27.07.2018

The main and primary task of any such center is to provide leisure time. A pensioner must see that he is needed and needed. Of course, each person has his own vital energy and potential. Many people are mistaken in believing that after finishing work a person should sit at home. This is completely wrong! In retirement, you can also diversify your life and save energy.

Every person who has reached retirement age has the opportunity to come to the city service center for pensioners and register. District centers are called CSOs, as well as Social Service Centers. Once registered, a person opens up many opportunities. For example, he has the opportunity to purchase the best tickets for an opera or ballet, as well as for the premiere of the latest cinema releases at low prices. Such centers organize full-fledged trips and outings for pensioners.

The municipality finances this action plan. The benefits of this benefit plan depend only on their leadership. It also happens that on holidays or on ordinary days, pensioners are provided with free food. Some centers even employ doctors who can give a referral to one or another treating specialist.

Interest groups operate near these centers. On them, pensioners do something close to them and share their experience with others. Every person of retirement age has the opportunity to open their own such circle.

Leisure centers have their own representatives in the virtual network. If you contact the help desk, they will be happy to provide you with the number of this establishment. Information about the centers is contained in the media. They are also called clubs. For example, if you pay attention to the capital, then popular leisure centers here are such as the Izmailovo Culture and Sports Center, Enthusiast, Health and Longevity, and others. In St. Petersburg, such a club is Troitsky. Here guests not only communicate, but even meet, creating couples. Popular in Yekaterinburg are “Golden Age” and “Friendship”.

Who is eligible for benefits?

Not all disabled Muscovites who have retired can count on additional support.

The main rule is that in order to receive “Moscow” benefits, you must have Moscow registration and not provide temporary registration services to persons from other regions (do not provide temporary registration).

There are several categories of pensioners, and the set of social privileges depends on belonging to each of them:

- Veterans of Labor;

- Rehabilitated;

- Veterans of wars (separately - the Great Patriotic War, the war in Afghanistan, the Chechen campaigns, etc.);

- Home front workers;

- Disabled combat veterans;

- Awarded “For the Defense of Moscow”;

- Leningraders marked with the sign;

- Honorary Donors;

- Disaster liquidators;

- Pensioners of the Ministry of Defense;

- Group I visually impaired;

- Disabled pensioners;

- Persons with dependents;

- Working pensioners;

- Single pensioners;

- Families of pensioners;

- Non-working pensioners;

- Pre-retirement people.

Benefits for Moscow pensioners are varied. Pensioners here can register the right to various privileges and create a set of necessary social support measures.

Most benefits must be applied for through Social Security and are not automatically awarded upon reaching retirement age. Benefits are granted only upon presentation of papers proving the relevant right.

Rehabilitation and its basic principles

- Consistent. The stages of rehabilitation are carried out in stages. There is continuity;

- Complex. Rehabilitation services are carried out on the basis of a systematic approach;

- Holistic. A holistic approach must be provided to the person;

- Individual. Measures are carried out in accordance with the person’s condition and his socially adaptive capabilities;

- Deployments. The pensioner himself must be interested in receiving a set of measures;

- Mutual adaptation to the environment. The goal underlying the complex of rehabilitation measures is the formation of an elderly person as a full-fledged member of society. This goal can be achieved through establishing public relations and psychological assistance;

- Conditional completion and socialization. Once all the complexes have been carried out, the pensioner can count on protection and support.

Additional payments to pension

A benefit that only those pensioners who have been officially registered in Moscow for more than 10 years can count on.

This support measure is called a social pension supplement.

Other types of additional payments are received by those whose pension is calculated below the subsistence level of a pensioner in Moscow, as well as by persons who have honorary titles, awards, and merits.

On some holidays, Moscow authorities pay pensioners “gift” one-time supplements to their pensions, the amount of which is established by the city government.

What the law says

In accordance with the law of the Perm region dated December 20, 2012 No. 146-PK, article 4, social support for labor veterans of the Perm region (as amended by the law of the Perm region dated December 25, 2015 No. 585-PK), such an annual payment is due to LABOR VETERANS of the Perm region the edges.

"1. Labor veterans of the Perm Territory, whose monthly income does not exceed twice the subsistence level established for pensioners in the Perm Territory, are provided with a measure of social support in the form of an annual cash payment for health improvement in the amount of 5,000 rubles, followed by annual indexation.”

I don’t know where else, in what regions, such a payment is available, but today I asked this question on the website of the Social Security Service of my Primorsky Territory.

Take an interest in this: 5,000 rubles, even once a year, is still not extra money.

In addition, on the “Social News” website, I found an article “Monthly payment of 2,700 rubles to pensioners”,

where it says: “... Few pensioners receiving pensions from the Pension Fund and RSD (regional social supplements) know about many other types of support expressed in financial equivalent. One of these little-known payments is 2,700 rubles for families consisting only of pensioners..."

