Citizens with the official status of military personnel, members of their families, as well as military pensioners, according to the letter of the law, have a number of benefits and privileges, including tax preferences. Thus, property tax for military personnel can be significantly reduced or even abolished, in addition, citizens may be exempt from paying certain duties. To find out what property tax benefits should be provided to military personnel, you should refer to the current legislation.

Conditions for providing tax benefits

Any military retiree can take advantage of the tax benefits. The exercise of this right is permitted after assignment of the appropriate status. Its assignment is subject to availability:

- Total service experience of at least 25 years.

- Continuous work experience in a specific military department for at least 20 years.

When providing benefits, it does not matter whether the military pensioner retired early or due to old age. The main thing is to have the necessary experience.

Tax benefits are provided to pensioners working in the following structures:

- National Guard;

- Ministry of Internal Affairs;

- Executive authorities;

- Fire Service;

- Other law enforcement agencies.

Registration of the status of a military pensioner is carried out in a subordinate structure. One of the regulations governing its provision is Federal Law No. 76-FZ dated May 27, 1998 (as amended on December 30, 2012) “On the status of military personnel.” It is pointless for a former employee to contact the Pension Fund. The exception is receiving insurance payments or old-age pensions. However, as a rule, they are rarely combined with a military pension.

Who is eligible to receive benefits

The very concept of military service is established in Art. 2 No. 53-FZ , from this legal norm it follows that this includes not only the performance of duties in the RF Armed Forces, but also in the National Guard troops, in the FSB, the military prosecutor's office, in the military investigative bodies of the RF IC, etc.

According to Art. 56 of the Tax Code of the Russian Federation , for military pensioners and military personnel of the bodies listed above, tax benefits are established that allow you not to pay a tax or fee, or to contribute a smaller amount than that paid by other taxpayers.

All persons who have tax preferences in the Russian Federation are established by the legislator in Art. 407 Tax Code of the Russian Federation . Within the meaning of this article, these include two categories of citizens:

- Contract employees and citizens serving under conscription.

- Persons who have reached the maximum age for carrying out activities in military service (for example, for women it is equal to 45 years according to Part 2 of Article 45 No. 53-FZ of March 28, 1998). As well as those dismissed from service due to deteriorating health, and citizens whose contract was terminated due to organizational measures.

At the same time, according to paragraphs. 7 clause 1 art. 407 of the Tax Code of the Russian Federation, the group of persons listed in the second paragraph has the right to receive tax benefits only if the duration of their service in a paramilitary organization was at least 20 years.

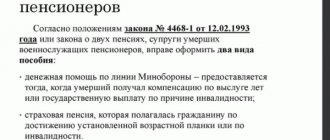

In addition, military family members can apply for tax preferences in the event of the loss of a breadwinner. These include the spouses of the deceased and his parents.

Tax benefits for military pensioners

A military pensioner has the right to count on benefits for all available tax payments, including:

- Tax on real estate and land plots.

- Transport tax.

In addition, a pensioner has the right to request a refund of previously paid personal income tax by filing a tax deduction. Provided that for the last three years he regularly paid income tax to the state treasury. It does not matter whether it was paid from official wages or profits from additional sources (for example, rental property).

The indicated tax benefits are provided throughout the Russian Federation, regardless of place of residence. However, regional authorities have the right to make their own adjustments to their provision, as well as expand the list of privileges.

Property tax benefits

A military pensioner has the right to apply for a property tax benefit. The regional government may provide a discount of 50-100%. Often, a complete exemption from paying annual property contributions is applied.

The conditions for providing benefits may include the age of the pensioner. Many regions require a man to be 60 years old and a woman to be 55 years old. To clarify these issues, a pensioner can contact the Federal Tax Service department located at the place of registration.

Benefits apply to paying tax for:

- Apartment;

- A private house;

- Dacha;

- Garage.

If a pensioner owns several properties of the same type (for example, two apartments or garages), the tax benefit will be provided for only one. The right to choose belongs to the owner.

A pensioner may be denied benefits if his property:

- Costs more than 300 million rubles

- Used for commercial purposes.

By renting out an apartment or private house, a military pensioner will lose the right to receive benefits. At the same time, he will be obliged to annually submit an income declaration to the Federal Tax Service and pay personal income tax.

