The issue of pensions worries everyone, starting from a young age. At the same time, it is very interesting to compare what the size and conditions of retirement are in different countries, where and why it is more profitable to live in old age. Pensions in England, similar to our country, are based on both age and length of service. These are different amounts and they are provided under different conditions, which are slightly different from those familiar to us.

In terms of the level of well-being of pensioners, England occupies a leading position even in the European region, which makes it one of the most socially protected countries. The local pension system differs significantly from the standards adopted in the Russian Federation, however, they have some similar features. Payments upon reaching a certain age and length of service are provided by the Department of Pensions and Work (DWP)

This is a special government service that provides the population with a whole range of social services:

- Pension sector (payment of pensions, preferential loans and benefits).

- Benefits and assistance in finding employment for persons with disabilities.

- Assistance in finding work for the working population, as well as payment of benefits.

- Child benefits.

Such an institution is in incredible demand from the local population, and the total number of its clients exceeds 20 million people. At the same time, the local benefit system presupposes the presence of three pensions at once - state, labor, and private.

Pension size in the world

Pension reform in the UK

In 2020, another reform of the UK pension system was carried out. Many key provisions have been adjusted. How the retirement age and its size have changed will be discussed in more detail below, but now let’s focus on one interesting point.

According to the innovations, persons who have reached 55 years of age have the right to fully withdraw the pension savings in their account by carrying out just one banking transaction. Moreover:

- no tax is paid on the first 25% of withdrawals;

- the remaining amount is subject to income tax.

Before the reform, most pensioners could have a constant source of funds until the end of their days. However, some of them decided not to prolong the pleasure.

In particular, there was a case when a person, having retired, immediately spent 120 thousand dollars on cars, alcohol and a casino. This story served as one of the arguments in the debate between members of the UK Parliament about the relevance of making changes to the country's pension system.

Types of pensions in the United Kingdom

The UK pension system provides three main types of pensions.

- State pension - state pension. The current maximum basic state pension is: for a single person - £125.95 per week;

- for husband or wife based on the other spouse's National Insurance contributions - £73.30 per week. Persons who have ended family relationships and who have not entered into a new marriage, even a civil one, before retirement can also receive this amount.

Every year, in accordance with the dynamics of the consumer price index, the basic pension is indexed. The State Pension is not available to people who have worked in the UK for less than 10 years.

- Occupational pension - labor pension. It is formed from funds: the part of the income received by the employee transferred to the pension fund (hereinafter referred to as the PF);

- the amount deposited by the employer into the employee’s PF account.

The employment pension is not issued to UK residents/citizens who worked part-time or earned little.

- Private pension – private pension. The employee himself chooses the fund in which the funds transferred from his salary for pension are accumulated. Upon retirement, the person will receive the amount generated from the investment. There are many funds operating in the UK with different conditions for accumulating funds.

Old age pensions in England consist of two components: the main (basic) pension and an additional part.

All Britons who have reached retirement age can apply for a basic state pension. An additional portion is due for length of service.

In the 60s and 70s of the last century, the so-called final salary pension was widespread in Great Britain. At that time, most large companies offered it to their employees. People worked in one place all their lives, accumulated experience, and when they retired, they knew exactly how much the company would pay them every month.

Due to increasing life expectancy, such a pension has become unprofitable for companies. Therefore, it is now extremely rare.

Here's something else to consider when planning for retirement. It was said above that in the UK, along with the basic pension, an Additional State Pension is accrued. When calculating it, not only earnings are taken as initial data, but also information about the volume of NI contributions made by a person. So: self-employed people cannot receive Additional state pension.

Choice for the employer

So far we have talked about choice in relation to employees as individuals. The 1986 Act also provided new choices for employers. Prior to this Act, only professional defined benefit schemes could withdraw from SERPS. As a result of the reforms, professional defined contribution schemes also gained this right.

Existing schemes hardly change from defined benefit to defined contribution, but two trends are clearly visible. Firstly, in almost all new

Professional schemes use a defined contribution mechanism.

Even by 1991, almost half a million workers were participating in the new SERPS defined contribution schemes, representing 8% of all members of the exited occupational schemes. About the same number chose

defined contribution schemes. Second, defined contribution plans have proven particularly attractive in segments of the economy where there is a high proportion of part-time or temporary workers (e.g., retail) and a traditional final salary scheme would not be appropriate, or where workers mostly young and mobile.

