In every country there are certain categories of people whose care government agencies are forced to take upon themselves. These are people who, for a number of reasons, were unable to earn a decent insurance pension, war veterans, disabled people, as well as large families with low incomes and single mothers. Payments due to such persons are called social. In some cases, citizens receive pensions, the amount of which is below the subsistence level, so up to this level, pensioners receive an additional payment from the regional budget. Unfortunately, not everyone knows what payments pensioners are entitled to in addition to the monthly pension. Based on government decree, all women in Russia receive benefits when they give birth to children. Social payments - what they include - you will find out in this article.

What exactly is the difference between an insurance pension and a social pension?

Insurance pensions are monthly material payments proportional to the amount of wages or other income received by a citizen of the Russian Federation while working.

This type of pension applies to pensioners themselves, as well as members of their families in the event that the insured pensioner dies. In addition to insurance and labor pensions, there are social pensions, which are more appropriately called benefits.

There are two categories of social pensions - social pension upon reaching retirement age, as well as social benefits for disabled people or persons who have lost their breadwinner. Now let's look at each type of social pension:

What is a funded pension?

To determine it, it is worth highlighting the main differences between accumulative accruals:

- comes from the mandatory contribution amount. They are contributed by employers. 6% of transfers go to needs

- the employee determines where he will invest;

- after retirement, it is proposed to receive it immediately in full without breaking it down into monthly income.

One of the varieties. Relatives can receive it in the event of the death of a pensioner. In addition, it is possible to use it if, during the period of working age, a person became disabled in groups I-III.

Placed in the following category:

- those born after 1966 participating in the compulsory insurance system. Employment after 2001 ;

- born men between 1953-1966 , women born 1957-1966 . The cumulative part is recorded in the period from 2002 to 2004 . The period of 5 years is not relevant for them;

- financing participants.

To receive accumulated funds, you must visit the Pension Fund in person with your passport . You will need to present a document confirming your experience and the presence of an open personal account. The application processing time is 30 days.

Additionally, read how the new type of international passport differs from the old one.

Concept, essence, meaning of benefits and their difference from other types of material payments

- Social assistance to certain categories of needy citizens (hereinafter referred to as Social Assistance) is provided in the form of free services, in the form of cash payments and in the form of exemption from fares on urban passenger transport routes.

- Social assistance is provided by separate types of support:

- social assistance in the form of free services;

- social assistance in the form of cash payments.

- social assistance is provided in accordance with the budget program “ Social assistance to certain categories of needy citizens according to decisions of local representative bodies” , the administrator of which is the state institution “ Department of Employment and Social Programs of the City of Astana ”, and within the limits of the funds provided in the city budget for these purposes for the corresponding financial year [13].

It is necessary to distinguish between a pension and social benefits, as it has a number of distinctive features. A pension is a long-term monthly payment of cash from the Center or accumulative pension funds as the main source of livelihood for persons who have reached the age established by law, as well as for length of service, disability, loss of a breadwinner [6, p. 64].

Social payments in the Russian Federation

All social payments and benefits in the Russian Federation can be classified according to various criteria:

- Based on the target orientation

- compensate fully or partially for the loss of basic income;

- provided as additional assistance

2. By duration of funds allocation

- are appointed one-time (at one time);

- paid monthly (regularly);

- are transferred once a year (payments to donors).

3. Depending on the categories of recipients

The concept of a pension, characteristics of pensions, differences between pensions and benefits and wages

Pension (A.D. Zaikin) is a monthly social and alimentary payment assigned to persons who have lost their breadwinner and other categories of citizens in connection with past socially positive activities in an amount that is usually commensurate with wages and was the main source of livelihood .

Pension in Latin means “payment.” In order to understand the essence of a pension, its legal nature, it must be distinguished from two payments (from payment under an employment contract and from social security benefits).

Types and features of insurance payments

The main difference between an insurance pension and a social pension is that a person has a certain length of service. It is necessary to obtain such security. There are only three main types of age insurance, which will directly affect the amount of payments, which worries almost every Russian today.

By old age

The most common in our country, according to statistics, is the old-age insurance (labor) pension. It’s not difficult to figure it out, since after working all his life, a person, upon reaching a certain age, has the right to go on a well-deserved rest. To receive payments, you need to submit a complete package of documentation to the Pension Fund of the Russian Federation, where it will be reviewed and analyzed by specialists. Only after this will the amount of monthly income be assigned to a personal account, card or by postal transfer.

