Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (7)

How to make an application for the return of the funded part of the pension

Important! When drawing up an application, you must comply with these requirements:

- provide personal data in full, in full accordance with identification documents;

- indicate the exact address of your residence, if it does not coincide with your registration address. If the place of residence is in another country, this must be reflected;

- consult a competent lawyer to avoid mistakes in drafting the document;

- indicate the type of pension;

- indicate a contact phone number, by calling which an employee of the Pension Fund will be able to coordinate or clarify certain issues related to your application;

- indicate the method of receiving funds. If this is a bank transfer, then additionally indicate the account number for such an operation;

- if your interests are represented by a trusted person, indicate in the application his personal data and information about the power of attorney on the basis of which he acts;

- at the end of the application, sign (your representative can sign for you if such a right is granted to him by virtue of a power of attorney) and indicate the date the document was drawn up;

- To record the submission of the document, take a notification receipt from an employee of the Pension Fund of the Russian Federation. Then put the date of acceptance and signature on the application again;

- you can fill out the form with a blue or black pen, or type it on your computer and then print it out;

- If you made a mistake or typo, you should rewrite the application, since employees of the Pension Fund of the Russian Federation may not accept the document with corrections.

The application will receive a written response within 30 days, containing confirmation of receipt of savings or a reasoned refusal.

ATTENTION! Look at the completed sample application for payment of the funded part of the pension:

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Documents for urgent pension payment

To apply for an urgent pension payment, you need to prepare the following documents:

- An application completed in written format or through the online service on the official website of the Pension Fund;

- Information on the amount of additions to insurance investments for the funded part of the pension, investments from the employer that were paid to the employee, accruals coming from co-financing, as well as savings from investing contributions;

- Work record book confirming work experience;

- Certificate of insurance SNILS;

- Passport proving your identity.

In the event that a citizen has not provided all documents, a deferment is given to provide the missing documents within three months. If after this time all documents are not ready, then the day of application will be considered the one when all the information required to receive an urgent pension payment was collected and transmitted.

Application for an urgent pension payment from pension savings

According to the Federal Law, a fixed-term pension can be assigned only to those citizens who have any savings in their accounts. An appropriate benefit can also be assigned to those citizens who are insured and receive a pension according to their age category.

To start the process of registering this security, you need to contact the Pension Fund and provide the documents that are needed to continue the procedure for establishing urgent pension payments. The need to draw up an application is also important. The content of the submitted appeal should reflect the following information:

- Provide the personal and contact information of the applicant;

- It will be important to include accurate passport information;

- Indicate the address and name of the institution to which the letter is sent;

- Mark the account number;

- Indicate the reason why the document is being drawn up;

- The conclusion is dated and signed.

The submitted application must indicate the period during which funds will be received from the funded pension. From the date of assignment of accruals, you must indicate at least 120 calendar months or 10 years.

Deadline for immediate pension payment

To receive this type of accrual, a citizen should contact either a state fund located at his place of residence, or a non-state fund in which savings are stored. Next, you need to provide the relevant documents and application.

After you submit your application to the fund, you will be notified that your application has been accepted for consideration. The decision on appointment or refusal is made by the institution within a ten-day period.

If the application is approved by the fund, the funds will be credited from the date on which the documents and the corresponding application to receive the money were submitted. Payments are made strictly for the period of time indicated by the applicant. That is, if a citizen noted that the period will be 10 years, then payments will be credited to his account for exactly 120 months, as indicated. The procedure and terms for payment of savings savings are carried out in accordance with established legal acts.

Any actions related to receiving government benefits must be carried out in accordance with the provisions of the law. It has been established that every citizen, if he has some financial resources, has the right to dispose of them in old age at his own discretion.

Who can receive a refund

Men whose year of birth is between 1953 and 1966 and women born between 1957 and 1966 have the right to return the funded part of their pension.

The fund for the return of pension savings was formed in the period from 2002 to 2004. Consequently, the amount of funds per pensioner is not large.

