What are insurance premiums

In Russia, medicine is conditionally free, and pensions are conditionally state-owned. “Conditionally” because in reality all working citizens pay monthly pension, insurance and social contributions. They do not pay themselves, but through a tax agent, who is the employer. But individual entrepreneurs pay such contributions for themselves, because they do not have a tax agent. They are their own employers. And if they have employees, they pay for them too.

The law obliges individual entrepreneurs to make contributions towards future pensions and contributions for health insurance. Social insurance, the funds of which are used to pay sick leave and benefits for the birth of a child, is a right, not an obligation. That is, payments to the Social Insurance Fund are voluntary.

How to pay contributions to a pension fund and save time? It is best to create a payment order on the tax service website and pay online through the mobile application or the Sberbank website.

Payment of insurance premiums is mandatory for individual entrepreneurs

Who is obliged to pay

Insurance contributions, one way or another, are paid by all citizens. Individual entrepreneurs pay them without exception. Even if an entrepreneur has ceased to operate, but has not been deregistered, payments to the Pension Fund and the Compulsory Medical Insurance Fund remain mandatory. There are judicial precedents in this area: all decisions of judges in such cases are made in favor of the state. All debts are collected from the taxpayer.

Therefore, if an individual entrepreneur decides to stop working, he must notify the Federal Tax Service and liquidate his individual entrepreneur status. Otherwise, insurance premiums will be charged as before.

There are still exceptions, but they are few. Entrepreneurs have the right to refuse to pay for insurance when they are not working because:

- serve in the armed forces;

- are caring for a young child or a child with a disability;

- are caring for a disabled person of the 1st group or an elderly relative over 80 years old.

Of course, any of these statuses must be confirmed by documents.

Suspension of activities in 2017

It happens that an individual entrepreneur does not lose its status, but simply suspends its activities for some reason. The Tax Code of the Russian Federation, as amended in force since 2020, provides for a number of periods for individual entrepreneurs when they may not conduct business and not pay fixed insurance premiums “for themselves” during this time. Such periods are defined by paragraph 7 of Article 430 of the Tax Code of the Russian Federation and refer to paragraphs 1, 3, 6 – 8 of Part 1 of Article 12 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”. These periods include:

- time of military service under conscription;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- period of residence with a spouse who was sent, for example, to diplomatic missions and consular offices of the Russian Federation.

You can avoid paying contributions in 2020 for these periods only if no business activity was carried out during these periods. This is directly stated in paragraph 7 of Article 430 of the Tax Code of the Russian Federation. That is, if, for example, in 2020 an individual entrepreneur wants not to pay insurance premiums, for example, for the period of child care, then during this period he should not have transactions on the current account. At least, this is the conclusion that suggests itself (although the condition of the absence of transactions on accounts is not directly stipulated in the Tax Code of the Russian Federation).

The procedure for exempting individual entrepreneurs in 2020 from paying fixed insurance premiums for the periods listed above (for example, for periods of child care) is not directly defined in the Tax Code of the Russian Federation. Let's hope that the Federal Tax Service will provide clarification on this issue.

Calculation of insurance premiums

How much money will you have to spend on these deductions? Now these are fixed amounts, which greatly simplifies calculations and payments. You will have to count something only when the profit for the year exceeds 300,000 rubles.

Fixed payments for individual entrepreneurs:

- medical insurance, compulsory medical insurance - 5,840 rubles;

- pension savings, Pension Fund - 26,545 rubles + 1% of income over 300,000 rubles.

Let's figure out how to calculate contributions to the Pension Fund using the sample. The businessman works alone and earned 527,500 rubles. What should he pay? Firstly, a fixed 26,545 rubles for the Pension Fund and 5,840 rubles for medical insurance. Secondly, an additional contribution for income over 300 thousand rubles. Please note that the percentage is calculated not on the entire amount, but on the excess of the limit. That is: (527,500 - 300,000) x 1% = 2,275 rubles.

Total payment amount: 5,840 + 26,545 + 2,275 = 34,660. This is exactly how much a businessman must pay to the state for a year. Fixed contributions of individual entrepreneurs have significantly simplified the life of taxpayers, since previously the amount of payments was tied to the minimum wage.

What is considered income?

Income in the broadest sense of the word is considered to be all money earned from a business minus operating expenses. Depending on the taxation regime, the concept of “income” changes slightly.

