- In contact with

Social protection of citizens is a priority task of the state. The most important component of this policy is the provision of pensions to citizens. Social payments are on everyone's lips; this topic is the subject of heated discussions and debates.

Pension legislation divides persons who have reached retirement age into two categories. Working and non-working pensioners. The approach to them is different. This is due to the fact that a working person is considered less defenseless and in need of material support.

In practice, people continue to work due to low pensions. They see it as a salary supplement, not as a source of livelihood. Citizens who continue to work receive only insurance payments and are deprived of social pensions and indexation. The size of their payments is somewhat smaller, they grow more slowly, and due to other mechanisms. Let us dwell in more detail on the changes in legislation and the amount of pensions that occurred in 2020 for working pensioners.

When indexation was canceled for working pensioners

This happened in 2020. Those elderly citizens of Russia who retired in 2020 or earlier and have been working in recent years receive a pension at the same level as three years ago. All indexations that were carried out from 2020 to 2020 did not affect them.

In Russia, about ten million pensioners continue to work after retirement. Freezing pensions for such people gives the country's budget significant savings. The only question is whether this is an acceptable source of savings.

Supplement to pension for those over 80 years old

Pensioners who reached 80 years of age in 2020 are entitled to an increase in the fixed part of their insurance pension by 2 times, that is, by 100%. The size of the fixed payment is now 4982 rubles, respectively, the amount doubled will be equal to 10334 rubles.

For pensioners who live in the Far North, the payment increases additionally depending on the coefficient. For those who have worked in the Far North for 15 or 20 years, the payment is additionally increased by 30 or 50% of the already doubled value of the fixed part of the pension.

Such an increase will affect all pensioners of this age with the exception of disabled people of group 1, whose pension is initially 2 times higher.

Pensioners at such an advanced age are additionally entitled to a compensation payment to pay for the services of a person who would care for them, because often elderly people cannot care for themselves and they need the help of an outsider. The amount of compensation is 1200 rubles.

Additionally, regions provide their own benefits and social support measures.

After the pensioner turns 80 years old, the pension will be automatically increased starting from the month following the month in which the birthday occurred. The pensioner does not need to go anywhere for this; the Pension Fund will do everything itself.

The pension fund independently calculates the pension after the pensioner reaches the age of 80.

How much do working pensioners lose in 2020 due to pension freezes?

Calculating this amount is not so difficult. Since 2020, Russia has undergone three indexations of old-age pensions:

- 2016 – by 4%,

- 2017 – by 5.8%,

- 2018 – by 3.7%.

Thus, if an elderly resident of Russia was already a pensioner in 2020 and has continued to work since the same year, then for every thousand rubles of his pension, he should have received another 141 rubles based on the results of three indexations.

That is, if such a person’s pension today is equal to 10,000 rubles, then if indexation were carried out, it would already be equal to 11,410 rubles. A pensioner loses almost one and a half thousand rubles every month due to freezing.

Of course, if a pensioner got a job in 2020, and his pension was recalculated in 2016, the results will be slightly different. As is the case with those pensioners who retired after 2016. But the general meaning becomes better understood when you deal with specific numbers.

Yes, the pensions of working pensioners increase slightly due to additional length of service (more on this below), but such an increase turns out to be very insignificant and can be neglected in our example.

Will there be 2 indexation on April 1

On April 1, a planned indexation of social pensions, not labor pensions, is planned. Social pensions do not depend on last year’s inflation level, but are calculated based on the current price level and the cost of living. The social pension is provided to those who have no work experience and cannot receive a labor pension. Such a pension, like an insurance pension, is divided into several subtypes:

- by old age;

- on disability;

- for the loss of a breadwinner.

Pension indexation will be carried out by 2.9%, since this is precisely the actual growth rate of the cost of living of pensioners over the past year. Thus, the following pension values are expected depending on the category of citizens:

- 13,410 rubles - pension for disabled children;

- 13,556 rubles - pension for disabled children;

- 12,688 rubles - disability pension for conscripts;

- 10,746 rubles - survivor's pension for the families of conscripts.

