Any changes relating to pension reform or the payment of pensions to the population invariably cause heated discussion in society, and this is not surprising: today there are more than 43 million elderly people living in Russia. Everything that concerns their well-being is directly related to the state budget and the financial burden on the working population. You can find out whether pensions will be indexed in 2020 and by what percentage from this material.

What is pension indexation?

Pension indexation is an increase in the amount of pension payments in accordance with the law. Produced annually to compensate older people for income losses caused by rising prices for consumer goods and services. In other words, indexation is a tool that protects pensions from depreciation. Every year, the state adds a percentage to older people that should cover the rate of inflation.

Multicard from VTB Bank - cashback for purchases

Apply now

Pension co-financing

The pension system was created and improved by the state in order to provide social protection for pensioners. In addition to the standard mechanisms for accumulating pension savings, additional opportunities are provided to ensure payments in the future. Co-financing a pension entitles you to receive new subsidies from the state. Accumulation is carried out according to the following scheme:

- To participate, a certain amount is deposited into a designated savings account;

- if a depositor contributes from 2 to 12 thousand rubles annually, then the state undertakes to double it;

- if you have the right to a pension and do not want to apply for it, the amount will increase 4 times;

- The program is calculated for 10 years.

The system has a number of advantages, one of the main ones is the possibility of participation of citizens born before 1967. They cannot participate in the traditional savings system, so this option is the best.

In 2020, the program was extended, and it became possible to invite an employer as a participant. The state supports such companies by providing benefits.

Something to remember! If the investor dies, all the money collected does not disappear. They can be transferred to the successor specified by the owner of the deposit, and in the absence of a corresponding order, the distribution of funds is carried out among close relatives.

In 2020, the pension co-financing program was extended, giving citizens of the Russian Federation the opportunity to participate in it. For this you will need:

- passport of a citizen of the Russian Federation;

- certificate of personal pension insurance;

- an application drawn up when submitting documents to the Pension Fund of the Russian Federation.

Documents for applying for a pension can be submitted in person or through your employer. Sometimes citizens register a private enterprise and enter into an agreement with the Pension Fund. To receive the money collected in the account as insurance coverage, you need to contact the organization that stores it:

- to the territorial branch of the Pension Fund;

- directly to a non-state pension fund, if an agreement has been concluded with it.

In connection with the pension co-financing program, rumors often arise that it may be canceled, and all funds will be lost. However, all proposals from the authorities relate only to the temporary cessation of connecting new participants, and the system itself does not provide for the freezing of funds - deposits are preserved and assigned to the owners.

How are pensions indexed?

Indexation of pension payments involves their regular increase by a certain percentage. The recalculation of pensions is based on the pensioner’s subsistence budget in the region of his residence. This indicator, in turn, changes under the influence of inflation. Indexation is carried out in order to protect older people, because the amount of payments guaranteed to them risks depreciating over the years. To prevent this from happening, the state strives to establish a percentage of pension indexation that would cover the inflation rate.

How is a pension formed?

Before considering the procedure and timing of indexation, you should understand what a modern pension payment consists of, which is transferred (handed over) to the pensioner. And since the pension system in Russia is quite confusing, this information will be useful not only to those who have already retired, but also to those who are just about to take a well-deserved rest.

The pension itself consists of 2 parts.

- Fixed payment (FB) to the insurance part of the pension. This is an amount that does not depend on the length of a citizen’s work, the period of transfers to the Pension Fund, or the size of the salary. It is a kind of subsidy and even a kind of “gratitude” from the state for transfers to the Pension Fund and work for the benefit of the country.

- Individual pension coefficient multiplied by its value. This amount of money is the insurance part of the pension. Its size is determined individually, depending on the length of service and the amount of contributions to the Pension Fund. That is, the higher the “white” salary a person received and the longer he worked, the more pension points he will have time to accumulate in his account.

But pensions often come with various additional payments and allowances, which are the “third” component of the total pension amount.

The amount of pension indexation in 2020

Separately, the situation with payments to working pensioners should be highlighted. A moratorium has been imposed on the indexation of their pensions, so in the coming year they can only count on the recalculation of pension points.

