Every citizen of the Russian Federation who has reached retirement age and decided to end his working career can apply to the territorial body of the Pension Fund or the MFC to receive an insurance pension. The day the pension is assigned will be counted from the date of submission of a written application to one of the specified authorities with a package of documents. This norm is established in Article 21 of Federal Law No. 400 of December 28, 2013.

You can learn from this article about how old-age insurance pensions are paid, within what time frames are paid and delivered, and what delivery methods exist.

Is it possible to receive an insurance pension?

The procedure for assigning and paying the insurance part of pensions is regulated by Law No. 400-FZ, adopted in December 2013 and subject to significant adjustments in 2020, in connection with the pension reform ongoing in the country.

Issues of receiving the funded part of the benefit are determined by Law No. 360-FZ, in force since November 2011.

Many people are interested in what part of the pension can be received in their hands at a time: funded or insurance.

The pension insurance system involves the monthly accrual of a pension to the recipient who has ensured the fulfillment of the necessary conditions. The full amount of insurance cannot be received at a time, since the insurance system is based on the collection of insurance pension contributions, from which regular payments are made. Unlike the insurance part, the savings part can be received in the form of a lump sum payment if the pensioner has sufficient accumulated funds in the Pension Fund account.

It is important to understand how to return the funded portion of contributions. A funded pension can be received as a one-time payment with a frequency of no more than once every five years. The refund option applies to the following pensioners:

- Male citizens born no later than 1953 and female citizens born before 1957, because only persons of the specified age characteristics will have time to accumulate enough funds to receive payments. This also applies to people who saved money for maternity capital and participated in the state co-financing program.

- Persons of pre-retirement age.

- Participants of the state and non-state fund for the accumulation of pension payments.

- Citizens whose share of the funded pension is at least five percent of the insurance pension.

To receive the accumulative part of the accruals, you must submit a corresponding application to the Pension Fund, identifying yourself with a passport and attaching a SNILS certificate.

Benefits for pensioners in the Russian Federation

Social benefits for pensioners for 2018:

- no need to pay property tax (if there is 1 owner), land and transport tax;

- no deductions in the form of personal income tax;

- targeted assistance;

- payment for travel to the vacation spot and back once every 2 years (regions of the Far North);

- providing leave at your own expense upon request for working citizens;

- reduction in the cost of travel documents.

In the regions, local measures can be determined to reduce the burden for pensioners.

In some regions, pensioners have the right to discounted travel on public transport

Conditions for receiving the insurance part of the pension

The conditions for calculating insurance benefits include:

- reaching the age mark for males of at least 65 years, for females - from 60 and above;

- earned minimum insurance period – 15 years or more;

- availability of a pension coefficient of 30 points and above.

Article on the topic: Features of voluntary pension insurance

In connection with the reform of pension legislation being carried out in the country, the age and coefficient indicators are increasing gradually, with the achievement of the above marks by 2024.

Certain categories of recipients may receive payments ahead of schedule. This applies to the following persons:

- workers employed in harmful or dangerous work and who have earned the length of service established by law;

- women with over 37 years of experience and men over 42 years of age, with the right to assign payment of the insurance portion according to age two years earlier.

In addition to age indicators, the insurance part of pension payments may be assigned in connection with disability or loss of a breadwinner.

The applicant receives the right to receive insurance benefits if the conditions provided for this are met, immediately upon reaching the established age limit, upon assignment of a disability group or loss of a breadwinner.

What besides work is counted towards experience?

When calculating the insurance period, 2 rules are used:

- for periods of working activity before the beginning of 2020, the procedure that existed before the pension reform is used;

- after 2014 - on the basis of Federal Law No. 400 “On Labor Pensions”.

Military service in the army is counted towards the total length of service

In addition to the moments of implementation of the labor process, the length of service includes:

- service in the armed forces of the Russian Federation;

- the period of caring for dependents (a child with disabilities, an elderly person over 80 years old, a disabled person of group 1);

- time of absence of a workplace for wives of military personnel in closed garrisons, etc.;

- parental leave for up to 1.5 years (no more than 6 years in total);

- periods of unemployment and receiving state benefits;

- temporary periods of serving a sentence in correctional institutions if a citizen is found innocent after a period of stay there.

The length of service includes the period of caring for no more than four children. Starting from the fifth, a woman has the opportunity to retire earlier than the period established by law.

A citizen himself has the right to decide where to store the savings portion: in a non-state pension fund or Pension Fund.

What determines the size of the insurance pension?

The size of the insurance portion of the payment that a citizen can receive is determined by the length of service - the number of years of payment of contributions to the Pension Fund and equivalent non-insurance periods and the amount of earnings. These criteria are expressed in the calculated value of the individual pension coefficient (IPC).

Another indicator is the cost of the IPC, established at the time when the future pensioner submitted an application intending to receive a pension.

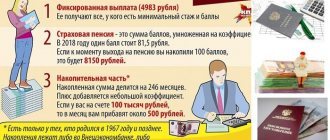

The amount of the accrued pension that can be received by an applicant who has ensured the fulfillment of the established conditions is determined by the following formula:

P = K×SK + FF, in which

- P – monthly payment amount;

- K – current value of the pensioner’s IPC;

- SC – the cost of one point at the time of accrual of payments;

- PF is a fixed part common to all pensioners on a specific date of registration of the pension.

