⭐ ⭐ ⭐ ⭐ ⭐ The legal topic is very complex, but in this article we will try to answer the question “Putin Abolished the Reduction Coefficient for the Military From October 1, 2020.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Please note that there will be no increase in long-service pensions for military personnel and persons equivalent to them in January 2020. The increase in the size of this type of pension provision is planned only for October 1 (preliminarily by 3%).

The State Duma Committee on Defense, in its conclusion to the draft Federal Budget Law for 2020, noted that in order to fully increase military pensions, it is necessary to index by 5% , and not by 3%, as included in the budget.

Will the reduction coefficient for military pensioners be increased in 2020?

Decree of the President of the Russian Federation No. 604 of 05/07/2020 establishes that pensions of military pensioners should grow annually at a rate of 2% higher than inflation. Indexation corresponding to price increases in 2020 is scheduled for October 1 (the increase will be 3%). But funds have not yet been provided for an additional increase of 2%.

Many veterans' organizations say that this is certainly unfair. The military pension is already almost equal to the “civilian” one. Let us add that her relatively elite status is preserved only by her earlier average age of retirement compared to ordinary pensioners.

The growth rate is also specified in the law - two percent annually. Moreover, these two percent are the minimum annual increase. The law allows the government to increase the reduction factor at a faster rate. Especially if inflation in the country requires it.

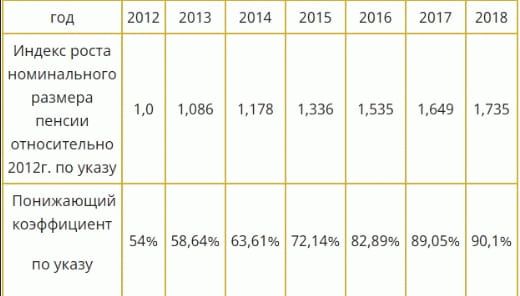

How the coefficient was increased in 2020-2020.

There will be no reason for retired military personnel to be particularly pleased with the increase in pensions next year. The state again froze the increase in this type of pensions beyond the percentage of indexation of pay in the active army. For now - until 2021. But if desired, freezing can be extended indefinitely. Let us remind you what the reduction coefficient will be for military pensioners in 2020, how it has grown in recent years, and what the average pension of a retired military man will be after the next indexation.

We recommend reading: Penalties for Rostelecom Budgetary Accounting Entries

The latest news from the Duma promises an increase in pensions by 4% from 2020 in relation to the amounts current for 2020. The total reduction factor will be 75.15%. Additionally, citizens who served in state military bodies will receive an increase in assistance by 3.8% due to indexation. The increase will occur against the backdrop of rising wages for military personnel. Funds for these activities are included in the draft budget.

Cancellation of the reduction coefficient for military pensioners in 2020

Russian President V. Putin signed a law for military pensioners: from May 1, 2020, the reduction coefficient for military pensioners was cancelled. More precisely, it was canceled for WWII participants. As a result of the Decree, their benefits should increase by approximately 9.5 thousand rubles monthly.

The timeliness of this payment can be debated. But first, let's figure out what the reduction factor is and why it is applied to military pensions.

Indexing

Indexation of pensions was also a forced measure, allowing the state to gradually increase the size of pension payments, focusing on the inflationary processes occurring in the country and the cost of living, which often changes with the instability of the economy.

At first, indexation affected only insurance pensions, but later a decision was made to include military ones. This decision did not bring the expected result, and then the government decided to give each military pensioner an increase of 5 thousand rubles.

This year, thanks to indexation and a reduction factor, the size of pensions for military personnel is growing rapidly, which indicates an imminent return to previous payments. Despite the negative feedback from pensioners, the state has thus ensured a stable increase that will not negatively affect the Russian economy.

What is a reduction factor

In 2012, the concept of a reduction factor when calculating pensions appeared. It only applied to pensions of former military personnel. This decision was forced by the Government in order to combat the economic crisis in the Russian Federation.

Thanks to this law, people who defended their country, sometimes at the cost of their health and immediate risk to their lives, cannot receive their well-deserved pension in full. In 2012, they were entitled to only 54% of its size.

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

The coefficient of 0.54 did not apply to representatives of the judiciary and military investigative bodies, which is strange in itself, and invariably causes discontent among other retired military personnel.

The essence of the coefficient: the pensioner is given an amount calculated as the earned pension multiplied by the coefficient.

