The number of pensioners is increasing every year and, according to projected data, it will be difficult for the state to provide pensioners with decent payments in the future. Therefore, pension legislation is being reformed, seeking new ways to form a pension base. Relatively recently, the accumulation part appeared, which will be discussed.

What is the funded part of a pension?

In accordance with current legislation, every working citizen must be a participant in compulsory pension insurance. Previously, registration was carried out on an application basis with the mandatory issuance of SNILS cards, which were the most important personal document of a citizen.

As of April 1, 2020, the green card is no longer issued, but this does not negate the availability of appropriate personal accounts for citizens insured in the OPS system. They are needed, first of all, to transfer insurance contributions to the Pension Fund, that is, funds from which the pension will be paid. This is directly handled by the employer. Persons with entrepreneurial status are required to pay fees for themselves.

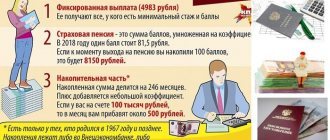

The amount of funds sent as contributions to the Pension Fund is not fixed (with the exception of individual entrepreneurs), but depends on the size of the insured person’s salary, amounting to 22% of it. At the same time, 6% goes to solidarity needs, that is, directly into the circulation of the Pension Fund. Due to this part, part of the payments to current pensioners is made. The remaining 16%, as a general rule, is directed to the formation of future savings of the insured person in the form of an insurance pension.

Attention! For employees performing labor functions in difficult and hazardous conditions, it is provided to pay additional insurance premium rates.

However, some citizens, in particular those who were born no earlier than 1967, decided that their insurance contributions would also form the funded part of the pension, in addition to the insurance one. In this case, only 10% goes to the insurance part, but 6% goes to the formation of a savings account.

A citizen can place funds for the formation of a future funded pension both in the state pension fund and in non-governmental organizations (NPF). The NPF, on the basis of an agreement concluded with a citizen, accumulates funds received from a portion of insurance premiums and invests them in various profitable projects. The subsequently received investment income directly affects the amount of pension provision in the future, significantly increasing it.

Example

If we agree that a person’s pension is calculated without the KPFV and KPPK indicators, then it will be indexed in the following order.

Let the IPC indicator be equal to 97 points. Then the insurance pension:

from January 1, 2020 will be: 97 x 93 + 5686.25 = 14,707.25 rubles. from January 1, 2021 will be: 97 x 98.86 + 6044.48 = 15,633.90 rubles.

It happens that the pension calculated using the above formula turns out to be lower than the pensioner’s subsistence level. This figure in 2020 for the Russian Federation as a whole is 9,311 rubles (law dated December 2, 2019 No. 380-FZ). Then, a federal surcharge is added to the result of such calculation so that the actual pension is not lower than the corresponding minimum.

In this case, not the entire pension is indexed, but rather the specified result of its calculation using the formula. In this case, the final pension is calculated according to the formula:

PENSION (MINIMUM) = PM + (IP/100) x INDEX, where:

-PM – living wage of a pensioner in the region; -IP – pension calculated according to the basic formula; -INDEX – the established indexation indicator at the beginning of the year of pension calculation.

Types of funded pension

After reaching retirement age, which in 2020 in Russia is 55.5 years and 60.5 years for women and men, respectively, a citizen, if there are grounds, has the right to apply for the accrual and assignment of his funded pension. Moreover, this form of material support comes in three types. Let's look at them in more detail.

Indefinite

A funded pension of this type must be paid to the pensioner throughout his life. However, its size depends on the “expected payment period”, which is 252 months. Accordingly, in order to calculate the monthly payment amount, it is necessary to divide the total amount of funds in the account (accumulated through contributions and investment income) by the above number of months.

Reference! The “expected payment period” of 252 months is taken into account when calculating collateral only in 2019. This value is not constant and changes annually.

Urgent

Payments will be received by the pensioner within a certain period chosen by the recipient himself. However, this period cannot be less than 10 years. The calculation procedure is similar to how a permanent pension is calculated, with the only difference being that the number of months is determined by the pensioner himself (minimum 120).

One-time

Receiving the entire amount in the account of an NPF or Pension Fund is possible only for certain categories of persons, including:

- recipients of survivor benefits;

- disabled people;

- recipients of an insurance pension, provided that the monthly calculated amount of funded payments is less than 5% of it.

