What documents are required for translation?

To transfer your pension you will need the following documents:

- passport

- pension certificate, insurance certificate of state (compulsory) pension insurance - green card on which SNILS is indicated (insurance number of an individual insurance account)

- document confirming registration in the locality where the pension will be received (if this information is indicated in the passport, no additional documents need to be provided)

MIR card in Sberbank

In 2020, Sberbank of Russia also joined the issue of Mir cards. So, with their help, transfers, non-cash payments are already made, and the account is managed remotely around the clock.

Today the bank provides the following Mir cards:

- debit classic, similar to Visa Classic and MasterСard Standard;

- pension, intended for clients of the appropriate age, in order to receive pension payments.

Both types have a validity period of 3 years and work only in one currency - rubles.

How can a pensioner transfer his pension to a Sberbank card?

To transfer a pension you must complete the following steps:

- Visit the nearest Sberbank branch with documents.

- Conclude a banking service agreement with the bank, which includes a range of services - issuing a card, opening a card account, connecting to Internet banking, issuing an additional card if the pensioner wants to provide access to the funds in his account to third parties.

- Visit the territorial department of the Pension Fund, where you fill out an application to transfer your pension to a bank account.

If you set a goal, you can transfer your pension to a Sberbank card within 1-2 days.

Other possible cases

Transferring a pension to a Sberbank card can also be done in cases where it is paid by mail or to a savings book.

How to transfer from a post office to a card

Many pensioners, tired of waiting in lines, want to transfer their pension from the post office to a Sberbank branch. In order for payments from the Pension Fund to reach the bank, you need to apply for a pension card. Sequencing:

- Preparation of documents: passport, pension certificate, SNILS.

- Filling out an application for issuing a card product, drawing up an application for banking services.

- Selecting a service package: Internet services, mobile banking, SMS notifications, etc.

- Receiving the card in your hands at the bank.

You need to get your personal account details from a credit institution employee and go to the Pension Fund branch with your passport. Fill out an application form so that pension accruals go to a plastic card. Be sure to provide details.

Important! After the completed manipulations, the citizen will receive a pension for the current and next month in the usual way. From the second month, funds will already arrive on the card.

If the pension was delivered by the postman

The pensioner himself has the right to choose the method of receiving his pension and can change it at any time. Sometimes delivering a pension to your home becomes inconvenient: you have to wait for the postman all day without leaving home. A pensioner can open an account and receive his pension at Sberbank.

To change the method of delivery of payments from the Pension Fund, you can submit an application to the MFC, to the Pension Fund or via the Internet. There is a personal account on the Pension Fund website. They go in and fill out an application. Starting next month, pensions will be transferred to your Sberbank card.

Registration from a passbook

To receive a pension on a Sberbank Mir card, you need to come to a branch of a financial institution with your passport and fill out an application form for a pension card. If you have a computer with the Internet at home, you can submit an application from the official website of the Savings Bank. All you have to do is go to the pension card page and enter your passport details. When the payment instrument is ready, a notification will be sent to your phone. To receive a card, come to the bank office with your passport.

Which card can I transfer to?

For pensioners, Sberbank offers several types of debit social cards:

- MIR pension card

- Master Card Active age

The MIR pension card does not involve a service fee, is issued free of charge, and there is no charge for cash withdrawals, when funds are credited to an account, or when receiving a statement. The balance of your own funds on the card account is charged 3.5% per annum.

Master Card Active Age, in addition to the listed advantages of the MIR pension card, provides additional services:

- special travel prices

- themed sales

- free access to video courses

Fund programs and tariffs

Until the beginning of 2014, company management was required to transfer 22% of earnings to the Pension Fund. At the same time, only 6% of this amount was intended for pension accumulation. Citizens were given the opportunity to manage these funds independently.

The remaining funds were used to generate insurance payments. They were located in the pension authority or were paid to those who had reached retirement age. Currently, future retirees are given the opportunity to choose where to save for their pension. This is due to the fact that after 2014, all 22% are allocated to the Pension Fund.

A person has the right to transfer funds to non-state companies that accumulate finances and subsequently provide for the pensioner.

Important! For example, you can send funds to Sberbank NPF. The main conditions for transferring funds are the age category of the citizen. For females, these are those born no earlier than 1957, for males - from 1953.

In addition, it is taken into account that the citizen has reached the age of majority and has not lost his legal capacity. An important point is that persons over this age do not have the right to act as investors. This means that all finances are located in the Pension Fund.

Until recently, Sberbank offered citizens to use the following programs:

- universal – provided for irregular transfers and a floating schedule;

- guaranteed - an individual procedure for depositing funds was established, which was influenced by the financial capabilities of the citizen;

- comprehensive - a person transferred funds upon his first visit to the organization and an individual pension plan was formed.

Currently, only the first program is used. The minimum down payment amount has been set at 1,500 rubles. At the same time, the next income should not be less than 500 rubles. A person can transfer finances in any way convenient for him.

For example, when using a bank card, using the official NPF portal or mobile application. You can also contact the Sberbank Online service or a Sb branch.

Advantages and disadvantages

5 advantages of receiving a pension on a Sberbank card:

- Reliability. Sberbank is a large state-owned bank, the fulfillment of obligations to depositors is guaranteed by the state, and the likelihood that the bank will go bankrupt is minimal.