When will it be cancelled?

Many people are interested in the question of when this coefficient will be abolished. At the moment, the government was meeting to resolve this issue, but since exact growth cannot be predicted, and the previous calculation showed that 100% food supply would be achieved by 2035.

This does not mean that this will not happen sooner, although the dynamics show that the increase is happening much faster. If we take into account the trend of last year and take 4% as a constant coefficient, then cancellation can be expected as early as 2024. The sooner the country's economic situation becomes stable, the more opportunities there will be to equalize payments.

How much is it in 2020

Calculation of the individual reduction coefficient: for a year of service on top of 20 years of military experience, a former employee of the Ministry of Internal Affairs of the Russian Federation is plus 3% to the coefficient. He himself changed several times:

- During the period from 2012 to 2020 it increased from 54% to 62.12

- By 2020 it had grown to 69.45

- By 2020, its size was 72.23.

This is important to know: Pension certificate of a military pensioner

Today it is planned to increase it to a maximum of 85%, but the increase is still frozen, at least until 2020. The only thing that received approval from deputies was the abolition of the reduction coefficient for military pensioners in 2020, which affected WWII veterans.

A separate approach is used when calculating mixed length of service. Preferential length of service includes at least 25 years of cumulative work experience, of which 12.5 are in the Ministry of Internal Affairs. The reduction factor increases by only 1% annually for each additional year.

The last increase in this indicator is planned in October - up to 73.68% (approximately 2%). Calculated on a national scale, the figure looks impressive. But for each individual person, given the rise in inflation, this amount means nothing.

Who will be affected by the change?

A reduction factor is applied when calculating pensions based on length of service for privates and commanding officers who served:

- through the Ministry of Defense;

- in internal affairs bodies;

- in the fire service, Ministry of Emergency Situations;

- in departments involved in the fight against drugs;

- in the Russian Guard;

- through the criminal correctional system - the Federal Penitentiary Service;

- to the FSB.

To receive a long-service pension, to which the PC applies, a serviceman must have served at least 20 years or have a combined length of service of 25 years, of which at least 12.5 years must be in the military.

Rice. 2. Risking their lives, military personnel count on decent security in old age

Regardless of the type of experience: pure or mixed, a coefficient will be applied to the assigned allowance, which reduces the size of the pension.

These rules do not apply to pensioners and members of their families who served in:

- Military Collegium of the Supreme Court as a judge;

- in military courts - by a judge;

- prosecutor's office, including military prosecutors;

- Investigative Committee of the Russian Federation.

In addition, on April 30, 2020, Federal Law No. “On Amendments to the Law on Military Pensions” was published, according to which, from May 1, 2019, the use of PC was canceled for military pensioners from among WWII veterans. This change made it possible to increase pensions for veterans by approximately 9,000 rubles.

Will the reduction coefficient for military pensioners be abolished: latest news

Today the coefficient is 72.23%. According to the Government's promises, the coefficient should gradually reach 100% and virtually disappear in the near future. But no one knows when exactly.

In 2020, it was planned to completely abolish the reduction rate for military pensioners who are the age of an ordinary Russian pensioner. There is no news about this yet.

This indicator was canceled only for pensioners who participated in the Second World War. Considering their age and number, it becomes clear why the “servants of the people” decided to take such a long-awaited step.

When will the cancellation take place?

The answer to the question of when 100% accrual of military pensions will return is unknown. The reduction factor is changed manually every year when drawing up the budget, and they periodically threaten to freeze it for an indefinite period.

Many pensioners believe that they will not live to receive their full pension. It is quite possible that it will be canceled only for small groups of pensioners, such as WWII veterans.

The abolition of the reduction coefficient for military pensioners over 60 years of age (for women - from 55 years of age) deserves a separate discussion. Upon reaching the appropriate age, they become entitled to 2 types of pensions: social old-age pension. However, the reduction rate also applies to her. It has long been planned for them to abolish this obvious injustice.

However, things are still there, pensioners will have to wait, and how long is unknown; the coefficient is still fixed and applied.

At the beginning of 2020, social pensions were increased in the amount of 7% for everyone except the old-age pension of former employees of the Ministry of Internal Affairs.

Most likely, there is no chance of a 100% return of pension payments for this category of pensioners: neither in the near nor in the distant future. According to legislators, an unfair situation will arise when a serviceman of general retirement age of low rank receives a payment that exceeds the pension of a 50-year-old colonel.

