Who can claim an old-age pension in 2020

An old-age pension is a regular monthly cash income paid to people who have reached retirement age.

Who will even be able to retire in 2020? Familiarize yourself with the periods for changing the retirement age, the list and sample documents, as well as the nuances of the employer’s interaction with the Pension Fund of the Russian Federation. When retirement age approaches, the employee decides whether to continue working or quit. To apply for a pension, citizens can independently apply to the Pension Fund of Russia (PFR). But many companies, in order not to distract employees from the production process, themselves begin to collect information about the length of service of the future retiree, prepare and check the necessary documents. Then they submit them to the relevant government agencies, observing the deadlines established for this procedure. This is usually done by the HR department and accounting department of the enterprise.

The new pension legislation sets out the conditions and requirements for citizens who are going to apply for pension benefits in 2020 and receive them in old age.

The conditions for old age pension in 2020 are as follows:

- The retirement age for a man should be 60.5 years, and for a woman - 55.5 years.

- Future pensioners must have 10 years of insurance coverage.

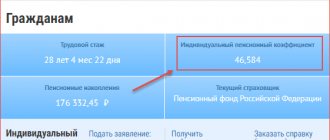

- The number of pension points, also known as the IPC indicator, should be equal to 16.2 points.

Let us recall the table of retirement periods prepared by the Pension Fund and posted on the official website of the Pension Fund.

A citizen can contact the Pension Fund at any of the above periods under the conditions that we have indicated. He will be able to submit an application earlier, but payments will begin to be made as soon as the citizen turns 60.5 or 55.5 years old.

Retirement age

To begin with, let us recall that as of 2020, the retirement age for the assignment of an old-age labor pension, as a general rule, is 65 years for men, and up to 60 years for women.

There is a transition period that will last from 2020 to 2027 inclusive. During this time, the same retirement age will apply (women - 55 years, men - 60 years), but increased by a certain number of months (from 12 to 60). In 2028, men born in 1963 will retire at the age of 65 and women born in 1968 will retire at the age of 60. In addition, for those who, according to the previous rules, should have retired between January 1, 2020 and December 31, 2020, an additional benefit has been introduced. They will be able to apply for an old-age insurance pension six months earlier than the “new” retirement age. Thus, a person who, according to the rules of the transition period, receives the right to retire in January 2020, will be able to apply for it already in July 2020 (read more in the article “Pension reform: how the rules for assigning insurance, social and funded pensions will change”).

We arrange a pension for an employee

Employee actions

Registration of a pension: where to start? This is the main question that concerns future retirees. The answer is simple: from collecting the necessary package of documents for transfer to the Pension Fund.

The employee himself must contact the Pension Fund with a corresponding application. The application must be accompanied by documents according to the list approved by Order of the Ministry of Labor of Russia dated November 28, 2014 No. 958n.

Main list of documents:

- statement (at the end of the article);

- passport (for citizens of the Russian Federation) or residence permit (for foreign citizens and stateless persons);

- certificate of compulsory pension insurance (SNILS);

- work book or documents confirming the duration of the insurance period. For example, papers issued by an employer upon dismissal from a job may be accepted as confirmation of insurance coverage, provided that they do not contain the basis for their issuance;

- certificate of average monthly earnings for 60 consecutive months up to 01/01/2002 during employment. Employers must provide information on average monthly earnings for 2000–2001;

- a document confirming the period of military service (copy of pages 1, 3 and 8 of the military ID);

- Bank account details for transferring payments.

Documents must be submitted to the Pension Fund of the Russian Federation at the place of residence (Clause 1, Article 18 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”). You can also attach documents on the basis of which gratitude and incentives were announced, and others necessary to confirm additional circumstances.

