Availability of sick leave allows an employee to receive cash benefits for the period during which he did not perform work duties due to illness. The percentage of sick leave payment depending on length of service has remained unchanged since 2007, when Federal Law 255 came into force.

In 2020, interest rates will remain the same, but the minimum and maximum amounts of payments for temporary disability will increase.

Payment of sick leave

The payment methods for sickness benefit reimbursement have not changed in 2020.

The main part is paid by the Social Insurance Fund. Full payment is made in the following cases:

- three pilot projects for payment from Social Insurance Fund accounts have been launched in experimental regions of the Russian Federation;

- in cases of liquidation of the organization at the time of payment;

- bankruptcy of the organization at the time of payment;

- insufficient insurance accruals to pay sick leave benefits;

- child care or quarantine in a child care facility;

- payment of maternity benefits for pregnancy and childbirth.

As a rule, the bulk of sick leave payments are made by the Social Insurance Fund.

Part is paid by the employer:

- the first three days of the employee’s incapacity for work;

- in case of industrial injury with violation of safety regulations.

Note! Funds paid for sick leave come from different sources and can be paid at different times. As a rule, the waiting time for funds from the Social Insurance Fund is longer.

Part of the sick leave payment is provided by the employer

Deadlines for sick leave payments

In 2020, the rules for payment of benefits neither for the Social Insurance Fund nor for employers have changed. They are carried out in the following order.

Deadlines for employers

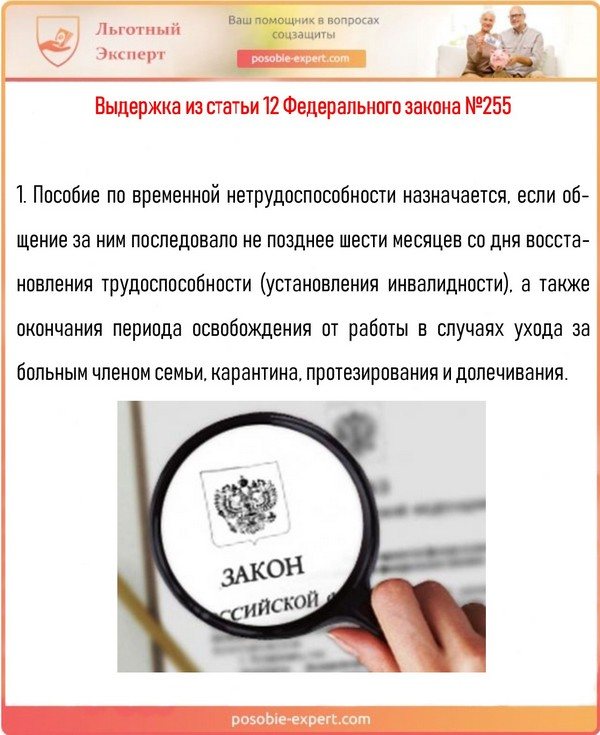

An employee can present a sick leave certificate no later than 6 months from its receipt. For relatives of a deceased employee while on sick leave, the period of provision is up to 4 months.

Note! The calculation period is given 10 calendar days from the date of granting sick leave.

The calculation is made taking into account the established rules at the enterprise and the timing of payment of wages.

Excerpt from Article 12 of Federal Law No. 255

Example: an employee brought a sick leave sheet, which indicates the dates of incapacity for work from February 1 to February 12, and they coincide with the attendance sheet. The employee starts work on February 13 and submits the sheet to the personnel department on February 14. With a payment schedule of 5 and 20 of each month, payments are accrued to him on February 24 by decision of management or on the general settlement day of March 5.

Terms of payments to the Social Insurance Fund

The Social Insurance Fund is required to calculate the amount of payments within 10 days from the date of receipt of sick leave.

Note! The payment date for sick leave is no later than the 26th of the next month.

Example: Let's consider for our case. The sick leave was received by the Social Insurance Fund on February 15, and it will be paid until March 26. And if sick leave is received after the first of March, the employee will receive the money until April 26.

Payment for sick leave is due by the 26th of the next month.