At the same time, persons who had certain deposits during their working career are entitled to receive additionally the following payments:

- government assistance. As a rule, this assistance is targeted. It is also provided to pensioners who are experiencing financial difficulties;

- deposits registered in the name of a pensioner;

- dividends that a pensioner is entitled to from investment activities. It should be noted that the amounts may be in foreign currency, but are paid in any case in Russian rubles, and are translated at the exchange rate as of the date of issue.

Can a pension be less than the subsistence minimum?

What to do if the employer did not pay contributions to the Pension Fund, read here.

Is it possible to receive a disability pension and a survivor’s pension at the same time? Read the link:

Important! A citizen’s pension consists of two components: the funded part, which is formed by the pensioner, and the insurance part, which is paid by the state. The amount of accumulated funds must be at least 5% higher than the amount paid monthly.

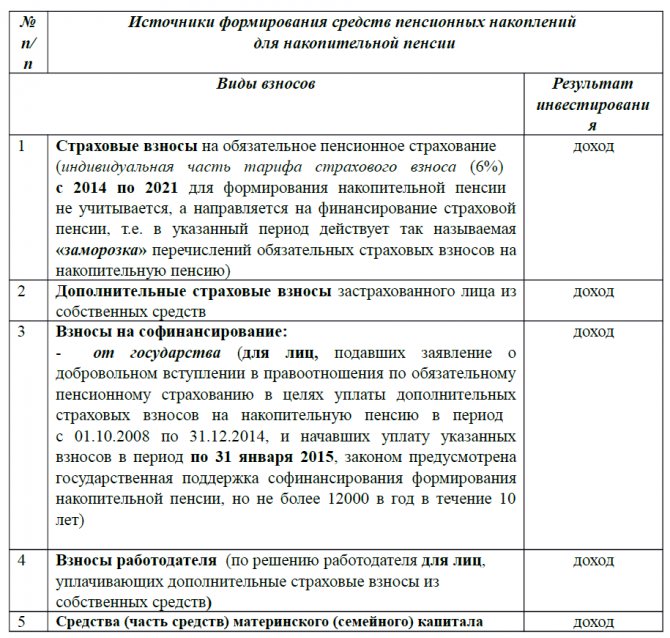

Currently, 22% of wages are subject to deductions to social funds (Pension Fund, Mandatory Medical Insurance Fund, Social Insurance Fund). 6% is transferred to the Pension Fund. These contributions form the funded part of the pension.

After receiving complete information about payments, the pensioner has the right to draw up an application for the return of pension savings by submitting it through the State Services portal.

How to apply for a funded pension

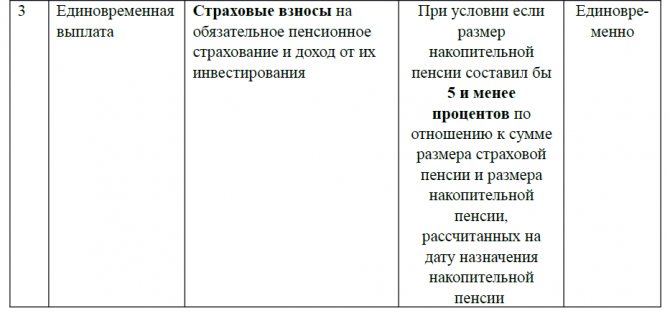

One-time payment – all pension savings are paid at once in one amount. Recipients:

- persons who have not acquired the right to receive a funded pension in accordance with Article 6 of Law N 424-FZ (due to the lack of the required insurance period or the required number of individual pension coefficients (taking into account transitional provisions) - upon reaching the age of 60 and 55 years (respectively men and women);

- persons whose funded pension is 5 percent or less in relation to the amount of the old-age insurance pension, including taking into account the fixed payment and increases to it, and the amount of the funded pension calculated on the date of assignment of the funded pension in accordance with Law No. 424-FZ - upon reaching the ages of 60 and 55 years (men and women, respectively), and for persons specified in Part 2 of Article 6 of Law N 424-FZ - upon reaching the age or maturity determined in accordance with Law N 400-FZ Federal Law as of December 31, 2018, and subject to the conditions giving the right to early assignment of an old-age insurance pension (availability of the required insurance period and (or) experience in the relevant types of work and the established value of the IPC).

