The term “minimum pension” is absent in the legislation and draft laws of the Russian Federation. According to the meaning of its name, it is clear that this is a value below which a citizen’s insurance pension accrual cannot be. In accordance with the order of the Russian government No. 1662-r (dated November 17, 2008), the concept of a minimum subsistence level for a pensioner (PNP) was introduced as a minimum pension provision.

If a pensioner who does not work has a pension accrual threshold that is less than the pensioner’s subsistence level (PLS), which is established in the subject (city, region) of his residence, then, according to government decree, he is entitled to an additional payment from the federal or regional budget, which should equalize his pension with PMP. At the same time, “federal” is paid extra by the branches of the Pension Fund of Russia, and “regional” is paid by the regional social security authority.

Table. Minimum old-age pension in 2018 by region

| Region name | Min. pension, rub. |

| Chukotka Autonomous Okrug | 19000 |

| Nenets Autonomous Okrug | 17956 |

| Kamchatka Krai | 16543 |

| Magadan Region | 15460 |

| The Republic of Sakha (Yakutia) | 13951 |

| Yamalo-Nenets Autonomous Okrug | 13425 |

| Murmansk region | 12523 |

| Sakhalin region | 12333 |

| Moscow city | 11816 |

| Khanty-Mansi Autonomous Okrug (Yugra) | 11708 |

| Khabarovsk region | 10895 |

| Arhangelsk region | 10258 |

| Komi Republic | 10192 |

| Moscow region | 9527 |

| Primorsky Krai | 9151 |

| Jewish Autonomous Region | 9013 |

| Tver region | 8726 |

| Republic of Karelia | 8726 |

| Vologda Region | 8726 |

| Kaliningrad region | 8726 |

| city of St. Petersburg | 8726 |

| Leningrad region | 8726 |

| Novgorod region | 8726 |

| Pskov region | 8726 |

| The Republic of Ingushetia | 8726 |

| Kabardino-Balkarian Republic | 8726 |

| Sverdlovsk region | 8726 |

| Tyumen region | 8726 |

| The Republic of Buryatia | 8726 |

| Tyva Republic | 8726 |

| Krasnoyarsk region | 8726 |

| Transbaikal region | 8726 |

| Amur region | 8726 |

| Baikonur city | 8726 |

| Novosibirsk region | 8725 |

| Irkutsk region | 8723 |

| city of Sevastopol | 8722 |

| Chechen Republic | 8719 |

| The Republic of Dagestan | 8680 |

| Smolensk region | 8674 |

| Kurgan region | 8630 |

| Tula region | 8622 |

| Voronezh region | 8620 |

| Lipetsk region | 8620 |

| Karachay-Cherkess Republic | 8618 |

| Kursk region | 8600 |

| Altai Republic | 8594 |

| Chelyabinsk region | 8586 |

| Tomsk region | 8561 |

| Oryol Region | 8550 |

| Kostroma region | 8549 |

| Kaluga region | 8547 |

| The Republic of Khakassia | 8543 |

| Altai region | 8543 |

| Krasnodar region | 8537 |

| Volgograd region | 8535 |

| Republic of Crimea | 8530 |

| Perm region | 8503 |

| Udmurt republic | 8502 |

| Ryazan Oblast | 8493 |

| Rostov region | 8488 |

| Omsk region | 8480 |

| Kirov region | 8474 |

| Ulyanovsk region | 8474 |

| Ivanovo region | 8460 |

| Vladimir region | 8452 |

| Bryansk region | 8441 |

| Samara Region | 8413 |

| Kemerovo region | 8347 |

| Republic of Bashkortostan | 8320 |

| Republic of Tatarstan | 8232 |

| The Republic of Mordovia | 8194 |

| Yaroslavl region | 8163 |

| Republic of Adygea | 8138 |

| Stavropol region | 8135 |

| Nizhny Novgorod Region | 8100 |

| Republic of North Ossetia-Alania | 8064 |

| Orenburg region | 8059 |

| Mari El Republic | 8036 |

| Belgorod region | 8016 |

| Saratov region | 7990 |

| Astrakhan region | 7961 |

| Chuvash Republic | 7953 |

| Penza region | 7861 |

| Republic of Kalmykia | 7755 |

| Tambov Region | 7489 |

| in general for the country | 8726 |

In some regions of Russia, this parameter barely exceeds eight thousand rubles. However, based on the current price level, we can say that this is very little. Utilities alone could account for approximately 50% of this amount. It is almost impossible to buy food and medicine with the remaining amount. A striking example is the deputy of the Saratov region (Nikolai Bondarenko), who is trying to live for a month on an amount equal to 3,500 rubles. He bought food with this amount. The grocery basket contained the following items in very small quantities: pasta, cereals, some chicken, some fresh vegetables, and a minimum of fruit. After a week of experiment, he lost 2 kg of his body weight. Every day he felt lethargic and exhausted, so his performance and productivity were minimal.