The fact that this situation is now unfair for many more people is not taken into account.

The State Duma Committee on Defense answered questions from military pensioners

Why did the maximum percentage bonus for length of service decrease after the adoption of Federal laws on reforming the pay of military personnel? Previously the size was 70% now 40%.

In the new structure of pay for military personnel, with a decrease in the amount of additional payment in percentage terms in absolute terms, there is a significant increase in its size (more than 2.5 times) due to a significant (more than 3 times) increase in salaries for military personnel.

For example: the size of the percentage bonus for the length of service of a regiment commander, colonel with 25 years of service in 2011 is 5756 rubles 80 kopecks ((official salary 4992 rubles + salary according to military rank 3232 rubles) * 70%). From January 1, 2012, his monthly bonus for length of service will be 15,800 rubles ((official salary 26,500 rubles + salary for military rank 13,000 rubles) * 40%), an increase of 2.7 times.

Why will the pay of military personnel from January 1, 2012 increase by 2-2.5 times, but pensions only by 60%? This violates the rights of military pensioners and is contrary to the Constitution of the Russian Federation. What is the reason for the 60% increase?

From January 1, 2012, the amounts of pensions assigned to citizens in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, bodies for control over turnover of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families" (hereinafter referred to as Law No. 4468-1) will increase by an average of 60 percent, indexation of military pensions will be provided twice a year - from January 1 of each year and from the day of increasing the salaries of military personnel, which, in our opinion, cannot be considered a violation of the rights of military pensioners.

An increase in the size of military pensions by 60% was determined based on the economic capabilities of the state; such an increase, as well as the procedure for indexing military pensions, will ensure that the average size of military pensions exceeds the average size of a labor pension by an average of 80% and further supports the material security of military pensioners at the proper level due to the annual guaranteed increase in the size of military pensions, including regardless of the indexation of military pay.

As the Constitutional Court of the Russian Federation has repeatedly emphasized in its decisions, compliance with the constitutional principle of equality, which guarantees protection against all forms of discrimination, means, among other things, a prohibition to introduce such differences in the rights of persons belonging to the same category that do not have an objective and reasonable justification ( prohibition of different treatment of persons in the same or similar situations); under equal conditions, subjects of law must be in an equal position; if the conditions are not equal, the federal legislator has the right to establish different amounts of social guarantees, taking into account differences in their actual situation.

Taking into account the above, the establishment of different levels of increase in pay for military personnel and pensions for citizens discharged from military service is in accordance with the Constitution of the Russian Federation.

Why is the 54% reduction factor for pensions not applied to pensions assigned to employees of the Prosecutor's Office and the Investigative Committee of the Russian Federation?

In accordance with Articles 1 and 9 of the Federal Law of November 8, 2011 No. 309-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain provisions of legislative acts of the Russian Federation in connection with the adoption of the Federal Law “On monetary allowances for military personnel and providing them with separate payments" and the Federal Law "On Social Guarantees for Employees of the Internal Affairs Bodies of the Russian Federation and Amendments to Certain Legislative Acts of the Russian Federation" (hereinafter referred to as Federal Law No. 309-FZ), official salaries of military prosecutors and military personnel of military investigative bodies are established using coefficient 1.5, which is not taken into account when calculating pensions in accordance with Law No. 4468-1, and the salaries of employees (who are not military personnel) of the prosecutor's office, the Investigative Committee of the Russian Federation and judges as part of the reform of the pay of military personnel and employees of internal affairs bodies do not increase . Thus, if a coefficient of 0.54 is applied to the size of their pensions, the size of already assigned pensions will decrease.

Therefore, in accordance with Part 6 of Article 12 of Federal Law No. 309-FZ, the provisions of Part two of Article 43 and paragraph “b” of Part one of Article 49 of Law No. 4468-1 (as amended by Federal Law No. 309-FZ) do not apply to judges of the Military Collegium the Supreme Court of the Russian Federation and military courts, prosecutors (including military personnel of the military prosecutor's office) and employees of the Investigative Committee of the Russian Federation (including military investigative bodies of the Investigative Committee of the Russian Federation), pensioners from among these persons and members of their families. In addition, in accordance with Part 6 of Article 12 of Federal Law No. 309-FZ, pension amounts for these categories of citizens are not revised from January 1, 2012.

Why can’t a reduction factor of 100% be established for military pensioners who have reached the age of 60?

