The legislative framework

Upon reaching a certain age, a citizen loses the ability to carry out work activities that ensure his living.

When retiring for a well-deserved retirement in old age, each citizen is calculated a pension designed to cover the costs of decent living.

All questions regarding the categories of citizens to whom benefits are intended, the calculation and provision of old-age pensions, as well as other nuances, are fixed in the current legislation:

- Federal Law No. 166 - determines the provisions on the assignment of pension benefits for all segments of the population;

- Federal Law No. 400 is one of the latest amendments, characterized by a description of insurance benefits;

- Federal Law No. 424 - determines the procedure for funded and old-age insurance pensions;

- Federal Law No. 385 is a law designed to make a final adjustment to all issues.

When entering a well-deserved retirement due to old age, a pension is calculated for each citizen

What affects the size of the pension?

The fundamental values for determining the size of the monthly pension benefit will be:

- The salary of a future retiree. The higher this indicator, the greater the monthly benefit will be.

- Duration of work activity. The longer a pensioner worked, the more pension points he receives.

- The age at which a pensioner stops working. The legislator sets the lower limits of the age allowing retirement: for women - 55 years old, for men - 60. If, for example, a man continues to work until he is 65 years old, then this fact will be taken into account when calculating the pension and will affect the growth of benefits.

Accrual procedure

The procedure for calculating the funded benefit has remained unchanged (it is calculated exclusively for people born in 1967 and younger). The reforms affected exclusively the miscalculation when calculating the insurance share.

Its calculation occurs according to a certain formula that determines the final payment amount.

The most significant amendments to the regulation of this issue were introduced in two thousand and fifteen. From that moment on, the total benefit for people who legally went on vacation was divided into an insurance share (the main part of payments) and a funded one.

The estimated old-age benefit is calculated by transferring all funds to the Pension Fund (for official employment) into equivalent points.

Then, this calculation is made by summing up the accumulated points and counting according to a certain formula.

This accrual procedure was introduced in order to achieve greater stability for pensioners given the poor economic situation in the country and the constant rise in inflation.

Upon reaching retirement age, labor compensation is calculated based on the value of points for the current year and at the time of making contributions to the Pension Fund. If, after calculation, the pension turns out to be less than the regional subsistence level, the state provides financial compensation to cover this difference.

In addition, the state government authorities carry out regular annual indexation, as a result of which old-age benefits are revised in favor of an increase.

Pensioners who have been working since two thousand and fifteen can count on additional pension supplements. However, its maximum value will be only three pension points, which is equivalent to 244.47 rubles.

The amount of 1 point for 2020 was 81.49 rubles.

In addition, an increase in benefits also occurs for citizens receiving an insurance pension for the disabled group and old age (a mandatory condition is the deduction of funds from each salary to the Pension Fund).

Calculation procedure

When calculating length of service for various purposes, the employee’s work book and all inserts are used. If it is missing, then the calculation is made on the basis of an employment contract, a certificate from a previous place of work, extracts from orders, salary slips and similar documents.

This is also important to know:

Survivor's benefit or pension - its amount as calculated in 2019

The specific calculation algorithm depends on the purpose of this procedure.

To receive a pension, benefits

In this case, every day of service is important, since the amount of payments depends on the length of the period. For the calculation, all periods of a person’s work are used, including time of municipal service, as well as other types that involve the deduction of insurance premiums.

According to the law, when calculating a month, a period of 30 days is considered, and a year is equal to 360 days.

The calculation procedure is as follows. First, you should write down the start and end dates of all periods of work. After this, the duration of each period is determined accurate to the day. Next, all the numbers are summed up and the number of full years, months, and days is indicated.

For example, a person got a job on September 5, 2012, and quit on December 19, 2014:

- First of all, you should count the days: 25 in September, 19 in December. Total 44 days or 1 month and 14 days.

- Next, count the months: 3 full months in 2012, 11 in 2014. Total 14 months or 1 year and 2 months.