Also in 2020, indexation will also affect pensions for military personnel. In accordance with the legislation of the Russian Federation, the recalculation of the size of military pensions is in direct correlation with the increase in the salaries of career military personnel. Reportedly, between 2020 and 2020. the increase will occur every year: 01/01/2018, 10/01/2019 and 10/01/2020 - and each time the payment amounts will be indexed by 4%.

Payments for those who continue to work upon retirement did not increase, since indexation of pensions for working pensioners was suspended back in 2020. For this category of persons, only recalculation of points was provided from August 1. The additional payment is determined for each person individually, depending on the IPC accumulated in 2020 that was not previously taken into account. Thus, the higher the pensioner’s salary in 2020, the larger the pension will be.

MTS Money Zero credit card from MTS Bank - annual rate 10%

Apply now

Indexation of pensions in recent years

Supporting socially vulnerable segments of the population is one of the priorities of the state.

Therefore, the purpose of indexation, as noted above, is to neutralize the effect of inflation by recalculating pension payments. Unfortunately, in reality, government measures do not always keep up with economic downturns. The table below shows the percentage of pension indexation for past years*. Pension indexation percentage for past years

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Insurance pension | 10,12% | 8,31% | 11,4% | 4% | 5,8% | 3,7% | 7,05% | 6,6% |

| Cost of pension coefficient | 71,41 | 74,27 | 78,58 | 81,49 | 87,24 | 93 | ||

| Social pensions | 1,81% | 17,1% | 10,3% | 4% | 1,5% | 2,9% | 2,4% | 6,1% |

*Source: Pension Fund of the Russian Federation

For example, the inflation rate in 2020 was 12%, while the size of pension payments in 2020 was adjusted by only 4%. Obviously, pensions have been and remain a sore subject. Today, older people are one of the most vulnerable categories of citizens of the Russian Federation, and ensuring their well-being places a burden on the state budget. Meanwhile, the country's leadership promises to seriously tackle increasing payments to pensioners. There is information in the news that in two years the average pension in Russia may reach 15.5 thousand rubles.

What other indexations are planned for 2020

The scheme for indexing payments to pensioners for 2020, in addition to the increase from January 1, provides for the following stages:

- Increasing the amounts of monthly monthly allowance, NSU and other payments for federal beneficiaries. They will be indexed from February 1 to last year’s inflation (that is, for 2020). The coefficient will be known only at the beginning of 2020, when the consumer price growth index will be calculated.

- Increase in social and state pensions from April 1 . The indexation percentage will be set depending on the growth index of the pensioner’s cost of living. The exact value of the index will become known closer to the date of the increase (it is approved by Government Decree).

Information on the increase in military pensions in 2020 can be read in a detailed article. Let us recall that military pensioners received an increase in October 2020: the military allowance (MS) was indexed and the reduction factor to the DD value was changed.

Subscribe to our group on Odnoklassniki - here we inform about all changes in pension legislation and only reliable ones!

Indexation of pensions in 2020

Indexation procedure in 2020

| Type of payment | Indexation terms | Indexation percentage |

| Insurance pension. | 1st of January | 6,6%. |

| Social pension. | April 1 | 6,1%. |

The changes will also affect the fixed part of the pension. If in 2019 it was 5334 rubles, then in 2020 it is 5686.25 rubles .

General information about pensions and pension benefits

Pensions differ from each other in terms of the number of persons entitled to receive them and the circumstances under which they can be paid. Indexation of pension benefits is rarely carried out, and most often in stages, which is why many pensioners expect and do not receive the supposedly “promised” increase.

To prevent such situations from arising, it is necessary to clearly distinguish between the existing types of pensions and pension provision.

What pensions are paid in Russia?

According to the law “On Labor Pensions in the Russian Federation,” there are two main types of pensions – labor and social. Payments of labor pensions are carried out in accordance with the law “On Labor Pensions in the Russian Federation”. Social pension, also known as state pension, according to the Law on State Pensions. Art. 5 of the law provides for the following types of pensions:

- long service pension;

- social old age pension;

- upon receiving the status of a disabled person;

- upon the death of the breadwinner.

The labor pension is paid every month as compensation for those salaries or other payments that a citizen could have received if he had not received the status of a disabled person or had not reached the legal age.