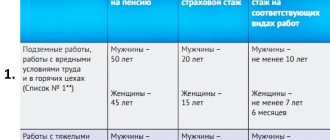

Who has the right to retire on preferential terms?

This is the basic requirement. The age of the beneficiary does not matter.

But not all education workers can retire early.

The state has determined the range of positions of educational workers who have the right to early retirement.

According to Government Decree No. 781, these include persons conducting their activities in an educational institution in the following positions:

- directors;

- deputy head responsible for the implementation of the educational process;

- head of academic department;

- teachers of various levels;

- kindergarten teachers of all levels;

- school teachers, pedagogues and methodologists with combined teaching positions;

- masters of vocational schools teaching industrial training;

- specialist organizers of extracurricular activities;

- teachers who are also psychologists;

- speech therapists, teachers acting as speech therapists;

- teachers of music schools, physical education, social educators, teachers conducting coaching activities;

- teachers working in additional educational programs;

- individual specialists.

In addition to the above positions, the educational institution in which the applicant for early leave of service worked or continues to work is important.

A preferential pension will be assigned only if the applicant has worked for at least 25 years in a particular educational institution .

The list of such institutions is specified in Government Decree No. 781. These include educational institutions:

- primary, secondary schools, specialized lyceums and gymnasiums;

- general education schools for orphans, children with physical and mental defects and developmental delays;

- paramilitary schools for boys;

- educational centers for gifted children;

- orphanages of various legal status, including family ones;

- sanatorium schools;

- correctional and special educational institutions of all types, including closed ones;

- kindergartens, nurseries, kindergartens;

- institutions of primary and secondary vocational education, including schools, technical schools;

- schools in special areas, for example, music or art;

- diagnostic centers, for example, a correction center;

- rehabilitation centers for children recovering from injuries and illnesses;

- educational institutions that teach children additional programs.

Labor activity in certain specialties is counted towards the preferential length of service of a teacher in the event that the teaching load was fulfilled during the working hours worked.

If the name of the position or educational institution does not coincide with that indicated in the list, then early retirement will not be possible.

Be sure to check the entries in your work book with the positions and institutions indicated in the lists. If there are discrepancies in the current period, the HR department can make corrections. If inaccuracies arose in an earlier period, then all arising conflicts are resolved by going to court.

What periods are included in the length of service?

Payment of sick leave for temporary disability directly depends on the employee’s length of insurance. According to the Federal Law “On Insurance Pensions”, it consists of all time periods when the employer or independently paid insurance contributions to the PRF for the employee.

It includes periods:

- military service;

- care for each child in the family, for a total of no more than 6 years;

- registration with the employment service, if confirmed by a document;

- detention with subsequent rehabilitation;

- care for persons over 80 years old, for disabled people of group 1, for disabled children;

- time of living with a spouse undergoing military service;

- time spent by the spouse in the diplomatic service;

- time of operational work on the task.

Various periods are included in the insurance period

Note! All time periods included in the length of service must be confirmed in the work book or other official documents certified by a notary.

Confirmation of length of service for calculating payments on a certificate of incapacity for work

The insurance period is of decisive importance when calculating payment for the period of illness. An employee can confirm work experience with the following documents:

- Personal work record. Sometimes situations occur in which an employee provides two such documents: in this case, the employer has the right to consider one of them invalid.

- A concluded employment contract. It is imperative to make sure that it is compiled correctly and, if possible, send a request to the pension fund.

- A certificate provided from the employee’s place of work.

- Extracts from documents such as orders, personal accounts and payroll statements.

- Documents that can confirm the employee’s military service.

- Other documents that are reflected in the regulatory legislation as possible for use as evidence of experience.

A separate feature is that if the employer did not make the required payment to the Social Insurance Fund from the employee’s income, then he does not have the right to issue a certificate of length of service for calculating sick leave.

When calculating the length of service, all periods during which the employee was officially registered at work are taken into account, and every 30 days (regardless of the beginning of such period) will be counted as one calendar month. Accordingly, after 12 months, regardless of when they began - in January, April or September, the employee is considered to have worked for one year.

What determines the payment of a percentage of the insurance period?