- Then determine the number of full years: 1 year in 2013.

- Now you need to add up all the resulting values: 1 year, 1 year and 2 months, 1 month and 14 days. Total 2 years, 3 months, 14 days.

This indicator is the total length of service.

For sick leave

The calculation to determine the amount of temporary disability benefits is carried out using a work book. The determination of the duration of the working period for this purpose must be carried out to the nearest day. If a person worked at several enterprises, the length of service is calculated for each place of employment.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

The value directly affects the amount of the benefit. That is, the longer the period, the higher the accruals. According to the law, the dependence is as follows:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- with work experience of up to 6 months, the benefit amount is equal to one minimum wage;

- up to 5 years - 60% of the average salary;

- up to 8 years - 80% of earnings;

- more than 8 years - 100% of the average salary.

The calculation method is the same as for determining the size of the pension. For example, if a person’s total work period is 2 years, 3 months and 14 days, then the amount of payments will be 60% of the calculated average salary.

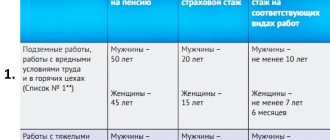

Who is entitled to benefits?

The age category upon reaching which the opportunity to receive a pension can be provided is clearly stated in legislative documents at the state level.

In Russia, you can retire to a well-deserved retirement with a guaranteed benefit after reaching the following ages:

- Men – 65 years old;

- Women - 60 years old.

However, the legislation provides for some factors, under the influence of which it is possible to retire into old age at an earlier age:

- Certain professional activities;

- The birth of five or more children;

- Special conditions under which labor activity was carried out;

- Location of production in certain territories specified in federal legislation.

You can accurately determine whether a professional activity belongs to preferential categories by contacting your local Pension Fund. In addition, the structure’s employees will provide assistance in calculating the coefficient and determine the number of points accumulated over the working years.

In order for the pension payment to be accrued in full, you will need to have a certain amount of insurance coverage when taking your required vacation.

Only the years of official employment during which calculations were made to the Pension Fund of the Russian Federation are taken into account.

In addition, the insurance period during absence from work is also taken into account, but only in the following situations:

- Vacation period;

- Time to care for a child with a certain disability group;

- The period of care for a disabled person of the first group;

- Absence related to caring for a citizen aged eighty or more.

The total work experience also includes periods when a person is paid unemployment benefits.

The procedure for confirming experience

If personalized accounting information is incomplete or insufficient to take into account all the circumstances relevant to the assignment of a pension, they can be supplemented with documents. In this case, the document may be in electronic form.

The requirements for the preparation of such documents are described in detail in the sections of Government Resolution No. 1015 dated 02.10.2014. These include:

- work books;

- labor and civil contracts;

- certificates from place of work or service;

- certificates from other bodies and persons.

If it is not possible to obtain documents, it is permissible to take into account data on insurance experience based on testimony. However, witnesses do not have the right to evaluate working conditions.

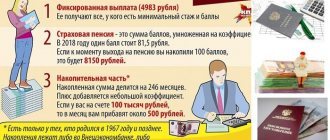

What parts does the pension consist of?

The latest adopted reforms affecting the area of old-age pension payments.

The accumulated benefits were divided into:

- Insurance share;

- Cumulative share.

The formation of the labor pension was made from the two above-mentioned shares. However, recent adjustments have led to the equalization of labor and insurance pension payments.

Since the adoption of the law, all employees in the Russian Federation who have a certain period of insurance payments in the Pension Fund are provided with payment precisely according to insurance savings.

At the decision of the pensioner, part of the funded pension can be paid as an independent payment.

The insurance share is also divided into several parts:

- A fixed rate is an increase to each insurance pension upon reaching a certain age. For the current year, its size fluctuates at the level of 4805 rubles. If pensioners have preferential benefits, they receive a fixed rate in an increased amount;

- The variable part is the same old-age insurance pension. This amount is calculated individually, and the amount depends on the pensioner’s length of service, salary for the position held and insurance premiums paid.