According to the law, the social pension cannot be lower than the subsistence level in the region, so if after calculations the value turns out to be less, then additional payments are assigned.

Pensions for working pensioners will remain frozen in 2020

All indexations that were planned for 2020 have already been completed. Thus, in January, old-age pensions for non-working pensioners, as well as military pensions, were increased. Social pensions were recalculated in April.

These are all indexations of pensions that are prescribed in the 2018 budget.

Of course, you need to keep in mind that only old-age pensions for working Russians are frozen. If a person receives a social pension and works at the same time, such payment will be indexed in any case.

Changes in 2020

The amount of payments for non-working pensioners will increase according to the already established procedure.

From January 1, insurance pensions will be increased.

From February 1, social payments, including disability benefits, benefits and other payments provided by the Pension Fund will be increased. Social pensions will be increased from April 1.

It is not yet known how much pensions will increase.

For working pension recipients, everything will remain unchanged. Without indexation, but with an increase in the number of accumulated pension points. Payments will begin on August 1.

In conclusion, I would like to remind you that for persons younger than 1966, insurance contributions for compulsory pension insurance consist of an insurance and savings part. The funded part of the labor pension can be transferred from the Pension Fund to any non-state pension fund. If such a fund is trustworthy, promises smart investment and its deposits are insured, then your pension savings can grow significantly. And with them comes a pension. Why not, go for it! Write a comment below.

- In contact with

Indexation of pensions for working pensioners in 2020 is possible only in one case

This case is the dismissal of a pensioner from work, at least formally. After leaving the workplace, the person’s pension will be recalculated taking into account all those indexations that did not affect him due to the freeze.

That is, if we take a conditional pensioner from the example above with a pension of 10,000 rubles, who retired before 2020 and worked in recent years, then his pension will automatically increase to 11,410 rubles, which we received as a result of our calculation.

It is important to know that in 2020 the scheme for recalculating the amount of pensions in this case has changed!

Until the end of 2020, pensions were recalculated only three months after dismissal due to some peculiarities of accounting in organizations and the timing of submitting reports on employees to the Pension Fund of the Russian Federation. In 2020, recalculation follows the dismissal starting from the next month. However, the pensioner will receive the money in his hands after the same three months.

Let's figure out how it works:

- Let's assume that the pensioner retired in May 2020 (no matter what date).

- Since June, according to the law, he has been entitled to a higher pension, taking into account indexation. But the Pension Fund does not know about this yet.

- In June, the organization where the pensioner worked submits reports to the Pension Fund for May, where the pensioner is still registered as an employee. Even if he only worked for one day.

- In July, new reports are received - for June. There is no longer a pensioner as an employee. The Pension Fund understands that the pensioner should undergo indexation, since he no longer belongs to the category of workers.

- In August 2020, the pensioner receives a higher pension, which is recalculated taking into account all missed indexations, as well as the difference between the new and old pension amounts for June and July.

If we return to the conditional pensioner from our example, who received exactly ten thousand rubles in pension, then after dismissal he will receive the same 10,000 rubles for another two months. In the third month, he will already receive 14,230 rubles. This is 11,410 rubles - his new pension, as well as 1,410 rubles for the previous two months. Then the pensioner will receive his 11,410 rubles and will be subject to all indexation of old-age pensions as a non-worker.

In connection with the described feature, it is important for a pensioner to correctly plan the time of dismissal. It's better to do this at the end of the month rather than at the beginning of the next. Then in the next month he will be entitled to indexation of his pension.

Increase in social benefits for pensions from February 1

On February 1, social payments were traditionally indexed. They are paid to the following categories of citizens:

- disabled people of groups 1, 2, 3;

- military veterans;

- WWII participants;

- heroes of Russia;

- residents of besieged Leningrad;

- former concentration camp prisoners;

- heroes of the USSR and the Russian Federation;

- liquidators of the Chernobyl accident;

- family members of fallen soldiers.