The scale of this phenomenon has not yet reached levels in the United States, where the share of workers participating in defined benefit plans fell from 78% in 1975 to [64%] in 1989 and is projected to fall to [64%] by 2000 (Turner , 1993; see also Gustman and Steinmeier, 1992). However, the UK is moving in this direction. A recent survey conducted for the Confederation of British Industry (CBI, 1994) interviewed over 500 company executives whose schemes covered more than a third of private sector members; They were asked the following questions: what type of pension plan they have, which one (based on their experience) they would like to use, and what plan they think they will have by 2010. The results are amazing. Despite 81% using defined benefit plans linked to final salary, virtually none have been introduced since 1988. Given the option of starting over, only 26% would now choose a defined benefit plan, while 57% would opt for some form of defined contribution and 13% would simply allow their employees to purchase an individual pension. In the future - by 2010 - only 31% are expected to maintain the defined benefit plan in its pure form; most are going to offer some form of defined contribution plan or a combination of defined benefit and defined contribution (for example, a basic defined benefit supplemented by a defined contribution scheme to bring the pension up to the desired level).

UK pension levels

The question of what the pension is in the UK in 2020 is of interest to many - not only potential migrants, but also local residents who have reached adulthood. Most of them know that in 2016, a reform of the pension system was carried out in the country and the real figures of pensions from the state have undergone changes.

First of all, it must be said that the minimum pension has increased, and significantly - by 33.7%. In particular, for a Briton who retired before 04/01/2016, it is £113.10 per week.

Residents of Foggy Albion who have received pensioner status since April 2020 are awarded a minimum of £155.65 per week, which in terms of the middle of the third quarter of 2020 is equal to 12,197 Russian rubles. For comparison: in the Russian Federation in 2020, the minimum pension was approved at the level of 8,846 rubles, not per week, but per month.

But the average pension in England is higher than the basic one. The fact is that the amount of financial assistance to older people from the state depends on many factors. For example, the longer the pension period, the greater the amount of payments. Every year of retirement increases an Englishman's income by £4.44 per week.

It is easy to calculate that with 5 years of pension service, an elderly person on average will receive £9,248.2 per year in the UK. In conversion, this amounts to 712,690 rubles per year, or almost 59,391 per month.

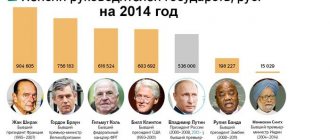

As for the maximum pension in the UK, its size is unlimited. To give you an idea of the order of numbers, here are just two examples.

- Former British Prime Minister Tony Blair receives £520.14 thousand per year during his well-deserved retirement (40,083,341 rubles). This is the largest pension in the world among former leaders of states.

- British Prime Minister Gordon Brown was entitled to approximately the same pension. But in January 2008, while in this position, he refused to apply for a pension in that amount after resigning. With this action, he called on parliamentarians to limit the increase in their salaries.

Other additional payments and benefits

The size of the pension is affected by various factors, including disability, military service, and widow status. Those injured during the Second World War are also entitled to a supplement. When calculating pensions for WWII veterans, military rank and the severity of injuries are taken into account (down to which finger was lost in battle).

The size of monthly payments ranges from 150,000 to 650,000 rubles.

Finally, there are many discounts, benefits and free services available to help seniors. The state helps pay for housing, medicine and transportation. The same situation is observed in other European countries. For example, in Germany, 98% of pensioners can live freely on their pension.

In these countries, older people can afford to buy new equipment and cars, lead an active lifestyle and travel a lot.

Retirement age in the UK

Since November 2020, the retirement age for men and women in the country has become the same - 65 years. Previously, men retired at the same 65 years, and women at 60 years. But the government will not stop there: it plans to raise the retirement age to 67 years.

However, specialists in some categories can retire at the age of 55. These are, for example, disabled people and workers in special fields of work.

Increasing the age limit is an objective necessity. After all, life expectancy in Foggy Albion for men is 79 years, and for women – 83 years. Thus, the shift in retirement dates is quite reasonable.

Nevertheless, British legislation allows for the option of early acquisition of pensioner status by a citizen of the country. This approach is practiced by people who, during their working career, have accumulated funds in an amount sufficient for a comfortable stay in a well-deserved rest.

And the state pension will be paid to them after their 65th birthday. At least until this age limit rises.

Personal pension plan

However, opening a personal pension plan with a private provider is becoming increasingly popular. Those who are self-employed or contracted simply do not have the option of joining a partially employer-sponsored retirement plan. Some people open a personal pension plan in addition to the one offered at their place of work. A person pays contributions to such a fund independently, from his own savings, while the state returns to him the income tax he previously paid on a part of income equal to the amount of the contribution.

Not so long ago, there were only a limited number of ways to manage your accumulated pension fund. Now this choice is much wider. Once you reach age 55, you can withdraw up to 25% of your accumulated fund in cash tax-free. The remaining funds will be subject to taxation and can be used in various ways:

- You can use your pension fund to buy a pension from an annuity company. This guarantees a constant income for the rest of your life.

- You can choose not to buy a pension, but instead take the necessary amounts directly from the pension fund from time to time.

In April 2020, the state introduced a new state pension, which is the same for everyone (flat rate), regardless of salary. The pension amount is at least £151.25 per week, and the criteria for receiving it have become stricter. To receive a full pension, the required work experience has changed to 35 years. But such changes will only affect those who retire in the future.