Social pensions are paid to disabled citizens; these pension payments, according to Russian legislation, are considered as compensation for the costs incurred by breadwinners for their maintenance.

Reference! Women have the right to a labor pension upon reaching 55 years of age and men at 60 years of age (Article 8 of Federal Law No. 400 “On Insurance Pensions”).

What does a labor pension consist of?

Pensions paid as labor compensation are formed from three components:

- individual part of the insurance pension;

- fixed part;

- the funded part of the pension.

The first and last parts of pension payments are formed from the so-called social taxes collected from enterprises and organizations that provide jobs.

They can accumulate in different accounts and even within different institutions, if the citizen so desires.

The Pension Fund of the Russian Federation ensures the savings of insurance capital, while the funded part is supervised by an investment organization subordinate to a state or non-state pension fund.

The future pensioner can choose where his pension will be accumulated.

The personal part of the insurance pension payment is calculated in accordance with the provisions of Federal Law No. 400 of December 28, 2013.

What does the pension of certain categories of citizens consist of?

Persons who served in the military forces of the Russian Federation, as well as pilots and cosmonauts, receive a pension in accordance with Federal Law No. 166 of December 15, 2001.

Each type of pension payment is calculated according to its own algorithm, for example, military pensions are based on:

- salary for the position;

- salary for title;

- bonuses for length of service.

The retirement age depends on the type of payment. Thus, military personnel do not receive a full pension, and the amount of payment is gradually increasing for them. This is not considered an increase to the pension, since the amount of payments is simply increased to 100%.

Note! You can find out the size of your pension remotely by using the service of the Pension Fund of the Russian Federation.

The site combines all existing pension funds, so every citizen will be able to find out exactly the amount of government support that he should receive and what it consists of.

Indexation of pensions in 2020 for non-working pensioners

The increase will again not affect working citizens, since in 2020 the moratorium on indexation of pensions for working pensioners will not be lifted. But from August 1, they can count on another recalculation of points. The IPC will be equal to 93 rubles.

The indexation table shows that payments will begin to rise at a higher rate above inflation. Accelerated indexation of pensions for non-working pensioners is directly related to pension reform. The procedure for adjusting payments from 2020 to 2024 was determined by Federal Law No. 30.

Indexation of pension benefits

The indexation period is determined mainly based on which part of the pension is indexed. Let's consider all 3 components.

Fixed payment

Indexation of the basic part of the pension (as the fixed payment is often called) is carried out annually on February 1. The increase occurs by the amount of the inflation rate, which was finally calculated in January for the previous year. But in the period from 2020 to 2024, the FV will be indexed annually on January 1 by an amount exceeding the projected inflation rate.

For example, Rosstat calculated that the increase in consumer prices in 2020 was 4.3%. But pensions were raised by 7.05% from January 1, which provided an additional 2.75%. In monetary terms, the PV increased from RUB 4,982.9. up to RUB 5,334.19 But if the growth had been only 4.3%, then the size of the PV would have reached only 5197.16 rubles. Additional increase of 137.03 rubles. provided only through increased indexation.

A separate increase in the PV is convenient for recipients of additional payments, which are based on it and are defined by Art. 17 Federal Law “On Insurance Pensions”. In particular, we are talking about disabled people of group I, elderly people over 80 years of age, pensioners of the Far North (and equivalent areas), agricultural workers, as well as those supporting dependents. Thus, pensioners who begin to receive additional payments due to an increase in PV can count on a much larger increase in maintenance than expected.

Insurance part

Like the PV, the insurance part of the pension is indexed on February 1. And regarding this part of the pension, the rule of early indexation (from January 1) for the period 2019-2024 also applies. Compared to 2020, the IPC in 2020 costs much more. The increase is still the same 7.05%, which in monetary terms is equal to 87.24 rubles.

Externally, the increase is small - only 5.75 rubles. But we are not talking about the amount of savings itself, but only about the cost of 1 point. Consequently, if a citizen has accumulated 100 pension points, then his pension increases by 575 rubles. through indexation of the insurance component of the pension.

Additional payments and allowances

Depending on the level of the established additional payment, which is untied from the insurance part of the pension and the pension fund, the size and period of indexation are determined. If we are talking about the monthly cash payment, then it is indexed from February 1 by a coefficient corresponding to the final calculated inflation rate for the previous period (1 year). And this causes some difficulties with actually calculating the indexation level.

