At the beginning of 2020, a new pilot project came into force. It refers to people offering goods and services to individuals and legal entities, without hiring labor.

The pilot project was launched in four constituent entities of the Russian Federation: Moscow and the region, Kaluga region, and the Republic of Tatarstan. If successfully implemented, the project will be distributed throughout the Russian Federation.

Entrepreneurs can optionally register their income and reclassify as self-employed. You can register yourself through the “My Tax” application or visit the tax office in person and write an application.

In order to approve an application to change the status of a citizen to self-employed, you must meet the following requirements:

- Receive up to 200 thousand rubles per month;

- Conduct labor activities not prohibited by this legislation.

Among the suitable professions for self-employed registration, you can choose:

- freelance: designers, writers, SMM specialists, targetologists;

- tutoring - conducting lessons online or teaching lectures at home;

- food production: dairy, fermented milk and bakery products;

- fishing: for the purpose of selling fish products;

- selling handicrafts - creating jewelry or decorative items with your own hands.

In connection with the specifics of a citizen’s work activity, the question arises regarding his future pension - whether percentage deductions from income include contributions to the Pension Fund and whether the length of service is accrued. We'll talk about this later.

Tax without contributions

Self-employed people pay a tax rate of 4% when receiving income from individuals and 6% when receiving income from legal entities and individual entrepreneurs.

According to Article 146 of the Budget Code of the Russian Federation, part of the tax paid is credited to the health insurance fund (37%), and part (63%) to the regional budget.

Let me add that this is how the tax itself is divided; you don’t have to pay anything on top of it.

Thus, self-employed people, unlike individual entrepreneurs, do not pay fixed contributions.

For many, this is the decisive factor when choosing a status.

However, in this case the formula works:

No contributions = no experience for pension and points

Results

From all that has been said, it follows that the legislator recognizes a pensioner who pays professional income tax as unemployed. This is due to the lack of payment of insurance premiums to them (or for them). Accordingly, he retains the right to annual indexation of his pension and additional payment to his pension up to the subsistence level. But for those benefits that depend on the general level of income, this rule does not apply.

Sources:

- Tax Code of the Russian Federation

- Law “On conducting an experiment to establish a special tax regime “Tax on professional income” dated November 27, 2018 No. 422-FZ.

- Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ

- Law “On Amendments to Certain Legislative Acts of the Russian Federation on the Issues of Assignment and Payment of Pensions” dated October 3, 2018 No. 350-FZ

- Law “On State Social Assistance” dated July 17, 1999 No. 178-FZ

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Pension without experience

As you know, the size of the pension directly depends on the amount of insurance premiums paid. But for now, let’s skip this size issue and talk about the right to a pension as such.

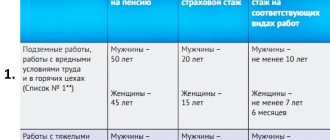

The fact is that the right to an insurance pension does not automatically occur upon reaching retirement age. It depends on two more criteria - length of service and points. To qualify for an insurance pension, you will need to have at least 15 years of experience and at least 30 accumulated points, the number of which, in turn, depends on the amount of contributions paid.

Let’s say a man has been self-employed all his life or has worked under an employment contract for a short time, but by the age of 65 years of experience or points he has less than the norm. What kind of pension can he expect? Only for social.

At the same time, you can apply for a social pension only 5 years after reaching the generally established retirement age. That is, for men, the right to such a pension will begin at 70 years old, for women - at 65 years old.

The size of the social pension is set by the state. Now it is 5283.84 rubles per month.

Does self-employment affect the size of your pension?

Issues of assignment and amount of pensions are regulated, in particular, by the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

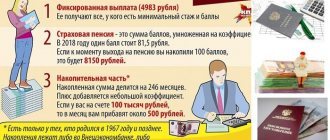

The pension amount depends on:

- on the volume of the fixed payment;

- the value of the accumulated individual pension coefficient (popularly called “pension point”);

- pension point value.

Payment of tax on professional income does not affect the total pension provision of a senior citizen. Accordingly, the pension amount will not change. However, a retiree may lose the right to some benefits or additional payments.