Required work experience

To be able to apply for a pension, you must confirm your work experience. Experts recommend carefully reading the calculation scheme for this indicator, finding out all the key parameters that influence it.

Qualifying years include:

- all years during which the employee had the status of employed;

- all years of employment in self-employed status, if National Insurance Contributions were paid;

- the period for which child benefit was provided, even if there was no work at that time;

- a period during which a person earned at least £155 per week.

Checking a person's pension status is done by making a request to the UK Government's HM Revenue and Customs (HMRC). If the length of service for the minimum pension turns out to be insufficient, you can pay the missing insurance premiums, thus purchasing the necessary years.

Features of obtaining work experience

For men born after April 5, 1945, and women born after April 5, 1950, the required work experience is 30 years. This will make it quite simple to apply for an old-age pension.

All males born before April 6, 1945, and females born before April 5, 1950, must work 44 years to receive a pension.

If a pensioner expects at least some payment from the state, then he or she must have length of service, which is at least 25% of what is required.

A future pensioner can choose a system of voluntary payments to the Social Insurance Fund so that pension funds increase.

State pension calculation

State financial assistance is paid to all citizens of the United Kingdom when they reach retirement age. Its value does not depend on length of service. But, as was said, the calculation takes into account the time spent on a well-deserved rest. The formula for calculating the state pension in the UK looks like this:

RGGP = (4.44 × PS + 155.65) ×52, where

- RGP - the amount of the annual state pension (in pounds sterling);

- PS – pension experience (years).

Thus, a man who turns 75 in 2029 will receive

(4.44 x 10 + 155.65) x 52 = £10,402.6/year.

This is the simplest example of calculating the British state pension. But its value is influenced, in addition to retirement experience, by some other factors, for example, widowhood, disability, and military service. To account for them, special tables with coefficients are used.

This approach is intended to increase the amount of financial assistance from the state, making the life of an elderly person more comfortable. As practice shows, the pension in the UK at £867 per month is sufficient for a normal life if a person has his own home. But this amount is clearly not enough to pay for the rent of the apartment,

Benefits for pensioners in the UK

The UK government has provided a variety of benefits for older people. Let's name just a few of them:

- favorable banking conditions, high interest rates on savings accounts;

- reduced tariffs for utilities. In particular, during the winter months there are significant discounts on heating;

- free travel on public transport;

- free provision of medicines prescribed by a doctor.

At the same time, all of the above does not allow us to give an unambiguous answer to the question of how pensioners live in England. It will not be possible to live without worries solely on a state pension. Yes, the government does not allow people on their well-deserved rest to live in poverty by providing various benefits. But in order to have a comfortable old age, a person must accumulate funds himself.

Foreign pensioners in the United Kingdom

Elderly foreigners, under certain conditions, can count on a special social benefit in the UK - Pension Credit. Older people have the right to receive such financial assistance even without a single day of work experience in the United Kingdom. You just need to have a residence permit, as well as proof of actual residence in the country.

The article “Residence permit, permanent residence, citizenship: concepts, features, differences” will help you understand the intricacies of the differences between statuses.

Pension Credit will increase a claimant/couple's weekly income to £155.65 per week for a single person or £243.25 for a couple.

Stateless immigrants have two options:

- when you reach old age, simply apply for the minimum Pension Credit benefit;

- earn enough experience to receive a state pension. In the UK it is 10 years.

The question may arise what foreigners who come to the country and work on a temporary or permanent basis receive. It all depends on the specific case.

If a foreigner has moved to the UK for permanent residence, works, pays taxes and transfers a certain amount each month into the National Insurance account, he is subject to all the rules regarding receiving a pension that apply to local residents.

In addition, by drawing up an employment contract, you can become a participant in the pension scheme of your employer. Another option is to open a personal pension plan with a private provider.

It may happen that a citizen of another country is planning to move to Foggy Albion at pre-retirement age, which is why he will not have time to obtain the length of service required for a state pension in the UK. Then he needs to make sure that it will be accrued in his home country.

Find out how pensions are paid for Russians living abroad in 2020.

If a foreigner lived in one of the EU states, he will be paid a pension in the amount to which he is entitled in accordance with the legislation of that country.

The article “Pension size in European countries” will tell you about the amount of contributions, retirement age and other issues related to the well-deserved rest of Europeans.

Non-state pension system

In Britain, it is possible to refuse the second tier of pensions and choose to accumulate a pension in one of many private funds or insurance companies. This scheme does not provide for an upper limit on payments.

Among wealthy pensioners, professional pension funds have gained the greatest popularity. To participate in them, you do not have to be a citizen of this country. It is enough to work for a British company for at least two years.

Most employees contribute 5–8% of their earnings, but the contribution can be increased if desired. From 2020, a reform will come into force that allows you to withdraw a quarter of all savings without paying tax. This will give citizens the opportunity, for example, to improve their living conditions now, sacrificing the amount of their pension in the future.