The total amount of insurance experience determines what percentage will be included in the calculation of disability benefits from the employee’s average earnings. Social insurance reimburses only well-founded, error-free calculations for payment of sick leave benefits. Average earnings are calculated from total payments for the last two years of work.

The amount of sick leave payments depends on insurance payments and the size of the official salary

In 2020, the percentage of the official insurance period did not change. Let's look at it in the table below.

Table No. 1. Calculation of insurance period

| n\n | Insurance experience (years) | % of payments | In which cases |

| 1. | 8 or more | 1 | Officially employed, making contributions to the Pension Fund. |

| 2. | Does not matter | 1 | For pregnancy and childbirth. |

| 3. | From 5 to 8 | 0.8 | Officially employed, making contributions to the Pension Fund. |

| 4. | Up to 5 | 0.6 | Officially employed, making contributions to the Pension Fund. |

| 5. | Doesn't matter | 0.6 | Former employees upon receipt of sick leave for 30 days if they are unemployed. |

| 6. | Less than six months | Minimum wage | Total experience less than six months. |

Sick leave, according to the tax code, is subject to personal income tax - 13%

Sick leave payments are subject to personal income tax

The amount of the bonus and the right to receive it

In monetary terms, pay for length of service is an individual value determined by internal and external factors. The numerical expression is affected by:

- Salary size and growth rate. The faster the salary increases, the higher the payment becomes, since it is calculated as a percentage.

- The general period of work and the procedure for its calculation. Under no circumstances is the length of service of teachers counted as two years, unlike in the military.

- Geographical location. Increasing district and regional coefficients increase the payment exponentially, since they are taken into account when forming monetary allowances and are multipliers in determining the total payment amount.

- Type of professional activity. The ratio of the growth rate of monetary remuneration and length of service established for civil servants and specialists of law enforcement agencies differs from the indicator established for medical, teaching and other public sector employees.

Despite the difference in the amount of remuneration received, additional payment for length of service in a budgetary institution is due to absolutely all employees upon reaching the minimum required period with a gradual increase in proportion to the increase in “length of service”. For military personnel and civilian government employees, the first payment is due upon reaching a two-year period, for others - after a year.

The dependence of the amount of additional payment as a percentage of length of service in years is presented in the table:

| Surcharge percentage | Duration of service in law enforcement agencies for the military, employees of the Ministry of Internal Affairs, Ministry of Emergency Situations, firefighters | Working period for state civil servants | Length of service for other public sector employees (teachers, doctors, scientists, etc.) |

| 10 | 2-5 | 2-5 | 1-3 |

| 15 | 5-10 | 5-10 | — |

| 20 | 10-15 | 10-15 | 3-5 |

| 25 | 15-20 | — | — |

| 30 | 20-25 | Over 15 | Over 5 |

| 40 | Over 25 | — | — |

When determining the total length of service, it is necessary to take into account not only the period of work at a specific place, but also the entire period of work in structures financed by the local, regional and federal budget.

In what situations is sick leave paid?

Situations when sick leave must be paid:

- it was received personally by the sick employee during an appointment with a doctor;

- if it is necessary to care for a sick child, a disabled person of group 1;

- during pregnancy and childbirth and in case of complications thereof;

- when caring for an infant up to 3 months, in case of adoption or guardianship;

- when undergoing rehabilitation in sanatoriums and resorts;

- in dental prosthetics.

In order for sick leave to be paid, it must be filled out correctly.

Who is entitled to sick pay?

Categories of citizens who may qualify for sick leave:

- employees working in government agencies: teachers, doctors, librarians, etc.;

- civil servants, state and municipal officials;

- workers and engineers working under an employment contract, regardless of their form of ownership;

- military, contract soldiers serving military service;

- employees of the Ministry of Internal Affairs, Ministry of Emergency Situations, FSB, inspectors of tax, fire services and units.

How to correctly calculate sick leave payments?

An employee who has missed work days for one of the above-mentioned valid reasons, and who has received a stamped sick leave certificate completed and signed by the attending physician in a standard manner at a medical institution, submits it to the accounting department.