The tax regime does not affect the amount of personal insurance premiums in any way, but it does matter in the payment schedule. We will explain below when you need to pay deductions under different tax systems.

Insurance premiums for employees

If an entrepreneur has employees, he automatically acts as their tax agent. Simply put, it calculates and pays income tax for them (13% of salary) and contributes funds to the Compulsory Medical Insurance Fund and the Social Insurance Fund. Unlike individual entrepreneurs, ordinary citizens are required to pay into the Social Insurance Fund.

The amounts here are not exact and are calculated as a percentage of salary. 22% in the Pension Fund, 2.9% in the Social Insurance Fund, 5.1% in the Compulsory Medical Insurance Fund. Let’s assume that an individual entrepreneur officially pays an employee 18,555 rubles. How much money will the state have to pay:

- Personal income tax: 18,555 x 13% = 2,412.15 rubles;

- Pension Fund: 18,555 x 22% = 4,082.1 rubles;

- Compulsory medical insurance: 18,555 x 5.9% = 1,094.7 rubles.

- Social Insurance Fund: 18,555 x 2.1% = 389.655.

The total is 7,978.605. That is, an entrepreneur will pay almost 8 thousand rubles in 1 month (!) to the state for an employee with a “white” salary of 18 thousand rubles. If there are violations in terms of volume and timing, the entrepreneur will be held accountable.

You can calculate insurance payments yourself, or you can use an online calculator

Self-contribution calculator

Mandatory payments of individual entrepreneurs are easy to calculate manually, since most of them are fixed values. They are approved by the government every year. Calculating 1% of income over 300 thousand is also very simple. However, there are modern free tools that will help you perform or check calculations in a few seconds. Find them: type “calculation of insurance premiums” in the search bar. To calculate insurance premiums for individual entrepreneurs, you only need to indicate the date of registration and income.

What values to consider

In order for an individual entrepreneur to calculate fixed insurance premiums “for himself”, which must be transferred in 2020, it is necessary to take into account the values of certain indicators (Article 430 of the Tax Code of the Russian Federation):

- Minimum wage at the beginning of the calendar year. At the beginning of 2020, the minimum wage is 7,500 rubles (as of January 1, 2020, the minimum wage was 6,204 rubles). See “Minimum wage from January 1, 2020”;

- tariffs of insurance contributions to the relevant fund. For 2020, the tariffs are as follows: in the Pension Fund - 26%, in the Federal Compulsory Medical Insurance Fund - 5.1%, in the Social Insurance Fund - 2.9%;

- the period for calculating insurance premiums “for yourself” (it can be a whole year, or maybe less).

Deadlines for payment of insurance premiums for individual entrepreneurs

The main part of the payments (without 1%) must be transferred to the funds before December 31. There are no time limits, and there are no requirements to deposit funds in advance. An entrepreneur can pay a little bit every month, divide the amount into 4 parts and pay quarterly or pay at once. It's his right. Inspection bodies cannot require a different payment procedure.

As for the additional charge, that is, 1%, it is paid until the beginning of July next year. For example, if a businessman earned 700,000 in 2020, then he will deposit the approved amount before January 1, 2019, and 1% of the “excess” 400 thousand before July 1, 2020.

What is the best way to pay: in parts or at once? The answer depends on the specifics of the job. If an entrepreneur is confident that at the end of the year he will freely find 33 thousand rubles without harm to the business, he does not have to bother himself with advances. But practice shows that it is much safer to divide contributions into several small parts and make payments throughout the year.

Responsibility of an entrepreneur for non-payment of contributions

First of all, it is worth mentioning 199 of the Criminal Code of the Russian Federation. Because tax collections are partly included in tax returns. However, Section 199 threatens an individual entrepreneur only in case of malicious, constant evasion of payment of insurance premiums in large amounts. In other cases, if insurance premiums for employees are not paid, you can expect:

- Fine in accordance with Art. 119 of the Tax Code of the Russian Federation. Not less than a thousand rubles - but not more than 30% of the insurance premium.

- In case of gross and malicious violation of accounting rules - fines ranging from 20 thousand rubles in accordance with (Article 120(3) of the Tax Code of the Russian Federation).