Thus, for the purpose of material support for pensioners whose income is below the subsistence level, a social supplement is provided. In accordance with Part 1 of Art. 12.1 of the Law “On State Social Assistance” dated July 17, 1999 No. 178-FZ, such an additional payment is assigned to those who do not engage in labor or other activities during which insurance premiums are paid for them or by themselves. The Pension Fund provided an explanation on the official website: if a pensioner does not pay insurance contributions, then a social supplement is provided, but if he voluntarily decided to pay, being self-employed, it is not provided.

But in relation to a number of benefits (for example, compensation for utilities), income from activities from which NAP is paid will still have to be taken into account. This rule also applies to all payments that are due to a person due to the fact that he is low-income.

How to earn the right to a pension

If a self-employed person simultaneously works somewhere under an employment contract, the issue of a future pension is less pressing for him, because contributions for him are paid by the employer, the self-employed person has work experience and no points whatsoever.

If the self-employed person is already a pensioner, then the issue of lack of experience and points under NAP is also irrelevant for him.

But the rest of the self-employed, if desired, can voluntarily form their pension rights.

To replenish their individual pension insurance with experience and points, self-employed people need to enter into voluntary legal relations for compulsory pension insurance and pay a contribution.

Contributions to the pension fund for the self-employed

A self-employed citizen annually determines the amount of payments to the Pension Fund within the minimum and maximum thresholds established by law. In 2020, the minimum contribution level (per year) is set at 29,799.2 rubles, the maximum level is eight times the minimum.

If you pay less than the minimum, the length of service for the paid year will be proportionally recalculated.

Important! Transfers of payments for previous years are not provided.

Independent contributions to the Pension Fund

Like any citizen of Russia, a person working for himself has the right to form the funded part of his pension by transferring contributions there. The amount of payments is determined independently.

Various non-state pension programs are available for the self-employed; when participating in them, you don’t have to worry about whether the self-employed have enough service, since the principle for calculating benefits in this option is different.

How many fees should I pay?

Federal Law No. 167-FZ specifies the minimum and maximum amounts of voluntary pension contributions. For ordinary individuals and for NAP payers, they are slightly different.

For the self-employed, the voluntary contribution is accepted as equal to the fixed contributions of the individual entrepreneur.

In 2020, the minimum contribution is 32,448 rubles .

You can pay a smaller amount, but then a period proportional to the payment will be included in the insurance period.

The maximum amount of insurance premiums is calculated based on 8 minimum wages and the contribution rate.

In 2020, the maximum contribution is 256,185.60 rubles .

Contributions can be paid in one lump sum or in installments throughout the year. Payment must be made by December 31st.

KBK - 39210202042061000160 - Insurance premiums paid by persons who voluntarily entered into legal relations for compulsory pension insurance, credited to the Pension Fund for the payment of an insurance pension.

What taxes do self-employed pensioners pay?

Self-employed citizens, regardless of the presence or absence of pensioner status, are NAP payers. This obligation is fixed in Art. 4 of Law 422-FZ.

Citizens applying the special tax regime “NPD”, on the basis of Part 8 of Art. 2 of Federal Law No. 422 are exempt from personal income tax, but only in relation to those incomes that are subject to personal income tax. All other taxes are calculated and paid in accordance with the general procedure.

In addition, self-employed pensioners, like other payers of this tax, are not required to pay contributions to non-state funds and the Pension Fund of the Russian Federation.

How to become a self-employed volunteer

If you decide to pay contributions towards a future pension, you must first register with the Pension Fund of the Russian Federation - voluntarily enter into legal relations under compulsory pension insurance.

To do this, you need to submit to the Pension Fund at your place of residence:

- registration application;

- information confirming the fact of registration with the tax authority as an NPA taxpayer (obtained through the “My Tax” mobile application).

After submitting the application, the Pension Fund will register the self-employed person and issue him a registration notice.

What pension will the self-employed receive?

A citizen will receive a self-employed pension if the following conditions are met:

- registration of a citizen as receiving income from professional activities;

- registration of relations with the Pension Fund of the Russian Federation.

You can receive a funded pension (state or non-state) if an agreement with the appropriate fund was concluded in a timely manner. In other cases, a self-employed person can only claim a social pension.