Filing an application for a tax benefit is carried out in accordance with Art. 407 of the Tax Code of the Russian Federation. A military pensioner will need to visit the Federal Tax Service by submitting:

- Written statement;

- Passport;

- TIN;

- Pensioner's ID;

- Title documentation for real estate;

- Extract from the Unified State Register of Real Estate;

If it is impossible to complete the application in person, it is possible to send documents by registered mail via Russian Post, the Federal Tax Service website or State Services.

Special treatment

The legislator develops and implements and publishes acts. Officials do not have such duties to teach the people the laws, they should only bring them to their attention. This means that citizens must contact the competent authorities themselves, submit applications, in response they will be given a benefit or the request will be denied for insufficient grounds.

Tax benefits for military pensioners are approved by Federal Law No. 117. To obtain the privilege, a certain procedure must be followed. To do this, you need to apply to the Federal Tax Service and attach documents confirming your right to the application. Laws tend to be adjusted under the influence of time, other legal acts come into force and outdated provisions are repealed. Reformation took place in this area in 2012, on the basis of Presidential Decree No. 46, the purpose of which was to raise the prestige of military personnel.

Transport tax benefits

The amount of the transport tax benefit depends on the region of residence. As a rule, military retirees are given a 100% discount on one car. At the same time, the regional government has the right to put forward an age requirement for applying for benefits (for example, 60 years for men). You can find out the exact conditions by contacting the territorial branch of the Federal Tax Service or from the information on the website of the regional tax service.

When providing benefits, the power of the car plays an important role. Most regions set the conversion limit at 100-150 horsepower. In case of owning several vehicles, the owner will be given a benefit for only one. Which one, the pensioner has the right to choose independently, taking into account the size of the benefit received.

Example. Vlasov Yuri Petrovich is the owner of two cars. The annual transport tax for the first is 500 rubles, for the second – 188 rubles. The citizen took advantage of his right to a 100% benefit by choosing the first car, since the cost of payments for it is more expensive.

The Federal Tax Service is in charge of issuing benefits. The pensioner will need to visit the organization in person, providing:

- Completed preference application form.

- Passport.

- Military pensioner certificate.

- TIN.

- Technical passport for the vehicle.

Federal Tax Service employees will check the documents for authenticity. After which, the application will be sent for consideration. If the answer is positive, tax accrual will stop from the date of application. However, you will still have to pay for the previous period.

Registration procedure

The procedure for implementing the preferential program involves contacting the tax authority. The first thing that needs to be done is to establish a suitable branch of the Federal Tax Service. The structure should be selected taking into account the place of registration of the pensioner. More often than not, there are no time limits for applying; in fact, an application for benefits can be submitted at any time. However, it is believed that the best option would be to register before November 1 of the year when it is necessary to use government support.

After identifying the inspection unit, a package of documentation should be prepared. It is attached directly to the application. It includes the following papers:

- identification document;

- TIN;

- certificate from the pension fund;

- information from the military registration and enlistment office about the status of the former military personnel;

- certificate establishing rights to property.

It is necessary to prepare in advance an inventory of transferred documents in order to control the procedure for their acceptance and consideration.

After reviewing the application, which takes about 5 working days, the military pensioner is sent a notification. If the result is positive, then the benefit begins to apply in the same month. When the tax office refuses, it often happens due to the lack of necessary information. Usually such errors can be corrected immediately, otherwise it is permissible to file a complaint with the head of the selected tax office unit and challenge the decision.

If you have experience in exercising your rights to benefits in connection with the status of a military pensioner, then share the information in the comments section and also ask your questions.

This year, the amounts of payments to pensioners, as well as the benefits expected for them, have been revised. This will allow civilian income to stabilize. In addition to payments to elderly people who have served, they are entitled to some other privileges. Tax benefits for military pensioners today are regulated by law with particular care.

Watch a video about government support for military pensioners:

Land tax benefits

Military pensioners are not completely exempt from paying land tax. However, they have the right to reduce the tax base. As a standard, the tax is calculated based on the total square footage of the land plot and the regional coefficient. Providing benefits allows you to reduce the area of the site by 6 acres. If it is less, the tax will not be calculated.