- In case of incorrect calculations, or arrears on the part of the tax authorities when paying, a fine is possible in accordance with (Article 122 (1) of the Tax Code of the Russian Federation). In the amount of up to 20% of the unpaid amount.

- In case of intentional non-payment, 40% of the insurance premium is charged (Article 122(3) of the Tax Code of the Russian Federation).

- Providing incomplete information about changes in the workforce at an enterprise to the Pension Fund of the Russian Federation - 500 rubles for each employee at the enterprise (Article 17 No. 27-FZ)

Reducing the amount of taxes due to insurance premiums

Individual entrepreneurs' pension contributions can be used to reduce taxes. This is beneficial because it helps reduce tax by 32 thousand. For small businesses, this could mean zero payments completely. This works slightly differently in different modes.

Individual entrepreneur contributions to the simplified tax system

Taxpayers under simplified taxation pay advance payments every 4 months and income tax at the end of the year. They are allowed to use personal insurance contributions to reduce the amount of payments, and in several ways. When an entrepreneur transfers small amounts to insurance once a quarter, each advance payment can be reduced. If the individual entrepreneur makes the entire amount of payments in December, you can immediately reduce the final payment by 32,385 rubles. This is really for entrepreneurs working entirely on their own.

Unfortunately, if an individual entrepreneur has hired employees, payments can only be reduced by 1/2 of insurance contributions.

How is this implemented in practice? Let’s assume that during the quarter a businessman earned 115 thousand using the simplified tax system. He decided to pay insurance premiums in 3 installments of 10,795. He pays 6% of his income to the Federal Tax Service, that is, for the quarter he will contribute 115,000 x 6% = 6,900 rubles. If he has already paid 10,795 rubles, the advance tax may not be paid at all.

Another option: the entrepreneur did not reduce advance payments and paid for insurance at once at the end of the year. At the end of the period, taking into account advances, he must pay 50 thousand rubles. He can deduct the entire fixed payment from them and pay only 17,615.

You can pay to the Pension Fund and the Compulsory Medical Insurance Fund at once, or in parts, this is the right of an entrepreneur

IP on UTII

Taxpayers on imputation have the right to reduce their tax due to insurance contributions: by 100% if they work alone and by 1/2 with employees. Only personal payments are used in the tax reduction. It is prohibited to reduce the amount in the declaration by employee contributions. The fee is paid quarterly. In order to reduce the payment to the Federal Tax Service by an insurance payment, two conditions will have to be met:

- pay for insurance before paying taxes;

- deposit funds every quarter.

USN and UTII

Taxpayers who combine two tax calculation systems: simplified tax system and UTII, are also allowed to reduce financial obligations using insurance contributions, but according to special rules. For example, an individual entrepreneur does not have hired employees on the simplified tax system, but does have employees on UTII. The simplified payment is reduced by personal insurance, and the imputed amount is reduced by 50% of the transfers for employees.

In the opposite case, when employees are listed according to the simplified tax system, but there is no one according to the imputation, the same rule applies: the simplified tax is reduced by 50% of the employees’ contributions, and the UTII is reduced by the full amount of their own. There should be no problems with calculations, because when combining two regimes, entrepreneurs are required to keep separate records of income and expenses, which means they have all the information about how much they must pay under the simplified regime and how much under the imputed regime.

General taxation system

Individual entrepreneurs extremely rarely operate under the general tax regime. But if for some reason they are forced to use such taxation or are automatically transferred to it due to exceeding the amount of income established by law or the number of employees, it is allowed to reduce personal income tax by the entire volume of personal insurance payments.

Calculation and amount of payments in 2019

You can make all the necessary calculations for insurance premiums for individual entrepreneurs using a specially designed online calculator. To do this, you need to go to the official website of the Federal Tax Service.

It is necessary to take into account that the service calculates the required amount of deductions based on a fixed contribution. If it is necessary to calculate the required amount if the income exceeds 300 thousand rubles, an error will be indicated on the monitor screen. This is largely due to the fact that the amount of income in the online calculator can be indicated exclusively for the current reporting period or the previous one.

In 2020, the BCC for transfers of established insurance premiums remained the same:

- transfer to pension insurance - 182 1 0210 160;

- transfers for compulsory health insurance - 182 1 02 02103 08 1013 160.

Important: the required contribution of 1% of excess income must be transferred to the specified policyholder code. There are no exceptions.