How to calculate your pension

To calculate the pension of the self-employed population, you will need to know the state of your pension savings. In the taxpayer’s personal account on the official website of the Federal Tax Service on the Internet, you can find out two key numbers:

- accumulated experience;

- number of pension points.

Based on these data, you can calculate the amount of your pension using the pension calculator located on the same portal.

How does the pension of self-employed and hired workers differ?

Self-employed pensions and employee pension benefits differ in size. For hired workers, the figure is higher, because the employer periodically makes contributions to the Pension Fund for each employee. Over the course of a year, the amount of these payments, according to statistical data, is approximately twice as high as payments made by self-employed people. During the same period, workers also receive twice as many insurance points, from which future benefits are calculated.

How is experience calculated?

The insurance period for self-employed volunteers will begin to count from the date they submit the application.

Moreover, the length of service also depends on the amount of contributions paid.

Even if the application was submitted at the beginning of the year (or even the previous year), but before December 31 the self-employed person paid contributions in an amount less than the established minimum, not the entire year will be counted toward his length of service. The Pension Fund will calculate the length of service in proportion to the contributions paid.

Thus, for 1 year of pensionable service in 2020, a self-employed person must pay 32,448 rubles .

What is pension and length of service?

A pension is a cash benefit that the state pays until the end of life to citizens who have reached a certain age. This age limit will increase until 2024 and will be 65 years for men and 60 years for women.

To obtain the right to payment of state benefits, in addition to reaching the established age threshold, you must have a certain length of work experience, which represents the total duration of work. In 2020, this period should be at least 10 years, in 2024 it will be 15 years. The amount of the pension benefit will depend on the length of service.

How are points calculated?

Let's calculate how many pension points a self-employed person will receive if they pay voluntary contributions.

The number of points is affected by three parameters:

- the amount of contributions paid;

- the maximum base for calculating contributions, which is different for each year and is established by the Government;

- the contribution rate, which is now 22%.

The formula for calculating points is as follows:

IPC = (DZ/22*16)/206 720 * 10,

Where

- DV - voluntary contributions;

- 22% - general contribution rate;

- 16% - individual part of the tariff;

- RUB 206,720 — contributions at an individual rate from the maximum base (1,292,000 * 16%)

Thus, having paid the minimum amount of contributions (RUB 32,448), a self-employed person will receive 1,142 points.

Having paid the maximum amount of contributions (RUB 256,185.60), a self-employed person will receive 9.013 points.

What to do with experience when there is no opportunity to work?

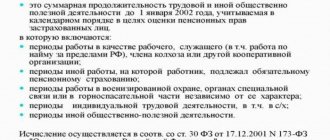

Self-employed people have an advantage over unregistered freelancers. The insurance period is counted for the periods:

- Caring for a socially vulnerable citizen (disabled group I, citizen over 80 years old, child under 1.5 years old). In these cases, the self-employed can simultaneously work (paying taxes under the simplified regime created for the self-employed) and receive benefits;

- Lack of work in the region where the spouse was sent (for example, he is a military man or a diplomat). If a self-employed person has lived in this status for up to 5 years, they will be taken into account in the insurance period.

What will the pension be?

So, we counted the points. How much is this in rubles?

The cost of a point is different every year. From year to year it grows by the indexation coefficient. By law it is established for the period until 2024.

But we will not get ahead of ourselves, predict future inflation, etc.

Let's calculate the increase in pensions in this year's prices. In 2020, the cost of a point is set at 93 rubles.

Accordingly, by voluntarily paying the minimum contributions, a self-employed person will earn 106 rubles. 21 kopecks (1,142*93) future pension.

By voluntarily paying the maximum contributions, a self-employed person will earn 838 rubles. 21 kopecks (9.013*93) future pension.

When calculating the insurance pension, a fixed payment is added to the part calculated based on points, which, for example, in 2020 is 5,686.25 rubles.

As mentioned above, to acquire the right to a pension, a citizen must have at least 15 years of experience and 30 points.

Thus, if a self-employed person decides to pay only the minimum contributions each year, he will have to pay them for an average of 26 years (30/1.142). Then, at age 60/65, she/he will become entitled to an insurance pension.