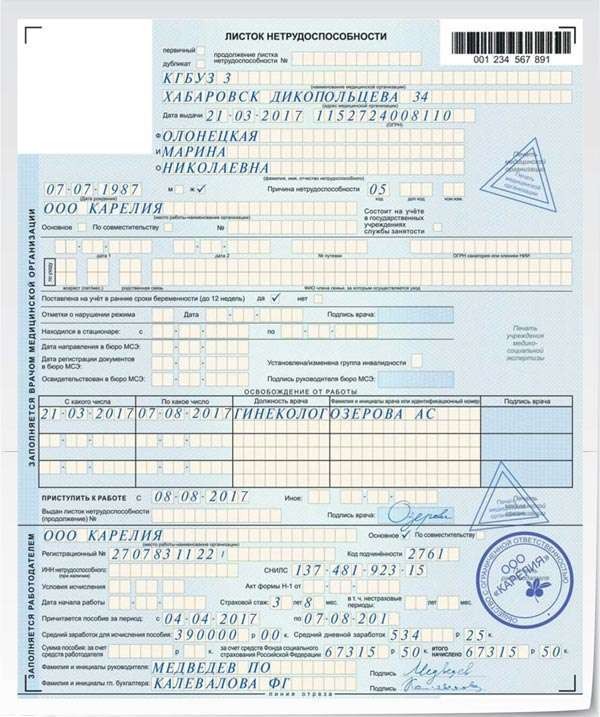

An example of a correctly completed sick leave form

The accountant, within a period not exceeding 10 days, must calculate payments for sick leave and submit it for payment.

The accounting calculation consists of several parts.

- Determine the calculation period, which consists of the last two calendar years before the illness. It is always 730 days, and no days are excluded from the calculation (Article 14 of Federal Law 255, Part 1.2).

- Determine the total earnings for the second accounting calendar year:

- it includes all payments for which SSF contributions were calculated (Article 14 Federal Law 255, Part 2);

- All non-taxable amounts are excluded: state benefits, financial assistance up to 4,000 rubles, compensation payments (Tax Code, Article 422);

- You can determine the average earnings for one day using the formula: Average daily earnings = Earnings for the billing period: 730 days

Note! Regardless of the length of the working week or part-time work, calculations are made in the same manner for all employees.

Calculation of sick leave payments is the same for all employees

Then the total labor and insurance experience is determined. The amount of payments to an employee on sick leave depends on the length of his work experience from the first days of his work, which is noted in the work book, employment contract or certificate.

Next, the period is calculated when the length of service was subject to mandatory social insurance tax in case of disability, illness, or maternity.

Periods of other activities subject to social insurance are included:

- business activities: private notaries, detectives, tutors, security guards and others,

- law office,

- collective farmers,

- members of cooperatives.

The calculation takes into account the length of insurance, time spent on sick leave according to the BiR, etc.

First, the experience is summed up for whole years, then added for whole months. All remaining days are summed up and converted into months of 30 days, and they are converted into years of 12 days. The result will be the total number of complete years and months.

Example No. 1 : An employee went on sick leave from May 15, 2020 to May 25, 2020.

Calculation of work experience.

| n\n | Name of place of work | Beginning of internship | End of internship | years | months | days |

| 1. | LLC "Ritual" | 15.03.2015 | 25.10 2017 | 2 | 13 | 40 |

| 2. | LLC "Pamyat" | 30.10.2017 | 14.05.2019 | 2 | 15 | 49 |

| 3. | Calculation of experience | 4 | 28:12=2,4 | 89:30=2,96 | ||

Result: Total work experience will be = 6 years + 7 months

In 2020, when calculating the insurance period, the total length of service is taken into account.

If an employee works in two places at the same time, the length of service is taken into account only for one place of work of his choice.

The calculation takes into account the total length of service

Note! The length of service up to the last day is taken into account, including the day before the opening of sick leave.

The average amount of sick leave benefits per day also depends on the established maximum and minimum limits. Letter of the Ministry of Labor No. 17-3/326 dated February 26, 2013 defines the procedure for calculating benefits taking into account the assigned limit base, which should not exceed the calculated daily base. The payment for 2018 had a limit value. In 2020, there is a maximum value of average daily earnings, which should not exceed the value obtained by the formula.