The basis for accrual is the insurance period, as well as special IPC points accumulated for contributions to the Pension Fund during work. The more such contributions received and the higher they were, the larger the amount of security will be. There is already an article on our website about the conditions and procedure for calculating old-age insurance pensions; it is worth reading it in more detail.

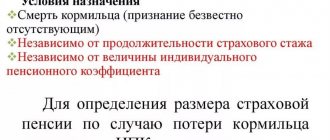

Upon loss of a breadwinner

Another type of pension insurance is payments for the loss of a single or both breadwinners. The state cannot leave its citizens in a difficult situation to their fate. Therefore, if a person who provided a decent life for an incapacitated person dies, then the state takes on all these concerns. Children, grandchildren, brothers and sisters up to eighteen years of age or, subject to full-time study at a station, up to 23 years of age, can receive such payments.

An insurance type benefit can be applied for by the spouses of the deceased, his elderly parents and even indirect relatives. For example, a woman living with a daughter-in-law, an elderly mother-in-law, or a husband’s child from his first marriage who has been in care for more than five years have the right to apply for an insurance pension for the loss of a breadwinner; more about this issue can be read on the corresponding page of the site.

If the relatives were not fully supported by the deceased, but after his death they actually lost the necessary means of subsistence, minimal assistance may be awarded. Most often, such nuances concern adoptive parents and children. To apply for such a benefit, you will have to provide certificates of death of the breadwinner, as well as of inability to provide for yourself, due to age and other objective reasons.

By disability

Regardless of the reasons for which a person became disabled, he is entitled to an old-age insurance payment if he has worked at least one day in his life. People with disabilities are considered to be one of the most vulnerable categories of the population, since they generally cannot provide themselves with a decent existence. The difference between insurance and social pensions for disabled people will not be very significant, because the state provides such people with a number of other benefits, concessions and privileges.

To obtain disability insurance payments, the status of a citizen must be proven. This means that disability must be confirmed by a medical and sanitary examination commission (MSEC). Based on the conclusion of such a commission, the disability group will be established, and, consequently, the final amount of payments, taking into account the accumulated experience. You should read about the conditions for assigning disability insurance pensions and how to correctly calculate them in a separate article on our website.

Should know

According to the law, in our country there are clear age limits for assigning an insurance-type pension. Women have the right to retire a little earlier, at fifty-five, and men at sixty. However, there are circumstances that allow you to go on vacation in advance, for example, when working in dangerous and difficult work, underground and in the Far North.

In all cases, when calculating insurance payments, personal coefficients (IPC) will be taken into account as a special multiplier introduced after the reform of the entire system in 2013. It is this indicator that directly affects the desire for official employment and “white” wages. After all, the size of the benefit will depend on the size and number of payments, so when figuring out which pension is larger, social or insurance, we can say with confidence that the second, and the “price range” will be significant.

Rules for determining the amount of benefits under the social security system

The concept of social security and extra-budgetary funds. Basic principles of social security: accessibility, universality. Analysis of calculation of old-age pensions. Types of health insurance: voluntary, compulsory. Social benefits.

History of development and general characteristics of benefits in the Russian Federation. Features of calculation and amounts of benefits in the Russian Federation. Ways to solve social security benefit legislation problems related to social benefits.

Which one is better?

In the case of an old-age pension, the answer is clear: it is better to receive labor. It’s easy to understand: firstly, it is prescribed earlier, and secondly, if the minimum requirements for the accumulated IPC are met, the insurance amount turns out to be about 5,700 rubles, and the social amount is only 5,034 rubles 25 kopecks.

But when assigning disability and survivor pensions, not everything is so simple, because there are no minimum requirements for pension points and length of service - it is enough for the deceased breadwinner or disabled person to work for at least one day.

What is more beneficial in case of disability or loss of a breadwinner?

Important: the size of the insurance pension is calculated as the sum of a fixed payment and the product of the IPC by the value of the point, and the social pension is established by the state. Which one will be higher depends on the number of pension points.

Let's consider several cases of granting a disability and survivor pension:

- Disability group 3. The social pension is 4,279.11 rubles, the fixed payment to the insurance (hereinafter referred to as FV) is 2,402.56. Social turns out to be more profitable if less than (4279.11-2402.56)/78.58=23.88 IPC has been accumulated. Here 78.58 is the cost of one point in 2020.