Establishing 100% of the pension amount for persons who have reached the age of 60 (i.e., without applying a reduction factor of 54%), will lead to the division of military pensioners into categories depending on the date of their separation from service (for example, a 60-year-old pensioner, retired with the military rank of lieutenant, the pension amount will be greater than that of a 50-year-old colonel).

For example:

We propose to compare the size of the military pension of a citizen discharged from military service from a military position as a platoon commander, with the military rank of lieutenant with 25 years of service without applying a reduction factor (who reached the age of 60), and the size of the military pension of a citizen discharged from military service from a military position regiment commander, with the military rank of colonel with 40 years of service in preferential terms (who retired at the age of 50) using a reduction factor.

Lieutenant, platoon commander, 25 years of service – 20,000 + 10,000 + (30,000*40%) = 42,000, 42,000*65% = 27,300 rubles. Colonel, regiment commander, 40 years of service – 27,000 + 13,000 + (40,000*40%) = 56,000, 56,000*54% = 30,240, 30,240*85% = 25,704 rubles.

A pension for citizens discharged from military service (service) is assigned not for age, but for length of service.

Its size depends only on three parameters at the time of discharge from military service:

1) position held;

2) assigned military rank;

3) duration of service.

The existing pension system should encourage military personnel to advance in their careers, including to receive a higher pension.

The State Duma adopted and entered into force the Federal Law of July 22, 2008 No. 156-FZ “On Amendments to Certain Legislative Acts of the Russian Federation on Pension Issues,” which granted military pensioners who continued to work after leaving military service the right to receive old-age labor pension (less the fixed base amount of the insurance part of the old-age labor pension) through the Pension Fund of the Russian Federation, simultaneously with receiving a military pension. The old-age labor pension is assigned to men upon reaching 60 years of age and to women at 55 years of age.

Why was it that military pensioners were given a reduction factor for their pensions, while other pensioners do not have it?

The legislation of the Russian Federation, in particular Federal Law No. 58-FZ “On the civil service system of the Russian Federation,” by establishing the various types of civil service that make up the system, defines uniform approaches to the organization, functioning and performance of the civil service. At the same time, it is possible to normatively highlight the features, principles and differences that determine the specifics of each type of public service in a given system.

Consequently, when legislatively establishing the basic conditions for performing public service, the possibility of introducing differences in the legal status of persons serving in public service in civil service positions of various types is not excluded, including the definition of special rules regarding the conditions of state pension provision for citizens who served in public service, in for the purposes of fair, reasonable consideration of specific factors in the performance of civil servants.

For example, for federal civil servants there are restrictions on the size of the pension and the timing of pension payment.

To calculate the pensions of federal civil servants, all types of wages are taken into account, however, in accordance with Article 21 of the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”, the amount from which their pensions are calculated ( average monthly earnings) cannot exceed 2.8 times the official salary.

Military pensioners, in accordance with Law No. 4468-1, receive the right to a pension for length of service regardless of age, at the same time, in accordance with Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation”, federal State civil servants have the right to a long service pension only simultaneously with an old-age labor pension, i.e. upon reaching the age of 60 for men (55 for women), regardless of the time when the length of service necessary for granting a pension was acquired.

Please note that the amount of the old-age labor pension in accordance with the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation” is established based on the amount of insurance contributions received to the employee’s individual personal account in the Pension Fund of the Russian Federation . Currently, insurance premiums amount to 26% of an employee’s salary. At the same time, the amount of wages on which insurance premiums are calculated is also limited to 463,000 rubles per year.

At the same time, Article 2 of Federal Law No. 309-FZ amends Law No. 4468-1, according to which an annual increase of two percent in the size of the “54% coefficient” is established, and, in addition, the possibility of growth of the specified coefficient in the amount is provided. exceeding 2 percent.

Why was information about the introduction of a reduction coefficient hidden, and only the unchanged procedure for calculating pensions was said (50% for 20 years of service + 3 percent for each year, but not more than 85% of the corresponding amounts of monetary allowance - Articles 13 and 14 of Law No. 4468-1) ?

Information about the “reducing factor of 54%” cannot be hidden, since it is indicated in the text of the bill, and all materials on reforming military pay are posted on the official website of the State Duma www.duma.gov.ru in the section “Legislative Activities” - “Automated system for ensuring legislative activity”, then transition to bills No. 556556-5 “On monetary allowances for military personnel and providing them with certain payments” and No. 556510-5 “On introducing amendments to certain legislative acts of the Russian Federation and invalidating certain provisions of legislative acts of the Russian Federation in connection with the adoption of the Federal Law “On monetary allowances for military personnel and the provision of certain payments to them” and the Federal Law “On social guarantees for employees of internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation” and were distributed to each deputy of the State Duma.