For example, at the end of 2020 - beginning of 2020, the EDV was expected to grow by only 3.4%. This is exactly the inflation forecast given by the responsible departments. However, the actual increase in consumer prices was 4.3%. Therefore, the EDV is indexed with a coefficient of 1.043.

As for the regional level - various types of additional payments due to circumstances established by the authorities of the constituent entity of the Russian Federation or the municipality of the locality, they increase, as a rule, from January 1. The increase coefficient depends on the legislation of the subject of the federation.

But due to a rather limited budget and the difficult economic situation in Russia in 2020, many additional payments to pensions were not indexed. Consequently, the 3rd part of the pension remained unchanged.

Everything described above concerns (mostly) only those citizens who do not work and enjoy well-deserved peace. The situation is slightly different with working pensioners.

News

Let's look at the latest news regarding changes for working pensioners.

Starting from August 1, 2020, working pensioners will receive a recalculation

This increase will be performed once; an application for its receipt will not be required. The recalculation will be made based on the insurance contributions that the employer transferred in 2020.

There are a number of restrictions, according to which the maximum amount of additional payment will not exceed 244.47 rubles. Unfortunately, this is the maximum amount that a working pensioner can count on.

The increase will be paid automatically - no applications required

And, of course, the payment will apply only to those employees who are officially employed - no recalculation is provided for those receiving “gray” salaries.

What will change in August for Russians?

It is important to note that from August 1, 2020, the Federal Tax Service of the Russian Federation will publish information about taxpayers that were previously considered a tax secret.

This will be the average number of employees, special tax regimes and other data as of December 31 of the previous year.

The innovation will apply to business partnerships and companies, except for strategic facilities and military-industrial enterprises, as well as major taxpayers.

In August 2020, some rules and payment amounts will change

Also, starting from August 3, the fee for issuing a foreign passport will be higher - a biometric document will cost 5 thousand rubles, and a passport for a child can be obtained for 2.5 thousand rubles.

It is also expected that the fee for obtaining a driver’s license will increase to three thousand rubles and obtaining a vehicle registration certificate (1,500 rubles).

What awaits working beneficiaries in the future?

The Government is faced with a task set by D. A. Medvedev: it is necessary to consider the question of whether the recalculation of pensions for working pensioners will be returned.

The responsible persons are now considering this issue.

It can be predicted that payments will not be made from 2020 - Topilin, Minister of Labor and Social Affairs. Defense confirmed that the recalculation was not included in the 2018-2020 budget.

Working pensioners also have the right to a pension, just the amount is slightly lower

Today, beneficiaries employed in official work receive payments that do not take into account the indexation that occurs according to the plan.

By the way, the news that working pensioners will be left without payments turned out to be unreliable - there was no such bill.

Separately, the revision of the amount of pension accruals was considered. This project will be submitted for consideration together with the budget of the Pension Fund of the Russian Federation. This is what can be predicted for next year.

How to calculate pension after 80 years?

How does a pension increase occur after age 80? Here is a simple example of calculating a pension:

The total pension amount is 15,000 rubles, of which 5,686 rubles. – fixed part. The additional payment to the pension after 80 years will be:

5686Х2 = 11372 rubles.

The size of the pension after 80 years in this case will be 20,686 rubles.

More information about the fixed supplement to the pension can be found on the website pfrf.ru.

Loan for pensioners from Home Credit Bank - rate 9.9%

Apply now

Who is entitled to an unscheduled pension increase?

In Russia there are several preferential categories of citizens who are entitled to an increased amount of a fixed payment to the old-age insurance pension. The simplest example is elderly people over 80 years of age who receive it at double the rate. Upon reaching such an advanced age, the pension automatically increases precisely due to an increase in the fixed payment.

Those who turn 80 in 2020 will start paying RUB 5,686.25 starting from the month following their birthday. more.

And all because the size of the fixed payment to the old-age insurance pension for 80-year-old citizens is no longer 5,686 rubles 25 kopecks, but 11,372 rubles 50 kopecks per month.

There are other life situations in which you can receive increased payments.