Part of the funded pension can be paid as an independent payment

Fixed part of pension

The provision of increased state benefits for old age is provided for by the legislation of the Russian Federation.

Accrual occurs when taking into account the factors indicated in the table.

| People who are entitled to the fixed portion of the old age pension | Number of citizens in custody | PV size (rub.) |

| Having not reached the age of eighty and not having been assigned a disability group. | — | 4558 |

| 1 | 6 078 | |

| 2 | 7 598 | |

| 3 or more | 9 117 | |

| Having reached the age of eighty, or having been assigned the first disability group. | — | 9 117 |

| 1 | 10 637 | |

| 2 | 12 157 | |

| 3 or more | 13676 | |

| Those under the age of eighty, without a disability group, who have worked in the Far North for at least fifteen years, and with at least twenty years of insurance experience for women and twenty-five men. | — | 6 838 |

| 1 | 9 117 | |

| 2 | 11 397 | |

| 3 or more | 13 676 | |

| Those who have reached the age of eighty, or with the first group of disability, have been working in the territories of the Far North for at least fifteen years, and have an insurance record of at least twenty years for women and twenty-five years for men. | — | 13 676 |

| 1 | 15 956 | |

| 2 | 18 235 | |

| 3 or more | 20 515 | |

| Those under the age of eighty, without a disability group, who have worked in the Far North for at least twenty years, and have an insurance record of at least twenty years for women and twenty-five men. | — | 5 926 |

| 1 | 7 902 | |

| 2 | 9877 | |

| 3 or more | 11 853 | |

| Those who have reached the age of eighty, or with the first group of disability, have been working in the territories of the Far North for at least twenty years, and have an insurance record of at least twenty years for women and twenty-five years for men. | — | 13 676 |

| 1 | 13 828 | |

| 2 | 15 804 | |

| 3 or more | 17 779 | |

| Citizens who have worked in agriculture for at least thirty years, are not burdened with labor, with mandatory pension insurance, living in rural areas. | — | 4 918 |

| 1 | 6 230 | |

| 2 | 7 542 | |

| 3 or more | 8853 |

The last category of citizens was added to the list of beneficiaries for whom the bonus is calculated only in the latest amendments.

Its effect does not apply when citizens move to urban areas.

Counting Features

When entering data into the calculator, you must adhere to the requirements prescribed in the relevant article of the Federal Law on the calculation of pensions.

- Calendar order . It is necessary to take into account the dates indicated in the work book or tax returns (for individual entrepreneurs). If two or more insurance periods coincide, as a rule, one of them is taken into account (more profitable for the pension recipient).

- Only RF . If a citizen has the right to a pension according to foreign laws, then to the extent that they do not coincide with the norms of the Russian Federation, this time will not be taken into account when calculating the length of service.

- Labor in subsistence farming . Self-supporting people, members of farms and various communities can include their labor time in their length of service if they have made contributions to the Pension Fund.

- Work for an individual . If a person worked for another person in accordance with a concluded contract, this period is considered an insurance period if the corresponding contributions were paid.

- Copyright royalties . Persons who sold copyrights to their works, as well as licenses, patents, etc., if they paid contributions to the Pension Fund of the Russian Federation from the funds received no less than the established amount, can include a period proportional to their contributions in their length of service.

- Does not have retroactive effect . If, according to the previously effective legislation of the Russian Federation, certain periods were included in the length of service, which was subsequently changed, they can be added to their total insurance experience.

What is IPC?

In addition to dividing the pension into two shares, recent amendments to the legislation have also brought an individual pension coefficient, also called a pension point.

This indicator is used when calculating old-age pension payments.

The higher the IPC indicator, the larger the amount of payments a citizen is entitled to.

The components of the IPC are the sum of the APC (annual pension coefficients), which are points awarded by summing up annual transfers from the official salary to the Pension Fund.

In case of unofficial employment, no transfers to the Pension Fund are made.

