Continuous work experience at an enterprise in harmful and dangerous working conditions is called “hot” experience. “Hot” experience (in fact, it is harmful experience) is part of such a concept as “preferential pension”, which involves retiring before reaching the general retirement age. Which professions are classified as “hot” seniority and how to calculate it can be found in this article.

The concept of hot experience

Such a term cannot be found in the current legislation of Russia; it did not exist before, including in the regulations of the USSR. It is used as a general term, and now it should be understood as a period of work that, according to the legislation on insurance pensions, allows you to go on a well-deserved retirement ahead of schedule with the appointment of monthly payments.

In a narrow sense, those who are mentioned in paragraph 1 and paragraph 2 of Part 1 of Art. 30 of Law 400-FZ, i.e. These are those workers who are engaged in underground work, have hazardous conditions, were involved in hot shops or were employed in work with difficult conditions.

In a broader sense, this can also include other categories mentioned in the article, be it women tractor drivers, locomotive train workers, civil fleet workers, public transport drivers, etc.

Each category mentioned in Art. 30 of the said regulatory document has its own individual conditions for the appointment of state support, including age, general and special experience, conditions for fulfilling one’s duties under the contract.

We will focus on the first two types, which belong to the so-called Lists 1 and 2, which were approved back in the USSR, but were not canceled and continue to operate. The first includes positions and professions with hazardous conditions (including hot shops, from which the type of work period under consideration received its name), the second - with difficult ones.

Basic provisions of Russian legislation on pension provision for citizens.

In accordance with Article 39 of the Constitution of the Russian Federation, the state guarantees every citizen social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law.

The provisions of Part 2 of Article 6, Part 4 of Article 15, Part 1 of Article 17, Articles 18, 19 and Part 1 of Article 55 of the Constitution of the Russian Federation presuppose legal certainty and the associated predictability of legislative policy in the field of pension provision necessary so that participants in relevant legal relations can reasonably foresee the consequences of their behavior and be confident that the right acquired by them on the basis of current legislation will be respected by the authorities and will be implemented by citizens.

The Constitutional Court of the Russian Federation in resolution No. 2-P of January 29, 2004, with reference to resolution No. 8-P of May 24, 2001 and ruling No. 320-O of November 5, 2002, indicated that in relation to citizens who acquired pension rights Until the introduction of new legal regulation, previously acquired rights to a pension are preserved in accordance with the conditions and norms of the legislation of the Russian Federation in force at the time of acquisition of the right.

In accordance with paragraph 8 of Article 13 of the Law “On Insurance Pensions” No. 400-FZ: When calculating the insurance period for the purpose of determining the right to an insurance pension, periods of work and (or) other activities that took place before the entry into force of this Federal Law and were counted when assigning a pension in accordance with the legislation in force during the period of work (activity), may be included in the specified length of service using the rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured faces.

When assigning a pension to a citizen, the principle of giving retroactive effect to legislative acts that improve the situation of citizens is taken into account. That is, new laws that improve the situation of citizens automatically improve the situation of those citizens who have already entered into certain legal relations even before the adoption of this legislative act.

Who is entitled to a pension and what is included in the seniority

Preferential benefits (at an earlier age) are granted to those Russian citizens who meet the following criteria:

- have reached the legal age (it is different for these two lists);

- have behind them the necessary period of work under harmful or difficult conditions (depending on the grounds for retirement);

- have earned insurance experience of the appropriate duration (in total with other non-preferential types of work);

- their insurance contributions generated an IPC (number of points) of at least 30.

In order to correctly count the periods providing the benefit in question, you need to familiarize yourself with the norms of Law 400-FZ and the lists approved by the Cabinet of Ministers of the USSR. List 1 includes such types of work as mining, ore mining, metallurgical, chemical, etc. The second includes professions and positions occupied, including in the same industries, but which are not affected by harmful factors.

In addition to the above categories of citizens, railway workers who are part of locomotive crews and those responsible for organizing transportation are entitled to a preferential pension based on their seniority.

How periods of training and retraining of employees are taken into account.

In accordance with subparagraph (h) and (i) of paragraph 109 of the resolution of the Council of Ministers of the USSR No. 590 dated August 3, 1972, in addition to work as a worker or employee, the following is also counted in the total length of service: (h) - training in schools and schools of the state labor reserve system and vocational education systems (in trade schools, railway schools, mining schools and colleges, factory training schools, agricultural mechanization schools, technical schools, vocational schools, etc.) and in other schools, schools and courses for personnel training, advanced training and retraining; (i) - training in higher educational institutions, secondary specialized educational institutions (technical schools, pedagogical and medical schools, etc.), party schools, Soviet party schools, trade union schools, workers' faculties; stay in graduate school, doctoral studies and clinical residency.