Registration of benefits takes place at the Federal Tax Service. As in the case of transport and property taxes, a military pensioner will need to write an application in advance and prepare documents for the land.

Property tax for military personnel

The above groups of persons are given the privilege of paying property tax. According to paragraph 2 of Art. 407 of the Tax Code of the Russian Federation , a military man has the right to receive a benefit of 100% of the tax amount for the taxable object of which he is the owner. However, this property should not be used for business purposes. Also, benefits can be established by the laws of the constituent entities of the Russian Federation at the location of the taxable real estate.

In paragraph 4 of Art. 407 of the Tax Code of the Russian Federation lists those objects for which this benefit applies:

- apartment or part;

- a residential building or part of it, for example, a room;

- used according to paragraphs. 14 clause 1 art. 407 of the Tax Code of the Russian Federation, premises, for example, private libraries, non-state museums;

- construction, in accordance with paragraph 15, paragraph 1, art. 407 of the Tax Code of the Russian Federation, in particular, structures on land intended for farming, a summer cottage;

- garage.

From this we can conclude that a serviceman has the right to receive a tax privilege on one or another property listed above. It should be taken into account that, according to clause 3 of Art. 407 of the Tax Code of the Russian Federation , this preference can be applied only to one object of each type.

This means that a person who has 2 apartments has the right to receive benefits only for one of them. At the same time, for example, he can also simultaneously receive a benefit for a garage, a residential building and an outbuilding at his dacha, if this structure is less than 50 square meters.

All other objects will be taxed on a general basis, such as a second apartment or another garage.

Therefore, when applying for a benefit, it is best for the taxpayer to choose the most expensive property, since the amount of tax is calculated based on its cadastral value, as established in Art. 408 Tax Code of the Russian Federation .

Many active military personnel and military retirees are interested in whether they can receive benefits for land plots. The list of persons who do not need to pay this type of tax is given in Art. 395 Tax Code of the Russian Federation .

Unfortunately, at the federal level, this category of persons is not exempt from land tax, since military personnel are not included in the list of persons of the specified legal norm.

In particular, mainly legal entities, for example, institutions of the Federal Penitentiary Service, as well as some categories of individuals, in particular, these include the indigenous peoples of Siberia and the Far East, can count on benefits for collecting land tax.

According to Art. 378 of the Tax Code of the Russian Federation , land tax is established by the constituent entities of the Russian Federation, therefore, to clarify the information, interested parties should contact the competent authority at the location of a specific plot of land.

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Tax breaks for military retirees

Many regions practice providing property deductions. The purpose of their implementation is to reduce the total amount of tax payments. So, when calculating the tax for a military pensioner, the following will be deducted from the total square footage of real estate:

- 20 sq.m. – for apartments;

- 50 sq. m. - for private houses;

- 10 sq. m. – for dorm rooms.

The benefit is provided to a pensioner on an application basis. To receive it, a citizen will need to visit the Federal Tax Service and submit a standard package of documents.

If the land is leased, the right to receive benefits is abolished. If there are two plots, to apply for a discount, the pensioner will need to choose one of them.

Types of government assistance

In addition to the listed benefits that former military personnel are entitled to regarding real estate taxation, the state provides additional types of support:

- A military pensioner has the opportunity to get his own square meters. This includes a one-time receipt of funds for construction, compensation for expenses for renting a home, or obtaining a certificate for housing;

- In case of injury during military service and the military man is declared incapacitated, he has the right to receive one thousand rubles per month as an additional payment;

- A former military man has the opportunity to receive free medical care at the medical institution where he was assigned during his service;

- In addition to treatment and services, pensioners are entitled to free medications;

- Military personnel can receive free treatment in sanatoriums;

- Retired military personnel have the opportunity to receive free dental prosthetics;

- Free travel in state vehicles is also provided;

- Other types of support.

When to apply for tax benefits

It is recommended to submit documents for tax benefits before November 1 of the current year. At this time, amounts are calculated and receipts are sent to taxpayers. Violation of deadlines is not critical. The citizen will be able to exercise his right in subsequent years. The statute of limitations is three years.

In case of overpayment of tax payments in previous periods, the pensioner will be able to demand their refund. To do this, you must make a written application and provide bank account details.