Every year the number of pensioners in the Russian Federation is rapidly increasing. Thus, according to the Pension Fund (PF) of the Russian Federation, compared to 2020, it increased by 600 thousand people. At the same time, the number of working-age population from whose salaries pension payments are made has not increased.

So should we expect pension growth in 2020? What basic insurance pension amount was established as of January 1, 2020? Was indexation and recalculation carried out for working and non-working pensioners? What percentage of indexation was included in the 2017 budget? Let's look at these questions in this article.

Who pays pensions in Russia

All transactions with payments to citizens who have reached retirement age are carried out by the Russian Pension Fund. It accrues, recalculates and pays monthly established amounts to all pensioners. But you can apply for benefits at the Pension Fund or Multifunctional Center (MFC).

In addition, a citizen can independently choose the authority that will deliver money to him monthly.

There are several options:

- Russian Post (at home or via cash desk);

- bank (via cash register or card);

- organization delivering the pension (the list is provided by the Pension Fund).

To choose or change the delivery method, you must contact the Pension Fund of Russia consultant directly or submit an application in your personal account on the “Unified Portal of State and Municipal Services” (https://www.gosuslugi.ru/).

What will pension capital be formed from in 2020?

The Ministry of Finance plans to use contributions in excess of this rate to form pension capital, which will go to non-state funds (NPF). The developers of the pension reform propose to abolish the Pension Fund's ownership of funds accumulated by citizens.

The Ministry of Finance document sets out the principles by which pension capital will be formed:

- these funds are not subject to taxation; a citizen can choose a rate from 0 to 6%;

- no contributions are made if the rate is set at 0%;

- the safety of these savings is ensured by the Deposit Insurance Agency;

- the guaranteed duration of positive returns will be 5 years, and in the event of bankruptcy of the fund, the accumulated amount will remain.

The draft pension reform indicates several options for obtaining pension capital. For example, in emergency situations, 20% of the accumulated amount can be transferred 5 years before retirement age.

It is assumed that the citizen will independently determine the payment format and the ability to change the payment rate.

How is the old-age pension calculated in the Russian Federation in 2020?

The pension reform that was carried out in Russia proposed a new method of calculation. Previously, this was done by Pension Fund specialists, and the person did not have access to information on his accruals, but was waiting for the final result. Currently, old-age benefits include three indicators:

fixed rate + insurance pension + funded pension.

You can find out the level of insurance payment using the established unified formula:

SP = IPK x SIPC + FV, where

- IPC – the sum of pension points that were accrued at the time of registration of the pension;

- SIPC - the cost of one pension point, changes annually (2020 - 93 rubles);

- FV is a fixed payment that will be subject to annual indexation (2020 – 5686.25 rubles).

The majority of Russian citizens receive insurance (83%) and government (8%) old-age benefits.

The funded system is currently frozen until 2022, so it is not taken into account when calculating new pensions.

All employer contributions in the amount of 22% are redirected to the insurance pension fund, regardless of the wishes of the employees.

The cost of living included in the budget of each region will be the minimum pension

What is the insurance part of the pension?

The insurance part of the pension benefit means a monthly monetary compensation at the end of the work experience, which depends on the salary and the number of years of work. It accumulates in a person’s personal account and is paid to the pensioner in equal shares over 19 years. The insurance part is established through contributions from the employer, regardless of whether it is a large company or an individual entrepreneur. If the citizen died before the payments ended, then the unpaid funds pass to the legal successor of the deceased.

Fixed payment to the insurance pension in 2020 amount

The fixed payment is established simultaneously with the amount of the benefit itself. Simply put, it is the minimum guaranteed amount of pension protection for each retiree. After the February indexation, its basic amount is 4805.11 rubles , which is determined in relation to the pensioner’s belonging to a certain category, the presence of dependents, and the type of benefit. In April, a second recalculation of indexation is expected, where the level of the insurance value will reach 5.8% .

What is a disability insurance pension and how to get it?

The specified benefit in the Russian Federation is provided to persons who have received 1, 2 or 3 disability groups. In this case, it makes no difference what length of service a person has, whether he works at all or is unemployed. The benefit is paid regardless of the reasons causing the disability.