Thus, if a pensioner refuses partial compensation for payment for landline telephone communication services and types of social assistance expressed in kind (food, clothing, shoes, etc.), provided that the family consists of pensioners, or the pensioner lives alone, he is entitled to monthly payment, in addition to the RSD and pension, in the amount of 2,700 rubles.

This value is set as the national average, since the formation of the amount is influenced by many factors, the main of which are:

- size and types of social support for pensioners in the region;

- economic indicators of the region;

- level of social security in the region.

Tax benefits

All pensioners whose real estate meets the following requirements can receive an exemption from taxation:

- Its cadastral value is below 300,000,000 rubles;

- Belongs only to the pensioner, without co-owners and shared ownership;

- Does not generate profit and is not used for gain.

You can apply for tax exemption for personal use items:

- Apartment up to 50 sq m;

- House up to 50 sq m;

- 6 acres of garden land;

- Garage;

- Outbuilding up to 50 sq. m.

Citizens must be 55 years old for women and 60 years old for men . Despite the increase in the retirement age (in 2020, people retire at the ages of 56.5 and 61.5 years, respectively), the Federal Tax Service has not yet made changes to the retirement age, which means that pre-retirees and people who have already those who have received a pension (regardless of whether they continued to work or retired).

You can apply for a benefit for one object from each category or for the number of square meters. So, if a pensioner owns two apartments with an area of 60 and 65 square meters, as well as a garden plot of 7 acres, he will not have to pay for 50 square meters of one apartment and for 6 of the 7 acres

.

Pensioners pay income tax only if they continue to work officially or have an individual entrepreneur.

Transport taxes

Moscow pensioners who own a car pay 25% less than able-bodied citizens.

If a pensioner has a disability, he is completely exempt from transport tax. To do this, his car must be equipped in a special way (manual control) and be low-power (up to 100 hp).

The owner of one boat with a motor of no more than 5 hp, and the owner of one type of agricultural equipment are exempt from transport tax.

New addresses for older citizens

Let us remind you that the first club for seniors opened last summer in Maryina Roshcha. Then its analogues appeared in the areas of Tagansky, Preobrazhenskoye, Severnoye Chertanovo, Yuzhnoye Butovo and in the settlement of Shchapovskoye. Pensioners are invited to the centers through personal accounts on the mos.ru portal. For those who are not comfortable with computers and gadgets, information is posted on posters at the entrances of houses, in “My Documents” offices, clinics, and schools. By the end of March, four more clubs should be launched in the city - in the Lomonosovsky, Sokolniki, Yuzhnoye Tushino and Moskovsky districts.

And these are grandmothers?! Muscovites of mature age competed in a beauty contest Read more

As practice shows, men willingly create billiards and table tennis communities. Women are more interested in healthy lifestyle clubs - they share recipes for proper nutrition, practice yoga, Pilates and breathing practices. There are many fans of theater and dance studios, language courses, and intellectual clubs. There are even clubs for board game lovers. The largest one, the Ig-Rai club, was created in the Chertanovo Severnoe district. Pensioners come to My Social Centers just to sit, read, and chat with friends. This is real club life.

Transport benefits

This category includes opportunities to use public transport at a discount.

In Moscow this right is implemented as follows:

- Free travel on public transport, including minibuses.

- Benefits for travel on suburban transport: half the cost.

- Benefits for paying for plane tickets: 75% of the cost.

- The right to use a social taxi (trips to socially significant objects: hospital, social service, etc.);

- Reimbursement of travel costs to the place of treatment.

Pension travel is issued in the form of a Moskvich social card at any MFC.

Regional measures to support pensioners in the Krasnodar region in 2020

As in other regions, in connection with the pension reform, citizens who were supposed to retire in the coming years received the right to receive social benefits intended for pensioners. In the Krasnodar Territory, they took this change in legislation seriously and increased the amount of funds allocated from the regional budget to finance social assistance for older people:

“Increasing the retirement age is a mandatory measure, as is the allocation of additional funding to meet the needs of people of pre-retirement and retirement age. Today we have (already in the second reading) a generally adopted document (author’s note - meaning, Federal Law No. 350-FZ of October 3, 2018 on increasing the retirement age and providing benefits to pre-retirees), which makes changes to 10 regional laws. It became obvious that this was necessary. There are Russian average statistics that show that there are 1.7 pensioners per employee, i.e. One worker supports 1.7 pensioners. This situation is not changing, but is getting worse due to the fact that from 40 to 60 pensioners come to the region from other regions and, unfortunately, for the most part people are now coming to retire. ”