When assigning old-age pensions, the periods specified in subparagraph “i” are counted towards the length of service provided that these periods were preceded by work as a worker or employee, or service in the Armed Forces of the USSR, or other service specified in subparagraph “k” (military service).

Based on Article 1 of the Labor Code of the Russian Federation, the goals and objectives of labor legislation include professional training, retraining and advanced training of workers directly from a given employer. In accordance with Article 21 of the Labor Code of the Russian Federation, an employee has the right to professional training, retraining and advanced training in the manner established by this Code and other federal laws. Based on Art. 196 of the Labor Code of the Russian Federation, the need for professional training and retraining of personnel for their own needs is determined by the employer.

The employer provides professional training, retraining, advanced training of employees, teaching them second professions in the organization on the terms and in the manner determined by the collective agreement, agreements, and employment contracts.

For employees undergoing vocational training, the employer must create the necessary conditions and provide guarantees established by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract.

Conditions of registration

Let's consider the requirements for citizens who apply for early assignment of a pension based on active service, depending on the grounds (list) in the form of a table:

| Criterion | List 1 (harmful conditions, underground work, hot shops) | List 2 (severe conditions) | ||

| men | women | men | women | |

| permissible retirement age, years | 50 | 45 | 55 | 50 |

| minimum special experience (with harmful or difficult conditions), years | 10 | 7,5 | 12,5 | 10 |

| total insurance period, years | 20 | 15 | 25 | 20 |

| IPC value | 30 | |||

If there is an incomplete period of work that provides a benefit, mentioned in the table, the citizen retains the opportunity to retire early for a well-deserved rest. To do this, you must meet all the criteria listed above, except one.

The period of work in hazardous or difficult work in this case must be at least half of the established period. Moreover, according to list 1, the generally established age (60 and 55 years for men and women, respectively) is reduced by 1 year for every half year of work in the relevant positions and professions, and according to list 2 - for every 2.5 or 2 years for men and women respectively.

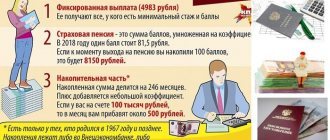

Miner's pension amount

The amount a miner who has worked for 20 years will receive depends on his length of service, the value of the IPC and the region of residence.

The formula for calculating the amount receivable is as follows:

P = A x B + C, where

P – monthly payment amount;

A – the number of accumulated pension points;

B – the cost of the individual coefficient (in 2020 it is equal to 81.49 rubles);

B – the amount of the fixed payment according to the law.

The minimum size of a miner's pension cannot be lower than the minimum wage, which from January 1, 2020 is 12,130 rubles.

Additional payments for overtime

We are talking about workers who worked at the mine in excess of the mandatory minimum for pensions. That is, more than 25 or 20 years (leading specialists and equivalent). Such employees can count on a monthly additional payment. It is paid from the contributions that the company paid to the Pension Fund.

Question:

What determines the amount of increase (EDV) to a miner’s pension?

Answer:

The amount of the monthly increase depends on the size of the salary, the average salary in Russia and the amount of insurance premiums. The duration of work in hazardous conditions also matters.

The rate of bonus for length of service (exceeding the mandatory length of service) in 2020 was 55%. Each “extra” year adds 1% to it. The maximum surcharge for overtime is 75%.

Retirement age based on longevity for men and women

The age required for preferential state provision mentioned in the article . This means that it was not affected by the overall increase and will remain unchanged throughout the transition period. Accordingly, the general figures from the table above allow you to find out the age of retirement.

Attention! Do not forget about the preferential age if you have half of the minimum established duration of work in jobs with harmful or difficult conditions. It will also differ depending on the gender of the employee, the period of work in such positions, and the category to which he belongs. Let's look at these ages in the table below.

| List 1 | List 2 | ||||||

| men | women | men | women | ||||

| Duration of special length of service (DSS), years | Retirement age (GDP), years | DSS, years/ months | GDP, years | DSS, years/months | GDP, years | DSS, years | Runway, years |

| 5 | 55 | 3/9 | 52 | 6/3 | 58 | 5 | 53 |

| 6 | 54 | 4 | 51 | 7/5 | 57 | 7 | 52 |

| 7 | 53 | 5 | 50 | 10 | 56 | 9 | 51 |

| 8 | 52 | 6 | 49 | ||||

| 9 | 51 | 7 | 48 | ||||

The right to early retirement pension arises only if all other conditions are met, including the general insurance period and the amount of the IPC.