Actions of the personnel officer

1. Preparation of documents.

When preparing documents, the HR employee, within 10 days after the employee’s application, submits to the Pension Fund:

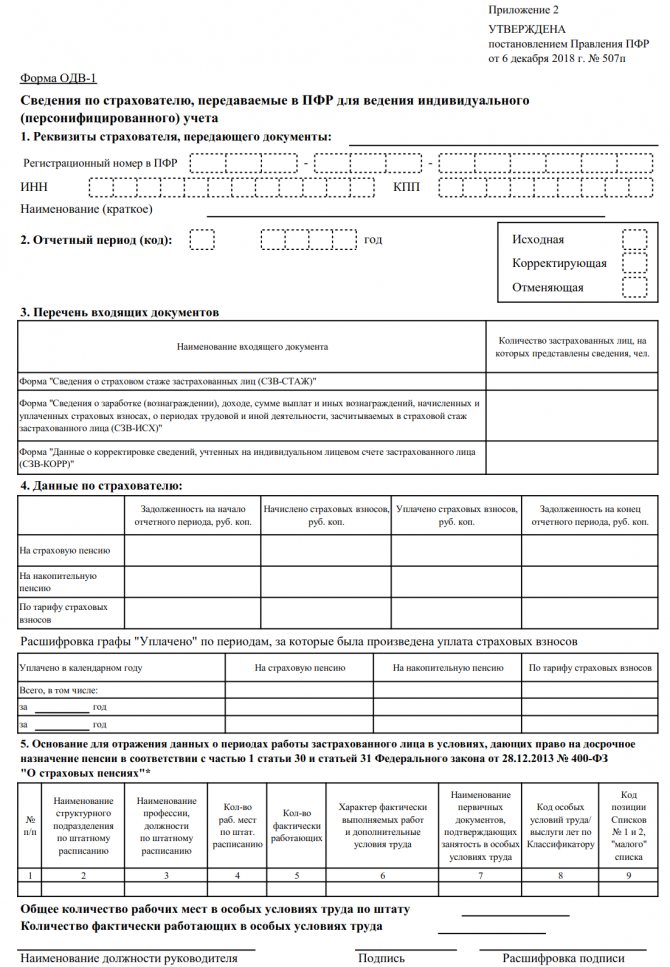

- information in the form SZV-STAZH (approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p);

- EDV-1;

- ADV-6-1;

- explanatory note.

All forms must be completed for the period from the beginning of the year until the day of retirement age. The form indicates the type of “pension assignment”.

The insurance period is calculated by the state on the date of their completion. It includes not only the period of work at various enterprises, but also military service, caring for a child under three years of age, the time of receiving unemployment benefits, participation in paid public works, caring for a disabled person of group 1 or a person over 80 years of age. These periods are called non-insurance periods.

2. Checking and issuing a work book.

As a professional in his field, the personnel officer checks the work book for possible corrections and inaccuracies. If incorrect filling is detected, he helps the future pensioner collect relevant evidence confirming the length of service. It is necessary to ensure that all data in the documents corresponds to reality (full name, dates, numbers, etc.) in order to avoid further paperwork.

The personnel officer, upon a written application from the employee, is obliged to give him a work book for presentation to the Pension Fund of Russia, and then make sure that he returns the book back.

3. Checking information.

To verify the data provided to the Pension Fund, the employer requests an extract from the individual personal account.

4. Dismissal of a pensioner is only at his request.

If an employee wants to end his career and retire, he is fired from the day indicated in his application. He is not required to work the two weeks required upon dismissal. If an employee wishes to continue working, he cannot be fired. It is also impossible to renew an open-ended employment contract into a fixed-term one.

We issue a work book

The work book is the main document that confirms the employee’s length of service (Article of the Labor Code of the Russian Federation).

If a person is employed, then, of course, he turns to his employer for a work book. Moreover, usually to apply for a pension, employees ask for the original, and not a copy. The fact is that there is an explanation from the Pension Fund of the Russian Federation, according to which employees of the fund have the right to demand from the employee applying for a pension (letter from the Pension Fund of the Russian Federation dated December 29, 2005 No. 25-19/14554):

- or original work book;

- or its notarized copy.