To receive insurance payments, a person needs to write an application at the Pension Fund office at the place of residence or registration. The Multifunctional Center is also dealing with this issue. Once a disability has been registered, there is no set deadline for filing.

Who is entitled to such a pension?

The Pension Fund is obliged to pay monthly benefits to people who have reached a certain age. In 2020, men who are 65 years old and women who are 60 years old will be able to retire. There are categories of citizens who have the opportunity to retire earlier. This usually applies to military personnel, medical workers and employees of hazardous enterprises.

Additionally, a person must have a certain amount of work experience. The main thing is to remember that when calculating your pension, only those years in which contributions to the pension fund were made will be taken into account.

Citizens who have worked most of their lives without registration will have to fill the gap and retire later. In 2015, the minimum work experience was 6 years, but the government prepared and approved a program for its annual increase. In 2020, people with at least 11 years of experience will be able to retire. And by 2025, the minimum value will reach 30 years.

The third criterion, which gives the right to retire, is a certain number of individual pension points. These are conventional units that represent each year a citizen works, and depend on the level of official income. In 2020, the pension coefficient will be 18.6 points, and by 2025 it will reach 30.

Citizens who have worked most of their lives without registration will have to fill the gap and retire later

What will the retirement age be?

There is nothing to indicate that the program for raising the retirement age is going to be canceled or changed.

It began in 2020, when 60-year-old men and 55-year-old women became pensioners. It will end in 2028, when 65-year-old men and 60-year-old women will become pensioners. Between these dates there are several stages of the transition period:

| Year of birth | Age (m/f) | Year of retirement | Coefficient (accumulated pension points) | Experience |

| 1959. 2nd half of the year | 60,5 / 55,5 | 2020. 1st half of the year | 18,6 | 11 |

| 1960. 1st half of the year | 61,5 / 56,5 | 2021. 2nd half of the year | 21 | 12 |

| 1960. 2nd half of the year | 61,5 / 56,5 | 2022. 1st half of the year | 23,4 | 13 |

| 1961 | 63 / 58 | 2024 | 28,2 | 15 |

| 1962 | 64 / 59 | 2026 | 30 | 15 |

| 1963 | 65 / 60 | 2028 | 30 | 15 |

If all goes according to plan, men and women will retire in 2021 at ages 61.5 and 56.5, respectively.

Now - about individual groups of citizens.

Working hard jobs

For this group, the retirement dates will not change. This includes those who work:

- In underground work. (This includes miners, mine rescue units, truck drivers in mines, mines and quarries).

- In hot shops.

- At field work. (These are researchers of soil, water and forest resources, etc.)

- On a sea or river vessel operating outside a port.

- On the extraction and processing of seafood.

- In the flight crew of civil aviation.

- At work with convicts.

- As workers in logging and timber rafting.

- As drivers on regular city passenger routes.

- As lifeguards in professional emergency services.

- In flight test personnel (aviation, aerospace, aeronautics and parachute equipment).

This was a list for both genders. Now only women. To retire under the old rules, they must work:

- In the textile industry for work with increased severity.

- As tractor drivers.

This group also includes those who suffered due to radiation or man-made disasters (including the accident at the Chernobyl nuclear power plant).

The amount of the old-age pension and the latest changes in 2020

The state annually announces the indexation of payments to citizens who have completed their working career. In 2020, the increase will occur again, which will cover the impact of last year's inflation.

Social pension

The recalculation of payments was carried out on April 1, 2020 by 6.1%, so the increase on average amounted to 566 rubles. According to statements by the Russian Pension Fund, the average pension will be 9,853 rubles. This amount is usually received by citizens who lack work experience or individual pension points.

Insurance pension

The increase in payments was carried out on January 1 by a total of 6.6%. On average, the increase was about 1 thousand rubles. Currently, the average pension that non-working citizens are entitled to is 16.4 thousand rubles.

Labor pension

According to a statement by the Pension Fund of the Russian Federation, since 2020, the state has introduced a new procedure for calculating pensions and the formulation of pension rights of citizens. In accordance with the introduced changes, the term “labor pension” is removed from the legislation and replaced by “insurance pension”.

Let us remind you that the average value of this benefit is 16.4 thousand rubles.

Regarding indexation for working pensioners

In 2020, Rosstat presented statistics that the share of working citizens among pensioners reached 36%.