Temporary transfer to another job.

In accordance with paragraph 17 of the Resolution of the Ministry of Labor of the Russian Federation dated May 22, 1996 N 29 “On approval of the explanation “On the procedure for applying Lists of works, professions, positions and indicators, giving in accordance with Articles 12, 78 and 78.1 of the RSFSR Law “On State Pensions” in the RSFSR "the right to an old-age pension in connection with special working conditions and to a pension for long service" when transferring an employee from a job provided for in the Lists to another job not provided for in the Lists, for a period of up to one month during the calendar year in the case of production If necessary, such work is equivalent to the work that preceded the translation.

According to paragraph 6 of the explanation “On the procedure for applying Lists No. 1 and 2 of production, work, professions, positions and indicators that give the right to an old-age pension (old age) on preferential terms, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 N 10", approved by the Directive of the Ministry of Social Security of the RSFSR dated May 15, 1991 N 1-57-U, when transferring an employee enjoying the right to preferential pension benefits to another job due to production needs or to provide patronage assistance in carrying out agricultural, construction and repair work on collective farms and other agricultural enterprises, the time of such work, not exceeding one month during the year, is equal to the previous work.

Calculation of pension for harmful activities using hot grid

In order to correctly calculate the right to early retirement based on seniority, you need to know the basic rules for calculating it.

These include the following:

- It is counted when performing work on a full-time or shift basis, depending on the terms of the employment contract and internal labor regulations (but not less than the established duration of the working month and the number of working hours per month).

- It is necessary to deduct insurance contributions to the Pension Fund of the Russian Federation.

- Those periods when the employee received benefits due to temporary disability (simply put, was on sick leave) are also included.

- Annual vacations (both main and additional) do not interrupt it.

- Calculated calendar (in years, months, days).

- If it is impossible to work full time (based on legal requirements) and if the work week is part-time, the length of service is counted according to the time actually worked.

- In some cases, special calculation rules apply, for example, for seasonal work of 6 months or more, they are counted for the full calendar year.

- Periods of suspension from work are not included.

Attention! The rules for calculating periods of work that give the right to preferential early state support are approved by the government. These can be both general rules and the calculation procedure for specific professions and positions or their groups. These, for example, are the Rules approved by Decree of the Government of the Russian Federation of July 11, 2002 No. 516.

Let's give an example of a calculation. The man worked for 6 years as an electrician in underground mining operations and for 2.5 years as a site manager in the same industry. Both of these positions are included in List 1, respectively, both periods are summed up and total 8.5 years.

After this, the employee held other positions that were not associated with harmful conditions; the total insurance period of his work activity was 23 years. This person has not met the special service criterion, but he can still retire with benefits. From the table above, it is clear that he is eligible for assignment of security at 52 years of age.

Calculation of regular monthly benefits

When calculating regular monthly benefits, the totality of all full working days is taken into account, subject to the required contributions (by the employer or employee) to the Pension Fund. The length of service also takes into account leave (maternity, child care and annual) and periods of temporary disability.

According to the law, the calculation of regular monthly benefits is carried out according to the established formula

: the total amount of a citizen’s length of service is multiplied by a fixed amount approved by the state (78.28 rubles).

The amount of payments is determined by law (Article 15 of the Federal Law). Payments are made monthly.

You can receive benefits at the nearest state post office, through banking institutions or through other organizations that deliver benefits. A pensioner can choose or change the method of receiving payments independently by contacting the nearest Pension Fund branch.

The legislation clearly spells out all the features of a citizen’s right to receive regular monthly benefits ahead of schedule. Knowledge of these aspects will help to avoid difficulties in the process of processing these payments upon reaching retirement age.

How to apply for a pension if you had a long period of service

The procedure for registering security is essentially no different from the usual one. The applicant must contact the territorial branch of the Pension Fund in advance, who will advise and, if necessary, help collect a package of documents.

Confirmation of the presence of preferential periods of work can be contracts, orders for the organization (for example, on temporary transfer to another job), a work book, certificates from archival authorities and from enterprises, etc.