The organization is obliged to issue the employee, upon his application, the original work book for the purpose of assigning a pension. In this case, a maximum of three working days after submitting the work book to the Pension Fund of Russia unit, the employee is obliged to return it (Article of the Labor Code of the Russian Federation).

Who is entitled to early retirement?

The law provides for the right to receive a pension early. Under what conditions it is provided, read the following regulations:

- Labor Code of the Russian Federation;

- Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 “On approval of lists of production, work, professions, positions and indicators giving the right to preferential pension provision”;

- Law of the Russian Federation of February 19, 1993 No. 4520-I “On state guarantees and compensation for persons working and living in the Far North and equivalent areas”;

- Federal Law of December 28, 2013 No. 426-FZ “On special assessment of working conditions.”

The conditions for assigning a preferential pension for them from 2020 still remain:

- Reaching the retirement age established separately for lists 1 and 2.

- Availability of full general insurance experience and the required number of pension points (IPC).

- Availability of the required preferential length of service.

The following categories of citizens can apply for early retirement:

- employees who have the necessary preferential length of service for working in difficult and dangerous working conditions;

- those who worked in the Far North or equivalent areas;

- teachers and medical workers with teaching (25 years) or medical (30 years) experience;

- mothers of many children who gave birth and raised five or more children up to the age of eight (they acquire the right to a pension at age 50);

- mothers (or fathers) who raised a disabled child from childhood (they have the right to retire five years earlier than the generally established age: women - at 50 years old, men - at 55 years old).

Law No. 350-FZ, which entered into force on January 1, 2019, which provides for an increase in the retirement age from 2020, changes the current system of early pensions in Russia. In particular, the new law provides for changes in the withdrawal deadlines for such preferential pensions as:

- by length of service - for teachers, health workers, creative professions;

- for residents of the Far North and equivalent territories.

For these categories of citizens, the period of working capacity will increase, starting from 01/01/2019. According to the new law, the requirements for special professional experience for these categories of workers will not change, but the deadline for processing pension payments for them will be delayed by 5 years relative to the year in which the required experience was acquired.

All changes will take place gradually, in several stages, providing for transitional provisions, during which the retirement period will gradually increase until it reaches the values provided by the bill.

It will be possible to issue pension payments to teachers and health workers in accordance with generally established requirements, that is, at 60 years old for women or 65 years old for men.

In addition to doctors and teachers, workers in creative activities (in theatrical and entertainment organizations) have the right to receive early pension payments. For them, the old law established requirements for special experience depending on the type of work - from 15 to 30 years. The new law provides for a similar increase in age for them to 55-60 years, respectively. The change for them will also occur in stages, with an annual increase of 1 year.

For citizens who, due to work in the Far North and equivalent areas, retire early, the law on pensions from 01/01/2019 also provides for a number of changes relating to increasing the period of working capacity.

It should be noted that the increase in the working period will not affect workers in the Far North and equivalent areas if they work in difficult or harmful conditions (for example, workers in ferrous and non-ferrous metallurgy, miners, railway workers, etc.). No changes are planned for them by the adopted law.

Can they refuse?

The legislator points out that the Pension Fund has the authority to refuse a person who has applied to the specified body for the assignment of pension benefits. This happens when:

- A person who was fired due to the termination of the company's activities was offered a job at the employment center. It is important to take into account that the proposed vacancy fully corresponded to the existing qualifications and education.

- Documentation is submitted to the pension authorities when there is a complete stop or temporary suspension of payments due to a person due to unemployment.

- The applicant receives benefits from the organization from which he was laid off.