Infographics. The size of pensions by region in 2018.

Information on the amount of pension accruals is presented based on data published on the official website of the Pension Fund of the Russian Federation.

Return to content

What is “minimum pension”

Let us say right away that there is no such definition as a “minimum pension” in the legislation. But it is also clear that we are talking about an amount less than which the old-age insurance pension cannot be. How is the minimum size determined?

To do this, let us pay attention to the concept of long-term socio-economic development of the Russian Federation for the period until 2020. It says that the minimum level of pension is set not lower than the subsistence level of a pensioner in the region of his residence (Part II of the Concept, approved by Order of the Government of the Russian Federation of November 17 .2008 No. 1662-r).

Thus, the cost of living of a pensioner in his region can be conventionally called the size of the minimum old-age pension.

Who is entitled to

Residents of the Tambov region have rights to receive a pension in the following cases:

if citizens hold government positions in the region, their age is increased to 65 years for men and 63 years for women;

The number of points received directly depends on the citizen’s salary and the amount of insurance premiums paid. Payments are made by the employer without the participation of the citizen.

Every year, while a citizen is officially employed and regularly makes contributions, he accumulates pension points and develops pension rights. The amount of the pension ultimately depends on these contributions.

What does the minimum old-age pension consist of?

It happens that a person was assigned an old-age pension, but its amount turned out to be lower than the pensioner’s subsistence level. In this case, he is entitled to an additional payment up to the “minimum wage”. It is correctly called “social supplement to pension” up to the pensioner’s subsistence level. The right to it arises when 2 conditions are simultaneously met:

- absence of work or other activity during which the person is subject to compulsory pension insurance;

- failure to achieve the total amount of material support for a pensioner equal to the minimum subsistence level of a pensioner in the region of his residence.

Keep in mind that in order to calculate the “total amount of material support”, almost everything is taken into account - all cash payments, including pensions and cash equivalents of social support measures to pay for telephones, housing, utilities and travel on all types of passenger transport (urban, suburban and intercity) , as well as monetary compensation for the costs of paying for these services.

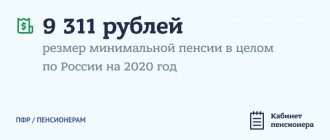

The amount of PMP for determining the size of federal and regional social supplements to pensions is established in the whole of the Russian Federation and in each subject of the Russian Federation. So, for 2020 in the Russian Federation it is 8,726 rubles, and, for example, in Moscow – 11,816 rubles.

The pensioner must receive a larger payment (when choosing between federal or regional). Also see “Where to apply for a social supplement to your pension: to the Pension Fund or Social Security?”

Conditions for obtaining a pension in Tula and the Tula region

To make monthly pension contributions, you must contact the branches of the funds located in Tula or the Tula region. To start receiving payments, citizens must correctly fill out an application to this institution. In it you need to indicate all the information about yourself and your work experience. To support your words, you must attach documents containing this information. Contributions can be received by citizens who, at the time of submitting the application, already have the retirement age determined by law. After these actions, the fund’s employees will check all information for relevance, and also calculate the actual monthly contributions to the applicant.

Are indexations taken into account when determining the minimum pension amount?

Insurance pensions of non-working pensioners were indexed from January 1, 2020 to 3.7. The cost of one pension coefficient after the increase was 81.49 rubles, and the size of the fixed payment was 4,982.9 rubles.

Social pensions have been indexed since April 1, 2020 by 2.9%, taking into account the growth rate of the cost of living of a pensioner in the Russian Federation over the past year.

As a result of indexation of insurance and social pensions in 2018, the average amounts of old-age pensions in Russia were:

- old age insurance – 14,151 rubles;

- social pension – 9,062 rubles;

These figures are provided by the Pension Fund on its official website.