The procedure will be difficult only if the Pension Fund refuses to recognize the existence of a grace period. In this case, it is recommended to contact the labor inspectorate, which will explain to the citizen his rights, and if he is right, will act as an expert in court.

After this, the citizen must apply to the court to certify the legal fact of working under harmful or difficult conditions. If there is a positive court decision, the Pension Fund is obliged to award a pension (subject to other conditions).

Are there plans to increase pensions for miners in 2020?

At the end of 2020, there was no talk of increasing pensions for miners. However, it will be recounted in 2020. The revision of the salary of retired miners is associated with changes in the minimum wage, the cost of living and an increase in insurance premiums that mining enterprises pay to the budget.

At the end of 2020, the average miner’s pension in Russia was about 17,000 rubles. The total amount depends on the region, the pensioner’s length of service, and his right to bonuses.

If you disagree with the accrued amount, an application is submitted to the Pension Fund for recalculation. The Pension Fund Management raises the documents and verifies the correctness of the accruals, taking into account the facts specified in the application.

What benefits and allowances exist for long service?

The main and only benefit for holders of active service is the right to early retirement. At the same time, another advantage can be indirectly identified.

If there are harmful or other abnormal factors affecting the employee at a particular workplace, employers are required to pay higher insurance premiums. They, accordingly, form a larger size of the IPC, which directly affects the amount of future government provision.

Thus, in terms of retirement for those workers who are employed in jobs with harmful or difficult conditions, nothing has changed as a result of the pension reform. They still retain the preferential age for the appointment of state support, subject to compliance with other mandatory requirements.

Calculation of length of service for receiving additional payments to pensions for coal industry workers.

Additional payment to pensions for coal industry workers is made on the basis of the Federal Law of the Russian Federation of May 10, 2010 N 84-FZ “On additional social security for certain categories of coal industry workers.”

The work experience that gives the right to an additional payment to the pension includes periods of work counted towards the length of service in the relevant types of work that give the right to early assignment of an old-age labor pension in accordance with subparagraph 11 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation” " The calculation of length of service giving the right to an additional payment to the pension is carried out in the manner prescribed by the legislation of the Russian Federation for the calculation of length of service in the relevant types of work when assigning an early retirement pension in accordance with subparagraph 11 of paragraph 1 of Article 27 of the Federal Law “On Labor Pensions in the Russian Federation”. Federation".

Thus, from the literal interpretation of this norm it follows that the procedure for calculating length of service for the purposes of the Federal Law “On Additional Social Security for Certain Categories of Coal Industry Workers” is identical to the procedure for calculating length of service for assigning a pension in connection with employment in underground work.

How to confirm

In order for an applicant to have the right to early retirement, a wide range of documents must be submitted to the Pension Fund:

- passport of a citizen of Russia or another country (for those living permanently in the Russian Federation for more than 15 years);

- SNILS;

- work book or a copy thereof in case of continuation of activity;

- certificates confirming special working conditions issued by the employer and executed in accordance with the standards;

- cards for recording time actually worked at enterprises.

List 1: particularly hazardous conditions

Establishing the fact that the nature of an employee’s labor function for a particular employer is associated with particularly harmful or particularly difficult working conditions, as required by List 1, is carried out through workplace certification.

The employer, as well as the relevant state (municipal) bodies, at the request of the employee, are obliged to provide him with a certificate about the nature and period of work. These documents are subsequently submitted to the Pension Fund and are the basis for calculating the employee's preferential length of service and early retirement in old age.

The right to an early preferential old-age pension according to List No. 1 with particularly harmful conditions is granted to an employee whose profession is identical to the profession from List 1, subject to the conditions that:

- the employee has full-time work (that is, at least 80% of his working time, the employee performs work in particularly harmful and particularly difficult working conditions) and

- the fact of working under special conditions can be documented.

The main, but not the only document confirming the fact of work in special conditions is the work book. The legislator does not limit the employee’s right to provide other documents, which the Pension Fund is also obliged to accept to calculate the insurance period to establish a preferential pension. This can be a certificate from the employer about the period and nature of the work, the employee’s personal card, an employment agreement drawn up according to the rules in force at the time of its conclusion, salary certificates, orders and other documents. The employee’s right to provide additional documents is enshrined in paragraph 11 of the Rules for calculating and confirming the insurance period for establishing an insurance pension, approved by Decree of the Government of the Russian Federation of October 2, 2014 No. 1015.