- Disability group 2. Social pension – 5,034.25, FV – 4,805.11. Social will be higher if less than (5034.25-4805.11)/78.58=2.91 IPC has been accumulated.

- Group 1 disability. Social pension – 10,068.53, FV – 9610.22. Social services are more profitable if there are fewer points (1068.53-9610.22)/78.58=5.83 IPC.

- A child who has lost one of his parents. Social pension – 5,034.25, FV – 2,402.56. It will be more profitable to receive a social pension if the deceased breadwinner has accumulated less than (5034.25-2402.56)/78.58=33.49 IPC.

- An orphan. Social security 10,068.53, FV – 4,805.12. It is more profitable to refuse insurance in favor of social insurance if the deceased breadwinner has accumulated less than (10068.53-4805.12)/78.58=66.98 IPC.

Concept, essence, meaning of benefits and their difference from other types of material payments

Activities of the Office of the Ministry of Social Development, Guardianship and Trusteeship. Financial support for the costs of paying benefits to citizens with children. Financial support for labor veterans. Improving the system of social protection of citizens.

Globalization and changes in social policy. Basic elements of protection systems. Experience of the USA, some examples of individual countries of Western Europe. Social passport program in Chile, family benefits in Armenia. Lessons on targeting and federalism in Russia.

Innovations for 2020

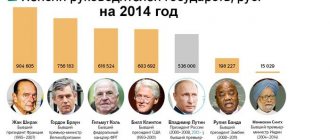

The amounts of insurance pension payments are increased annually. This is due to the constant rise in prices, as well as an increase in the cost of living of the Russian population. This year the government promises to increase payments by 5.4%, last year's increase was 4% (for non-working pensioners). However, these amounts can be roughly compared, taking into account the level of inflation.

How is a labor pension established, how is it different from an insurance payment?

According to the Federal State Statistics Service, inflation growth in 2020 was 5.4%. In this regard, it was planned to bring the indexation coefficient to a value of 1.054 with an individual pension coefficient equal to 78.28 rubles.

It guarantees that the insured person (an employee to whose account his employer made mandatory contributions) upon the occurrence of an insured event (retirement) receives compensation - a pension benefit formed from contributions from the employer.

Formation of an insurance pension

This type of pension provision in the form of an insurance pension is established for all citizens in 1966 .

Persons born in 1967 are given the opportunity to choose to pay an insurance premium for an insurance pension or a funded .

- Having abandoned pension savings, a citizen forms only an insurance pension. Accordingly, the employer will transfer insurance payments for him to the Pension Fund in the amount of 22%, from which 16% goes to the insurance pension. These percentages are recorded on the personal account of the insured person and then recalculated (translated) into points.

- If you choose a funded pension, contributions to it will be 6%, the remaining interest will go to insurance pension payments.

In 2014-2020 the state took a kind of pause, redirecting all payments to insurance premiums . This step will reduce the PFR budget deficit for current payments to pensioners and increase the security of existing savings, because During this time, all NPFs will have to go through the corporatization procedure and will then be included by the Central Bank in the register, guaranteeing the safety of accumulated funds.

The insurance pension payment is formed from insurance contributions, guaranteed by the state and increased annually by an indexation factor.

Social benefits and pensions – what will change

For workers, this amount may be higher and should be 40% of the average earnings on which insurance premiums are calculated. From January 1, 2011, maternity benefits are calculated based on average earnings calculated over two calendar years. At the same time, the maximum earnings amount is 512,000 rubles for 2012 and 568,000 rubles for 2013. As for the monthly child benefit for low-income families, the procedure for its assignment and payment is established by the legislation of the constituent entities of the Russian Federation.

Military personnel with service from 15 to 20 calendar years, dismissed without the right to a pension for length of service or due to disability (for health reasons, organizational and staffing events, due to violation of the terms of the contract in relation to the employee, upon reaching the age limit) with 15 years of service a monthly social benefit is paid in the amount of 40% of the amount of salary (salary according to military rank and military position), plus 3% for each year over 15 years. This benefit is paid for 5 years from the date of dismissal. If the length of service is less than 15 years, a salary according to military rank is paid for 1 year.

We recommend reading: Sports Scholarship at Russian University

What are state social payments

This is interesting: Second pension for pensioners of the Ministry of Internal Affairs

Funds are allocated free of charge in the following cases:

- For partial or full compensation of temporarily lost income (unemployment benefits, temporary disability benefits, maternity benefits, etc.).