How long will it last?

There is no specific information yet about how long this type of pension system will last. However, a review of this issue is planned in 2020 to finalize the method of using funded contributions.

The Ministry of Finance, together with the Central Bank, propose to transfer such contributions to the category of voluntary ones in excess of the established rates. This will be an individual pension capital, to which employers will contribute up to 6%.

Other positive points were discussed:

- Possibility to withdraw up to 20% of the accumulated amount for personal purposes.

- In unforeseen difficult situations, the opportunity to withdraw the entire amount of the IPC.

- Compensation for the increased percentage of pension contributions through tax deductions.

Time will tell whether such a system will be adopted; for now it is impossible to say anything definitely.

How to find out the amount of savings

The size of the funded pension in the Pension Fund of the Russian Federation can be found out by contacting directly the territorial branch of the fund or obtain the necessary information on the State Services portal.

If funds are accumulated in accounts in a non-state pension fund, then the relevant information can be clarified by contacting the office of a non-state fund.

Important! Many large non-state pension funds provide their clients with the opportunity to create a personal account on their websites on the Internet. In them you can find out the size of your future pension.

Example

Let's agree that a person living in the Tver region has few pension points, for example - 47. His calculated pension (IP indicator) in 2020 will therefore be:

37 x 93 + 5686.25 = 9127.25 rubles.

In this case, the indexed pension compared to 2019 will be:

PENSION (MINIMUM) = 9302 + (9127.25 / 100) x 6.6 = 9904.40 rubles, where

9302 – living wage for a pensioner in the Tver region in 2020 (regional law dated September 13, 2019 No. 52-ZO);

6.6 – pension indexation coefficient in 2020.

Pensions will be indexed in January 2021 in the same manner. In the formula for calculating the PENSION (MINIMUM) indicator, regional PM indicators will be used after their approval, as well as a new indexation coefficient of 6.3, already known today.

Who is entitled to receive a funded pension?

The following categories of persons are entitled to receive this type of security:

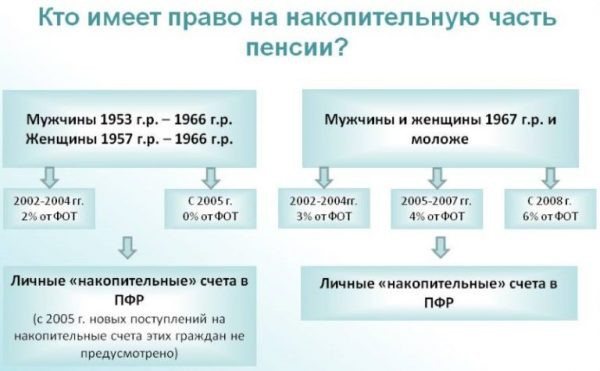

- citizens who were born before 1967 and chose to form this type of pension;

- citizens who take part in state co-financing of pensions;

- women who used maternity capital funds for their future pension.

The right to receive appropriate payments occurs after the citizen reaches the age of retirement.

How to receive the funded part of a pension: paperwork

Receipt of the funded part of pension payments does not occur automatically after a citizen acquires the corresponding right. Most aspects of interaction with the Pension Fund of Russia and Non-State Pension Funds are of a declarative nature, therefore, when applying in order to receive monetary support, the applicant should, among other things, confirm the existence of this right. Confirmation occurs by providing the necessary documents.

Below is an approximate list of required documents that should be provided when applying for a funded pension:

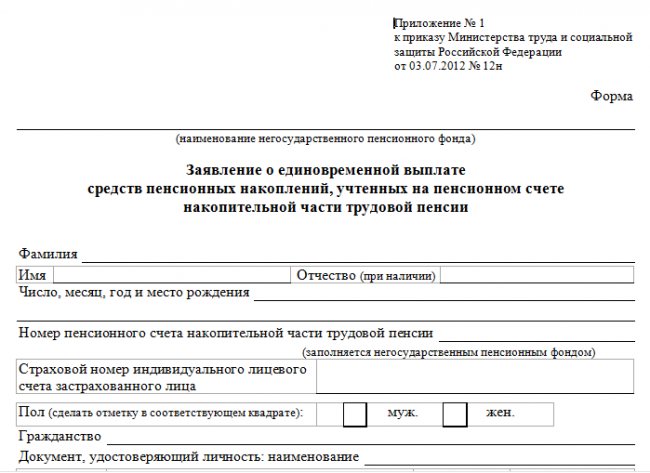

- Statement . The application, as a rule, is standard and is issued directly at the institution at the time of application.