Yuri Burlachko, Chairman of the Legislative Assembly of the Krasnodar Territory

First of all, the leadership of the Krasnodar Territory provides the opportunity to significantly save pensioners’ budgets through tax incentives operating at the regional and municipal level:

| No. | Tax benefit | Benefit recipients | Clarifications regarding registration conditions |

| LAND TAX BENEFITS (MUNICIPAL) | |||

| 1 | 50% discount on land tax | Ilskoye, Tikhoretskoye, Black Sea villages | All pensioners without exception |

| 2 | Krymsk, Afiop territorial- administrative unit | ||

| 3 | Complete exemption from land tax | Abinsky and Khadyzhensky districts | Pensioners over 70 years of age |

| 4 | Abinsky district | For pensioners who are family members of deceased police officers or military personnel | |

| 5 | Timashevskoye, Tuapsinskoye, Dzhubgskoye, Nebugskoye urban settlements | To all pensioners without exception | |

| 6 | Temryuk district | Pensioners over the age of 70 who have monthly amounts of funds not exceeding the cost of living in the region | |

| 7 | Kurganinsky district | Pensioners who are guardians of minor children or live alone | |

| 8 | Neftegorsky and Absheronsky districts | For pensioners over 75 years of age | |

| TRANSPORT TAX BENEFITS (REGIONAL) | |||

| 1 | 50% discount when paying tax | Pensioners who have received an old-age pension | For one vehicle |

| 2 | Full tax exemption | ● Disabled people of groups 1 and 2; ● victims of radiation (Chernobyl nuclear power plant, Semipalatinsk test site); ● combat veterans; ● veterans of the Great Patriotic War. | Applies to the following types of transport: ● motor boats with a power of no more than 20 hp; ● motorcycles, scooters with an engine power of no more than 35 hp; ● passenger cars with a power of no more than 150 hp. |

| 3 | ● Heroes of Labor of Kuban; ● full holders of the Order of Labor Glory; ● full holders of the Order of Glory; ● Heroes of the USSR and the Russian Federation; ● Heroes of Kuban; ● Heroes of socialist labor. | Any vehicle owned by a beneficiary. | |

Important! In the Krasnodar Territory, land tax benefits are provided for the entire plot of land, regardless of its area.

Benefits for housing and communal services

The first thing a Moscow pensioner can count on is a subsidy for housing and communal services.

This is a refund of part of the money paid for utilities from the regional budget.

In Moscow, there are certain upper limits for payments for housing and communal services, which depend on the living conditions of the pensioner:

- Total income of the family living in the apartment;

- Total amount of utility bills;

- The number of square meters for each family member.

If incomes are low, the number of square meters does not exceed the threshold, and the amount of utilities is higher than the established value, you can apply for a subsidy. Whether a pensioner is entitled to this subsidy is decided on a case-by-case basis.

You can apply for a subsidy for all types of utility payments: for water; for electricity; for gas; for the elevator; for maintaining the house and removing garbage, etc.

To apply for a subsidy, you need to contact the management company with a set of documents proving your right to the privilege: receipts for the last six months, a pension certificate, a certificate of family composition, information about living space and income of family members. Additionally, ITU certificates from disabled people are provided, if they live in the apartment.

An important condition for receiving a subsidy : all debts must be closed before contacting the Management Company. The subsidy is accrued only on payments from the moment of application.

Benefits for housing and communal services for pensioners in Moscow

In addition to subsidies, you can apply for benefits:

- Free landline phone;

- Solid waste removal.

Overhaul for Moscow pensioners

A separate issue is contributions for major repairs. You can apply for a benefit here.

Half of the overhaul fee is paid by:

- Single pensioners over 70 years of age;

- Families of pensioners over 70 years of age;

- Other beneficiaries (for example, a disabled pensioner, a repressed person, a labor veteran, etc.).

Single pensioners over 80 years of age, order bearers, heroes, war participants, blockade survivors, etc. are completely exempt from paying for major repairs.

What are they doing?

Every pensioner has the opportunity to register with the CSO - Social Service Center. After this, he can enjoy a lot of benefits and privileges - purchase the best cinema and theater tickets at discounted prices, go on excursions for free, and travel. On holidays and weekends, pensioners have the opportunity to dine here for free. Funds for all this are allocated by municipalities. Some organizations have hobby groups. Here you can learn a new hobby or share existing knowledge and experience with other participants.

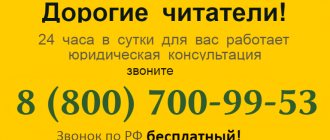

Information about the location of such centers can be found in the help desk, on the Internet, as well as on free classifieds websites.

Common mistakes on the topic “Benefits (payments) to pensioners in the Krasnodar Territory in 2020”

Error: A pensioner living in the Krasnodar region is trying to apply for a transport tax benefit for 2 of his vehicles (a car and a truck) on the grounds that these are different types of vehicles.

In fact, tax exemption can be issued for only one vehicle, and only federal exemptions are not subject to restrictions on vehicle power.

Error: A pensioner registered in Kuban refused to receive regional benefits so as not to lose the right to obtain federal privileges, which seemed more tangible to him.

Registration of federal benefits does not prevent the receipt of regional benefits in full. The only thing is that you won’t be able to sum up the same benefits. For example, you cannot obtain an exemption from property tax on 2 real estate properties of the same type at once.