- Providing financial support when expenses increase (assistance for the birth of a child, funeral expenses, for families with children under 16 years of age, etc.).

Social benefits serve as a form of state social security for the population and are regulated by federal legislation.

Characteristic features of social benefits

The benefit differs from other types of social payments in that the funds are transferred directly to the beneficiary and do not depend on the type of social support or the preferential category of the applicant.

This type of payment has certain features:

When assigning social benefits, the following factors are taken into account:

Each of the above factors may be grounds for seeking support from the state.

Do you need expert advice on this issue? Describe your problem and our lawyers will contact you as soon as possible.

Federal and regional social payments

In many cases, federal benefits are a significant addition to the recipient's basic income, and sometimes the only source of income.

Federal payments in Russia are assigned:

- Citizens who have certain services to the state (title or awards): Hero of the USSR, Russian Federation, Honorary Donor of Russia.

- Persons who have received national status: labor veterans and disabled people, rehabilitated citizens, home front workers, the unemployed, etc.

Federal payments are financed from the federal budget. Money is allocated on a target basis to the relevant ministries and departments, which distribute the budget for the calendar year.

Regional payments are established in each region independently by the local administration. The allocation of funds occurs at the expense of regional budgets and therefore may differ in size or be completely absent in some regions (krai).

Regional assistance is intended for people who are most in need of additional measures of social support from authorities. For example, pensioners, labor veterans, citizens with extensive work experience.

Certain types of support are paid directly by the applicant's employer. In the future, these funds will be compensated from state funds.

Difference between Benefit and Pension

A special type of social assistance is medical assistance. In case of illness, loss of ability to work and in other cases, citizens have the right to medical and social assistance, which includes preventive, therapeutic and diagnostic, rehabilitation, prosthetic and orthopedic and dental care, as well as assistance in caring for the sick, disabled and disabled, including the payment of benefits on disability.

Unlike pensions - a permanent and main source of livelihood - benefits, as a rule, are assistance that temporarily replaces lost earnings or serves as an addition to the main source of livelihood (earnings or pension).

Who can claim benefits

This social benefit is intended mainly for citizens who have lost their ability to work or their breadwinner.

These include persons in the following preferential categories:

- single pensioners who are unable to work anymore;

- large families with children under 18 years of age (or up to 23 years of age - full-time students);

- persons with disabilities, including children;

- children under the age of 18 who have disabled or retired parents;

- children raised without one parent (father or mother);

- orphans and children under 18 years of age without parents;

- citizens who have state insignia (titles, awards);

- full-time students with children;

- persons caring for a disabled person of group 1 or a disabled child;

- pregnant women and those on maternity leave;

- persons who were laid off at the enterprise.

The state guarantees the allocation of funds from the federal budget to all of the above categories of the population. Regional authorities cannot cancel these privileges.

Differences between a pension and social security benefits

Based on the legislation in force in the Republic of Crimea, as of February 21, 2014, a disability pension is assigned for the entire period of disability determination, if the application for a pension occurred no later than 3 months from the date of disability determination. In other cases, from the date of application.

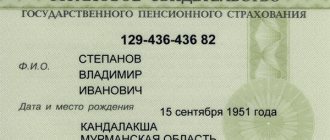

- The most common type is old age pension . Upon reaching retirement age, a citizen must submit an application to the Pension Fund for accrual of payments. The basis is a certificate of compulsory pension insurance.

- An insurance pension due to disability is assigned if a person has received a disability, regardless of the group. In this situation, insurance experience is also required. Considering that it is the same for any type of pension, the great importance of paying regular contributions should be emphasized. It is necessary to provide the following documents: applications for accrual of pensions, passports, certificates of payment of insurance premiums, extracts from a document about a medical examination recognizing a disability, a certificate of disability.

- Insurance includes income compensation payments assigned to family members who are disabled and have lost their breadwinner . It is available provided that they were supported by a deceased relative. These legal norms include children and grandchildren who have not reached the age of majority. These may be relatives who are under 23 years of age and studying at one of the educational institutions. The parents, husband or wife of a breadwinner who has reached retirement age or is disabled are also granted this right.

How to receive an old-age social pension in 2020

Note that the insurance pension of a non-working pensioner is in any case subject to indexation - in an amount that is determined taking into account inflation.

Benefits for caring for a sick family member. When caring for a sick child, one of the parents or another family member, at the discretion of the parents, is given the right to stay in the hospital for the entire period of the child’s treatment. In this case, the parent is issued a certificate of incapacity for work.