Table. Calculation of the average daily earnings limit

| Limit for 2020 | Limit for 2020 | Sum | Calculation for every day | Limit on daily earnings in 2020 |

| 775000 | 815000 | 1590000 | 1590000 : 730 | 2150.68 rub. |

When calculating the accrual of benefits for sick leave in 2020, the average daily earnings of an employee cannot exceed the received value - 2150.68 rubles. This means that the total payment of all earnings for the last two years, divided by the number of days 730, cannot exceed the base for which the limit amount is taken.

The calculation takes into account the daily earnings limit

Note! If an employee worked simultaneously in two different organizations, then they calculate the average daily salary based on their accrual amounts. The total figure for the Social Insurance Fund from two organizations may exceed the estimated limit for 2020.

The minimum average daily amount should not be less than the minimum wage approved by the government for 2020 - 11,280 rubles. per month. When calculating using the formula, we get:

11280 (rub.) x 24 (months): 730 (days) = 370.85 rubles.

It is necessary to take into account the minimum wage when calculating the SDZ

How much will it be?

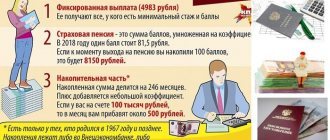

Let's see exactly how much the pension will be if the official work experience is 10 years.

For women

The average for all regions of Russia for women is 8,026 rubles. Women are also provided with additional payment for children born. It depends on multiple factors. Even if you take two pensioners who have the same number of children, the size of the increase may differ.

The fact is that this is influenced by the following factors:

- place of work;

- seniority;

- wage;

- the moment of birth of children.

Find out more about the length of service for women for retirement and its impact on the amount of payments here, and here you can find out about the special conditions for assigning benefits if you have northern experience, as well as two or more children.

For men

For male pensioners, the average pension is 8,600 rubles. But here you need to take into account your place of residence and place of work. There are a number of territories in Russia in which the amount of benefits and pensions is calculated with an increasing factor.

If a person changes his place of residence, then the increasing factor is lost.

For example, if you lived in a city located above the Arctic Circle and then moved to the southern region, then after changing your place of residence, your pension payments will be reduced.

Read about the intricacies of calculating northern length of service for a men's pension here, and this article talks about the general requirements for length of service for a men's pension and its impact on insurance payments.

When is the minimum wage taken into account when calculating sick leave benefits?

Let's list the cases:

- during the billing period the employee had no earnings due to unemployment;

- the employee’s average earnings for two calendar years are below the minimum wage;

- The employee has a total length of service of less than six months.

The calculation of the final benefit to the employee based on the sick leave provided is calculated for all days of illness using a formula.

Formula for calculating sick leave benefits.

Sick leave benefit = Salary for two calendar years in rubles. : 730 days x Percentage based on length of service (100%; 80%; 60%) x Days on sick leave

You can calculate using a special formula

Differences in calculations may arise in the event of disability associated with a work injury or resulting from an accident, as well as pregnancy and childbirth. The final calculation includes 100% regardless of the insurance period.

The employee must provide salary data if he has previously worked for another organization for two years.

The calculator below will help you calculate the amount of sick leave benefits.

Go to calculations

Example. Let's calculate the benefit amount for the option already discussed above.

The employee went on sick leave from May 15, 2020 to May 25, 2020:

- the total salary for 2020 was 478,800 rubles;

- the total salary for 2020 was 653,000 rubles;

- total work experience will be = 6 years + 7 months, based on 80%;

- days on sick leave – 11.

Let's make the calculation:

| Sick leave benefit | = | Salary for two calendar years in rubles. | : | 730 days | X | Interest based on length of service 0.8 | X | Days on sick leave |

| 4843.61 | = | 478800 + 653000=1131800 Less than 1590000 | : | 550.41 | X | 440.33 | X | 11 |

The amount of sick leave benefits depends on the length of service

Payment of sick leave for minimum earnings

Often, a company sets the amount of wages based on the approved minimum. For 2020, the amount is fixed at 11 thousand 280 rubles. Based on the above fact, the average daily earnings does not exceed 370 rubles.

