Rights of working pensioners in Russia

In the Russian Federation, working pensioners have the following rights:

- The right to receive a labor pension not lower than the subsistence level (for women over 55 years of age and men over 60 years of age).

- The right to employment on a general basis.

- The right to additional unpaid leave of 14 calendar days. The employer cannot deny him such a vacation, nor can he forcefully send him away.

- The right to dismissal without two weeks of work (Article 80 of the Tax Code of the Russian Federation).

- The right to service out of turn (if this is provided for by regional legislation).

State social assistance for pensioners.

It turns out both at the regional and federal levels. It is usually expressed in cash payments or can act as in-kind assistance.

In order to receive this type of compensation from the state, the pensioner goes to the nearest territorial body of the Pension Fund of the Russian Federation and writes a corresponding application.

State assistance also includes a social supplement to pensions, provided that the pensioner’s income does not exceed the subsistence level.

Advantages and disadvantages of combining retirement and work

Combining retirement and work, a citizen feels both the “pros” and “cons” of such a combination. Key benefits are:

- Increasing well-being through receiving pension payments and wages. Often, the amount of the assigned pension cannot provide a person with an acceptable standard of living, so he has to continue working.

- Increase in the amount of pension savings and annual recalculation of pension payments. For a pensioner, the employer pays insurance contributions, which lead to an increase in the pension and its recalculation once a year.

Each pension consists of an insurance and a fixed part. The last one in 2020 is equal to 4,982.9 rubles. – this is the amount guaranteed to every citizen of retirement age. IPC - an indicator of the amount of pension compensation without taking into account the fixed part of the pension - is initially calculated when issuing a pension certificate. The IPC is the quotient of dividing the amount of the pension without taking into account the fixed part by the cost of the IPC.

At the beginning of January, after the indexation of pensions, the cost of the IPC increased by 3.7% and amounted to 81.49 rubles. The coefficient itself shows the number of points that a person has accumulated during his work. The more there are, the higher the size of pension payments. The annual IPC is calculated each year. The coefficient is necessary to determine the number of points earned by a person during this period and the amount of pension compensation.

Disadvantages of working in retirement:

- the pension is not indexed;

- there is no social supplement to pension provision.

The abolition of pension indexation is the main “disadvantage” of a pensioner’s work activity. Upon retirement and subsequent dismissal, pension payments are indexed for the entire period from the date of receipt of the pension certificate. When returning to work again, the size of the pension, taking into account the indexation carried out, is not reduced, but is simply “frozen” for the period of working activity.

The legislative framework

Today, the rights to preferential benefits for working pensioners are determined by the following bills.

| Law number | Characteristic |

| Federal Law No. 76 | Fixes the right to receive benefits for citizens who have served in the RF Armed Forces and who continue to work after retirement due to old age. |

| Article No. 18 of Federal Law No. 173 | Determines the process of providing pension payments to citizens, as well as the issue of annual indexation with an increase in the amount of funds provided. |

| Article No. 80 of the Labor Code of the Russian Federation | Clearly sets out the reasons why citizens who have reached a certain age can be fired. |

| Article No. 128 of the Labor Code of the Russian Federation | Allows an elderly citizen engaged in working activities to receive additional leave. |

| Article No. 217 of the Tax Code of the Russian Federation and Order of the Ministry of Health | Determine the rights of a working pensioner to receive medications on preferential terms. |

| Article No. 218 of the Tax Code of the Russian Federation | Fixes the issue of income tax benefits for working citizens of retirement age. |

The above legislative documents are fundamental, but they can be supplemented at the level of individual regions.

What benefits does a working pensioner have?

The following benefits may be provided:

- pension: increasing the size of the pension and its annual recalculation;

- labor: additional leave, reduction of the working week, free advanced training or new education;

- social: discounts on utility bills, free travel on public transport, etc.;

- medical: free healthcare, including services in public clinics and hospitals, annual flu vaccination (age from 60 years), medicines, etc.;

- tax: discounts on personal income tax, transport, land and property taxes.

Labor veterans

This category of pensioners has the right to receive leave without pay at their request. Its duration is 30 days throughout the year. If desired, you can take it not completely, but in parts. To receive it, you need to write an application and obtain the consent of the manager to provide it.

For this category of the population it is provided:

- Receiving medical services free of charge.

- There is a discount when purchasing medications. It is 50% of the cost.

- When traveling on public transport you do not need to pay for travel. The only exceptions are taxi trips.

Labor preferences

Working pensioners may be provided with the following labor benefits:

- Additional unpaid leave of two weeks.

- An opportunity to improve your skills or acquire a new profession for free. This point applies to those pensioners who are not yet working officially, but want to do so. To obtain the necessary knowledge for free, you need to visit the Employment Center at your place of residence. All expenses are paid by the state, provided that the citizen will work in his acquired profession.

- Opportunity to work part-time.

- The opportunity to resign without mandatory work for two weeks, in accordance with Art. 80 Labor Code of the Russian Federation.

- Possibility of reducing the working day or week. This item is carried out in agreement with the manager. Working hours can be reduced, for example, if a pensioner is caring for a disabled person.