In connection with the development of anti-crisis measures, the procedure for increasing his pension payments was adjusted.

According to Law No. 385-FZ, from 2020 indexation for citizens who have reached retirement age and are still working has been abolished.

This restriction continues until they leave the workplace.

After dismissal, indexation and all increases will be applied to their accruals.

Compared to previous years, old-age pensions in 2020 have undergone minor changes.

Indexation will only affect non-working pensioners, since their income is much less than that of working people.

Pensioners have been assigned one-time payments of 5 thousand rubles, for which separate applications are not required.

Also, starting from 2020, the minimum length of service and the number of pension points will begin to rise.

Inflation will affect defined benefits and the value of the pension point.

back to menu ↑

From January 1, 2020, the old-age pension will be calculated in points

Amount of old age pension by region

The size of the monthly state subsidy after completion of work directly depends on the region of residence. Therefore, residents of the capital and cities located, for example, in the north of Russia, will receive different benefits.

In the Moscow region

After the next indexation, carried out at the beginning of the calendar year, residents of the region can count on payments in the amount of 9908 rubles. The corresponding resolution was recorded in the Law of the Moscow Region No. 173/2019-OZ “On establishing the cost of living for a pensioner in the Moscow Region for 2020.”

In St. Petersburg

Having calculated the inflation rate, the local government decided to increase payments to people, setting the minimum value at 9,514 rubles. This resolution was confirmed by the Law of St. Petersburg No. 614-132 “On the budget of St. Petersburg for 2020.”

In the Rostov region

At the end of 2020, the regional law of the Rostov region No. 256-ZS “On the regional budget for 2020 and for the planning period 2021 and 2022” was adopted. According to the resolution, local residents will receive a pension in the amount of 8,736 rubles throughout 2020.

In Samara

This year, citizens of the region will receive monthly payments in connection with the end of their labor activity in the amount of 8,690 rubles. This decision is spelled out in the law of the Samara region No. 88-GD “On establishing the cost of living for a pensioner in the Samara region for 2020.”

To Tolyatti

The City Duma met on December 11, 2019 and adopted the budget for the next calendar year. In Resolution No. 427 “On the budget of the Togliatti urban district for 2020 and the planning period 2021 and 2022.” The amount of payment to pensioners is indicated as 8,690 rubles.

What will be the pension for citizens with high incomes?

READ ON THE TOPIC:

The new pension system is not being discussed in the government.

Authorized persons explain that citizens with a monthly income of about 100 thousand rubles will also receive pensions in Russia.

Deputy Finance Minister Alexei Moiseev previously said: “No state system can ever afford to pay a replacement rate of 40 percent to a person who received 100 thousand rubles during his lifetime. It doesn't happen that way. A person who received 100 thousand had to save for his own retirement.” At the same time, the official noted that this provision applies to citizens earning more than 40 thousand rubles.

This idea was supplemented by Assistant Deputy Minister Svetlana Nikitina: “The Ministry of Finance is only talking about an additional savings component, which can be formed through banks or through non-state investment funds. Voluntarily. So that this is some kind of pension capital. We are not touching the current pension system, which consists of mandatory payments.”

The authors of the project adopted this idea from the Australian pension system, within which citizens make monthly contributions to a special fund in the amount of up to 8% of income. If the amount of contributions for the year is 1 thousand dollars, then the state additionally transfers half of this amount to the citizen’s account. In addition, $1,000 is transferred annually to the account of each citizen participating in the program.

Minimum pension table by region of Russia 2020

In each region, pension payments are different, which is directly related to local budgets, climatic conditions and living standards. Minimum values are shown in tables, which are divided by county.

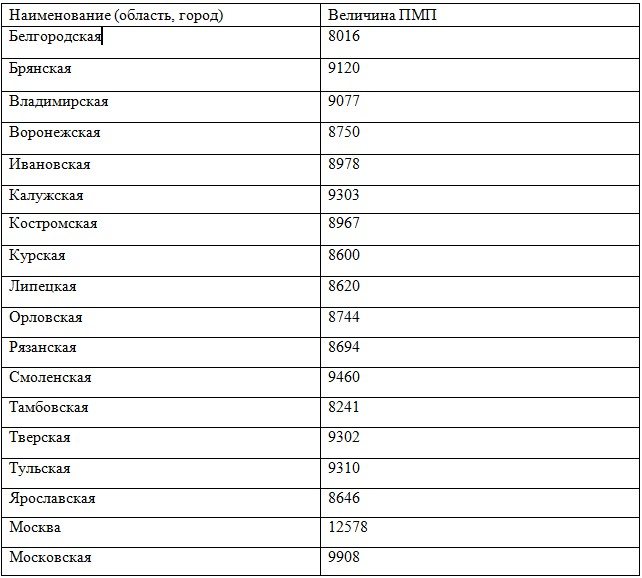

Central Federal District

Residents of the region in 2020 can count on the following payments:

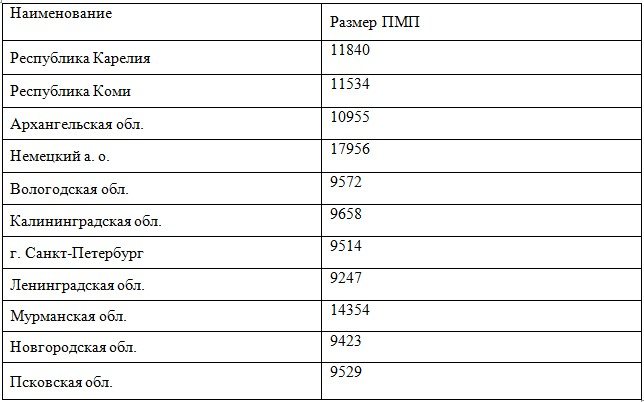

Northwestern Federal District

Local authorities have designated the following pension level:

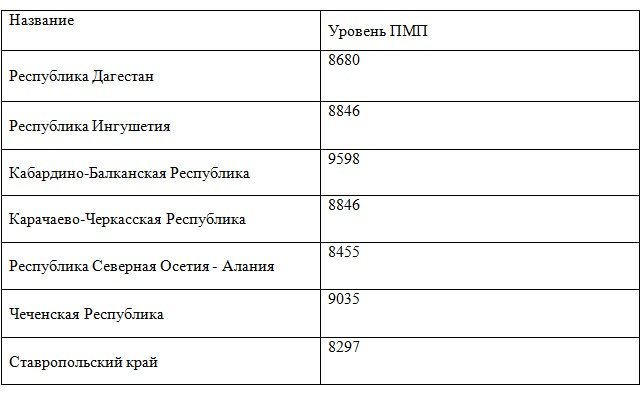

North Caucasus Federal District

According to the government decree and the increase in the minimum level of pensions, citizens will receive the following payments:

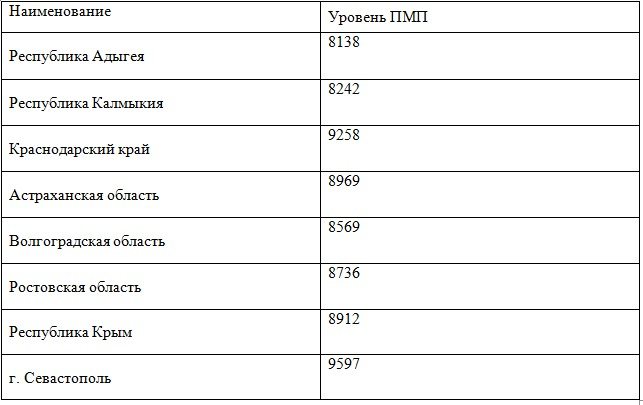

Southern Federal District

Residents of warm regions will receive the following subsidies:

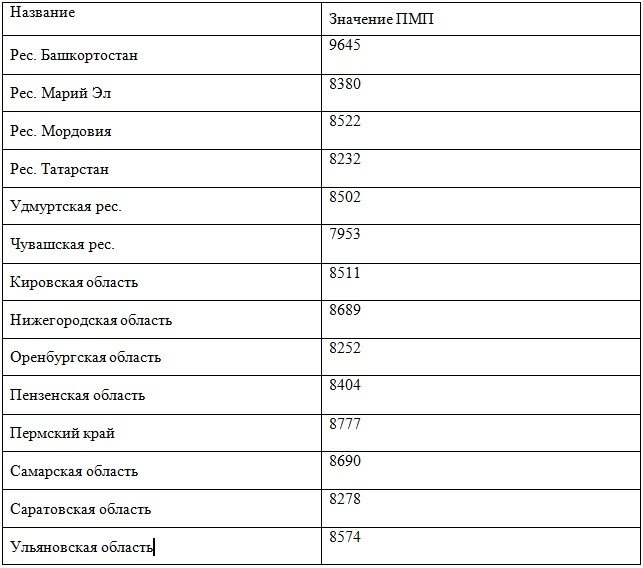

Volga Federal District

After the indexation carried out in January, the new pension level was:

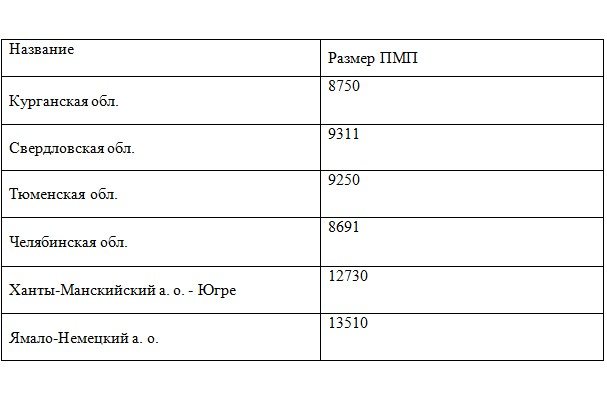

Ural federal district

According to the government decree, residents of the region will receive the following payments:

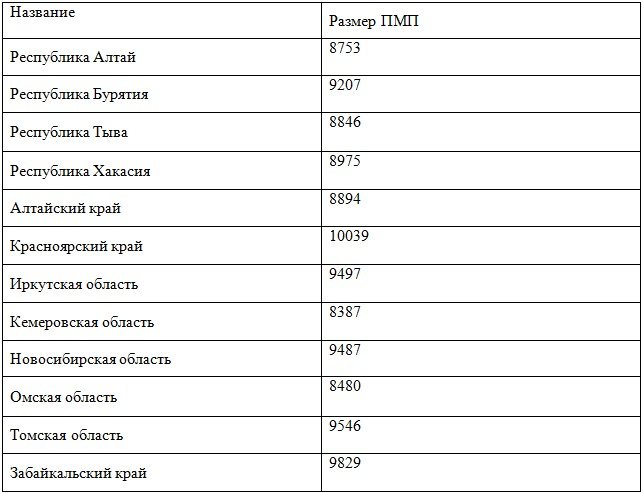

Siberian Federal District

Natives of the district will receive the following minimum pension in 2020:

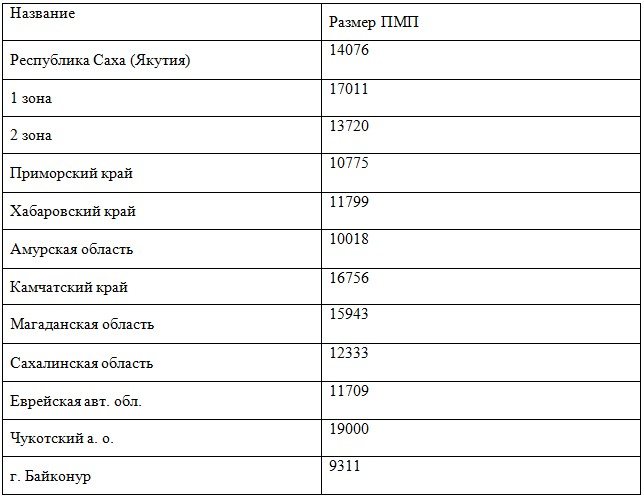

Far Eastern Federal District

Living in an area with a harsh climate, you can expect the following pensions:

Minimum insurance pension

The government has decided that from January 1, 2020, non-working pensioners whose benefits are below the federal or regional subsistence level (PLS) will be paid the amount missing to this minimum.

Pension payments differ in each region

The federal PMP is included in the budget at the level of 9,311 rubles, which means that the minimum pension in 2020 will start from this value.

The pension reform, which began in 2020 and continues to this day, makes multiple adjustments to the procedure for calculating pensions. However, the government has simplified calculation methods, allowing ordinary citizens to independently find out what payment they are entitled to and how much more time they need to work to increase its level.