Next, the calculation is carried out in the standard way. The percentage of sick leave is calculated only from length of service - no other factors affect the indicator. If you have a certificate of income (2NDFL), it is possible to make independent calculations. If the accountant has withdrawn the wrong amount, the employee can always defend his rights.

Examples of calculations

Example. Calculation of sick leave benefits according to the minimum wage

Employee Petrov A.A. works on the basis of Salut LLC for workers, brought a sick leave note, which noted the days of illness from February 15 to February 24, 2020. He returned to work on February 25, 2020.

On the basis of Salyut LLC Petrov A.A. He has been working since July 2020, and his earnings amounted to 182,000 rubles; he did not provide information about earnings from his previous place of work. The total insurance period is 10 years; a regional premium of 20% applies in the region.

Calculation of benefits for sick leave.

| Sick leave benefit | = | Salary for two calendar years in rubles. | : | 730 days | X | Interest based on length of service (100%) + 20% R.C. | X | Days on sick leave |

| 4 450,20 | = | 162000 Less than 1590000 | : | 221.92 Less than 370.85 according to the minimum wage | X | 445.02 = 370.85x100%x20% | X | 10 |

In some cases, the minimum wage is taken into account when calculating

For the first three days, Petrov A.A. The employer pays sick leave benefits - 1335.06 rubles, and the remaining funds are paid from the Social Insurance Fund.

Example. Calculation of sick leave benefits when the limit on the maximum base is exceeded.

Lopatina N.N. works on the basis of Salut LLC as a warehouse manager, brought a sick leave note, which noted the days of illness from February 19 to February 24, 2020. She returned to work on February 25, 2020. The total insurance period is 6 years; the regional supplement does not apply in the region. In 2020 Lopatina N.N. had a total earnings of 856,000 rubles; in 2020, the total earnings amounted to 916,000 rubles.

Calculation of sick leave benefits when the limit on the maximum base is exceeded.

| Sick leave benefit in rubles. | = | Salary for two calendar years in rubles. | : | 730 days | X | Interest based on length of service + 20% R.C. 0.8 | X | Days on sick leave |

| 10,323.26 rubles (2150.68 x 6 days x 80%). | = | 856000+916000 = 1772000 Over limit 1590000 | : | 2,150.68 per limit | X | RUB 10,323.26 = 2150.68 x 80% | X | 6 |

For the first three days Lopatina N.N. The employer pays sick leave benefits in the amount of 6,452.04 rubles, and the remaining funds for three days are paid in the amount of 6,452.04 rubles.

If the amount obtained is greater than the limit, then the maximum possible amount according to the limit is paid

Example. Calculation of sick leave benefits for an employee caring for a child under 7 years old.

Features of the calculation in this case:

- the child is under 7 years old, the employee is paid one sick leave benefit for the entire period of illness;

- the total number of days on sick leave in the current year cannot exceed 60 days.

Kazakova A.M. works at Salut LLC as a merchandiser, brought a sick leave certificate for caring for a 5-year-old child, which noted the days of illness from January 15 to January 24, 2020 - 10 days. She returned to work on January 25, 2020. The total insurance period is 6 years; the regional supplement does not apply in the region. In 2020 Lopatina N.N. had a total earnings of 406,000 rubles, in 2020 the total earnings amounted to 502,000 rubles, which does not exceed the limit base for these years - 1,590,000 rubles.

Calculation of sick leave benefits for caring for a child under 7 years old.

| Sick leave benefit in rubles. | = | Salary for two calendar years in rubles. | : | 730 days | X | Interest based on length of service 80% | X | Days on sick leave |

| 9950.72 (1243.84 x 80% x 10). | = | 406000+ 502000=908000 Less than the limit 1590000 | : | 1243.84 | X | 995,072. = 1243.84 x 80% | X | 10 |

Personal income tax in the amount of 13% is deducted from the calculated benefit amount - 9950.72 x 13% = 1294 rubles.

