Non-state pension funds (NPFs) operating in the Russian Federation offer their pension services to citizens with pension savings. Currently, many banks offer their clients to entrust the formation of future pensions to those non-state pension funds that are subsidiaries or partners. Such a non-state pension fund for Post Bank is Lukoil-Garant.

Service cost

The card is not completely free. Additional fees apply for some bank services:

- SMS banking – 50 rubles per month (starting from 3 months of use),

- 1% commission for withdrawals from third-party banks (minimum 100 rubles),

- transfers between cards at the rates of another bank (from 15 to 1000 rubles),

- 300 rubles for registration.

Other services are free:

- “linking” the card to the account,

- transfer of money to government accounts and funds,

- receiving a report on accruals and checking the balance on the balance sheet.

Tariff offers

A credit organization within the VTB Group, created on the initiative of the Russian Post, offers elderly citizens a special savings account. Financial services for pensioners are provided within 2 tariff plans:

- "Basic";

- "Pension".

Post Bank offers deposits within the framework of basic tariffs.

The first option is available to all bank clients. Features of the capital investment program:

- monthly interest accrual;

- The minimum deposit to open an account is RUB 1,000;

- annual rate when placing 1 thousand - 100 thousand rubles. — 3.5%;

- annual income when storing an amount exceeding 100 thousand rubles. — 6%;

- Possibility of use for payroll.

The “basic” tariff is issued to citizens of the Russian Federation who have reached the age of 14 years. Can be applied for scholarships.

For the convenience of clients, money is stored on Mir, VISA Classic and Platinum plastic cards. No remuneration is paid to the bank for issuing the first 2 types of means of payment. The premium package includes paid registration of a registered means for non-cash payments.

Advantages of a pension card from Post Bank

The client receives advantageous offers, including:

- 3% cashback when paying in stores,

- + 0.25% to the base rate on deposits,

- 2,500 bonuses on the Pyaterochka card, which can be spent on paying for goods,

- partial or complete deferment of a pension to savings with an increase in interest on the balance.

In addition, the advantages of the card are:

- simplicity of design,

- the ability to pay for utilities, mobile communications and the Internet from a card,

- it is accepted in all retail outlets, pharmacies, cafes and so on, but only in Russia,

- free release and virtually free maintenance.

"Care Line"

Automatically activated. With her, by calling the number free of charge, you can get professional psychological, legal, and medical advice. There is no additional charge for the service.

“13th pension” program

This is a kind of affiliate program. The client can bring 5 people to the bank who will transfer their pension to Post Bank and receive a reward in the amount of 8,700 rubles. The amount is paid for every 5 people. There is no invitation limit. Depending on his activity, a person earns additional money.

Efficiency of investments and guarantees of their safety

Favorable conditions for investing and increasing the amount of personal savings for older people are provided by the existing deposit programs of Post Bank. Their features allow senior citizens to:

- save funds in accounts intended for future major expenses;

- preserve accumulated capital and receive additional income that compensates for inflation.

For the first option, Russian pensioners use the “Accumulative” deposit. According to the terms of the current program, it is possible to regularly replenish or close an account early without losing accrued interest.

The maximum benefits are received by clients who have opened a “Capital” or “Income” deposit. Profit is generated by charging an increased rate, compensating for the inability to replenish and prematurely close deposits.

Investment security is ensured by investment insurance. Under current domestic legislation, when a credit organization declares bankruptcy, depositors are paid the amount of savings in full with accrued interest. The guarantor is the state, which has ownership rights to the bank.

Registration of a pension card

To receive a debit card, the client must provide copies of his passport, TIN, pension certificate, SNILS, and also fill out an application. The card can only be issued in person at a bank branch.

Next comes the endorsement of the contract. Please read it carefully before signing!

After activating the card, it is “linked” to a phone number. This is necessary to receive secret codes, as well as information about deposits and withdrawals of money. The bank employee tells the client the PIN code for the card. If desired, the owner can independently change it at an ATM.