Social benefits consist of monthly cash payments, funeral benefits, and a certain set of social services. Social services mean: payment for travel, sanatorium treatment, provision of free medicines or payment for them. Social services can be received in kind or in monetary terms. The amount of social benefits on February 1 was indexed by 2.5%, respectively, payments are:

- 5701 rubles - funeral benefit;

- 1075 rubles is the monetary equivalent of a set of social services.

The size of monthly payments for each individual category of citizens has its own meaning.

In August 2020, pensions for working pensioners will increase. Maximum 245 rubles

August is the traditional month when working pensioners receive a slight increase in their pensions. This happens due to the fact that the person worked for another year and earned additional pension points.

Unfortunately, the state has set a maximum number of points that a working pensioner can receive, namely three points. In 2020, one pension point costs 81 rubles 49 kopecks. Thus, even in the most favorable scenario, when a person receives a fairly high salary, he will receive an increase in pension in the amount of no more than 244 rubles 47 kopecks. For most, the amount will be less.

Federal social supplement

Federal social benefits are a type of financial assistance to non-working pensioners whose pension provision is below the subsistence level in the region. According to the law, such additional payment must be regular and made until the pensioner finds a job, or the amount of his total income becomes equal to the subsistence level. Total income refers to all types of pensions, additional payments, compensations and benefits received by him.

Those pensioners who:

- live on the territory of the Russian Federation;

- does not work;

- receive pension benefits below the regional subsistence level.

The size of the social supplement varies depending on the region and the cost of living in it. That is, it is exactly the amount that does not reach the pensioner’s subsistence level.

On December 15, 2020, Dmitry Medvedev signed an order to allocate 7 billion rubles for additional payments to pensioners. At the same time, the funds will be distributed among 13 regions in which pensions for non-working pensioners are below the subsistence level. The list of regions includes:

- Sakhalin;

- Kamchatka;

- Chukotka;

- Komi;

- Yakutia;

- Primorsky Krai;

- Khabarovsk region;

- Arkhangelsk;

- Magadan Region;

- Murmansk region;

- Nenets Autonomous Okrug;

- Jewish Autonomous Region;

- Moscow region.

An example of a federal social supplement. The federal cost of living (LM) for a pensioner in 2020 is 8,726 rubles. The regional cost of living, for example, in Vladimir is less, 8,452 rubles. The pensioner was assigned financial support in the amount of 7,500 rubles. Since the regional minimum wage is lower than the federal one, a federal social benefit is assigned. 8726-7500 =952 rubles.

An example of a regional social supplement. The federal cost of living for a pensioner in 2020 is 8,726 rubles. Regional. for example, in Murmansk it is 12,523 rubles. Payments to a pensioner amount to 10,500 rubles. The value is greater than the federal one, but less than the regional one, so there will be the following additional payment: 12523-10500 = 2023 rubles.

Registration of recalculation

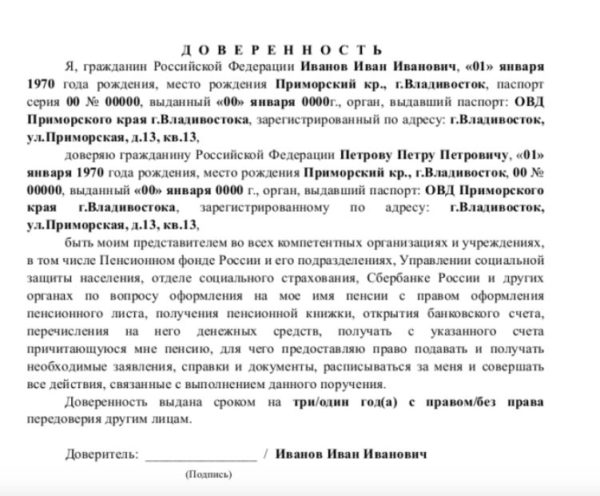

In most cases, changes in the amount of payments occur automatically; allowances and additional payments are often assigned during the initial registration of payments. Automatic recalculation without an application occurs upon indexation, reaching certain age limits, or upon completion of work. However, in some cases, a citizen’s independent appeal to executive bodies and centers is required (for example, when receiving disability, changing group). This can be done for a pensioner by his personal representatives on the basis of a power of attorney.