If a self-employed person decides to pay the maximum contributions each year, they only have to pay them for an average of 3 years (30/9,013). Then, at the age of 60/65, she/he will acquire the right to an insurance pension (of course, provided that 15 years of service have also been accumulated).

If a self-employed person does not want to voluntarily pay contributions to the Pension Fund and the length of service and points from his other work activities are not enough, then, as was said, he will be able to retire 5 years later than his peers. And the pension will not be insurance, but social.

Social pension for the self-employed

Social Pensions are established for Russians if they do not have enough length of service and pension points to establish insurance payments. For the self-employed, this is the most likely outcome.

In this case, there is no need to count on large payments. For example, in 2020, the old-age social pension amounts to RUB 5,606.15 after April 1. Moreover, after the pension reform, the age of retirement gradually begins to increase - 60 and 65 years, depending on gender.

How to increase old age benefits

The legislation provides all citizens, and therefore entrepreneurs, with the right to form savings for the retirement period. The original version of the law established the following rule:

A person can independently distribute part of the mandatory contribution:

- entirely for the formation of insurance benefits;

- shares for insurance and savings.

Attention: a moratorium has been imposed on the transfer of part of the mandatory contribution to old-age savings.

It has been extended until 2021. However, citizens still have the opportunity to form capital through:

- voluntary transfers;

- investment of capital in retirement.

The mechanism of formation of accumulation is as follows:

- A citizen chooses a trusted financial institution:

- non-state pension fund (NPF);

- management company (MC);

- Gives her the right to manage money.

- The selected organization invests savings in order to increase their size:

- accrues income annually;

- reports to investors;

- insures deposits in case of losses.

Attention: if the capital is entrusted to a non-state pension fund, then it is this organization that is responsible for assigning and transferring pension amounts to the investor (after the occurrence of an insured event).

What is self-employment

In order to understand this issue, you should first find out who the self-employed are from the legal point of view.

Let us immediately note that there is no clear formulation for this category of citizens. All attempts to formulate the term “self-employment” turn out to be insufficient and one-sided to varying degrees. The most accurate definition of a self-employed person is a person who works and makes a profit independently (or as part of a group, artel) as a result of his own labor, without an employer, without drawing up an employment contract and without creating a legal entity.

Important! The fundamental difference between a self-employed person and a classical entrepreneur is the absence of hiring workers and the removal of surplus value.

Thus, averaging various regulatory legal acts (NLA), this category of workers includes:

- individual entrepreneurs;

- citizens engaged in private practice (notaries, lawyers, etc.);

- persons providing services to the population in various areas, this also includes freelancers.

And if for other categories of employees all payments to tax and social authorities are made by the employer, then the self-employed must transfer funds for themselves.

What is the procedure for applying for a pension?

The principle of cooperation between self-employed individuals and the country in the process of preparing pension payments should start with registration with the authorities. You should definitely go through the following algorithm:

- Submit papers for registration as an individual entrepreneur, when the data is automatically sent to the Pension Fund database.

- Receive a classic format document confirming state registration.

- Based on personal data, undergo verification under medical and pension insurance programs.

- As an independent entrepreneur, transfer standard contributions, the amount of which is regulated by the state.

If a citizen is going to hire another person to help with his work or starts selling his services under a contract, then he automatically becomes an insured. By law, he is obliged to declare a new IP format within 30 days from the date of cooperation. In order for self-employed persons to receive a pension as an employer, it is additionally worth submitting papers to obtain this right:

- personal statement;

- passport documents;

- SNILS certificates;

- documents on registration in the register of entrepreneurs and tax authorities.

This category of citizens is required by law to provide monthly reports on personalized accounting. In accordance with Art. 430 of the Tax Code of the Russian Federation, pension indexation depends on the type of activity carried out by a self-employed subject and the amount of his income.

With annual earnings not exceeding 300 thousand rubles, the person pays 29,354 rubles. for 2020 and RUB 32,448. for 2020. If annual income exceeds this amount, then they pay a fixed payment for the year (indicated for 2020 or 2020, respectively), plus 1% of earnings. Payment of pension contributions occurs before December 31 of the current accounting year at a frequency convenient for the payer (every month, quarter, or the full amount at once).