It is important to remember that the amount in hand will be less due to the deduction of personal income tax

As a result, it turns out that Kazakova A.M. child care will be paid for all 10 days of sick leave benefits. Its amount will be 9950.72-1294=8656.72 rubles, these funds are paid in full by the Social Insurance Fund.

Example. Calculation of sick leave benefits for an employee during pregnancy and childbirth.

Features of the calculation in this case:

- when calculating maternity benefits, the government approved the maximum payment amounts for 2020: minimum - 51,919 rubles, maximum - 301,095.20 rubles;

- the total duration of issuing sick leave is determined: maternity leave for the duration of pregnancy and childbirth with complications is at least 156 days, maternity leave for the birth of two or more children is 194 days;

- Personal income tax is not withheld from maternity payments for pregnancy and childbirth;

- All maternity benefits are paid at the expense of the Social Insurance Fund.

Antonova I.T. The secretary at the Salut LLC base provided the management with a sick leave certificate issued by the Women's Consultation for the period of pregnancy and childbirth for a period of 140 days. Her total salary for 2020 was 174,000 rubles, and for 2020 - 196,000 rubles. The amount for two years turned out to be (174,000 + 196,000) = 370,000 rubles.

To determine average earnings, divide the amount for two years by 370 days a year - 370,000/730 = 506.85 rubles.

Sick leave according to BiR is paid in full - personal income tax is not withheld

A manual for Antonova I.T. for pregnancy and childbirth for 140 days will be 506.85x140 = 70959 rubles.

Example. Calculation of sick leave benefits for an employee with less than 6 months of service.

Features of the calculation in this case:

- for a full month, the amount of the estimated salary does not exceed the payment according to the established minimum wage;

- the average salary will be the minimum wage for the number of days in a month of paid sick leave.

Commodity expert Ivanova M.M. has only 3 months of work experience at Salut LLC. She provided a sick leave sheet, which noted the days of illness from January 15 to January 24, 2020 - 10 days. She returned to work on January 25, 2020. Ivanova started working in November 2019.

Considering that the employee has less than 6 months of work experience, earnings in the amount of the minimum wage are taken into account - 11,280 rubles. Divide by 31 days in January: 11280/31 = 363.87 rubles.

If the work experience is less than 6 months, the minimum wage is taken into account

The amount for 10 days of sick leave benefits is calculated taking into account the coefficient for length of service: 60%. And it will be 363.87x10x60% = 2183.22 rubles.

Taking into account personal income tax, 13% accrual to Ivanova M.M. will be 2183.22 x 13% = 1899.22 rubles

For the first three days Ivanova M.M. The employer pays sick leave benefits in the amount of 3x363.87x60% = 654.97 rubles, and the remaining funds for seven days: 7x363.87x60% = 1528.25 rubles, are paid at the expense of the Social Insurance Fund.

Example. Calculation of sick leave benefits for an employee in case of non-compliance with the treatment regimen.

Features of the calculation in this case:

- the employer conducts an investigation into the reasons for the note on the sick leave about the employee’s non-compliance with the treatment regimen established for medical institutions;

- if it is determined that the employee had valid reasons for the violations, he is paid sick leave benefits on a general basis.

- if it is determined that there are no compelling reasons and the employee violated the sick leave regime unreasonably, the first part of the benefit, before the violation is noted, is paid on a general basis, and the second part after the noted day of violation is paid in accordance with the established minimum wage.

If the treatment regimen has been violated, the amount of sick leave benefits will be less

Commodity expert Suslova M.M. has 9 years of work experience at Salut LLC. She provided a sick leave sheet, which noted the days of illness from January 15 to January 24, 2020 - 10 days; she returned to work on January 25, 2020. The doctor made a note on the sick leave that the treatment regimen was violated. On January 23, the patient did not show up at the appointed time to see the therapist without a good reason.

The employee’s salary for the previous two years was 239,000 rubles. in 2020 and 186,000 rubles. in 2020. The amount was (239,000 + 186,000) = 425,000 rubles, which is less than the limit base.

The average earnings for one day are: (239000+186000): 730 = 582.19 rubles, where 730 are billing days for two years.