Power of attorney from a pensioner to perform actions on his behalf

Where to go?

To quickly resolve the issue related to the recalculation of accruals, it is recommended to submit an application and a package of documents to the local branch of the Pension Fund of the Russian Federation. It is permissible to use the services of the MFC (multifunctional center). They act as intermediaries and will themselves transfer information from the citizen to the PF. You can send the documentation by mail (registered mail with an inventory).

ATTENTION! The pensioner’s employer also has the right to submit an application for recalculation of accruals, but only with the latter’s consent.

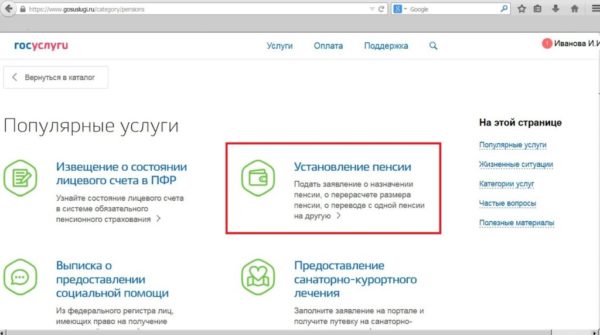

It is possible to send documentation online via the Internet using the “State Services” service. To do this, you need to go to the section on pension payments and fill out the proposed fields.

Recalculation through the State Services resource

When sending documentation to change the benefit amount via the Internet or the MFC, the review period is 1 month. To speed up the resolution of the issue, it is advisable to contact the Pension Fund in person.

List of documents

The list of documents required for recalculation includes:

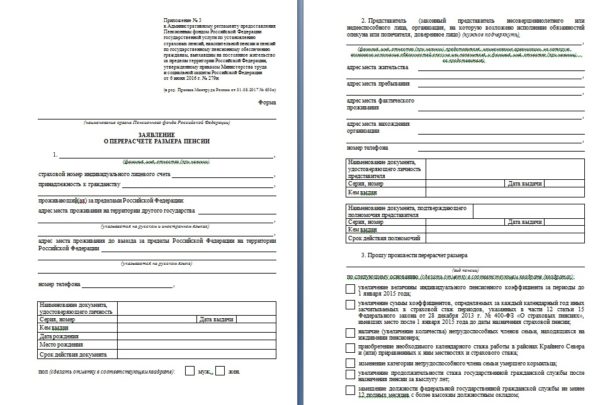

- statement. The form will be provided to the Pension Fund upon personal application, it can also be downloaded from the official fund resource;

Sample application for pension recalculation

- citizen's passport and pension certificate;

- SNILS;

- documents on work experience;

- additional papers confirming the basis for recalculation: about the status of unemployed, a medical report on assignment of disability, a certificate of family composition, information about children, about marriage, and so on.

The period for reviewing documentation when applying to the Pension Fund is 5 days. If it is necessary to make requests to other government agencies, the period may be increased to 3 months. If a positive conclusion is made, an order is drawn up to conduct a recalculation for the citizen. If a pensioner is denied bonuses, he has the right to appeal to a higher authority or court to appeal the decision.

The Government of the Russian Federation has outlined an extensive list of grounds for recalculating pensions for citizens. The bonuses and additional payments are designed to improve the poor financial situation of Russian pensioners. At the same time, the state’s social policy should be aimed not at ensuring the minimum acceptable level of living for a citizen, but at creating decent and fulfilling living conditions for him.