- Wide network of branches and ATMs. With a Sberbank card you can withdraw funds without commission in any corner of Russia and abroad. Sberbank has one of the largest ATM networks in the world.

- Modern technologies. Card holders have access to the multifunctional Internet bank Sberbank Online, which allows you to manage your account remotely, mobile banking, SMS notifications, and a variety of ATM functionality.

- Benefit. The issuance and maintenance of the card is free, 3.5% per annum is charged on the account balance, the SMS notification service is provided free of charge for the first 2 months, and then has a symbolic price of 30 rubles. per month.

Disadvantages of a pension on the map:

- the card can be lost, forgotten, or stolen

- you can forget your PIN code, as a result of which money will become inaccessible for a while

- there may be no money in the nearest ATM, and the terminal at the point of sale may not work

If you think sensibly, then any disadvantages of a bank card can appear no more often than with cash in your wallet. After all, your wallet can just as easily be lost or forgotten, and you will have to stand in line for hours to get your pension.

Advantages and disadvantages

A citizen needs to decide whether to transfer a funded pension to a non-state pension fund after a thorough study of the company’s activities. For this reason, you need to find out what the positive and negative aspects of the fund’s activities are.

The advantages of this organization include:

- citizens have information about invested funds at any time;

- it is possible to track the account status online; for this, a person can use his personal account or mobile application;

- speed of contract execution;

- confirmed reliability of the fund, since all finances are insured. This means that upon completion of the organization’s activities, the pensioner will receive funds from the insurance company;

- there is a possibility to choose a method for receiving finance;

- free service.

In addition, the funds are protected from third parties. If a divorce occurs, these finances cannot be divided between citizens. In a situation where a person does not live to retire, the money is transferred to legal successors, and not to government agencies.

There is also the right to early withdrawal of funds.

The main disadvantages include:

- income instability;

- delays in payments.

It is worth considering that the activities of any organization have both positive and negative assessments. Speaking about the disadvantages, citizens note that employees clearly provide information on how to transfer funds to NPFs, while the issue of withdrawing money remains unclear.

Attention! Payment delays last for several months. Representatives of the fund say that the reason for this is that they have been accepting documentation from citizens for a long period of time. After which you need to check all the acts and send them to the necessary authorities.

Transfer of pension to Sberbank deposit

Temporarily free funds that are stored on a card account at Sberbank can be placed in deposit accounts, which allows you to receive a little more income. Sberbank offers pensioners the Pension-plus deposit of Sberbank of Russia. The annual deposit rate is 3.67%; if necessary, funds from the deposit account can be withdrawn and replenished without losing interest. The minimum minimum balance is symbolic and is 1 ruble. Interest on the deposit is accrued quarterly and added to the deposit amount, which increases the deposit amount, and, therefore, the pensioner’s income.

When connecting to your Sberbank Online personal account, you can avoid unnecessary hassle by opening a deposit account remotely. To place temporarily free money on deposit, you do not need to visit a bank branch; all procedures are carried out without leaving your home.

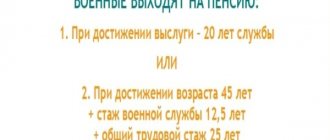

How is the pension determined?

Currently, every Russian’s pension consists of two parts. The first part of the insurance goes to pay benefits and pensions to existing pensioners, since contributions go to the state budget. The second savings part is an account assigned to a specific citizen. Money from the account is not spent and does not disappear anywhere. In this regard, many people are wondering whether to transfer the funded part of their pension to Sberbank?

The funded part of a future pension is deductions from a citizen’s salary, which accumulate in a specific account. Upon retirement, the employee receives increased benefits. The money from the account in which it was accumulated will be divided into several parts and added to the basic pension. It is also worth noting that relatives have the right to inherit this part of the funds in the event of the employee’s death.

Experts recommend that citizens not remain silent, but make a choice in favor of a funded pension, because in the future they will not have a chance to influence the amount of monthly payments in old age.

Issuance of cards from other banks

Pension transfer is possible not only to Sberbank, but also to any other credit institution chosen by the citizen. The most popular are Alfa-Bank, VTB, Tinkoff, Gazprom and Post Bank.

Each financial institution provides services on its own terms, so when giving preference to one or another option, the following factors should be taken into account:

- Location of branches. Due to the fact that long distances can be difficult to overcome for older people, it is advisable to apply for a card from the bank whose network of branches is most developed. In this case, you will be able to find an office located near your home.

- Cash burden. Some credit institutions charge their customers a fee for withdrawing cash from ATMs. To avoid unplanned expenses when receiving social benefits, it is better to familiarize yourself with card servicing tariffs in advance.

- Package of services. There are debit cards that must be connected to, for example, paid notifications. As a result, an amount of 30-100 rubles is debited from the account monthly. If it is impossible to refuse SMS notifications, you will have to pay or block the “plastic”.

- Advantages. A nice bonus for using the card is the accrual of interest on the balance or cashback. These services will allow the pensioner to receive additional benefits from using the card.

If a citizen previously transferred a pension to Sberbank, and then decided to become a client of another credit institution, he will need:

- Contact the selected organization to issue a card;

- Get new details;

- Submit up-to-date information to the Pension Fund and write a corresponding application;

- Close the Sberbank card.