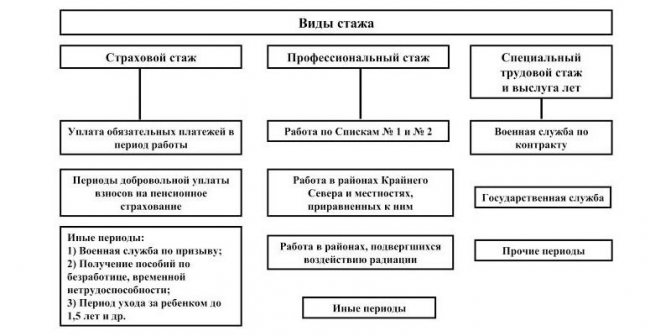

Types of insurance experience

Old age payments are assigned and calculated based on three types of length of service:

- General insurance. Summarizes all working periods of citizens. They are recorded in the work book. Total output also covers non-work segments of citizens’ lives, determined by law.

- Continuous. Work in the same organization or at different enterprises, but the transition period does not exceed 1 month (3 weeks if the employee quit of his own free will).

- Special (professional). This is the total duration of work in a profession associated with conditions that are harmful or dangerous to life and health, work in areas with a harsh climate, for example, the northern regions of the country.

How to calculate your old age pension yourself?

Federal laws provide a specific formula by which the coefficient can be calculated for any citizen, which is taken as the basis when calculating the amount of benefits.

To calculate the coefficient for the entire year, use the following formula:

The above calculation of annual points consists of three indicators:

- GPK - annual pension coefficient;

- SSP – the amount of insurance pension contributions collected from the employee’s total profit for one year;

- SSM - the amount of insurance fees in the amount of sixteen percent of the maximum salary subject to insurance contributions, which is annually established by the RF Government;

- 10 – used to make the calculation of pension points simpler. In addition, the number ten is the maximum allowed number of points accumulated over the year.

Pension points in the amount of 10 will be awarded exclusively from two thousand and twenty-one. Also, such a coefficient will be provided to those who do not participate in the formation of funded pension payments.

State authorities have provided for a gradual increase in the coefficient since the adoption of the law (2015) for subsequent years, which is shown in the table below.

| Year of granting old-age pension | The maximum IPC indicator when forming a funded pension | The maximum IPC without the formation of a funded pension |

| 2015 | 4.621 | 7.39 |

| 2016 | 4.89 | 7.83 |

| 2017 | 5.16 | 8.26 |

| 2018 | 5.43 | 8.7 |

| 2019 | 5.71 | 9.13 |

| 2020 | 5.98 | 9.57 |

| 2021 onwards | 6.25 | 10 |

As an example, if the coefficient calculated in 2020 is 9.7, then the payment is calculated only at the maximum coefficient of 8.26.

The IPC is derived by summing the GPC for all officially employed years when transfers were made to the Pension Fund.

Accordingly, the higher the employee’s official salary, the higher the individual pension coefficient.

It follows from this that the larger the IPC, the larger the size of the pension intended for him.

where GPC2015 is the number of pension points earned by a citizen in 2020, GPC2016 - in 2016, etc.

The higher the employee’s official salary, the higher the individual pension coefficient

Classification

Regulatory acts distinguish between several types of length of service.

General

Defined as the duration of work under employment contracts . Social activities also fall into this category.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Breaks in work do not affect the length of the period, since the calculation is based on the total amount of time worked. That is, if for some reason a person was not officially registered in the organization, with further continuation of activity, the length of service will increase, its countdown will not start all over again. In this case, the break period itself is not added to the working period.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Based on the value of this indicator, pensions are calculated for long service, disability, and old age.

The types of activities to be included include:

- work under an employment contract, including work that began before the formation of the USSR, as an employee, worker, member of a collective farm or any other enterprise;

- other work during which the person was subject to state insurance;

- activities in residency, graduate school, etc.;

- military service;

- individual entrepreneurial activity;

- working hours under contract agreements;

- participation in paid public works.