Urgent pension payment. Its duration is determined by the citizen himself, but it cannot be less than 10 years. It is assigned and paid upon reaching the ages of 60 and 55 years (men and women, respectively) if they have the required insurance period and the amount of IPC established by Law No. 400-FZ to assign an old-age insurance pension.

For persons specified in Part 1 of Article 30, Article 31, Part 1 of Article 32, Part 2 of Article 33 of Law No. 400-FZ, an urgent pension payment is assigned upon reaching the age or maturity date determined in accordance with Law No. 400-FZ as of December 31, 2020, and subject to the conditions that give the right to early assignment of an old-age insurance pension (availability of the required insurance period and (or) experience in the relevant types of work and the established amount of the IPC).

An urgent pension payment is assigned to persons who have accumulated pension savings through contributions under the State Co-financing of Pensions Program, including employer contributions, state co-financing contributions and income from their investment, as well as from maternity (family) capital funds aimed at forming a future pensions and income from their investment.

A funded pension is assigned for a period of life and is paid monthly . Its size from 2020 is calculated based on the expected payment period - 258 months. To calculate the monthly payment amount, the total amount of pension savings accounted for in the special part of the individual personal account of the insured person, as of the day from which the payment is assigned, must be divided by 258 months.

Return of the funded part of pensions to pensioners

Please note! If the funded part of the pension is formed using additional sources (except for deductions from wages), you will be able to return the following amounts of money:

- deposits;

- dividends from investment activities;

- funds received under the state pension co-financing program.

There is a procedure for returning pension savings, the period of which is 10 years, and the amount of the funded part of the pension must be more than 5% of the total pension amount (it includes the funded and insurance part).

In order to obtain information about the amount of savings, contact the territorial office of the Pension Fund in your area. You can also use the State Services portal and get the information you are interested in by entering your SNILS number.

The funds that make up the funded part of the pension will be issued based on the pensioner’s application.

An urgent pension payment, its difference from a funded pension, and how to receive two types of payments?

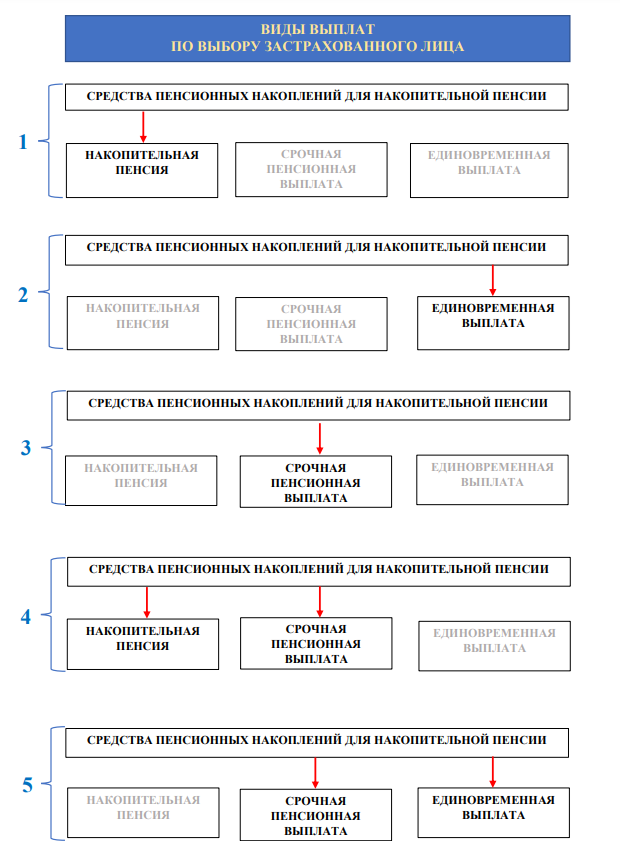

1. The following types of payments can be established (assigned) from pension savings funds for a formed funded pension:

- funded pension;

