What is an insurance pension?

Benefits paid to citizens every month and provided in the form of compensation for wages or other payments lost due to a health condition that does not allow them to perform work (or old age and other circumstances: loss of a breadwinner) are called insurance pension .

The presented concept and the conditions for its receipt, as well as payments in Russia, are determined by Federal Law No. 400.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

According to the rules, a fixed cash payment is added to the insurance pension benefit, depending on the type of pension.

Persons entitled to an insurance pension

Insured citizens who comply with the conditions specified in Federal Law No. 167 can receive an insurance pension. Persons with temporary or permanent registration in the territory of the Russian Federation, as well as foreign citizens ( including stateless ones ) are considered insured:

- carrying out labor activities under a contract;

- who are self-employed ( individual entrepreneur, lawyer, notary, etc. );

- who are members of family communities engaged in traditional farming ( as well as farming );

- representatives of the Church ministry;

- other categories covered by pension insurance.

Legal regulation

The main law regulating the system of compulsory pension insurance in the field of law in the Russian Federation is Federal Law No. 167-FZ. It provides basic concepts and spells out the rights and obligations of the main active parties, and defines the grounds for obtaining security.

The following are also responsible for the legal regulation of compulsory pension insurance:

- Constitution of the country;

- Federal Law No. 165-FZ;

- Federal Law No. 212-FZ;

- Federal Law No. 173-FZ;

- Federal Law No. 27-FZ.

Types of insurance pension

According to the regulatory legal act, the insurance pension is divided into the following types:

- by old age;

- on disability;

- for the loss of a breadwinner.

By old age

After reaching the legal age, citizens immediately have the right to appropriate payments, which can be issued at a convenient time. To exercise this right, you must submit an application to the Pension Fund (both at the place of registration and at the place of actual location) or to the MFC , and it is also possible to submit an application electronically using the State Services portal.

It is allowed to submit an application one month before reaching the required age limit, but not earlier.

The day from which old-age benefits will be assigned is determined depending on the method of sending the application:

- personal visit of a citizen (or representative) – day of reception;

- by the Russian Post service - the date specified when sending;

- multifunctional center – day of application;

- personal account on the Pension Fund website – the day the application was received.

To draw up an application, a citizen will need a certain list of documents:

- passport;

- information that confirms work experience or other periods;

- certificate of income for 60 months. until the beginning of 2002 during the term of the employment contract;

- other information required to confirm other circumstances.

Conditions of appointment

According to the law, an old-age pension is granted subject to certain conditions:

- Reaching the required age: for women - 60 years , for men - 65 years (the phased system is mentioned in Appendix 6 of Law No. 400-FZ). Age of citizens holding government jobs. or muniz. positions, is regulated by Appendix 5 of Law No. 400-FZ.

- Duration of working periods is 15 years . As with the age limit, there is a transitional increase in length of service.

- Pension points - 30.

Conditions for early appointment

Registration of an old-age insurance pension is possible at the age of 55 for the female part of the population and 60 years for the male population , but for specific categories of people:

- professional activities associated with harmful and difficult working conditions;

- employees engaged in work activities that pose a threat to health (list No. 1)

- persons working in the RKS;

- guardians of disabled people, etc.;

- and others.

By disability

The presented insurance payment is due to citizens with 1, 2 or 3 disability groups and length of service (any), regardless of the moment of its occurrence.

From the documents to the Pension Fund or MFC you will need to submit:

- citizen's passport;

- paper confirmation of experience;

- certificates confirming other circumstances;

- certificate of disability.

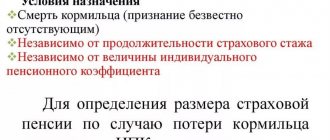

On the occasion of the loss of a breadwinner

The benefit is paid to disabled citizens who are related to the deceased (children, brothers/sisters). This right is not enjoyed by persons involved in an act that resulted in the death of the breadwinner.

The required list of documents when submitting an application to the Pension Fund is:

- passport details;

- official confirmation of the death of the breadwinner;

- official confirmation of family ties with the deceased;

- information about periods of work;

- other official documents confirming the presence of other circumstances.

Payment to working pensioners

According to the latest edition of the pension legislation, pensioners who continue to work receive an insurance pension, as well as a fixed cash benefit, however, without indexation. Upon termination of an employment contract, a citizen is paid a pension benefit, taking into account indexation at the time of work.

Conditions of appointment

To apply for an insurance payment, a citizen needs to submit an application to the nearest Pension Fund or MFC, or, using the Internet, through State Services.

The application for employment or its termination will be taken into account from the day employees receive reports from the policyholder.

How to get accurate information

Those who work full-time in an official workplace can independently find out the amount currently available in state pension accounts through the Pension Fund of Russia. Data is available in two ways:

- a personal visit to the local PF office, where it is enough to make a request to an employee;

- via the Internet through registered accounts on the websites of the State Service and the Pension Fund of the Russian Federation.

In the second case, the service is provided literally the same minute the request is received. By the way, the information or lack thereof can also be checked by citizens who have not worked.

As for the funded half, this is a completely separate topic and an autonomous component of the future state pension, which has many other nuances. Its main difference is unlimited investment limits, the opportunity to receive the entire deposit at a time and/or pass it on to relatives by inheritance. With the skillful distribution of this share, the younger generation in the future will be able to count on a truly decent post-work life.