The cost of living for a pensioner has not changed in any way due to the aforementioned indexations in 2020. Therefore, the minimum old-age pension remained at the same level. On many Internet sites you can find tables with strange amounts as minimum pension amounts, where the cost of living is indexed by an indexation factor. This is fundamentally wrong. The minimum cost of living for a pensioner remained at the same level. No need to index it!

From May 1, 2020, the minimum wage was equalized to the subsistence level. Now the federal minimum wage is 11,163 rubles. However, this increase also did not in any way affect the size of the minimum old-age pension, since the pensioner’s cost of living did not change). Its size for determining the amount of additional payment to the pension is established in accordance with the Federal Law of the Russian Federation of October 24, 1997 N 134-FZ “On the cost of living in the Russian Federation” for the country once every next year . In the constituent entities of the Russian Federation, the size of the subsistence minimum for determining the amount of social additional payments is also established once a year no later than November 1 of the current year.

Average size of insurance pension in Tula and Tula region

The average amount of insurance calculations is determined from the total value of pension contributions paid throughout the entire territory of the region for a certain period of time. Based on the results obtained, the maximum average and low payout levels are calculated. Today, in the Tula region and the city of Tula, the average value of pension insurance payments is 10,540 rubles. In total, 540,650 people are officially registered as receiving payments in this region. Every year the pension savings index receives certain increases. This is influenced by the economic situation in the regions of the country and the Russian economy as a whole. The government, based on current regulatory legal acts, issues decrees to increase the level of accruals in a certain period. To date, the size has increased by 1.5 percent. The region itself can also make additional payments to citizens. The economic situation and the current coefficient in a given territory also depend on the size of such charges. The amount of these additional payments may not increase.

Who is entitled to

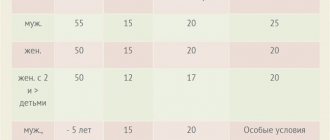

Residents of the Tambov region have rights to receive a pension in the following cases:

- reaching retirement age (55 years for women and 60 years for men; the military calculates age using other criteria);

- if citizens hold government positions in the region, their age is increased to 65 years for men and 63 years for women;

- in 2020, the insurance period must be at least 9 years, it is calculated in accordance with Federal Law No. 400 of 2013;

- a sufficient number of pension points (9.40 in 2020, by 2025 the number will increase to 30).

The number of points received directly depends on the citizen’s salary and the amount of insurance premiums paid. Payments are made by the employer without the participation of the citizen.

Every year, while a citizen is officially employed and regularly makes contributions, he accumulates pension points and develops pension rights. The amount of the pension ultimately depends on these contributions.

7 (St. Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

- reaching retirement age (55 years for women and 60 years for men; the military calculates age using other criteria);

- if citizens hold government positions in the region, their age is increased to 65 years for men and 63 years for women;

- in 2020, the insurance period must be at least 9 years, it is calculated in accordance with Federal Law No. 400 of 2013;

- a sufficient number of pension points (9.40 in 2020, by 2025 the number will increase to 30).

Multifunctional center - Veliky Novgorod

Where is it issued?

| Name of institution | Multifunctional center - Veliky Novgorod |

| Area | |

| [email protected] | |

| Working hours | Monday-Wednesday: from 09:00 to 19:00 Thursday: from 09:00 to 20:00 Saturday: from 09:00 to 15:00 Friday: from 09:00 to 19:00 |

| Institution website | https://mfc53.novreg.ru |

| Region of the Russian Federation | Novgorod region |

| Phones | 8 (ext. 5141) |

| Address | Novgorod region, Veliky Novgorod, Lomonosova street, 24/1 |

How to apply for a Russian pension

Pensions in Russia cannot be claimed until you reach the official retirement age in Russia, unless you fall into the category of exempt trades and trades. To reimburse the Russian state pension and company pension, applications must be sent to the Pension Fund at the address below (unless you choose to pay for the NFP investment). To receive payments from a private Russian pension fund, you must make contributions to the asset management company of your choice.

Social allowances

Low-income non-working pensioners of the Novgorod region can apply for an increase, provided that their total income is below the established minimum threshold. When recalculating, all subsidies received and subsidies paid monthly will be taken into account.