In particular, the following categories of citizens have the right to an extraordinary increase in pensions:

✓ Recipients of old-age insurance pensions if they turned 80 years old last month.

✓ Pensioners who have minor dependents.

✓ Pensioners who retired last month. Provided that their pensions were not previously indexed like working people. In this case, all lost indexation will be restored to them.

✓ Recipients of insurance pensions who moved last month for permanent residence to an area with an increased regional coefficient.

The minimum level of pension provision in Russia must always be no lower than the subsistence level of a pensioner in the region where he lives. If the amount of the pension, together with other payments due to a non-working pensioner, is below this subsistence level, then a social supplement will be established for him.

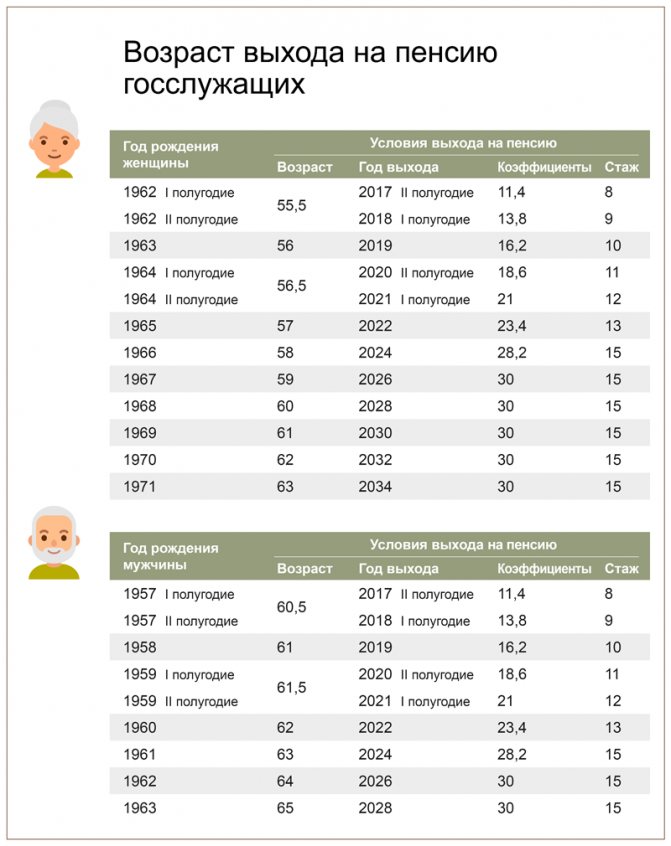

Retirement age for civil servants

For state civil servants at all levels of government (federal, regional and municipal), the transition to new retirement age values occurs in stages. Until 2021, the age increase is six months a year, then the rate is synchronized with the general rate of increase in the retirement age in the country and begins to increase year by year. Male civil servants will retire at 65 by 2028, and female civil servants will retire at 63 starting in 2034.

In addition, for all federal civil servants, starting from 2017, the requirements for the minimum length of service in civil or municipal service, which allows them to receive a state pension for long service, are being increased. Each year, the specified length of service increases by six months (from 15 years in 2020) until it reaches 20 years in 2026.

Taking into account all the changes, the insurance pension for civil servants is assigned in 2020 upon reaching 56.5 years (for women) and 61.5 years (for men). A long-service pension is awarded after 17 years of civil service experience.

Assignment of pensions to doctors, teachers and artists

For employees who are granted a pension not upon reaching retirement age, but after acquiring the required length of service (special length of service), the right to early retirement is retained. Such workers include teachers, doctors, ballet dancers, circus gymnasts, opera singers and some others. The minimum required specialized experience for granting a pension does not increase and, depending on the specific profession, as before, ranges from 25 to 30 years.

At the same time, starting from 2020, the retirement of workers in the listed professions is determined taking into account the transition period to raise the retirement age. In accordance with it, the assignment of pensions to doctors, teachers and artists is gradually postponed from the moment of development of special experience. At the same time, they can continue working after acquiring the necessary length of service or stop working.

Example To retire, rural health workers require 25 years of service in health care institutions, regardless of age and gender. If a rural doctor completes the required length of service in September 2021, his pension will be assigned in accordance with the generally established transition period for raising the retirement age - after 3 years, in September 2024.