The share of the insurance part of the labor pension that exceeds the fixed basic amount of the insurance part of the labor pension depends on the amount of insurance contributions paid to finance this part of the labor pension.

Difference between Benefit and Pension

It has already been said above, upon the occurrence of which particular insured events, the insured have the right to receive one or another benefit, and the types of these benefits were also named. A distinctive feature of benefits provided to the insured at the expense of extra-budgetary funds is that their size is proportional to the amount of earnings that they reimburse in full or in part.

Benefits can also be classified according to the duration of their payment.

According to this criterion, benefits are distinguished: one-time, monthly, periodic. The types of benefits mentioned above are an example of one-time benefits. They also include, for example, benefits for working women who are registered with medical institutions in the early stages of pregnancy; benefits for the pregnant wife of a military serviceman undergoing military service; benefits when placing a child in a family for upbringing. Monthly benefits are: for child care until he is one and a half years old; for the child of a serviceman undergoing military service; on unemployment. An example of a periodic benefit is a temporary disability benefit (for the period of temporary disability); maternity benefit (for the period of prenatal and postnatal leave).

How does a pension differ from an allowance?

If a disability is established without limiting the ability to work, the right to a disability retirement pension does not arise.

Differences between a pension and a benefit: The intended purpose is, in fact, the only difference. The benefit additionally compensates for the loss of earnings; material support. Pension - to fully provide for the citizen.

Insurance pensions are financial payments accrued to insured citizens who have reached retirement age. For men, the current minimum retirement age is 60 years, and women can retire at 55 years. The right to receive an insurance pension is given to social or professional categories of residents of the country specified by law. Temporary disability benefits if it is necessary to care for a sick family member during his outpatient treatment, with the exception of cases of caring for a sick child under 15 years of age, is paid in an amount determined depending on the length of the insurance period of the insured person in accordance with Part 1 of this article .

Social and insurance pension: what is the difference

Social and insurance payments are quite similar, they are replacement and are of a purely applicant nature. That is, no one will bring anything on a silver platter until the future beneficiary himself applies to the relevant authorities with a request to accrue payments.

Social security, contrary to popular stereotypes, not many people apply for and regularly receive social security, only from two to five percent of the total number of pensioners in our country. According to the law, such security can also be of three main types, but the terms of assignment are somewhat different. To receive financial assistance from the state, it is not at all necessary to provide a certificate of employment or insurance experience. In essence, social payments are minimal material benefits that will allow you to survive in a difficult situation.

The procedure for processing social payments

The assignment and payment of benefits occurs through the relevant government bodies and institutions. Therefore, depending on the specifics of the payment, the applicant will need to contact various government agencies to obtain state assistance.

Which authorities should I contact for registration?

- To receive assistance in connection with the birth of a child, the applicant must contact:

- to your employer;

- to the local Pension Fund Office;

- to your local social services department.

2. To apply for disability benefits, you should go to your local Social Security Administration.

3. Budget employees can prepare all the necessary documents at the social protection departments.

List of required documents

To register the right to receive privileges from the state, the following documents will be required:

Pension in Armenia

Thanks to reforms carried out in the 1990s, the Armenian economy has developed steadily, growing by 10% annually. However, in 2009, there was a serious decline due to the fact that cash receipts from Armenians working abroad decreased significantly. Indeed, a significant part of Armenians work abroad, and a large number of them are in the Russian Federation. Armenia is among the top ten countries in the world in terms of emigration rates.

Armenians are one of the most ancient peoples on the planet. The formation of the first Armenian state in this territory dates back to the 6th century. BC e. This is a country where Christianity became the state religion earlier than in any other state on the planet. Nowadays it is a unitary state, 95% of the population of which are Armenians. It borders with Turkey, Georgia, Iran, Azerbaijan and the unrecognized Nagorno-Karabakh. It has no common border with Russia and no access to the sea.

Main differences

The main difference between the two types of pensions:

- Although both types are not limited by the timing of payments, social security payments may be permanently terminated under certain circumstances.

- The insurance pension is noticeably higher than the social pension. The average difference can be 4-5 thousand rubles, which, given the size of the payments, is a noticeable amount.

- The insurance pension of a pensioner who decides to continue working is recalculated annually and increases in his favor. Social income increases only due to indexation, which gives a small, albeit stable, annual increase.

