Russian citizens can receive survivor benefits, the amount of which is provided by the government. An insurance pension is awarded to non-working family members if the deceased or missing person worked and contributions were transferred from his salary.

Cash benefits are calculated and assigned to such people based on Federal Law No. 400 of December 2013 “On Insurance Pensions”. According to the law, persons applying for payment must be officially recognized as disabled. When a person who was left without a relative, who was supported by him, may be obligated, but does not want to work, he will not receive help from the state.

The circle of persons entitled to a pension under the SPC

- Children, brothers, sisters and grandchildren of the deceased breadwinner who have not reached the age of 18. The period of this payment can be extended to 23 years of age if the pension recipient is studying full-time in institutions of secondary or primary vocational education; foreign institutions can also be included in this list if the person was sent to study under an international treaty of the Russian Federation. Children are recipients of compensation by default and their rights are difficult to challenge, but as for other specified persons, it is necessary to prove that they are dependent, that is, they should not have parents obligated to support them. I would also like to note that children lose the right to a pension when they have their own dependent.

- Compensation can also be received by able-bodied citizens, for example, a spouse or one of the parents, if they are caring for the young children of a deceased breadwinner who have not reached the age of 14 years.

- Parents or spouse of the deceased breadwinner, if they cannot independently receive income due to age or disability.

- Grandfather and grandmother also have the right to this payment, only if there are no persons who are obliged to financially support them (children) and their age exceeds the retirement age.

There are several other conditions that must be fulfilled when assigning this type of pension:

- As mentioned above, brothers, sisters and grandchildren have the right to a pension under the SPC on the same basis as children, only if they do not have able-bodied parents who are obliged to support them. Based on this, it is necessary to clarify that deprivation of parental rights or serving a sentence in a place of deprivation of liberty is not grounds for denial of maintenance. That is, if parents are deprived of parental rights, they still must fully financially provide for their children.

- Natural children have the same rights as adopted children, the same can be said about parents, who can award compensation on an equal basis with adoptive parents.

- Entering into a new marriage is not grounds for terminating pension payments to a spouse.

- As a rule, the dependency of minor children does not require proof ; the child retains the right to a pension upon adoption.

- As for the stepfather or stepmother of the deceased breadwinner, you need to confirm the fact that they supported their stepson or stepdaughter for 5 years. Confirmation occurs in court using checks, witness statements and other factors.

- The fact of being a dependent must necessarily occur before the death of the person or before he is declared missing.

- If it is recognized that the breadwinner's income was the main source of funds, then the person receiving another type of pension can make the transition to a pension under the SPC.

- A disabled spouse or parents are entitled to monthly compensation under the SPC , regardless of the amount of time that has passed since the death or recognition of the person as missing if they have lost their source of livelihood.

- In case of violation of the conditions for appointment (the deceased breadwinner has an insurance record or illegal actions of dependent persons resulting in his death), there is no right to an insurance pension, but it is possible to apply for a social pension under the SPC.

Where to apply for a pension

- To the territorial body of the Pension Fund at the place of registration, and if there is none, then at the place of stay.

- The application can also be submitted through the multifunctional center; in this case, the day of application will be considered the day the application was submitted.

- Citizens who have left for permanent residence outside the Russian Federation have the right to contact the main office of the Russian Pension Fund, which is located in Moscow at 4 Shablolovka Street.

- To submit an application electronically, you can use your personal account on the official website of the Pension Fund.

- If the application was sent via mail, then the day of submission of the application will be considered the date of departure indicated on the envelope.

- A citizen can apply for a pension in person, with the help of a legal representative or a proxy.

Appointment dates and payment

The date of application for benefits under the SPC is considered to be the day an employee of the authorized body receives an application from an applicant for its receipt. Documents are reviewed by the territorial branch of the Pension Fund. The period for studying the papers and processing the payment is 10 working days. The SPC benefit is accrued from the date of death of a person if the applicant applied for it no later than a year after the tragedy. If this period is exceeded, the pension will be assigned for the full 12 months preceding the submission of documents.

The survivor's pension is calculated monthly. The recipient's representative can pick it up - he will need a power of attorney. The recipient has the right to choose the paying institution and the delivery method, in writing or electronically through his personal account on the organization’s website by notifying the territorial body of the Pension Fund:

- on house;

- to the cash desk of an authorized organization;

- to a bank account;

- to the nearest Russian Post office.

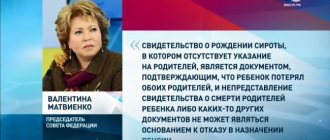

Required documents

It must be remembered that all documents must be submitted in two copies (original and copy).

If any documents are missing, the citizen will have three months to submit them without completely stopping the registration process:

- Application for a pension.

- Passport of a citizen applying for a pension under the SPC.

- Certificate of death of the breadwinner or a court decision declaring a person missing.

- Certificate of compulsory pension insurance (SNILS) for both the future recipient and the deceased breadwinner.