These provisions must be taken into account when applying to the pension authority. It is worth pointing out how the pension benefit is calculated for a person who has applied to the specified authority. If the application for a pension occurred earlier than the established period, then the calculation is carried out on a general basis. The amount is influenced by various factors, including the level of salary the applicant received. This amount is reflected in the submitted certificate. Work experience also influences. It is taken into account at the moment when the application is submitted. The level of indexation established during such a period of time by government agencies should also be taken into account. In the Ministry of Internal Affairs, pensions are assigned in a similar way.

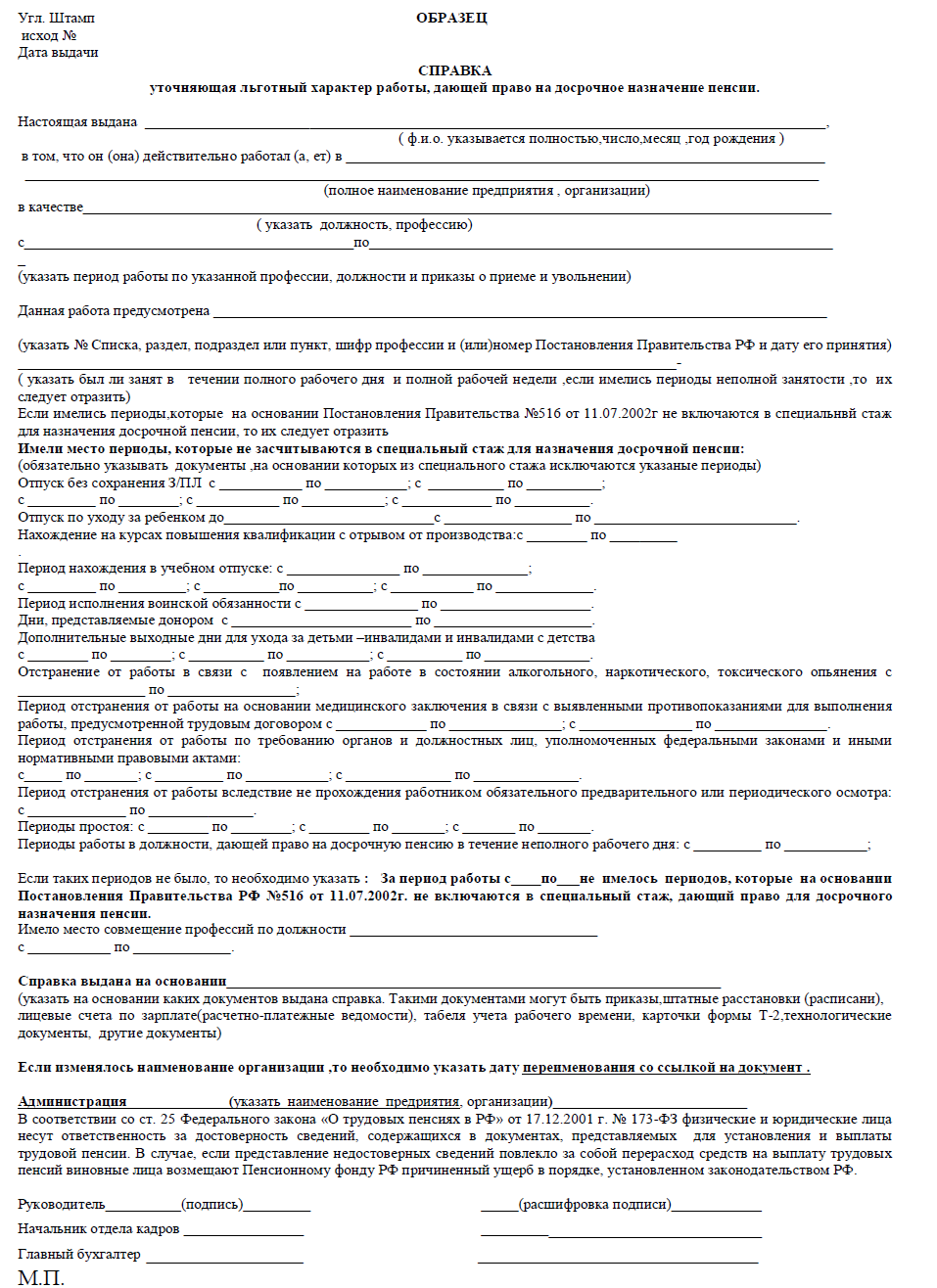

Registration of a preferential pension

In the case of a preferential pension, the HR department prepares documents to confirm the benefit. To do this, you must provide the following to the Pension Fund:

