioner will receive such an increase in pension for work during Soviet times.

What is the dependence of pensions on length of service?

Experience indicators are taken into account when an insurance payment is calculated to a citizen. For each applicant, calculations of this type of pension are made separately. This manual consists of 2 parts.

These include:

- fixed;

- insurance

The amount of the fixed component is established by the Government of the country. To calculate the insurance part, you will need to multiply the number of accumulated points by the value of 1 IPC.

In 2020, monthly payments are assigned to citizens if they have at least 10 years of service and have accumulated 18.6 points . Only the time during which the organization paid insurance premiums for the person is taken into account.

What affects the possibility of receiving a bonus for length of service?

The fact of official employment will affect the possibility of receiving bonuses.

This applies to situations where:

- there is unaccounted output due to the fact that there is no supporting documentation;

- the person continues to perform labor functions, having the status of a pensioner;

- retirement is postponed (increasing factors are applied to both components of the pension for each year);

- The amount of experience allows you to obtain the title Veteran of Labor.

Additional payment is made if the above circumstances are documented.

How to calculate valorization in 2020

10% is added to the previously obtained result and 1% for each year of work during Soviet times. Let us take for calculation the data of citizen V.I. Grigoriev. What we get:

10% + 15% = 25%,

it turns out that in addition to the existing bonus, the pensioner will receive 25% of the amount of 148,852.08. So:

25% * 148,852.08 / 228 * 5.6418 = 920.82 rubles. – this will be the amount of valorization.

Next, let's make some more calculations:

- 920.82 / 64.10 = 14.35 points.

- 14.35 * 93 = 1334.55 is an additional payment due to valorization.

- 5317.74 + 1334.55 = 6652.29 – the total amount of additional payment to V.I. Grigoriev’s pension.

Important!

All calculations made are just for example, so that it is clear what we are talking about. You shouldn't do them yourself. All calculations must be performed by Pension Fund specialists.

What actions should be taken to valorize pension payments in 2020

Most often, nothing is required from pensioners; all recalculations are made automatically by employees of the Pension Fund. But, the pensioner’s work experience will be determined based on the documents that were previously submitted to the department at the place of registration.

Therefore, if any changes occur, the pensioner must submit new documents.

For example, previously he could not confirm the entire period of service during Soviet times. The initial experience was 13 years, and according to the new documents - 18 years. Accordingly, the size of the bonus for work during Soviet times will become larger.

What to do if your pension has not been recalculated

If a pensioner has not received a payment or believes that the calculation was made incorrectly, he must submit an application to the nearest Pension Fund branch. In it, the citizen must state his requirements and attach to the application all the necessary documents for correct calculation.

Pension Fund employees will recalculate or explain their previous actions.

Important!

The response from the fund must be in writing. You will need it in the event of initiation of legal proceedings regarding the assignment of a pension in a smaller amount.

Valorization for representatives of certain categories of the population

If a citizen, in addition to the insurance part of the pension, also receives a disability payment, then the Soviet experience will not be counted:

- military

- the period of service that preceded the receipt of disability benefits, and the length of service taken into account in the pension payment for length of service; - for cosmonauts

- the same conditions as for military personnel.

Pensioners whose work experience begins in 2002 will not receive valorization indicators.

Legislation

According to Russian legislation, pension payments consist of:

- the insurance part, that is, points accumulated during work;

- the funded part, that is, monthly insurance contributions from the employer.

The procedure for assigning additional payments is regulated by Federal Law No. 400 and other legal acts.

According to the law, the main conditions for receiving additional payments are:

- availability of work experience;

- availability of employer insurance contributions;

- availability of additional contributions to the Pension Fund.

Features of pension supplements for citizens of the Russian Federation:

- With a work experience of more than 25 years for men and 20 years for women, the pension supplement is 1% for each year worked in excess of the norm. The rule has been in effect since 2002.

- Every working citizen receives “pension points” for their entire work experience, which have a special value and are converted into rubles upon retirement. In 2020, 1 “pension point” is equal to 81 rubles. The longer the work experience, the greater the number of accumulated points.

- Persons with the title “Veteran of Labor” receive an increase in pension established by the regional budget.

Information about other regional additional payments and pension supplements can be obtained from the Pension Fund of the region, as well as from the social service at your place of residence.

The length of service includes not only the period of actual work activity, but also other periods.

Namely:

- conscription service in the Russian army;

- stay on maternity leave and child care up to 1.5 years inclusive;

- caring for a disabled family member, for example, a disabled child under 18 years of age;

- receiving unemployment benefits for a certain period.

At the same time, the time spent studying at a university, including in the correspondence department, is not included in the total work experience.

In the case where a pensioner continues to work after retirement, pension accruals are recalculated annually until the final departure from work.

Common mistakes on the topic “Increase in pension for Soviet service from 1971 to 1991”

Error:

The pensioner did not timely submit certificates confirming his work experience in the USSR.

As a result of such an error, the pensioner is not assigned an additional payment to the pension benefit if there are grounds for receiving it.

Error:

The citizen submitted an application for calculation of valorization, and his work experience begins in 2002.

Valorization will not be carried out, because The pensioner is not entitled to additional payment. It is designed for people who have work experience from 1971 to 1991, at least a few months or even days.

Required documents

Despite the fact that additional benefits and additional payments are assigned to the Pension Fund without the participation of pensioners, if new facts and documents are discovered, the following papers may be needed to submit to the Pension Fund:

- passport of a citizen of the Russian Federation;

- statement about the need for recalculation;

- document confirming additional work experience. For example, extracts from archives, contractual acts, etc.;

- certificate of pension insurance;

- pensioner's ID;

- labor veteran certificate (if any);

- certificate of opening a personal account or savings book number required for transferring funds.

Application form is available.

When contacting the Pension Fund, the applicant is given a notification of receipt of documents for consideration. The decision must be made no later than 10 calendar days after submitting the application. If the decision is positive, the additional payment is accrued with subsequent pension payments and continues to be received monthly.

In case of refusal, additional payments will not be accrued.

The Pension Fund may refuse for a number of reasons:

- an incomplete package of documents was submitted for consideration;

- the information was provided incorrectly, errors were found in the application;

- deliberately false information was provided.

If you disagree with the decision of the Pension Fund, the applicant may apply to the court with a statement of claim for the acceptance of documents in order to make additional payments to the basic amount of the pension. If the court's decision is positive, the increase will be made next month.

If the decision is negative, an appeal can be filed, but in practice a re-hearing does not produce results.

Thus, working pensioners or citizens who have retired and have an impressive work history have the right to receive additional payments from the Pension Fund and other benefits from social security. The law distinguishes four categories of citizens entitled to additional payments for length of service.

In case of working for more than 30-35 years, the bonus is made automatically from the regional Pension Fund. If you have more than 50 years of experience, you must contact the Pension Fund to confirm the data. The total amount of bonuses depends both on the length of service, and on the level of wages and the final coefficient.