- Insurance variation allows you to retire in old age relatively earlier. The difference increases more when a citizen has the right to early exit.

| Insurance | Social |

| Accrued from 60/55 years | Accrued from 65/60 years |

| Requires work experience | Can be issued to citizens without work experience/disabled citizens |

| Depends on length of service/a number of other characteristics | In most cases it is fixed |

Recipients of these types of financial support rarely overlap. People with official work experience receive insurance; it will be much longer than social insurance - there is no point in choosing the latter. Social benefits are received by people who worked unofficially or who have not worked for a sufficient amount of time at all; insurance is not available to them. If it is possible to receive both categories of payments with an equal degree of probability, the citizen has the right to choose.

Pensions and benefits

If you live in Moscow or St. Petersburg (as well as in their regions and some other regions - see the list in the application form) and want to contact a lawyer or lawyer with any question, then you have the opportunity to get free legal advice

.

In accordance with Art. 43 of the Constitution of the USSR, Soviet citizens have the right to financial support in old age, in case of illness, complete or partial loss of ability to work, as well as loss of a breadwinner. This right is guaranteed by social insurance of workers, employees and collective farmers, benefits for temporary disability; payment at the expense of the state and collective farms of pensions for age, disability and loss of a breadwinner; employment of citizens who have partially lost their ability to work; care for elderly citizens and people with disabilities; other forms of social security. Pension provision is carried out on the basis of the USSR Law “On State Pensions”, adopted by the Supreme Soviet of the USSR on July 14, 1956 and the Law “On Pensions and Benefits to Collective Farm Members”, adopted on July 15, 1964. With some differences in the conditions and procedure for assigning and paying pensions Both of these laws provide for the following main types of pensions: old age pensions, disability pensions, survivors' pensions. Certain categories of workers (educational, healthcare workers, theater and other theatrical and entertainment enterprises and groups, civil aviation flight crews, as well as military personnel and senior and enlisted personnel of the Ministry of Internal Affairs) are granted pensions for long service. In the system of providing citizens with benefits, first of all, state social insurance benefits and social insurance benefits for members of collective farms are allocated. The regulations on the procedure for the appointment and payment of benefits for state social insurance, approved by the resolution of the Presidium of the All-Union Central Council of Trade Unions of February 5, 1955 (with subsequent amendments), define benefits for temporary disability (including for illness, for sanatorium treatment, for the illness of a family member in case of need to care for a sick person, during quarantine, during temporary transfer to another job due to tuberculosis or an occupational disease, during prosthetics with placement in the hospital of a prosthetic and orthopedic enterprise), maternity benefits, for the birth of a child, for retraining, as well as a funeral benefit. The regulations on the procedure for assigning and paying social insurance benefits to members of collective farms, approved by the resolution of the Union Council of Collective Farms dated March 4, 1970 and the resolution of the Presidium of the All-Union Central Council of Trade Unions dated April 15, 1970 (with subsequent amendments and additions), provide for temporary disability benefits, birth of a child, as well as funeral benefits. Maternity benefits for collective farm women are assigned and paid in accordance with the Law on Pensions and Benefits for Collective Farm Members. It must also be borne in mind that specialists, machine operators and collective farm chairmen are provided with pensions and benefits according to the standards and in the manner prescribed for workers and employees. What pensions and these benefits have in common is their connection with the citizen’s work activity (work experience, the fact of working at the time of disability, and so on). This is their difference from other types of benefits (for large and single mothers, disabled people since childhood, etc.), which, although they may have the nature of periodic payments, are determined by events, as a rule, not related to the work activity of the person being provided. All pensions and benefits in our country have one thing in common: they are paid from public consumption funds, without any deductions from the worker’s earnings. The decisions of the 25th Congress of the CPSU provide for an increase in payments and benefits to the population at the expense of public consumption funds by 28-30% during the Tenth Five-Year Plan.

Old age pension: insurance, social, minimum

Despite the undeniability of the differences between a social pension and an insurance pension discussed above, it is fair to say that the first is intended for a situational (temporary or permanent) replacement of the second.

A pension is money that a person receives due to reaching old age, the loss of a sole breadwinner, or disability. In our country there are two types of pensions - insurance (it is also called labor, it may also include a funded part) and social. What each of them is and how they differ from each other, read on.

Everyone is guaranteed social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law.

The most important difference between insurance and social pensions is that when assigning the second, length of service and IPC do not matter. They may not exist at all - if the person did not work at all (or received a salary “in an envelope”). The main criterion for receiving a social pension is reaching the legal age.

