The reform of the pension system of citizens being carried out in the state has spurred interest in the state of their pension accounts and information about the amounts of current payments from the latter. If earlier this required a personal visit to the Pension Fund of Russia branch, today data can be obtained in a much shorter and faster time without leaving home. And with the development of Internet technologies, you can find out the size of your pension without leaving your home computer.

Is it possible to find out the size of your pension using SNILS online?

SNILS should be understood as the account number in the OPS system, participation in which is mandatory for all citizens working in the territory of the Russian Federation. It is to this account that funds sent to employers as contributions to an employee’s pension come.

Therefore, all data regarding the scope of pension rights of a particular citizen is linked to this number. Also, using SNILS, a citizen can find out the amount of pension savings and other payments through the Pension Fund.

Reference! The insurance number is indicated on a special green card, which until recently was issued to every citizen, starting from the moment of his birth. However, as of April 1, 2020, the Pension Fund of Russia stopped issuing this document, which means a gradual restriction of its circulation. However, the personal account number itself remains the same and is assigned to citizens from birth.

You can find out the amount of payments due using your insurance number either by arriving directly at the Pension Fund of Russia, be sure to have a document with you that confirms the identity of the applicant, or by using various online resources.

All about checking your pension savings for 2020

The reform carried out in 2020 makes it possible to independently form your own pension with certain savings. The insurance pension, in turn, is divided into the following groups:

- in case of loss of a breadwinner;

- establishing the fact of disability (disability group);

- reaching the age limit for old age pension.

Also, pension savings are divided into 3 categories:

- target;

- urgent;

- one-time

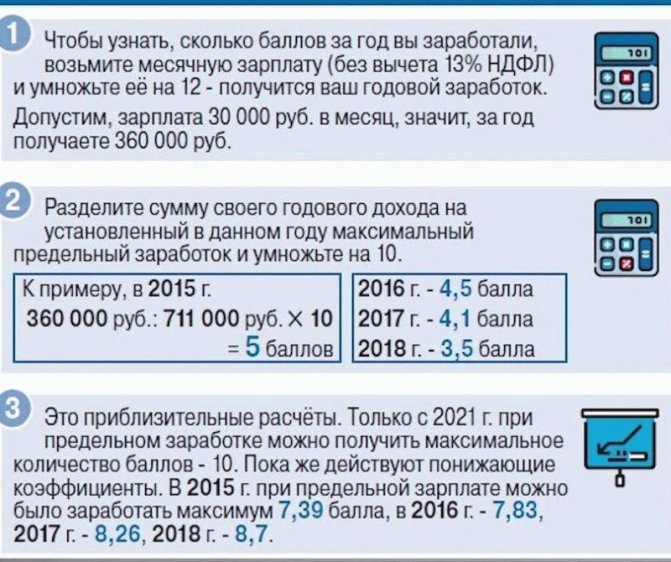

This right is granted as a result of the formation of the required number of points or IC (individual coefficient).

Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question Every year, during your working life, points are awarded. In the case of the formation of an exclusively insurance benefit, a person adds 10 points .

Basic methods

Modern information technologies make it possible to obtain the necessary information without leaving home. Recently, many government agencies have provided the opportunity to create personal accounts on their official websites, when working with which you can not only receive information, but also submit applications, complaints, and other documents.

The most convenient service for this is Gosuslugi. Also, the account on the PFR website allows you to obtain the necessary information.

"Government Services"

The State Services website allows citizens registered on it to interact with most government bodies, submit and order the necessary documents, and receive the necessary information.

To use government services, you must register. The main login for logging into your account can be SNILS or a mobile phone number.

Using your insurance number as a login is preferable because it does not change throughout your life.

To obtain information about the amount of your pension, you must do the following:

- Go to the service catalog page.

- Find and select the link “Pension, benefits, benefits”.

- In the resulting window, go to “Account status notifications”.

- Order information.

The necessary information will become available almost immediately after submitting the application.

Attention! To receive such confidential information, the user must have a verified account on the portal.

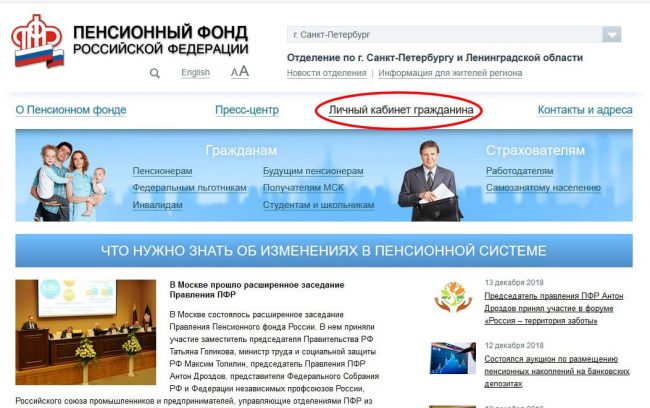

On the Pension Fund website

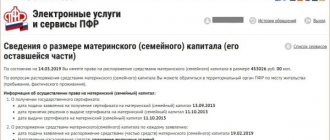

You can obtain the necessary information regarding the size of your pension in your personal account, but in order to create it, you must already have a confirmed account in the ESIA, that is, be registered on the State Services portal.