The following periods of time are not included in the total length of service:

- training in universities and colleges;

- caring for a disabled person of group I;

- residence of military spouses in areas where they could not find employment due to the impossibility of this action;

- residence abroad of spouses of employees of any international organizations, as well as Soviet institutions;

- caring for a child during the period starting 70 days before his birth and ending with reaching the age of 3 years;

- caring for a disabled child until he reaches the age of 18.

Special

This type is understood as the total period of labor activity in certain industries, in certain positions, in established areas, under special conditions .

These activities include:

- work in difficult climatic conditions, for example, in the north;

- hazardous industries;

- work in areas exposed to dangerous radioactive radiation;

- employment in the intelligence services.

Based on this period, a special preferential pension is assigned. Length of service is also provided.

Continuous

Represents a period of prolonged work in one or more enterprises .

Until 2007, the value of this period influenced the calculation of payments for sick leave. However, currently the amount of this benefit is determined depending on the total length of insurance coverage.

Continuity is maintained in cases where:

- the break in work was no more than a month;

- a woman has a disabled child under 16 years of age;

- the break after dismissal by agreement of the parties is less than three weeks;

- the dismissal was caused by the transfer of the spouse to another area, as well as retirement.

The value of this indicator is not used to calculate pension payments.

Example of calculating individual coefficients

Before you start calculating the amount of pension payments, you need to understand that twenty-two percent of the funds are deducted from the employee’s official salary to the Pension Fund.

Which are intended for:

- Sixteen percent is transferred to create the employee’s insurance pension. At the request of the employee: ten percent is charged to the insurance part, and six percent to the savings part;

- Six percent goes to the Pension Fund account. It is from them that a fixed rate of insurance pension is paid to pensioners.

Calculation of the Civil Procedure Code with an accrual of 10% of the official salary

Melnichenko A.G. received salary the fee in two thousand and sixteen was 40,000 rubles per month. At the request of the employee, the employer paid ten percent for the insurance pension and six percent for the funded share of the pension.

The calculation of the number of contributions paid to the insurance share will be:

40,000 rubles x 12 months x 10% = 76,800 rubles.

For 2020, the maximum salary subject to payment in the Pension Fund was 796,000 rubles. The maximum annual payment per worker was 127,360 rubles.

The amount of pension payments will be:

Calculation of the Civil Procedure Code with the accrual of ten percent of the official salary

Calculation of the Civil Procedure Code with accrual of 16% of the official salary

Let's consider the same Melnichenko A.G. with the same level of official salary for the year two thousand and sixteen.

If the employer pays sixteen percent of the annual salary, the following contribution amount can be calculated:

40,000 x 12 months x 16% = 76,800 rubles

From this you can calculate the 2020 coefficients for Melnichenko A.G. according to the following formula:

When transferring exclusively insurance pensions, the coefficient is much higher, which implies many times larger accruals of old-age pensions.

Example of old age pension calculation

Benefits can be calculated using the new formula:

SPS = FV × PC1 + IPK × SPK × PC2

Melnichenko A.G. reached retirement age in 2020. In the process of two thousand and fifteen, his pension entitlement was converted into equivalent points. By summing up all points earned, the size of the insurance pension was 91.6 points.

- Fixed payment – 5000 rubles (presumably);

- The pension point amount is 81.49 (for 2018).

Therefore, it is calculated using the formula:

ATP = FV x IPK x SPK

5,000 rubles + 91.6 x 81.49 rubles = 12,464 rubles – the amount of Melnichenko A.G.’s insurance pension.

Explanations from the Social Insurance Fund on the procedure for calculating length of service

At the end of 2020, the FSS indicated that periods of work (service, activity) are calculated on a calendar basis based on full months (30 days) and a full year (12 months). In this case, every 30 days of these periods are converted into full months, and every 12 months of these periods are converted into full years (FSS Letter No. 02-08-01/17-04-13323l dated December 17, 2018). The request submitted to the FSS can be viewed here.