In this case, any one-time benefits and payments and social support measures expressed in kind will not be taken into account. In addition, pensioners who have reached the age of 80 receive a fixed part of the pension at double the amount. Please note that disabled people of group 1, who initially receive a double social pension, cannot apply for this form of support.

In addition, pensioners retain benefits on public transport and utility bills.

Important! Social benefits are not provided for employed pensioners.

Statistical level

According to Sberbank, weak financial oversight has proven to be a problem for a number of private pension funds, which have recently not been required to disclose their investments and have often invested in assets owned by fund managers. These issues are likely to be addressed by the Bank of Russia as it strengthens its regulatory role (Russia does not have an independent financial watchdog equivalent to the SEC; the central bank plays that role), but remains unresolved for now.

Multifunctional center - Veliky Novgorod

Where to apply

| Name of institution | Multifunctional center - Veliky Novgorod |

| Area | |

| Region of the Russian Federation | Novgorod region |

| Site | https://mfc53.novreg.ru |

| Working hours | Monday: 08:30 to 14:30 Tuesday-Friday: 08:30 to 17:30 Saturday: 09:00 to 15:00 |

| Phone number | 8 (ext. 5155) |

| Organization address | Novgorod region, Veliky Novgorod, Oktyabrskaya street, 1 |

| [email protected] |

Department of Labor and Social Protection of the Population - Veliky Novgorod

Organization

| Name | Department of Labor and Social Protection of the Population - Veliky Novgorod |

| What area is it located in? | |

| Institution website | https://ksz.natm.ru |

| Institution address | Novgorod region, Veliky Novgorod, Velikaya street, 8 |

| Telephone | +7 |

| In what region | Novgorod region |

| Operating mode | Monday-Friday: from 08:30 to 17:30, break: from 13:00 to 14:00 |

How to receive additional payments to your pension in Veliky Novgorod in 2020

Asset freeze

There have been numerous reports of funded contributions being “frozen” for three years in a row, a move that will continue into next year. But what does this really mean? First a couple of important notes. It is important to remember about pensions that seemingly small percentage changes in the system's income and expenditure are extremely important. According to current estimates of the 2020 federal budget, social spending (about 4.6 trillion rubles) is very close to a third of all spending. Secondly, according to Sberbank analysis, payroll taxes generate about 5-5.5% of GDP in revenues, while pension costs require about 8-8.5% of GDP in expenditures.

This is a perfect example of the first point: the pension deficit is about 2.3 trillion rubles, which is approximately 15% of total spending. When oil prices were high, this wasn't a particularly problematic indicator (thanks, severance tax!): Revenue was quite large. Now, however, things have become more complicated.

To answer this question, a pension freeze entails an allocation of savings contributions to current insurance costs. In other words, using the “private” pension savings of current workers to pay current retirees. This maneuver saves about 0.5% of GDP in spending, which frees the Ministry of Finance (and the government as a whole) from spending on other priority items.

While this effectively takes money away from people, until this year it was at least used for pension purposes, that is, to fund retirees. But this year, the frozen contributions (totaling 342 billion rubles or $5.4 billion) were turned into a "presidential reserve" (Sounds like Putin's brand of whiskey to me, but I digress). 150 billion rubles from this reserve were used to save the VEB bank, which, in addition to acting as a piggy bank for irresponsible government projects, also manages funded pensions. The rest will be used to pay off the debt of the defense sector.

How does the calculation work?

- Participation of an applicant for state support in labor activities. This factor determines what type of pension benefit the applicant is entitled to.

Methods for regulating the income of disabled persons

Download for viewing and printing:

Addresses of PFR branches in Tambov and the region

For information: work with applicants is carried out on weekdays from 8:30-17:30 (on Friday until 16:30).

In other settlements of the region, citizens are received by units located at the following addresses:

lgoty-vsem.ru

Multifunctional center - Veliky Novgorod

Where to go

| Name | Multifunctional center - Veliky Novgorod |

| Area | |

| [email protected] | |

| Site | https://mfc53.novreg.ru |

| In what region | Novgorod region |

| Telephone | 8 (ext. 5501) |

| Institution address | Novgorod region, Veliky Novgorod, Bolshaya Moskovskaya street, 24 |

| Opening hours | Monday-Wednesday, Friday: from 09:00 to 19:00 Thursday: from 09:00 to 20:00 Saturday: from 09:00 to 15:00 |

Who is entitled to standard tax deductions in Veliky Novgorod in 2020