The creation of a personal account occurs automatically and does not require the user to enter any personal data, since the latter are available on State Services, from where they are simply duplicated.

To clarify the amount of your pension on the website, in the “Pensions” line, click “Get information about pension provision”. The necessary information will be generated almost instantly.

Rules for using the pension calculator on the Pension Fund website when checking pension savings

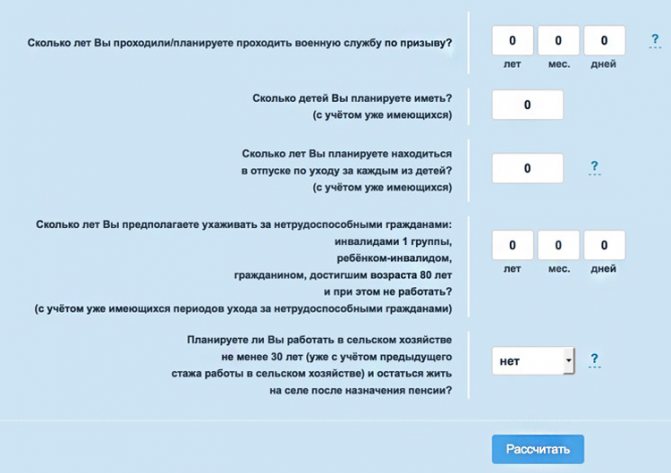

The pension calculator is very easy to use, and everyone can understand how it works. This service has been successfully operating since 2020. The new pension system is based on a system that operates on the principle: the more you work, the more you will receive later. The work of the pension calculator is based on it.

It also takes into account the time spent on military service and maternity leave, that is, payments will also be accrued on them. The service includes the principle that the longer a person does not receive a pension and accumulates work experience, the larger the amount of future pension payments he can count on.

To predict the size of your future pension, you will need to go to the website of the “Pension Fund of the Russian Federation”: https://www.pfrf.ru. On the main page of the site you will be asked to familiarize yourself with the latest news and changes in laws relating to pensioners, and at the end of the page you can see a clickable button: “Pension calculator”.

The service visitor does not need to register, confirm his identity or waste time on other formalities. Anyone can calculate their pension savings.

The procedure itself takes no more than five minutes. On the downloaded page, you must enter your year of birth, gender, the number of years spent serving in the army or maternity leave, as well as indicate how many more years you plan to work and the amount of your monthly salary.

Elena Smirnova Pension lawyer, ready to answer your questions. Ask me a question In addition, if the user plans to retire later than the legal age, this also needs to be recorded in the calculator. There is a special column for this.

You will also need to provide additional information such as:

- How many years do you plan to care for disabled relatives (disabled people or elderly people over 80 years old) without working?

- In what form do you carry out your labor activity (self-employed or hired worker; combination of hired labor and independent work).

After entering all the data, the user will see the size of his future pension, the number of individual pension coefficients and total work experience. It will also be possible to obtain detailed information regarding all the nuances and algorithm for forming pension savings.

Other methods

In addition to the above, you can obtain the necessary information in the following ways:

- Personal appeal to the Pension Fund. To do this, you need to arrive at the Pension Fund office at your place of residence during office hours with your passport, where a specialist will provide all the necessary information.

- Contact the MFC . Multifunctional centers have convenient opening hours, making it much easier to plan a visit to the MFC. To find out the size of your pension, during a consultation at the MFC you must give the specialist your passport and SNILS.

Obtaining information about the amount of pension benefits according to SNILS may become a necessity for a person who is concerned about his current and future financial situation. This information is easy to find out through modern electronic services.

Those citizens who prefer more conventional methods of obtaining government services can obtain the necessary information during an independent visit to the pension fund or MFC.

Information for future retirees

Recently, the pension system has undergone significant changes. Now each citizen’s pension is divided into an insurance and funded part. The funded part of the pension can be left to be managed by the Pension Fund or transferred to any non-state pension fund at your discretion.

You should know! The size of the funded part of a pension located in a non-state fund cannot be found out through the State Services portal or the official website of the Pension Fund. To obtain information, you must contact the NPF directly.

Pension for foreign citizens in Russia

0 668 According to the rules and regulations for calculating pensions in the country's pension fund, it is possible in a number of cases for citizens of other states to receive pensions.

Under similar provisions, foreigners have... — Read more —

What affects the amount of pension benefits?