- immediate pension payment;

- lump sum payment (more information about this type of payment can be found here)

2. Who can receive an urgent pension payment.

Citizens of the Russian Federation, foreign citizens and stateless persons insured in the compulsory pension insurance system (hereinafter referred to as insured persons), who form a funded pension, including through additional insurance contributions from their own funds, or employer contributions, or funds (part of the funds ) maternal (family) capital, by contacting the Pension Fund of the Russian Federation or a non-state pension fund, depending on where pension savings are taken into account for the formation of his funded pension.

3. Conditions for receiving an urgent pension payment.

3.1. The presence of the following grounds simultaneously:

- the insured person reaches the age of 60 years for men, 55 years for women;

- having the right to an old-age insurance pension (having the required insurance period and the established value of the individual pension coefficient);

- who have formed pension savings for a funded pension from the following sources.

3.2. Or the presence of the following grounds simultaneously:

- before reaching the ages of 60 and 55 years (men and women, respectively);

- having the right to early assignment of an old-age insurance pension (having the required insurance period and (or) experience in the relevant types of work, the established value of the individual pension coefficient) as of December 31, 2018;

- who have formed pension savings for a funded pension at the expense of the above funds.

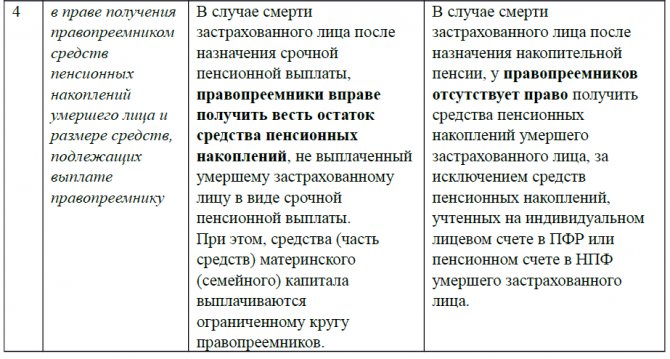

4) Differences between a fixed-term pension payment and a funded pension.

5) How can you get the largest possible payment amount from pension savings for a funded pension?

Insured persons who form a funded pension and have the right to an urgent pension payment have the right to distribute pension savings (see table) and issue two types of payments simultaneously:

- immediate pension payment and funded pension,

- or an urgent pension payment and a lump sum payment.

Required documents

The following documents will need to be attached to the application:

- applicant's passport;

- SNILS;

- work book, as well as an employment contract (the last place of work before retirement is taken into account);

- a certificate from the Pension Fund confirming the assignment of a pension to the citizen;

- details for transferring funds.

Watch the video. Payment of the funded part of the pension:

Deadlines and fees

10 working days are allotted for consideration of the application after its receipt. As a rule, it is reviewed within a week.

Remember! If a person has not submitted all documents, he is given the right to additionally submit them. If the missing documents were submitted within the next 3 months, then the day of application is the day the application was submitted.

As a rule, it takes a month to calculate your pension after submitting your application. Payments begin from the next month after settlement.

The amount of state duty does not have clear boundaries and is subject to changes depending on the region. The state fee for performing notarial acts is paid to cover costs.

How to return to legal successors

To receive the funded part of the pension of a deceased pensioner, you must contact the relevant territorial branch of the Pension Fund in person or through a representative.

Alternatively, you can send the letter by mail. If, for one reason or another, you missed the allotted deadline, you can restore it only in court.

To receive pension savings, you will need to submit documents that confirm the applicant’s right to them. There is a list of documents contained in the Rules for Payment of Pension Savings.