- Documents confirming the breadwinner's length of service and his earnings. These include a work book, with all correctly entered entries, it is also necessary to submit a salary certificate for 60 months before 2002, if you have work experience at the specified time.

- Documents that confirm your relationship with the deceased breadwinner, for example, a child’s birth certificate or marriage certificate.

- For children over the age of 18, it is necessary to submit a certificate from an educational institution confirming full-time education.

In exceptional cases, additional documents are required confirming being dependent on the deceased breadwinner; when contacting the Pension Fund, the employee will indicate the missing part, which is determined for each individual or may not be required at all.

Conditions for appointment

A son, daughter or disabled parent has the right to receive benefits if the breadwinner is declared dead or missing. The insurance pension is due when the one who supported them worked for 1 day, and contributions were transferred from his salary for this period.

The condition for receiving benefits is that the disabled dependent has not committed a crime that led to the death of such a relative.

If the deceased breadwinner had no work experience, the dependent is paid social benefits. At the beginning of 2020, its value was 5034.25, by April 1 it will increase to 7586.35 rubles.

The insurance pension is paid after an application is submitted, to which the necessary documents are attached. The right to receive it arises regardless of how long contributions have been made from a person’s income to the Pension Fund. However, you must contact the appropriate authority within the year in which the breadwinner died.

The insurance payment is assigned regardless of the length of work experience.

Deadlines for assigning an insurance pension in the event of loss of a breadwinner

Appointed from the date of application, but not earlier than grounds for receiving compensation arise.

If the application for a pension was made no later than 12 months from the date of death of the breadwinner, then it is assigned from the actual date of death, but if the period of 12 months was exceeded, then the pension is assigned starting 12 months from the date of filing the application.

For example, if the death of the breadwinner occurred on January 20, 2014, and the application for a pension followed on March 20, 2015, then the payment will be assigned starting 12 months from this date, that is, from March 20, 2014.

If a citizen had the right to receive a pension under the SPC, but he did not use it, that is, he applied for a pension later than the fact of death, then he will be paid a lump sum for all months.

The Pension Fund employee has 10 days to consider the application, but if a lack of documents is detected, the process is suspended for a maximum of 3 months; if during this time all the missing documents are provided, the deadline will not be interrupted.

A pension under the SPC is assigned for the time when the dependent is disabled, including indefinitely.

Legal regulation

The procedure for providing financial assistance to relatives and family members who have lost their breadwinner is prescribed by the legislation of the Russian Federation (hereinafter referred to as the RF). Accrual procedure and conditions of appointment:

- insurance pension under the SIC is regulated by Article 10 of the Federal Law of the Russian Federation (hereinafter referred to as the Federal Law of the Russian Federation) dated December 28, 2013 No. 400-FZ;

- social and state benefits under the SPC are regulated by the Federal Law of the Russian Federation dated December 15, 2001 No. 166-FZ;

- military pension according to the SPC are indicated by the Law of the Russian Federation of February 12, 1993 No. 4468-1.

Amount of insurance pension in case of loss of a breadwinner

The amount of the insurance pension is calculated using the following formula: SPspk = IPK x SPK,

- Where SPspk is the amount of insurance pension in case of loss of a breadwinner;

- IPC is the individual pension coefficient of the deceased breadwinner.

- SPK is the cost of one pension coefficient as of the day from which the insurance pension is assigned in the event of the loss of a breadwinner.

Also added to these indicators is a fixed payment, which as of 2020 is 2,279 rubles 47 kopecks. But do not forget that for some citizens this payment increases.

For orphans, this payment is assigned in the amount of 4558 rubles 94 kopecks. Also, for persons permanently residing in the regions of the far north or in equivalent areas, the fixed payment increases by the corresponding regional coefficient.

When moving from these territories, the increase stops.

What documents are required for registration?

To apply for an insurance pension in the event of the loss of a breadwinner in 2020, documents are attached to the application (Regulations approved by Order of the Ministry of Labor and Social Protection No. 14n dated January 19, 2016) certifying:

- applicant’s identity - passport, residence permit, birth certificate;

- compulsory pension insurance number - SNILS;

- death of the breadwinner - death certificate;

- presence of family ties with the deceased;

- periods of work, service or other activities of the breadwinner;

- other circumstances, for example, studying at an educational institution or the absence of a crime in the circumstances of the death of the breadwinner.

Payment of insurance pension under SPK

The pension is paid monthly and the citizen has the right to choose the method of receipt, these include:

- Through Russian Post - you can receive a pension at the organization's cash desk or order it delivered to your home, a specific date of receipt will be set.

- Through a credit institution , you can get a bank card and receive your pension in the form of money transfers.

Also, a payment for a citizen can be received by his authorized representative; every year the fact that the pensioner is alive will be established in order to exclude the possibility of fraud.

If the pension has not been received within 6 months, then the payment is suspended, but it can be resumed by submitting an application, and a lump sum payment of all previously uncollected amounts is made.