Employers are required to make contributions for each employee to the Pension Fund, based on the percentage of total earnings established by the Government of the Russian Federation. But if the salary is paid in envelopes, then no transfers are made from it, and as a result, the employee is paid the salary in full. But there is a certain risk here - you can no longer count on a decent pension, because there will be no accrual of points, no increase in insurance and work experience, which affect the amount of old-age security.

If the future pensioner has a short insurance and work experience (less than 10 years), then he will only be paid social benefits in old age, and 5 years later than provided for persons who have reached the legal age.

Types of charges

Pension payments can be insurance and funded; both of these options are formed from deductions from wages during official employment.

But some pensioners receive only an insurance pension, while others receive from both sources. Moreover, the state regularly indexes the amount of old-age insurance payments, but funds from the funded part go to private funds for investment in economic projects. And the activities of these funds do not always bring profit; there are investments with negative results, so waiting for an increase in this case is pointless.

But since January 2014, contributions to savings funds have been canceled, and the amounts go directly to insurance pension payments.

Classification of main types of pensions

In accordance with the regulations of Federal legislation, the following classification of the main types of pensions can be carried out:

| Pension type | Who can receive |

| Insurance | |

| By old age | This type of pension is claimed by the majority of the country’s population who have the required length of service and a minimum amount of pension points. |

| By disability | People with disabilities assigned to groups 1, 2 or 3 can apply for this type of pension. A prerequisite for processing such payments is the insurance period, the duration of which is not taken into account in the calculations. Also, the Pension Fund does not take into account the time of onset of disability, nor the causes, nor the presence or absence of work at the moment. |

| For the loss of a breadwinner | Such a pension can be applied for by minor citizens who have lost one or both parents on whom they were dependent. Persons under the age of majority who committed an act that resulted in the sudden death of their breadwinners are not entitled to receive such payments. |

| State | |

| For length of service | Individuals who worked in government agencies, as well as test pilots and astronauts can apply for such a pension. |

| By old age | Citizens who have suffered from man-made or radiation disasters can apply for such a pension. |

| By disability | Persons who suffered in hostilities, radiation and man-made disasters, WWII veterans, astronauts, etc. can receive such a pension. |

| For the loss of a breadwinner | Disabled family members of astronauts, citizens affected by disasters and military personnel can count on monthly payments |

| Social | Such a pension can be assigned to citizens who are disabled and reside permanently in the Russian Federation |

Required documents

To register a pension in the Pension Fund, an individual must personally come to the nearest branch or authorize his representative by writing a power of attorney in his name. You need to have a documentation package with you, which should include:

- Personal passport.

- Identification code.

- Employment history.

- SNILS.

- Military ID.

- A certificate of earnings, if in those years in which personalized accounting had not yet been introduced, they received a higher salary.

- Certificate from a medical institution confirming the assignment of a disability group.

- Death certificate of a parent (if the pension is issued for the loss of a breadwinner).

Looking for an answer to the question - what is an old-age insurance pension and to whom is it paid? Then we recommend following the link and reading the article. How to find out the funded part of a pension according to SNILS through the state. services, you can read here. You can find out how length of service is calculated for assigning pensions to military personnel by following this link.

Formation of the insurance and funded parts of the labor pension

0 1264 Every citizen by law has the right to the formation of funded pensions in accordance with the provisions of the current agreement with the pension fund.

The formation of the considered parts of pensions occurs in strict... — Read more —

What pensions are considered social?

0 3451 The law establishes the possibility for citizens to receive various types of social benefits.

One of these types of payments are social pensions assigned to certain categories of citizens when... — Read more —

One-time payment from maternity capital

0 646 The law establishes the opportunity for citizens of the country to receive one-time payments from the total volume of maternity capital.

The rules for accruing funds and their subsequent distribution to citizens are established... — Read more —

Documents for assigning a pension via the Internet

Before submitting an application, the future pensioner must collect the following package of documentation for registration:

- a document confirming the absence or presence of family members with disabilities;

- general civil passport of the Russian Federation;

- a certificate from the place of residence or actual stay, if the citizen does not live according to registration;

- employment history. If there is none, the Pension Fund can accept from the citizen a certificate issued by the employer, which indicates the length of service;

- a document indicating the average monthly income;

- if your surname has changed during your life, then a document confirming this fact is required;

- certificate of disability or lack thereof.

After receiving a response from the State Services on an electronic application, the originals of all documents are sent to the Pension Fund for consideration.

Maternity capital for 2 children

0 5500 Maternity capital is one of the most common social security schemes for citizens.

The procedure and main features of its issuance are regulated by the norms currently in force in the country... — Read more —

Freezing maternity capital

0 600 Maternity capital can be issued to citizens for specific needs.

To receive it, a citizen must provide documentary evidence of belonging to a specific category of persons who, by law, receive... — Read more —

Social pension for disabled people

0 532 Disabled people have the right to receive social benefits from the state in accordance with the provisions of the current legislation of the country.

According to the norms of current laws, one of the types of such accruals is the possibility... — Read more —