- reference (at the end of the article);

- constituent documents;

- certificate of entry into the Unified State Register of Real Estate;

- certificate of registration with the tax authority;

- information letter from statistical authorities with OKVED;

- license or certificate of admission to a certain type of work (SRO);

- staffing schedule;

- job descriptions or production instruction cards, etc.;

- copies of workplace certification documents, certification cards, state examination reports of working conditions;

- copies of local acts describing production technology;

- copies of documents on the availability of equipment;

- other documents confirming preferential length of service.

Procedure for admission and consideration

The full package of documents is provided in person or through a legal representative (notarized power of attorney).

The time for consideration of an application by the Pension Fund should not exceed 10 working days. To assign payments from the date of retirement age, we recommend that the future pensioner contact the Pension Fund a week before his birthday.

If at the time of submitting the application not all necessary documents are attached, he will be given three months to collect the missing ones. In this case, the day of application will be considered the day the application was received.

Documentation

To retire early, you need to contact the body operating in the field of pensions. The appeal takes place to the territorial unit. The following papers are provided for registration:

- an application that is written according to an established template;

- employment history;

- for men - military ID;

- SNILS;

- the act by which the identity of the applicant is established;

- certificate showing the average salary.

Additionally, they may require the submission of certain acts. In particular, this applies to certificates that indicate the composition of the family, certificates confirming the birth of children. If someone in the family is unemployed or dependent, you must bring a document confirming this. If a person is disabled, then an additional certificate confirming this fact is submitted.

Read on the topic: The procedure for dismissing a pensioner by agreement of the parties

How to increase your pension

To understand, you need to understand what pension payments consist of.

Let's divide the payments into three parts and see what they consist of and how to increase them.

From January 1, 2019, the amount of the fixed payment to the insurance pension is indexed by 7.05% and amounts to RUB 5,334.19. Such an increase is provided for in Part 8 of Art. 10 of Law No. 350-FZ of October 3, 2018, which came into force on January 1, 2019.

| Pension payments | Explanations | Size | Pension increase |

| Basic part | Paid from the budget. Paid to citizens if they have length of service. | As of 01/01/2019, the amount is 5334.19 rubles. per month. | The persons listed in Article 17 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” are entitled to an increase. |

| Insurance part | Determined from the amount of insurance premiums. These payments are made by the employer based on the official salary. | It is set individually depending on the value of the coefficients. Affects: age and experience. |

|

| Cumulative part | It is accumulated in the same way as the insurance part, but is increased by the income received when placing funds on the securities market. Citizens have the right to independently manage the funded portion. | Savings of citizens born in 1967 and subsequent years. |

|

Amount of pension for early retirement due to health

The amount of monthly payments upon recognition as disabled consists of an individual and a fixed payment. Individual is determined by multiplying the accumulated pension points by their value; the fixed value is established by the Government and in 2020 is:

- disabled people of group I – 10,668 rubles. 38 kopecks;

- Group II – 5,334 rubles. 19 kopecks;

- Group III – 2,667 rubles. 10 kopecks

If there are dependents, the amount of this payment increases. For example, a disabled person of group I with 3 dependents has the right to a monthly payment of 16,002 rubles. 56 kopecks, as well as those funds that have accumulated in his individual account.

So, if he managed to accumulate 30 points, the value of which in 2019 is 87.24 rubles, then he will also receive an individual payment in the amount of 2,617 rubles. 20 kopecks