Payment of sick leave benefits is divided into two calculations: 8 days before the fact of violation of the treatment regimen and 2 days after.

In case of violation of the treatment regimen, payment is divided into two parts

Calculation of sick leave benefits for non-compliance with treatment regimen.

| Sick leave benefit in rubles. | = | Salary for two calendar years in rubles. | : | 730 days | X | Interest based on length of service 100% | X | Days on sick leave |

| 4657.52 = 8 x 582.19 | = | 239000+186000= 196000 Less than the limit 1590000 | : | 582.19 | X | 582.19 | X | 8 |

| 741.7 = 2 x 370.85 | = | 11280 minimum wage | : | 370.85 | X | 370.85 | X | 2 |

The total sick leave payment as a result of addition will be 4657.52 +741.7 = 5399.22 rubles. From this amount, personal income tax is deducted 13% = 701.9, and in total the following will be paid: 5399.22 - 701.9 = 4697.32 rubles.

For the first three days Suslova M.M. The employer pays sick leave benefits 3x582.19 = 1746.57 rubles, and the remaining funds for seven days are paid 5399.22 - 1746.57 = 3650.65 rubles at the expense of the Social Insurance Fund.

Part of the money is paid by the employer, part by the Social Insurance Fund

How is PIC determined for unlimited insurance?

It is no secret that insurers offer to buy a car license on the condition that any drivers are allowed to drive. This condition is convenient:

- taxi drivers who often change drivers;

- bus owner;

- car enthusiasts who often entrust their car to friends or acquaintances.

How to calculate the coefficient in this case? If you study the tariffs, you can understand that there is no need to calculate anything, since the PIC for such a policy is fixed and equal to 1.

In this case, insurers use the KO indicator (restricted use coefficient) of 1.87, which is relevant only for “unlimited” insurance.

It turns out that the calculation is made according to the maximum coefficient, which is established by age and length of service.

How is sick leave benefit calculated for child care?

Sick leave issued to parents to care for a child is paid entirely from the Social Insurance Fund.

Sick leave received by a parent during his next vacation is not paid, and the vacation is not extended.

A child under 7 years of age is entitled to sick pay for up to 60 calendar days for the entire current year.

A parent has the right to take sick leave if a child is ill

For a child aged 7 to 15 years, parents are paid sick leave for each disease for up to 15 days, but not more than a total of 45 days per calendar year.

For children over 15 years of age, 7 calendar days are paid for each illness, but not more than 30 days per year.

Note! Every parent has the right to sick leave to care for a child, and payment is provided in the same way for each.

For a family with two or more children, the calculation rules apply separately for each child.

If there is more than one child in a family, the calculation rules apply to each

The amount of the benefit depends on where the child is treated:

- for outpatient treatment (the child is at home), the first 10 calendar days are paid to the parent in full, and for all subsequent days - 50% of earnings;

- When caring for a sick child in a hospital, the parent is paid the full sick leave benefit.

If a child becomes seriously ill, the duration and number of sick leaves is not limited.

So, sick leave can be paid in different ways: it all depends on how long the employee has, how long he was on sick leave and for what reason. In the article, we provided examples of various calculation options that should help you calculate the amount of unemployment benefits.

Required period of work

On January 1, 2020, the pension formula was introduced. According to it, the insurance period comes to the fore when calculating the amount of the pension (the rules for calculating and confirming the insurance period are described here)..

To become a pensioner and receive a monthly state payment, as of 2020, the minimum insurance period must be 7 years.

But the government will not stop there, since in 2024 it is planned to increase the minimum length of service to 15 years.

If this condition is not met, the pensioner will only be able to count on a social pension. It has a fixed size. Women over 60 years old and men over 65 years old will be able to receive it.

Pension payments can be increased if you work even after retirement.

For each working year after reaching retirement age, additional points are awarded, which increase the amount of the pension.

For example, when a person still works 5 years after retirement, his fixed payment will increase by 36%, and the number of points will be 45.

A person may not work at all, for example, be a housewife, a student, work informally, or earn money on the Internet. However, they do not lose the right to receive an old-age pension. They just have to rely on a social pension.