Possibility to terminate the contract early

When opening a deposit, it is recommended to carefully study the terms of the deposit program offered by the financial institution. Important factors determining the choice of investment method for Russian pensioners:

- profitability depending on the annual interest rate;

- the possibility of premature closure of a deposit caused by the need to withdraw savings when there is insufficient funds for current expenses, without loss of profit.

According to the current conditions of Post Bank deposit programs, unilateral termination of the agreement and withdrawal of money ahead of the period specified in the document, without reducing income, is allowed only for the “Accumulative” deposit. In other cases, the client is not paid any interest accrued during the storage of the investment.

Online services for pension cards

You can monitor your account status and the movement of funds in several ways.

Working with a map on the Internet:

- register on the bank's website,

- log in to your personal account using your login and password,

- enter your mobile number,

- send information to the operator,

- receive a secret code on your phone, enter it in the required field and send it for verification.

After this, the client can:

- control your account,

- learn about promotional offers,

- make transfers.

Calculation example

On the official website of the credit institution there is a calculator for calculating possible income under the stated conditions - it is located under each deposit description. However, you can calculate it yourself.

For example, when concluding an agreement to open a Capital deposit in the amount of 400 thousand rubles and for a period of 367 days, the rate, taking into account the pension coefficient, is 5.85% per annum. Payment is made on the last day. Its size is determined as: 400,000 * 0.0585 = 23,400 rubles - this is exactly how much the pensioner will receive upon expiration of the contract.

Transfers from other accounts

When transferring money from another card, you must carefully enter all the data.

Expert opinion

Kochetov Vladimir Viktorovich

Leading specialist in finance. 23 years of experience in a large bank in Moscow. Specialization: loans, mortgages, refinancing.

Ask a Question

- If the funds are not withdrawn from the account and not transferred to another card, then there is not enough amount on the balance.

- If money was transferred via telephone or Internet, debited from the account, but there was no receipt, then an error was made in the recipient’s card number. In this case, you need to contact the bank, provide a receipt and return the money back.

- If it is impossible to either deposit or withdraw money from the card, then it is blocked. You need to go to a bank branch with your passport.

Comments: 25

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Anonymous

04/22/2020 at 08:54 Why the hell are they going to retire?

Reply ↓ Anna Popovich

04/22/2020 at 14:49Dear client, the dates of transfer of pensions and other social payments in your region can be clarified on the website of the Pension Fund of the Russian Federation. The receipt of money into the account at Post Bank occurs on the same day as the payment to the Pension Fund.

Reply ↓

05/02/2020 at 20:25

I called the Russian Pension Fund and even there they didn’t answer anything, now we’ll call you and tell you they’re still calling

Reply ↓

- Irina Rusanova

06/01/2020 at 08:00 Posted by

Good afternoon The Brobank.ru service cannot influence the work of the Pension Fund. We recommend that you call again.

Reply ↓

05/03/2020 at 23:23

Well, what kind of nonsense did they write, Post Bank in Moscow delays pension payments every month!!!

Reply ↓

- Irina Rusanova

06/01/2020 at 08:08 Post author

Good afternoon If you encounter such a problem, we recommend calling the Pension Fund of Russia on its toll-free hotline and clarifying the situation.

Reply ↓

Irina

06/09/2020 at 19:03

This phone doesn't work

Reply ↓

Anna Popovich

06/10/2020 at 12:39

Dear Irina, if the hotline phone number does not work, we recommend that you contact a bank specialist via chat in Pochta Bank online or using the feedback form with the bank on the website.

Reply ↓

06/08/2020 at 13:46

We are waiting for my husband’s June pension... We are waiting all the time, I have a pension in Sberbank, I like it better - it’s on time and there is no such gap between pensions and social benefits as in Post Bank! Choose the best for yourself, future retirees!

Reply ↓

05.05.2020 at 17:51

Post Bank is constantly delaying pensions. I called the Pension Fund on April 29 and they assured me that the pension had already been transferred. Today is May 5th, no money. And there are thousands of people like me, and it’s not at all difficult to calculate how much the bank has without crediting pensions to accounts.

