The Federation of Independent Trade Unions of Russia (FNPR) sent a letter to Prime Minister Mikhail Mishustin with a proposal to cancel the funded part of the pension. The text of the letter is posted on the federation website.

The document states that the FNPR consistently advocates excluding the funded component from the state compulsory pension insurance system. But this issue has not been resolved and, according to trade unions, “leads to legal conflicts.”

Questions and answers How will the procedure for receiving pensions and benefits on the card change from October 1?

Why do trade unions want to abolish the funded pension?

FNPR associates its demand with the annual increase in the expected period for payment of a funded pension. Based on this parameter, which is also called the period or survival period, the size of the monthly payment of a funded pension is calculated: the total amount of the pensioner’s savings is divided by this period.

The parameter for the expected period of pension payment is saved only for the funded pension and is regulated separately. In 2020, the expected payment period was 228 months (19 years); from January 1, 2016, a mechanism for its annual increase was launched. In 2020, the period was already 258 months (21 years and 6 months), and in 2021 it will increase to 264 months (22 years).

The unions note that the annual increase in the expected payment period reduces the amount of pension coverage for the insured, and this “discredits the very idea of a funded pension.” The FNPR also believes that the expected survival period for the compulsory pension insurance system should be 12 and 15 years for men and women, respectively. This is explained by the fact that the average life expectancy of Russians is 72 years, and the right to a funded pension arises, as before, upon reaching 55 years for women and 60 years for men.

According to the FNPR, if the funded part is in the state compulsory pension insurance system, it is necessary to be guided by uniform standards. But currently, separate approaches are being used. In this regard, the federation proposes to abandon the increase in the expected payment period and remove the funded component from the state compulsory pension insurance system.

What do you mean by freezing your pension?

Let's take a closer look at what a pension freeze is. By default, part of the salary of each working person goes towards a funded pension, from which the person will receive security in the future. And this money will not be used for pensions, but for the current expenses of the country - this decision to freeze pension savings was made by the government of the Russian Federation. But if they take the money, it means they are needed for something. This is what freezing pension savings means for retirees. The question is - for what? To finance which particular state institutions will all the funds accumulated by the population over at least 3 years be used?

Who can receive a funded pension?

The funded part of the pension is formed for some pensioners and future pensioners. These are, in particular, working citizens born in 1967 and younger - their employers transfer insurance contributions to finance their funded pension. Men born in 1953-1966 and women born in 1957-1966 also have pension savings, since from 2002 to 2004 their employers paid insurance contributions to the funded part of their labor pension. In addition, those who voluntarily made contributions under the pension co-financing program or allocated maternity capital funds for their formation have pension savings.

Question answer

What will the new pension certificate look like?

Since 2014, the funded pension has been frozen: all contributions to the funded part go to payments to current pensioners. Before this, Russians could use these contributions to form their own pension savings or add them to the insurance part of the pension, increasing the points for calculating their insurance pension. The savings accumulated at the end of 2013 have not disappeared: they are invested and paid to citizens when they reach retirement age.

Freezing funded pensions undermines confidence in the pension system - deputy

The current system of funded pensions within the framework of state compulsory insurance undermines confidence in the pension system. This opinion was expressed on Thursday by the head of the State Duma Committee on Labor, Social Policy and Veterans Affairs Yaroslav Nilov (LDPR).

On Wednesday, the Russian government introduced a bill to the State Duma extending the freeze on the funded part of pensions for another year, until the end of 2023. Earlier this week, the Federation of Independent Trade Unions of Russia sent a letter to Russian Prime Minister Mikhail Mishustin with a proposal to exclude the funded component from the state compulsory pension insurance system.

“The main disadvantage is that the state’s decision to actually deny working citizens the right to independently manage their pension savings, contrary to their will, plans and expectations, seriously undermines confidence in both NPFs [non-state pension funds] and the pension system as a whole. In addition, a multi-year freeze without specific proposals and plans from the government to solve the problem suggests that this system is floundering. In my opinion, the introduction of a funded component into the compulsory pension insurance system was initially a mistake,” Nilov’s press service quotes him as saying.

At the same time, in his opinion, with the existing level of trust in the pension system of citizens, it will be “extremely difficult to encourage” citizens to voluntarily form a funded pension. “Of course, unless you offer some super-transparent and super-attractive conditions,” he suggested.

The parliamentarian cited the opportunity for Russians with low incomes to “earn more insurance points” as a benefit of the freeze. “This increases the likelihood of avoiding a situation where, upon reaching retirement age, they are faced with a lack of insurance points to assign a pension. Unfortunately, this problem occurs every year in tens of thousands of citizens. Therefore, the essence of the freeze is that the money does not disappear anywhere, but goes not to the savings account, but to the insurance account,” Nilov explained.