Unemployment benefits are paid to citizens who are officially registered at the employment center. This type of payment is assigned temporarily in order to speed up the employment of citizens and is limited in time.

Citizens raising children are awarded and paid several types of state support. They can be combined into the category “Children’s benefits”.

After the Pension Fund makes a decision, the citizen will be notified by letter of the positive or negative outcome of the commission. Conditions for appointment When applying for a pension benefit, a number of conditions are always put forward for receiving it.

State pension - this payment represents compensation for lost income for certain categories of citizens, these include test pilots, victims of radiation and others.

Another additional condition is the presence of a certain work experience. This condition is also mandatory. It is also necessary to have contributions to the insurance fund during your work experience.

The fixed base amount corresponds to the size of the base parts of the labor pension established after indexation on December 1, 2009, and depends on the category of the pensioner and the type of pension.

In turn, this led to a noticeable decline in the standard of living of a huge number of people, and as a consequence, to the creation of a social protection system for the population. The main goal of this direction today is to improve the lives of low-income and disabled segments of the population, with special attention paid to families with children.

Amount of social pension To reduce the effects of inflation, government payments are subject to mandatory indexation - this calculation is carried out annually on April 1. At the same time, if the final amount of the social disability pension (and other indicators) is less than the established minimum subsistence level for a given region, then the recipient is also assigned special additional payments.

Temporary disability benefits (or “sick leave”) are paid in the event of illness or injury of the insured person, caring for a sick family member, quarantine of the insured person, or prosthetics for medical reasons.

What are the differences between a state pension and an insurance pension: how to switch from one to the other

- application for transfer from state pension to old-age insurance;

- passport;

- SNILS;

- documents certifying insurance experience with numbers, dates and reasons for issuance (employment contracts, statements of personal accounts, appointment orders, etc.);

- a certificate of average monthly earnings for 5 years (60 months) continuously until January 1, 2002 - it can be issued by the employer for whom the citizen worked before 2002, an example of the form in the photo and if it is liquidated, then you need to contact the archive: if In this case, you need to indicate for what period the data is needed, for example, from 1972 to 1975, example of a photo reference

- documents on additional circumstances (in case of a change of surname - marriage/divorce certificate; birth certificates of children; certificates from housing authorities on the upbringing of children under 8 years of age; information about dependents, etc.).

- Contact the branch of the Pension Fund of the Russian Federation with this package. It doesn’t matter at the place of registration or actual residence. If a legal representative applies, then it is necessary to issue a power of attorney for him. Contact is possible:

Where to apply

You can submit a written request for a pension as soon as you have the opportunity to do so. You should contact the nearest branch of the Pension Fund or the MFC.

A written request for a pension can be submitted not only by the future pensioner himself, but also by his representative. The employer can also send an application. But the fastest and most convenient way is to use the government service portal.

How to submit an application through the state portal?

Go to the state portal for the provision of services to the population. Using your login and password, go to your personal page - personal account. Find the “Electronic Services” column. In the menu that appears, select “Pension” and then the phrase “Submit an application”.

The easiest way to apply is through the state website

Decide which written request you are submitting and select it. If you are planning to apply for a pension, find “About the assignment of a pension.” After filling out all the required lines, use the special button to create an application and send it.

In the same personal account, you can view what stage of consideration your application is at. You will be informed about the need to appear in person at the Pension Fund and provide a package of documents.

On your personal page you can not only submit an application, but also see what your work experience is, where you worked and how much insurance premiums your employer paid for you.

The pensioner himself chooses how and where he will receive money:

- At the post office yourself or they will deliver it directly to your home. If you choose the second option, the funds will arrive later as additional delivery time is required. Each branch has its own maximum period during which money is delivered to pensioners.

- Using the services of a banking institution. You won't have to pay a commission. You can withdraw money yourself at the cash desk of a bank branch, or issue a debit card. In this case, funds can be withdrawn on the same day when the Pension Fund transferred funds towards pension payments.

- By signing an agreement with a special organization that brings the pension home. You can also pick up the money yourself at the cash desk of this company. A list of such companies can be found on the official portal of the Pension Fund.

To use any of the methods listed above, it is enough to notify the Pension Fund in writing.

You can apply for pension payments no earlier than a month before reaching the statutory retirement age.

Compulsory pension insurance

A citizen receives the right to be called an insured from the moment of birth. Throughout his life, he studies, receives some benefits, goes to work, takes care of children, serves in the army and thereby accumulates insurance coverage.