Reply ↓

- Irina Rusanova

06/01/2020 at 08:14 Post author

Good afternoon An objective delay is 1-3 business days. It is possible that some operations took longer to complete: receiving money from the Pension Fund, distribution among accounts, etc. If the date the Pension Fund transfers your pension to the bank is the 29th, then the situation could have turned out like this: April 29, 2020 is Thursday. If you take 3 working days, then they expire exactly on May 5th. Please clarify, did your pension arrive in your account on May 5?

Reply ↓

05/07/2020 at 14:15

Altaiskaya 26v 233. A complete disgrace, there was a month and a half interval between pensions in April, they received 30, today is May 7th, and it’s not there, what if someone is sick!??? Insolent!!!

Reply ↓

- Irina Rusanova

06/01/2020 at 08:16 Post author

Good afternoon If you have questions about pension transfer dates, ask them via the Pension Fund’s toll-free hotline 8(800) 600-44-44. The situation will be explained there.

Reply ↓

05/15/2020 at 19:08

The writing is complete nonsense. No pros, all cons. The transfer of pensioners in St. Petersburg was voluntary and compulsory. Previously, I calmly received it in the mail in the morning, now you wait all day for an SMS about the transfer of your pension to the card. When receiving a pension at the post office before weekends and holidays, they always gave out money ahead of schedule. Now pensions are transferred to the card after weekends or holidays. In addition, you run from ATM to ATM looking for where the money is.

Reply ↓

- Irina Rusanova

06/01/2020 at 08:21 Post author

Good afternoon You have the right to choose the method of receiving your pension yourself. If you are not satisfied with the service of Post Bank, you can change it to another bank, choose to receive it at a Russian Post office or to your home. To change the method of receiving your pension, you must submit an application. To do this, you need to visit the branch of the Pension Fund of the Russian Federation or the MFC. If you have access to your personal account on the website of the Pension Fund of the Russian Federation, you can submit an application through it remotely.

Reply ↓

Roman

08/07/2020 at 06:21

Hello. I’m from the city of Omsk, I would like to ask how I can find out how I can find out or see what date my disability pension is transferred to me? It’s just that with my epilepsy they don’t hire me, but I need to pay my rent on the 8th, and sometimes the numbers are different, like 10 then 9 or 8, then 27 in total, but everything comes to the post office bank card

Reply ↓

Anna Popovich

08/07/2020 at 07:17

Dear Roman, the enrollment schedule is handled not by the bank, but by the Pension Fund. There is no specific date on which all pensioners receive their due payment. The question of what date your pension will arrive on your Post Bank card is best asked to your territorial Pension Fund.

Reply ↓

05/22/2020 at 12:23

Post Bank very often delays transferring pensions to the card, I already very much regret that I receive my pension through this bank. Is it really impossible to somehow improve the situation? Only once in the month of April in 2020 was a pension suddenly transferred earlier than the 22nd. And so there are always delays in payments and the pension fund has nothing to do with it - I called there, the transfers are on time. At least that's what I was assured.

Reply ↓

- Irina Rusanova

06/01/2020 at 08:23 Post author

Good afternoon If you are not satisfied with the service at Pochta Bank, you can change it to another bank, for example, to Sberbank. If Post Bank really delays the transfer of pension payments and violates the deadlines, you have the right to contact the prosecutor’s office.

Reply ↓

06/07/2020 at 21:55

I used to receive my pension on the 11th, transferred it to the post office bank, now it began to arrive ahead of schedule, but in parts. The first arrives around the 4th, the second until 9, but always on different days, it’s very annoying, you don’t know exactly when it will arrive, you’re constantly on your nerves, the bank employees don’t know the date either, I was already thinking about changing the operator or returning everything as it was! Moscow

Reply ↓

08/13/2020 at 12:32

Extremely negative work, tel. indicated incorrectly, and your call is temporarily blocked. Ugliness!