It is easier to consider calculating the amount of a pension using a specific example.

Citizen N turned 61.5 years old by the beginning of 2020, having achieved an IPC value of within 130 points. The cost of one point as of February 2020, when the application was submitted, was 93 rubles. with a fixed part size of RUB 5,686.25.

The amount of pension paid to citizen N will be:

P = 130×93 + 5,686.25 = 17,776.25 rub.

The recipient does not have to calculate the amount of the insurance portion of pension savings. It is enough to use the calculator proposed by the Pension Fund of Russia, presented on the official website of this structure.

Article on the topic: Features of pension and life insurance for pensioners

Also, pensions received annually by non-working citizens are subject to indexation, taking into account the impact of inflation. The size of compensation allowances is determined by the rate of inflation processes.

How to collect the insurance part of your pension

If there are appropriate grounds for receiving the insurance part of the pension, the citizen can begin to process these payments. Next - more details about how to apply for benefits and what papers you need to take for a visit to the Pension Fund.

Who is entitled to payment?

Find out more about who is entitled to these payments. The possibility of receiving an insurance pension applies to the following persons:

- Russian citizens who participated in the pension insurance system and regularly made contributions to the Pension Fund;

- disabled relatives of the above persons in cases provided for by law;

- foreigners and stateless persons registered in the Russian Federation on a permanent basis and who have received the right to these payments on an equal basis with Russian citizens.

The listed categories of persons can receive the insurance part of the pension if the above conditions for age, length of service, and also in the presence of other grounds providing such an opportunity are met.

Where to contact

To receive an insurance pension, you must contact the following authorities:

- PFR branch located at the applicant’s place of residence;

- in the MFC - acting as an intermediate link and providing assistance to citizens in communicating with government agencies.

An alternative option involves remote registration of benefits by submitting an application electronically through the State Services portal. To do this, you must first obtain an account and log in to the resource. Documents in paper form are provided after consideration of the electronic application to the Pension Fund branch.

It is also possible to send documents by mail.

What documents are needed to obtain

The submitted application is accompanied by the following documentation:

- the applicant's civil passport;

- work book and other documentary evidence of insurance experience;

- a certificate of the average monthly salary received for the previous 60 months in a row, based on the results of labor activity before 2002;

- SNILS certificate.

Depending on the basis for receiving the insurance portion of payments, it may be necessary to provide a death certificate of the breadwinner, a disability certificate and an MSEC conclusion, and other papers. The need to provide additional documents to the applicant will be indicated by the Pension Fund or MFC employee accepting the papers.

If the work book does not contain information about individual periods of work, the data can be restored by providing a certificate from the relevant employer or in court, subject to the availability of witness testimony confirming the specified fact of employment.

A retirement application is drawn up on a standard form, indicating the following information:

- names of the authority where the papers are submitted;

- information about the applicant;

- presence of Russian citizenship;

- residence addresses abroad if a foreigner is applying for a pension;

- registration address in the Russian Federation and actual place of residence;

- telephone number and passport details;

- gender

Related article: Pension insurance and compulsory insurance

A sample application can be downloaded here.

The document allowing you to receive payments is confirmed by the personal signature of the applicant and the current date is indicated.

You can get acquainted with an example of a completed application on the official website of the Pension Fund or obtain a document at a branch of this fund.

Appointment and payment terms

The period for review by the Pension Fund of the submitted documents for receiving benefits is within 10 days, excluding weekends and holidays.

Note! The process of processing documents submitted for retirement may be suspended for up to three months if the papers attached to the application are insufficient and it is necessary to provide additional documentary evidence from previous places of work.

Features of receiving the insurance part of a pension by a working pensioner

The peculiarity of receiving the insurance portion of payments for pensioners who continue to work is that the employer can apply for the accrual of benefits instead.

Unlike pensioners who have completed their working careers, for working citizens, the insurance benefit is not indexed annually, increasing only in connection with the actual increase in the length of service.

The procedure for paying an insurance pension after the death of a pensioner

Many people are interested in whether it is possible to take away the pension left after deceased relatives. The possibility of inheritance by the relatives of a deceased citizen of his remaining unused pension is provided only in relation to the funded part, subject to the presence of a balance in the account. A sample application can be downloaded here.

The accrual of the due insurance portion of the deceased's pension ceases after the death of the recipient. The specified payment cannot act as an inheritance item. Relatives can receive only part of the pension after the death of the recipient for the period until the end of the month in which the pensioner died. The only option that allows you to receive additional assistance from the state as financial compensation is to apply for an insurance pension for the loss of a breadwinner from the Pension Fund of the Russian Federation, if the dependent was supported by the person to whom the insurance part of the benefit was accrued.

The law does not provide for the possibility of inheriting the insurance part of the pension.

Pension savings are created to support a person at the end of his working career, when his age and state of health no longer allow him to work. We can only hope that the domestic insurance and funded pension system will create sufficient conditions for a decent standard of living for retired citizens.

Video on the topic of the article

Personal presence

In each of the listed cases, the formation of accruals begins even before the citizen applies to the Pension Fund. But personal presence in the organization may be required if clarification of certain information is necessary. This usually concerns the data that the pensioner himself wants to know.

When planning to retire, a citizen should collect and prepare all the necessary papers and certificates in advance. The sooner he contacts the appropriate organization, the faster and easier the procedure will be. In the article we talked about the timing of applying for an old-age pension.