Sample application:

- A document with which you can identify the applicant. As a rule, this is a passport.

- Employment history. It is the main document confirming the length of service, periods and nature of the employee’s work throughout his life.

- SNILS . In the presence of.

- Agreement. If the funds will be paid from the NPF.

Reference! If the documents are submitted not by the future pensioner himself, but by his representative, then the latter must have a power of attorney, which is certified by a notary.

Where to contact

To assign a funded pension, you should contact the institution where the accumulated funds are placed.

If this is the Pension Fund of Russia, then you should come for an appointment at the pension fund branch in the area where the future pensioner is registered.

If there is a valid agreement with a non-state pension fund, then you need to contact the nearest office of a non-state fund.

Deadlines

Current legislation does not define specific requirements for when it is necessary to apply for a funded pension. This can be done either at the time of submitting documents for assignment of an insurance pension or later. In addition, you can declare your right before the retirement age, but not earlier than a month before that.

The NPF is obliged to consider the application within 10 days, after which it makes a decision to begin payments or to refuse to accrue them. In exceptional cases, this period may be extended.

Indexation of old-age pensions in 2021 for working pensioners

For working pensioners, the insurance pension increases only due to the IPC indicator (individual pension coefficient), as their length of service increases. Since February 1, 2016, the indicators SPK (the cost of the pension coefficient) and PV (fixed payment) are not indexed when calculating the insurance pension of a working pensioner (Article 7 of Law No. 385-FZ dated December 29, 2015).

Thus, the indexation of pensions of working pensioners - the one that is ahead of inflation and the one that is laid down in Law No. 350-FZ and the plans of the Ministry of Finance - is not carried out, and indefinitely, since Law No. 385-FZ does not have provisions limiting the terms of the corresponding restriction on indexation .

After a pensioner stops working, his pension is recalculated and he begins to receive it, taking into account all indexations made during his employment.

Is it possible to receive a funded pension early?

A funded pension is an insurance payment, and the insured event is loss of ability to work, therefore, as a general rule, you cannot count on receiving payments before reaching the appropriate age.

However, this rule does not apply to persons who have become disabled. In addition, some categories of citizens (teachers, medical workers, “northerners”, workers in hazardous and hazardous industries) have pension benefits associated with the opportunity, under certain conditions, to go on vacation earlier. Accordingly, their right to receive funded payments also occurs at an earlier age.

How to receive a funded pension for a deceased person

If the citizen who forms the funded part of the pension dies before reaching the appropriate age, then his legal successors have the right to claim the amount of savings. The same applies to the unpaid part of the fixed-term type of funded pension provision.

Attention! Legal successors cannot lay claim to the cash balances in the account of a deceased pensioner who received permanent payments.

During his lifetime, a citizen has the right to determine the circle of possible recipients of his savings in the event of his death. In the event of his early death, his successors apply for payments to the NPF or Pension Fund.

If a citizen has not determined the circle of recipients of savings, then they are automatically included in the inheritance mass and distributed among the heirs in the manner prescribed by the Civil Code of the Russian Federation.

A funded pension is one of the tools for decent material security in old age. The most attractive in this regard is the opportunity to increase savings through investment income. The procedure for assigning this type of pension is not complicated and differs little from the procedure for applying for an old-age insurance pension.

At what age are citizens eligible for this program?

Due to constant changes in legislation, a funded pension will be available to citizens of the following year of birth:

- Women born in 1957 to 1966, in whose funded part of the pension contributions were made in the period 2002-2004.

- Men born 1953 to 1966 with a similar deduction period.

- Citizens born in 1967 and younger, who chose a similar formation system. Citizens of other ages are not paid the funded portion.

Reference. For those who started their working career after January 2014, you may want to consider choosing the formation method within 5 years, or until you reach the age of 23.