- Cardiologists advise reducing daily calorie intake during self-isolation

- Why is All-Russian clinical examination of adults needed?

- 5 ways to get rid of forehead wrinkles

Vacation benefits for working pensioners

Every working pensioner has the right to additional leave for 2 weeks. Unfortunately, the employer does not pay for it. The boss cannot refuse additional leave. Some managers, in order to save wages, force pensioners to take additional days off. According to the Law, bosses do not have the right to do this. If a working pensioner is disabled, then he has the right to such leave up to 60 days a year, if a WWII participant - up to 35 days.

Benefits in 2020

Pensioners who continue to work can count on receiving benefits in the following areas:

- labor;

- pension;

- medical;

- social;

- tax.

In 2020, there are no plans to introduce additional benefits for working pensioners compared to 2020.

Benefits for working pensioners. Latest news in this video:

The Labor Code of the Russian Federation in Article 128 guarantees employees who are retired the opportunity to receive additional leave. Moreover, such employees, on the same basis as all others, have the right to regular annual paid leave.

Tax benefits for working pensioners

Tax benefits for both working and non-working pensioners are almost identical. Preferences are possible for the following taxes:

- personal income tax;

- property tax;

- land tax;

- transport tax.

Income tax and personal income tax deduction

Working pensioners can receive the following income tax deductions:

- deduction for the purchase of real estate or land intended for the construction of a residential building;

- when purchasing property in the amount of 2 million rubles. for actual expenses incurred during the purchase of real estate and land, including repair costs, etc.;

- when purchasing property in the amount of 3 million rubles. for interest actually paid when repaying accounts payable on a mortgage or consumer loan;

- when selling your own real estate in the amount of 1 million rubles.

Working citizens receiving a pension are completely exempt from paying personal income tax on the following types of income:

- pension provision;

- the cost of a self-purchased voucher to a medical sanatorium;

- financial assistance paid directly by the employer (no more than 4,000 rubles)

Another advantage that working citizens of retirement age can take advantage of is the transfer of the balance of the property tax deduction for income tax to previous reporting periods. Regional authorities can expand the above lists of income tax benefits using funds from the local budget.

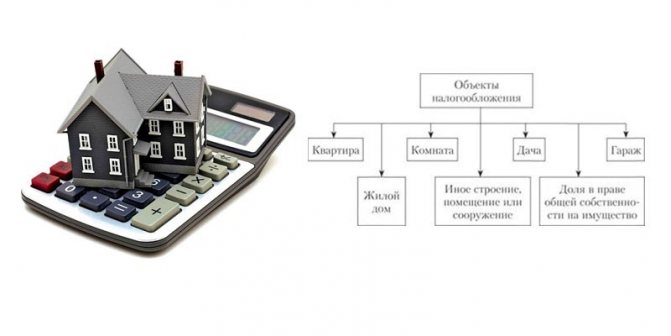

Property tax

In our country, property tax benefits are provided for both working and non-working citizens receiving a pension. You can use this preference only for 1 property owned. Its cadastral value must be less than 300 million rubles. Tax can be reset for the following items:

- room;

- apartment;

- a private house;

- creative workshop, atelier, studio, non-state galleries, libraries, museums;

- garage (parking space);

- outbuildings with an area of no more than 50 m² (they must be located on land intended for individual housing construction, summer cottages or farming).

Land

Until 2020, the land tax benefit consisted of reducing the base by a non-taxable amount of 10,000 rubles. Thanks to Federal Law No. 436-FZ of December 29, 2020, the reduction will currently occur “by the amount of the cadastral value of 600 square meters of land area.” Only one such property per owner is eligible for preference. This federal benefit is available to all categories of retirees.

Regional authorities have the right to additionally establish preferences for this tax. They can appoint a complete exemption for working pensioners from paying land taxes or reduce the tax base. In some regions, such relaxations are possible only for a small group of working pensioners. These include disabled people of groups 1 and 2, Heroes of the Russian Federation and the USSR who received a diagnosis of “radiation sickness” and others. The benefits of a specific subject can be found on the Tax Inspectorate website.

- How can pensioners save money on housing and communal services?

- 9 benefits for military personnel in 2020

- Triceps exercises with dumbbells

Transport tax

The amount of the transport tax discount is determined by the regional authorities independently. In one subject of our country, it is possible to completely cancel such a fee, and in another - its partial payment. In Moscow and the Moscow region there are no transport tax benefits. The Samara and Nizhny Novgorod regions give working citizens of retirement age a 100% discount on the payment of this tax.

In St. Petersburg, you don’t have to pay such a tax if the car has a power of no more than 150 hp, and was manufactured in Russia before 1991. The Leningrad region allows you to pay only 80% of the tax amount if the car has up to 100 hp. The transport tax benefit in the Novosibirsk region applies to only one vehicle. For cars with power up to 150 hp. There is an 80% discount on tracked and pneumatic self-propelled vehicles - 95%.