The same thing that makes up state pension insurance, an emergency reserve that the state uses only for its intended purpose, without risks and additional markups.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

Federal Law “On Insurance Pensions”

Like many other areas of human activity, pension provision is regulated by a certain set of laws. The conditions for receiving the corresponding payments are established by the Fed. by law of December 28, 2013 No. 400-FZ “On insurance pensions”.

Changes and additions in 2020

From the beginning of 2020, the amount of the fixed benefit to the insurance pension is 5,686.25 rubles. , and the monetary amount of the pension point is 93.00 rubles.

The changes also affected the retirement dates of citizens engaged in professional activities in the following areas: medicine (doctors), education (teachers), including additional centers, etc. For the presented categories, a 5-year deferment is introduced.

From 2020, additional payments will be made in the amount of RUB 1,333. 54 kopecks pensioners who carried out activities related to agriculture.

Pension reform 2020

Innovations developed as a result of reforms in the pension system also affected the insurance part of accruals.

Changes to Federal Law No. 350 of October 3, 2020 are regulated.

They are that:

- Indexation is scheduled for January 1;

- Indexation is defined as 7.05%. According to the law, amounts are recalculated in accordance with the inflation index;

- The total pension amount was recalculated by an average of 1,000 rubles, which allowed inflation to be covered ahead of schedule;

- The age at which a citizen can transfer to pension funds has been revised upward by 6 months and is 60.5 years for men in 2019 and 55.5 years for women. After 2020, the age sufficient to receive pension subsidies will continue to gradually increase by 6 months annually;

- It is necessary to collect 30 individual special pension points throughout the entire work experience, which must be at least 15 years or 6 years to accrue the minimum level of benefits.

As of January 1, 2020, the fixed insurance portion of the old-age insurance premiums provided to each pensioner is from 5,334 rubles 19 kopecks.

Fixed payment towards pension

Thanks to the reform implemented in 2020, citizens, after ceasing to work, have the right to choose the type of pension received upon reaching the required age limit: funded or insurance.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The fixed payment is a mandatory monetary addition to the insurance pension, which, in turn, is calculated on the basis of insurance points.

Insurance

The insurance part of the pension is accrued upon reaching the required age and is calculated on the basis of contributions made by the employer during working life.

Cumulative

Formation is carried out on the basis of regular percentage contributions to the Pension Fund by the employer from the citizen’s monthly salary.

Labor, insurance and social pensions: differences

Since January 2020, the concept of “labor pension” has ceased to exist, splitting into 2 separate legal acts: on insurance and funded pensions.

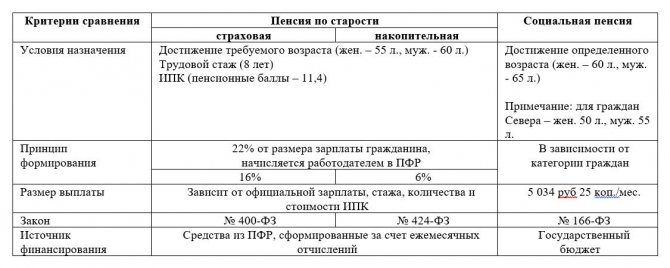

The labor pension was divided into insurance and funded pensions, which a citizen has the right to receive simultaneously. For a visual comparison of different types of pensions according to the main criteria, a table is provided, the data of which corresponds to 2020.

Open table

| Comparison criteria | Old age pension | Social pension | |

| insurance | cumulative | ||

| Conditions of appointment | Achieving the required age (female - 55.5 years old, male - 60.5 years old) Work experience (10 years) IPC (pension points - 16.2) | 1. Reaching a certain age (women - 60 years old, men - 65 years old) Note: for citizens of the North - women. 50 years old, male 55 l. | |

| Formation principle | 22% of the citizen’s salary is accrued by the employer to the Pension Fund of Russia | Depending on the category of citizens | |

| 16% | 6% | ||

| Payment amount | Depends on the official salary, length of service, quantity and cost of IPK | 5,034 rubles 25 kopecks/month. | |

| Law | No. 400-FZ | No. 424-FZ | No. 166-FZ |

| Source of financing | Funds from the Pension Fund generated through monthly contributions | The state budget | |

Question answer

Almost everyone often has questions regarding the pension provision of citizens. It is worth considering the most discussed ones, both in the Pension Fund and on the Internet.

How is the insurance pension calculated?

The insurance part of the pension is calculated taking into account age, length of service and the number of individual pension plans, while for the funded pension the amount of savings is important.

How to calculate insurance pension?

The old age insurance pension is calculated using the following formula:

Insurance pension = sum of pension points * cost of 1 point + size of the fixed payment.

Will there be indexation of insurance pensions?

For pensioners who terminated a contract concluded for the duration of their work activity and receive payments for any type of insurance pension, in 2020 the amount of the insurance payment is indexed by 7.05%, and next year it will be indexed by 6.6%.

How are contributions to compulsory pension insurance calculated?

Accounting for contributions to compulsory pension insurance in Russia is carried out using a special number - SNILS. It is assigned to each citizen and through it all paid contributions are recorded. Based on the information in this account, the payment due is calculated.

The rules for paying contributions differ for employers and self-employed (IP). In the first case, there is an obligation to pay tax for your employees by the 15th day of the month following the billing month. Individual entrepreneurs make contributions based on the results of the whole year and make until June 30 of the next year.

Thus, pension provision under compulsory pension insurance represents financial support for citizens upon the occurrence of certain events and their fulfillment of established requirements. Payments are made from funds accumulated by the Pension Fund through payments from all insured persons.