Commenting on the idea of the FNPR, the head of the Ministry of Finance, Anton Siluanov, said that such a step makes sense only after the creation of a system of voluntary pension savings in Russia. The first deputy head of the United Russia Duma, Andrei Isaev, told TASS that the abolition of the funded part of the pension is not being worked out at the legislative level.

In Russia, since 2002, a compulsory pension insurance system has been in place, under which the employer transfers insurance contributions from the employee’s salary (22%) to the Pension Fund of Russia (PFR).

16% goes to the employee’s insurance pension, and 6% to the funded pension. Until 2014, savings were managed by the Pension Fund of Russia, or, at the request of a citizen, were transferred to a non-state pension fund. Since 2014, the funded part of the pension has been “frozen” - it automatically goes to pay current pensions. Russian Information Agency TASS

How can I get pension savings?

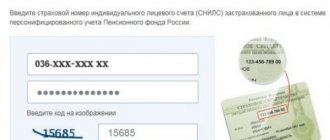

You can apply for a funded pension at any time after the right to it arises: upon reaching 55 years of age for women and 60 years of age for men. To do this, you need to have the minimum number of required pension points and length of service: in 2020 this is 18.6 points and 11 years, respectively.

The payment can be assigned either simultaneously with the insurance pension or separately. Pension savings can be paid in three ways. The first is a lifetime monthly funded pension, the amount of which is calculated based on the expected payment period. The second is in the form of a lump sum payment, which can be applied for every five years (issued provided that the size of the funded part is less than 5% of the amount of the pension received). The third method is to receive an urgent payment, when savings are paid within the time specified by the recipient in the application (but not less than 120 months).

Insurance pensions

Are you interested in the possibility of circumventing the current situation? Well, then you should seriously think about the option of an insurance pension. This option provides for the payment of a monthly amount that will be used for subsequent pension payments, that is, it will serve as compensation for lost income received during work. But it can also be paid in the event of loss of ability to work or if disabled family members have lost their breadwinner. A special feature is that payments are made in a certain amount, which directly depends on the previously chosen type of insurance pension. It should also be added that the amount of payments is indexed by the state every year, so you don’t have to worry about the safety of your savings. Bye.

Experience of other countries

In this situation, the experience of other states may be useful. It should be noted that the aging of the population and the entry of the economy into regression or stagnation is not a problem for Russia alone. For a full analysis of the situation, one should also take into account the important fact that other countries have a completely different system of pension accruals. So, if we compare it with the US pension system, it should be said that there is no traditional state funded pension here, and all Americans have to take care of their maintenance in the days when old age comes, with their own hands. For most American citizens, the solution to the problem is to pay regular contributions to private pension funds. But, given the realities of our state, the likelihood of creating reliable and “long-lived” non-state pension funds is quite doubtful.

On the other hand, a solution to the problem from the European Union may be interesting: increasing tax pressure on the most solvent citizens. In most countries, millionaires and billionaires give away more than half of their net income, and in some countries this figure is over 75%. It can be considered curious that under certain conditions the tax rate can exceed 100%. Considering the number of millionaires and billionaires in the Russian Federation, as well as various large enterprises, this option can be considered as very promising. And if they had begun to implement it several years ago, perhaps most citizens simply would not have learned what freezing pension savings meant for themselves, and would not have thought about what consequences this step could have for the lives of pensioners in the Russian Federation.

Government comments

As you can hear from the head of government and the Ministry of Economic Development, 2020 will be the last year of freezing pension savings. But if you take an interest in the publications of 2014 and the beginning of 2020, you can read the same thing about 2020. After all, if back in 2014 few people had any idea what freezing pension savings meant for pensioners, now this issue is of interest to an increasingly wider segment of the population due to the threat of literally losing their pension. In this case, we can make the assumption that the freezing of pension savings will continue until the budget of the Russian Federation is filled in other ways.

But, alas, given the slow pace at which plans for creating production and introducing scientific developments are being implemented, the creation of new sources of money for the budget is very doubtful in the near future. The current economic situation does not inspire optimism.

Where will the money go?

All contributions that have been and will be collected by the state will be used to maintain normal life. This money will be used to pay salaries of teachers, doctors, officials, emergency workers, and the army. Thus, government programs will be financed, including those for reforms. In most cases, funding will be provided in full, and if necessary, additional funds will be taken from reserve funds, such as the national welfare fund. But for now, thanks to decisions such as freezing pension savings, there is no need for this.