How to submit reports on insurance premiums

If an entrepreneur runs a business alone, without employees, there is no need to report insurance payments. It is enough to bring them in on time. But when you have hired employees, you will have to regularly submit several reports:

- S3V-M to the Pension Fund of Russia department - before the 15th day of the month, after the reporting month;

- 4-FSS - until the 20th day of the month, after the reporting month;

- 6-NDFL and a single calculation form to the tax service within a month after the end of the quarter;

- 2-NDFL to the tax service until April 1 of the year following the reporting year.

The pension fund is paid a fixed amount of 26,545 rubles per year + 1% of income over 300 thousand rubles

Payment orders 2020

Starting from 2020, insurance premiums for compulsory pension and health insurance for individual entrepreneurs must be transferred to the Federal Tax Service (FTS). However, you need to prepare separate payment documents:

- for the payment of medical contributions to the budget of the Federal Compulsory Health Insurance Fund (FFOMS);

- for the payment of pension insurance contributions to the Pension Fund budget.

If an entrepreneur decides to pay voluntary contributions to social insurance in 2020, then they must be transferred to the Federal Social Insurance Fund of Russia as a separate payment order.

Read also

22.10.2016 03.11.2016 03.11.2016 09.02.2017 25.08.2017 03.01.2019

How to generate a payment receipt for payment of fixed payments

You can fulfill the obligation to transfer contributions in cash at a bank branch or electronically. In addition, you can draw up a payment order and make a transfer through an open bank account.

How to generate a payment using the tax service on nalog.ru?

The tax website offers a convenient service for automatically creating a receipt for payment of contributions through a bank branch.

Step 1. Go to the tax website https://service.nalog.ru/payment/payment.html

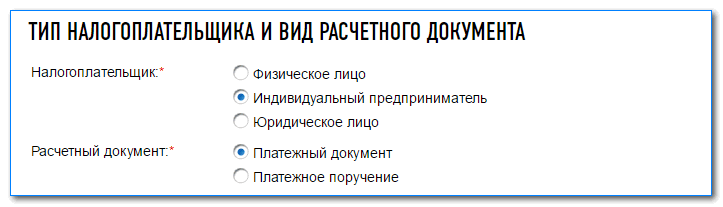

Step 2. In the payer field, click “Individual entrepreneur”; in the “Payment document” field, enter “Payment document”. With its help, you can obtain a form for transfer through a bank, or pay with electronic money. If you select “Payment order”, you can generate a document to transfer these amounts from the current account. But it will also be necessary to indicate the details of the tax authority - the recipient.

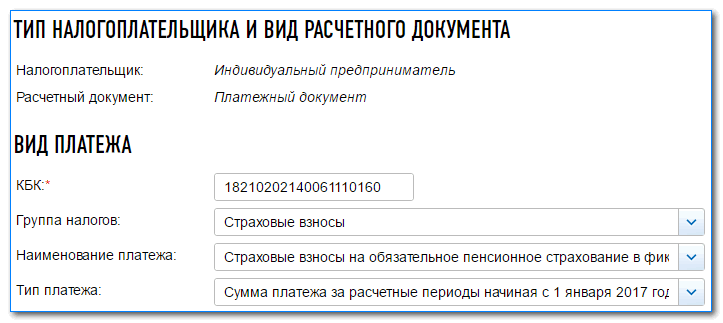

Step 3. Enter the required KBK, after which you need to press Enter. The remaining fields should be filled in automatically. In this case, the code must be specified without spaces or other unnecessary characters. If you see inaccuracies in the information entered, you can click the “Back” button and fill out the fields again.

Attention! The CBC must be entered together without spaces.

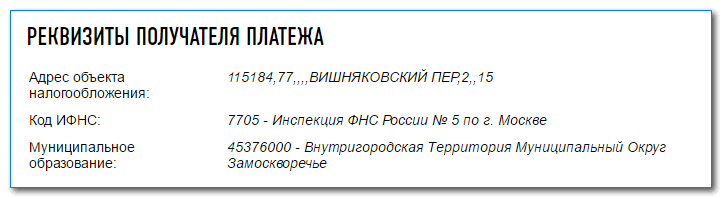

Step 4. Fill in the details of the recipient of contributions. The column “Address of the object of taxation” should be skipped. In the “IFTS Code” you select the tax office to which the payment is made. The municipality is indicated below (selected from the drop-down list).