At the same time, these bills do not directly contain information that Articles 13 and 14 of Law No. 4468-1 are not amended or repealed, but will continue to operate in their existing form, which, judging by the numerous requests from citizens, requires additional clarification.

Why did the State Duma adopt Federal laws on reforming the pay of military personnel without establishing salaries for the pay of military personnel, because in such a situation it is impossible to determine the level of increase in the pay of military personnel and the pensions of military retirees?

When the bills on reforming the pay of military personnel were adopted in the second reading by the Government of the Russian Federation, deputies of the State Duma were presented with draft resolutions of the Government of the Russian Federation, which contained data, among other things, on the size of salaries for military pay.

The size of the military pension after innovations

Expert opinion

Grigoriev Pavel Kirillovich

Head of the department for conscription of citizens for military service of the Russian Federation

This year, military pensions will be increased by more than 6% in October. This increase includes an indexation of military pay by 4.3% and an increase in the coefficient to 73.68% (versus today's 72.23).

This is important to know: Medical support for military pensioners

The State Duma, by the way, planned to freeze the coefficient. However, payments to former military personnel will be increased by an additional 2% due to an increase in the coefficient. The presidential decree on the abolition of the reduction factor actually increases the pension of WWII participants by 9 thousand rubles. This is the only real increase in pensions in recent years.

How is pension calculated for former military personnel?

According to Art. 43 of the legislative act of February 12, 1993 number 4468, the amount of payments to former army employees and their relatives is determined by taking into account monetary allowances. In addition, the size of the pension depends on:

Pension coverage for army employees is divided into 4 types:

- For 20 years of service.

- For 12.5 years of service, with the recipient’s total experience of at least 25 years.

- For the loss of a breadwinner for disabled relatives: sons/daughters; mother/father with a disability or retired; a wife who is caring for a child under fourteen years of age.

- Due to disability that occurred during military service or due to illness during this period.

Salary is the salary of an army employee, including salary and allowances. According to Art. 2 of the legislative act of November 7, 2011 number 306, military personnel receive bonuses for:

- rank - 5-30 percent;

- access to classified information – up to 65 percent;

- service under special conditions; performing tasks that are dangerous to life and health; achievements in service – up to 100 percent;

- conscientious performance of official duty - up to 300 percent of the annual salary.

Calculation algorithm

The initial value is taken as the salary of a military personnel. Then a bonus for the rank is added to it, the resulting result is multiplied by the bonus for length of service. The result obtained is added to the sum of the salary and bonus for the rank. This forms the basis for calculating pension benefits.

The base is multiplied by an adjustment factor (depending on length of service) and a reduction factor. The product is then multiplied by the district index. The result obtained will indicate the size of the military pension.

What's expected in the near future

The latest news from the Duma reports that the delayed and small (4%) increase in military pensions in 2021 will be offset by social benefits and an increase in civil pensions. Able-bodied people who retired due to age will be able to receive an increase in their second pension legally.

Increasing the welfare of retired military personnel will go in several directions:

- By further providing benefits - transport, tax and social. These include discounts on housing and communal services, free travel on public transport, free trips to department sanatoriums and even assistance when moving to a new place of residence. However, such prerogatives and bonuses depend not only on individual indicators (position, length of service and place of service), but also on the region of residence, ability to work and some other circumstances.

- Indexation in 2021 will be 4%, and together with the indicator for 2020 as a whole it will be equal to 11%. However, financial experts focus on the fact that several stages were lost from the funds of military pensioners while the indexation of the component part of pension payments was frozen for civil servants.

- It is possible to reduce the reduction factor by 2%, then retired military personnel will immediately receive an increase of 6%. But you shouldn’t particularly count on this, due to budget difficulties that arose as a result of shortfalls in insurance premiums caused by the coronavirus pandemic.

The latest news today about military pensions in 2021 allows us to logically assume an increase in total income thanks to the initiative of President V. Putin, already enshrined in legislation, about the opportunity to earn a second, civilian pension. It will increase annually not only by the amount of interest determined for insurance pensions, but also by the value of individual points earned.