However, it is not safe to use these clarifications, since they are not a normative document. In addition, they contradict previously given clarifications, according to which the transfer of 30 days to full months and 12 months to full years is provided only for incomplete calendar months and incomplete calendar years (Letter of the Federal Social Insurance Fund of the Russian Federation dated December 9, 2016 N 02-09-14/15- 02-24113). The insurance period calculated in accordance with the new clarifications of the FSS will be higher than under the old rules. And this is fraught with disagreements with a specific branch of the fund.

Extra points

In addition, federal legislation awards an additional number of points from 1.8 to 5.4 points for certain stages of life when insurance premiums were not charged:

| Life circumstances | Allotted number of additional points (per year) |

| Time spent serving in the army. | 1.8 |

| Lack of care for a newborn up to the age of 1.5 years. | |

| Term for caring for people with disabilities (as well as children with disabilities), or pensioners over eighty years of age. | |

| When caring for a second child. | 3.6 |

| When caring for a third or more children (total period no more than six years). | 5.4 |

| Maternity leave for twins, etc. | Odds do not add up |

How is it calculated

Rules for calculating insurance output:

- the calculation is carried out according to the calendar principle - yearly;

- when the non-work period (which is counted) and work overlap each other, the citizen himself chooses which of these to take into account;

- the activities of citizens working under civil contracts and other self-employed are included only if there were insurance contributions to the Pension Fund;

- pensioners with a pension for long service and for disability related to work in the law enforcement agencies can receive old-age insurance benefits instead if they are employed after their military retirement;

- for representatives of seasonal professions, a working period of 2 to 5 months is counted for the actual year of production;

- For authors, the calculation is based on insurance premiums from their contracts, and if the amount exceeds the minimum, this is equivalent to a year.

Premium odds

Government authorities do their best to encourage citizens who have reached retirement age to retire as late as possible.

This is taken into account when calculating the old-age pension in the form of an additional coefficient, which is provided to those pensioners who continue to work with the required pension.

The bonus coefficients provided for by federal legislation when calculating old-age pensions are shown in the table below.

| Number of months | IPC increase coefficient | PV increase factor |

| Less than 12 | 1 | — |

| 24 | 1.07 | 1.056 |

| 36 | 1.15 | 1.12 |

| 48 | 1.24 | 1.19 |

| 60 | 1.34 | 1.27 |

| 72 | 1.45 | 1.36 |

| 84 | 1.74 | 1.58 |

| 96 | 1.9 | 1.73 |

| 108 | 2.09 | 1.9 |

| 120 or more | 2.32 | 2.11 |

How to apply for an old-age pension?

To receive government benefits, you will need to visit the local Pension Fund, where you need to provide all the necessary documents.

To apply for a pension benefit, you will need the following package of documentation:

- Completed application;

- Copy of the passport;

- A copy of the work book confirming official employment;

- Conclusions obtained from companies where the candidate for payment worked;

- Photocopy of the insurance certificate issued by the Pension Fund;

- Extract from payroll records for the last five years;

- When changing your name, you will need official certificates confirming this;

- Photocopy of military ID;

- Certificate for citizens supported by the candidate;

- A document confirming registration or place of residence;

- Photocopies of certificates of disability, or the presence of relatives requiring regular care;

- Conclusions that confirm the presence of periods of life when the citizen did not work, but has the right to include them in his work experience;

- Bank details (Sberbank), to which the old-age pension will be received every month.

When providing photocopies of documents for the first time, you will need to take the originals with you.

Do not confuse insurance and work experience

The concepts of insurance and work experience are often confused, but they differ fundamentally:

This is also important to know:

We formalize the transfer to a non-state pension fund

The insurance period is the time when insurance premiums were paid for the employee (plus the periods listed above).

Work experience is the sum of all periods of an employee’s work activity.

The main difference is that the length of service includes all vacation periods at your own expense. They will not be included in the insurance period, because at that time no insurance premiums were deducted for the employee.