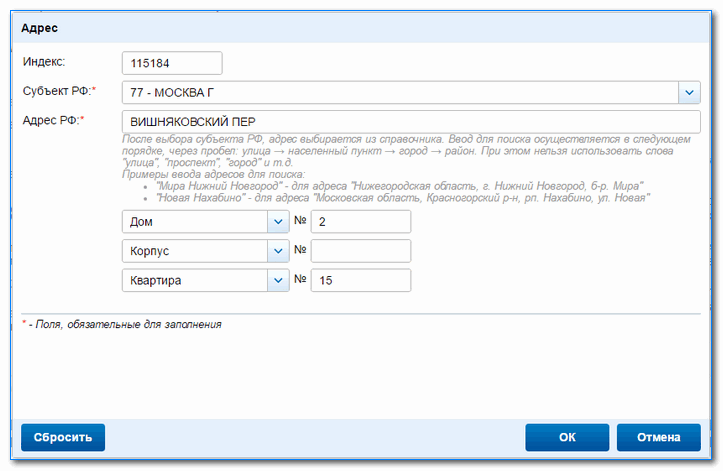

To enter the address, an additional window will open:

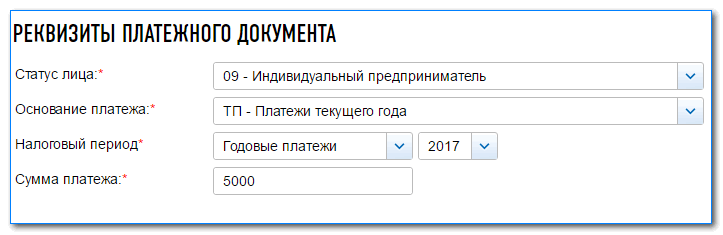

Step 5. Specify the details of the payment document. “Person status” – select 09, entrepreneur. “TP” is selected as the basis for the payment - the current payment of this year. In the “Tax period” field, the payment for the year is selected, and the year for which the payment must be made is also reflected. Payment amount—the desired payment amount.

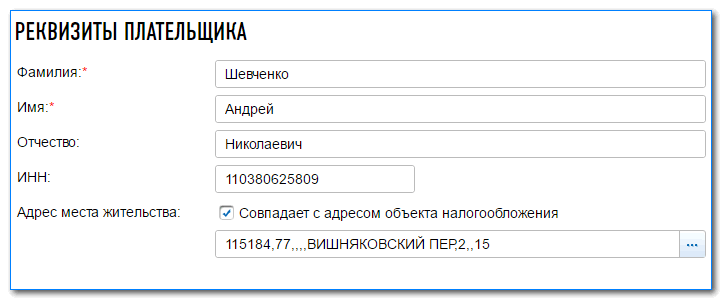

Step 6. Enter payer information. His full name and TIN code are filled in. The “Address” field is filled in in a separate window; information is selected from directories. The TIN field must be filled in if you plan to pay electronically.

Step 7. You need to check the correctness of the data again and click the “Pay” button. In the window that opens you need to select:

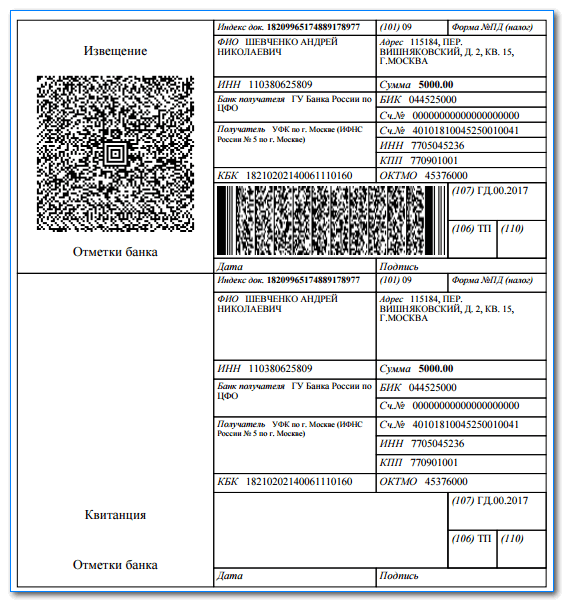

If payment is made in cash through a bank branch, then a receipt will be created for printing:

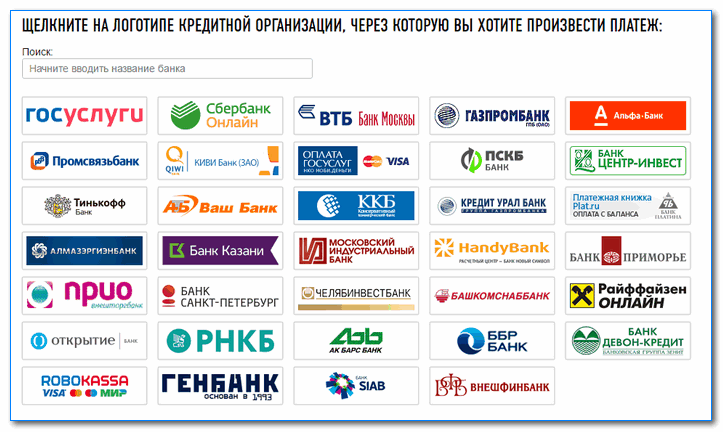

If the fee is paid non-cash, then a window will open with the logos of banks and payment systems, and you will need to select the desired one:

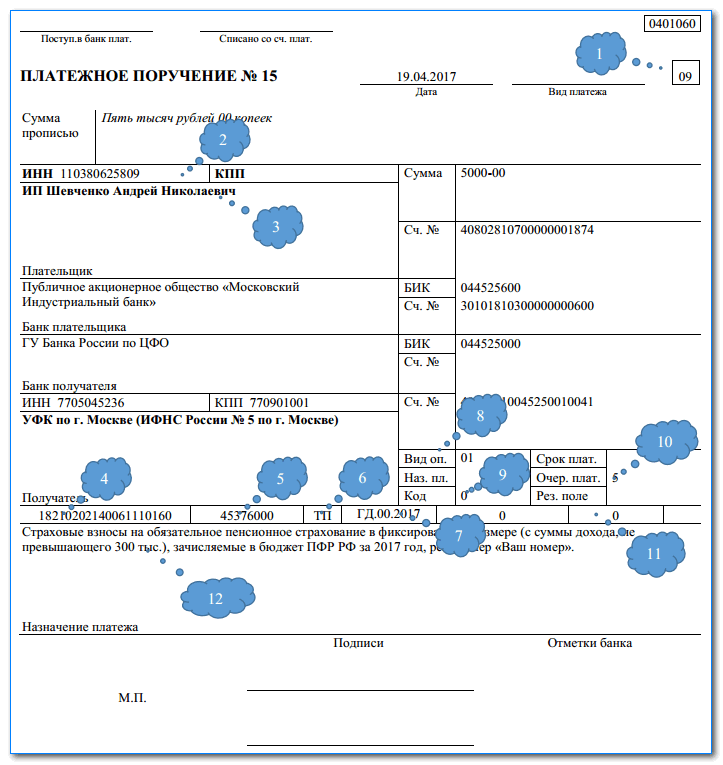

How to fill out a payment order for payment through a bank on an individual entrepreneur’s account

If an entrepreneur has a bank account, then fixed contributions can be paid through it by drawing up a payment order. To do this, it is best to use special assistant services or accounting programs.

Features of issuing a payment order for the transfer of fixed contributions:

- The payer status is entered with the code “09”;

- The entrepreneur's TIN is recorded; the checkpoint field must be left blank, because the entrepreneur does not have one.

- The full name of the payer (entrepreneur) and his bank details are indicated - the name of the banking organization, BIC, correspondent account and current account. Below are the details of the recipient - the tax office. They can be found on the Federal Tax Service website.

- In field 104 the BCC of the payment is entered without spaces;

- OKTMO is written in field 105;

- The code “TP” is written in the next field - that is, the current payment;

- The payment periods are years, so GD.00.17 is written in the next field. The last 2 digits are the two digits of the payment year, 2020.

- In the “Type of payment” field “01” is written;

- The “CODE” field is entered as 0;

- Payment order: 5;

- Fields 108 and 109 must be filled in with “0”; field 110 is not filled in.

- The purpose of the payment is recorded. Here you need to indicate that fixed contributions are paid on income up to one hundred thousand rubles for 2020 and indicate the registration number.