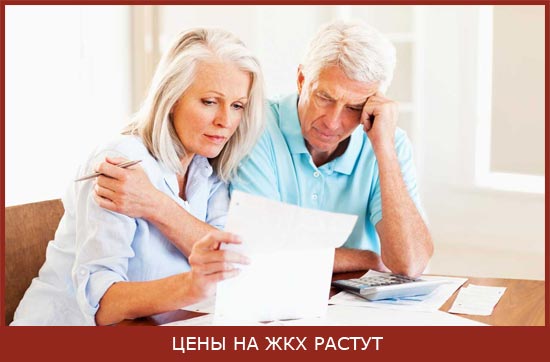

Benefits for housing and communal services

Whether there will be benefits for working pensioners in paying utility bills or not depends on the presence of certain circumstances.

- If a pensioner’s family is recognized as low-income and the cost of paying for housing and communal services is higher than 22% of its total income (according to Articles 158-160 of the Housing Code), it is entitled to a discount, the amount of which can be calculated using a special formula. First, you need to multiply the total family income by 22% (or 0.22) and then subtract this amount from the lowest regional cost of housing and communal services. Every six months you need to confirm your right to the benefit.

- In some regions, those who have reached the age of 80 do not have to pay for major repairs, and those who are over 70 years old only have to pay 50% (according to Article 169 of the Housing Code).

- Pensioners with disabilities can qualify for payment of only half the cost of housing and communal services (according to Article 17 of Law No. 181-FZ).

- Persons injured as a result of the Chernobyl accident and nuclear tests in Semipalatinsk can count on a 50 percent discount (under Article 14 of Law No. 1244-1).

- Military veterans, disabled war veterans, WWII participants, residents of besieged Leningrad and labor veterans may not pay 50% of the bill (according to Articles 16, 15, 14 and 18 of Law No. 5-FZ).

To pay for utilities at a discount, you need to contact Social Security, write an application there, attaching documents confirming your right to the benefit. If the pensioner’s family is low-income, you need to bring the passports of all its members and a certificate of their income for 6 months, a document from the BTI on the area of the living space, and a certificate of absence of debts for housing and communal services.

Social privileges

The Law does not provide for additional social benefits for working pensioners. An exception is the case if the pension amount is below its minimum level. Then a working citizen of retirement age is entitled to an additional payment from the Pension Fund of the Russian Federation. There are also various social allowances for disabilities, combat veterans, labor veterans, etc.

There are no federal benefits for working pensioners as such. But in almost every region of our country there are regional preferences. Social benefits for working pensioners may be as follows:

- free travel on commuter trains and electric trains;

- free travel on buses, trolleybuses, trams and other public transport;

- free garbage removal;

- compensation for paying contributions for major repairs (for residents of apartment buildings);

- discounts on utility bills (or compensation);

- additional allowances from the regional budget.

For example, in Moscow, citizens of retirement age (working and non-working) are entitled to the following preferences:

- free travel on the metro, buses, trolleybuses and trams;

- 50% discount on utility bills (if the working pensioner has a labor veteran’s certificate);

- discounts on the purchase of medications prescribed by a doctor;

- discounts when purchasing tickets for long-distance trains.

Individual social assistance prescribed for old age.

Another type of financial support from the state for non-working pensioners is partial reimbursement of gas costs.

It should be noted that this assistance is provided individually, and a prerequisite must be the fact that the premises in which the pensioner lives are not his property.

Benefits provided by the state to certain categories of pensioners

In addition to basic benefits, certain categories of working pensioners may be provided with other preferences. People eligible for additional assistance include reserve military personnel, labor veterans and disabled retirees. More information about the benefits that these citizens can claim is written below.

Reserve military personnel

In accordance with Federal Law No. 76, reserve military personnel are provided with the following preferences:

- expanded free medical care in departmental clinics, hospitals, sanatoriums, dispensaries, etc.;

- the right to priority employment in civilian professions;

- placement of their children and grandchildren without waiting in line at preschool educational institutions and schools;

- additional civil pension provision;

- the right to receive free housing (if a former serviceman is recognized as in need of this, a special NIS program);

- 75% discount on sanatorium treatment (the amount includes travel costs);

- indexation of pensions 2 times a year;

- maintaining the “northern” bonus regardless of place of residence;

- free travel to the place of treatment in both directions (once a year).

Labor veterans

Representatives of this category can receive the following benefits:

- additional unpaid leave up to 30 calendar days;

- free medical services;

- 50% discount on the purchase of medications;

- vacation at any convenient time while maintaining your salary;

- free travel on public transport (except taxis);

- seasonal discounts on travel on suburban transport.

Working disabled people

A disabled pensioner, depending on the degree of limitation of his ability to work, may qualify for the following preferences:

- obtaining a position corresponding to the state of health;

- additional unpaid leave up to 60 calendar days;

- 35-hour work week (group 2 disabled);

- extraordinary enrollment in educational institutions;

- receiving EDV (monthly cash payment);

- free medical services;

- receipt of NSOs or compensation for them;

- 50% discount on sanatorium treatment (for disabled people of groups 2 and 3);

- receiving free medications according to the list (for disabled people of groups 2 and 3).