Reply ↓

- Max

08/17/2020 at 17:11

[email protected] to hell with this bank

Reply ↓

08/17/2020 at 17:09

Reply ↓

09/08/2020 at 15:47

Postbank regularly delays pensions, this is a disgrace. The Pension Fund of the Russian Federation both transferred the pension on the 5th and still sends it, but on the appointed 7th the pension does not arrive, I sit hungry and waiting.

Reply ↓

09.09.2020 at 16:47

What kind of nonsense are you writing, the Pension Fund transfers funds on the 20th of every month. And crediting to the account is up to the bank.

Reply ↓

SMS notification

This service is very useful because it allows you to find out when funds are credited to your account. Information is subject to a fee, but there is no charge for the first two months after opening an account. If you do not need this service, you can refuse it.

To check card transactions, you can use a mobile application or online banking. But this option is suitable for a pensioner who has a smartphone. If it is not available, it is better to activate the SMS notification service.

“Post Bank” application

The mobile service is available for Android and iOS. The advantages of the application are simplicity and ease of use. There is no subscription fee for use, and you can download the service for free. The application is not available for the Windows Phone operating system.

Download the Post Bank application on your Android phone

To use the functionality of the application, you need to download it from the Play Market. The service will be installed automatically; no additional actions are required. Next, enter your username and password. Now you can start using the functions of Post Bank.

Post Bank on iPhone, iPad and iPod Touch

For users of Apple technology, the Post Bank application is available for download in the App Store. The installation will take place automatically. Open the application, log in. Now you can use all its functions.

It was easier before

It may feel like you are being forced to switch to a national payment system. Indeed, Visa and Mastercard cardholders will have to re-register. However, there are exceptions, as mentioned above.

“These legislative innovations are based on the good old principle set out in Article 55 of the Constitution. It says that the rights and freedoms of a citizen can be limited to the extent necessary in order to protect the foundations of the constitutional system, ensure the defense of the country and the security of the state. Actually, the national payment system was introduced for this purpose. How much this really corresponds to the interests of the Russian Federation and its citizens is more of a political question,” Omarova concluded.

Nikita Strogoff

Withdrawal limit

There are virtually no daily or monthly withdrawal limits. However, there are some rules. If the funds arrived in your account by bank transfer and remain there for less than a month (30 days), then you can withdraw up to 100 thousand rubles without any restrictions. If you withdraw more than the established limit, you will have to pay a 7.9% commission. Although it is unlikely that any pensioner withdraws such large amounts, so there is no need to worry about the limit.

If you pay with a plastic card at retail outlets, you will not receive SMS notifications about the money spent. To see them, use the mobile application.

Loan for pensioners

If you have pension certificates in your hands and are rightfully considered a bona fide pensioner, Post Bank will be happy to give you the required amount on credit on preferential terms. The chances of receiving cash in this case are high, since there has always been a personal approach to pensioners in terms of lending.

Why is the chance of receiving money for people who have reached retirement age high? Yes, everything is simple, they have a permanent personal income in the form of a pension, which will not disappear anywhere, because it is paid by the state itself.

The fastest way to get a loan from Post Bank is to submit an online application on this page. After filling out all the fields, wait for the manager to call, come to the nearest branch and receive the required amount.

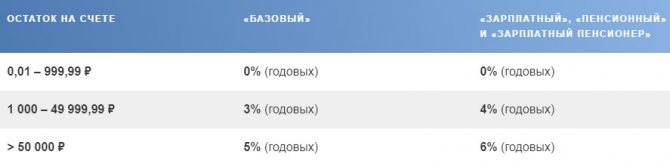

Savings Account Features:

- For deposits up to 50 thousand rubles, the owner receives 3% per annum;

- For deposits over 50 thousand rubles, the bank charges 5% per annum.

The conditions apply to investors covered by the “Pension” tariff. For other persons the following conditions apply:

- For deposits up to 50 thousand rubles, the client receives 4% per annum;

- For deposits over 50 thousand rubles, the bank charges 6% per annum.