- Constitution of the Russian Federation.

- Federal Law No. 165 of December 1, 2014 “on compulsory social insurance of Russian citizens."

- Federal Law No. 27 of 04/01/1996 “on an individual approach to calculations in the OPS system.”

- Federal Law No. 272 of October 16, 2010 “on changes regarding points that are important in pension calculations.”

Federal Law No. 173 of December 28, 2013 “on labor pensions.”

What if the insured person dies?

What to do if the insured person dies?

Pension savings are paid to successors if the insured person dies before the funded portion is assigned to him. Or before adjustments are made to its amounts.

But only if the successors themselves contact the relevant authority a maximum of six months after the death of the immediate addressee.

But the insured may prematurely indicate which relative will receive the savings if something happens.

If such an application is not received, then the money will be distributed among children and spouses, first of all.

Expert opinion Elena Fink

Legal expert on benefits.

Legal consultation

The ongoing pension reform since 2020 has affected many aspects. One of the most important and unpleasant is the one that significantly increases the possibility of obtaining a labor and social pension; as a result, it will be increased for almost everyone by five years.

At the same time, the minimum number of points and years to receive a labor pension will also increase. And the further payment of the social pension and its size in general is in question.

The existing system of voluntary funded pensions has been recognized as ineffective and inappropriate. Overall, it provided payers with far fewer notional dividends than expected.

This is largely due to the inept and ineffective work of most non-state pension funds, as well as transfers of funds from one fund to another without the knowledge of citizens, which was practiced until 2020.

A new system of contributions to the fund for this future part of the pension is being developed. Some financiers believe that it should be abandoned altogether. The possibility of replacing it with individual pension capital is being considered.

How and what is the difference between an insurance pension and a social pension?

According to the Federal Law “On State Pension Provision”, a labor pension can be divided into two components – insurance and funded. In fact, insurance and labor pensions are identical concepts, and to be more precise, they replace each other. Since 2002, labor pensions have been abolished. They were replaced by savings and insurance.

Comments (13)

Showing 13 of 13

- Valery 05/13/2016 at 18:49

There is a lot of talk now that young people can already influence the size of their future pension. My daughter is 36 years old. Please tell me what she can do to count on a decent pension in the future?answer

- Yulia 05/14/2016 at 18:00

In Russia, from the beginning of 2020, a new procedure for calculating pensions has been in force. Its size is influenced by several factors. First of all, this is the amount of the official salary - the higher it is, the higher the future pension payment. In addition, the length of experience has an impact. For each year of work, pension coefficients will be calculated. Accordingly, the pension amount will be greater for the one who accumulates more of these coefficients. An important feature with the adoption of the new law is the age of retirement. By postponing the pension date by a year or more, you can also increase the size of the future payment. In addition, if your daughter is a participant in the co-financing program, the state will increase the pension payment by doubling the voluntary contributions of citizens.

answer

Who came up with such a calculation of pensions that an ordinary person will never understand? Previously, the USSR had a very simple system and anyone could check the correctness of pension calculations. Everything was done on purpose, they confused everyone so that they wouldn’t figure it out, and whichever one they’ll charge, that’s what you’ll get.

answer

This is what it is designed for.

answer

An insurance pension is a state-guaranteed monthly payment to pensioners that compensates them for lost income. A pensioner on well-deserved retirement is assigned a pension consisting of a minimum wage and a fixed payment (as of April 1, 2020, it is 4805 rubles 11 kopecks). Until 2001, the employer in the USSR paid insurance payments to the pension fund. Russia is the legal successor of the USSR. When assigning a pension to those with work experience, the state established a basic payment. However, when indexing pensions in Orenburg, for some reason the fixed (basic) payment to a pensioner as of April 1, 2020 is not indexed (4805.11 rubles X 0.38%/100% = 18 rubles 26 kopecks). Each pensioner in Orenburg did not receive an additional pension in the amount of 18 rubles in April 2020. 26 kopecks Perhaps this situation is also in other regions. The legality of the correct indexation of the pension should be checked by lawyers. The state saves budget funds on the most vulnerable segments of the population - pensioners.

answer

Yulia 04/14/2017 at 09:14

Unfortunately, this is the case everywhere. When carrying out pre-indexation, the government only mentioned that the cost of one pension point would increase from 78.28 to 78.58 rubles, which is why the fixed payment was not increased.