How is a pension calculated for an individual entrepreneur?

Individual entrepreneurs also pay interest to the Tax Inspectorate (until 2020, contributions were made to the Pension Fund). The method for calculating an individual entrepreneur's pension will be different, depending on the taxation system used.

Individual entrepreneur

Individual entrepreneur: pension recalculation

If a pensioner continues to work after reaching retirement age, he can recalculate.

Two types of individual entrepreneur contributions:

- Pension;

- Health insurance.

The legislation establishes a single minimum contribution, which is the same for each individual entrepreneur and is paid regardless of how much profit the entrepreneur received or whether he received it at all. This amount is 36,238 rubles per year (for 2020). Of these funds, 29,354 rubles are allocated for pensions, and 6,884 rubles for medical insurance.

Individual entrepreneurs have the right not to pay fixed fees in exceptional cases. For example, lack of profit while the entrepreneur was in prison, and the individual entrepreneur has no employees.

The contribution amount is calculated in 2 ways:

- Income did not exceed 300,000 rubles = divide the fixed contribution by 12 months and multiply by X (the number of months in the period for which the contribution is planned to be made)

Reference! Contributions can be paid for a period: month, quarter, half year, year.

- If income exceeds 300,000 rubles = Mandatory contribution + ((income for the year – 300,000) * 1%).

In general, all formulas for calculating pensions for individual entrepreneurs are identical, but the basis for calculating contributions depends on the taxation system.

On the simplified tax system (simplified)

On the simplified tax system there can be 2 bases for calculation. If the system is “STS Income”, then the base will be all income received by the individual entrepreneur for the year. Under the “STS” system of income minus expenses, an entrepreneur has the right to reduce the tax base by the amount of expenses.

For example, an entrepreneur made a profit of 200,000 rubles and incurred expenses of 50,000 rubles. In the first case, the taxable base will be 200,000 rubles, and in the second - only 150,000 rubles (200,000 - 50,000).

Reference! The simplified tax system can be combined with other taxation systems. In this case, the simplified tax system will be the main, primary system, and the PSN or UTII will be an additional one. In this case, the calculation of the taxable base will be based on the rules of the additional taxation system.

On UTII

The same rules and a fixed contribution to the tax office apply to UTII. But UTII has one significant difference - the tax and additional contribution are calculated not from total income, but from imputed income. Tax authorities check how much an entrepreneur must pay.

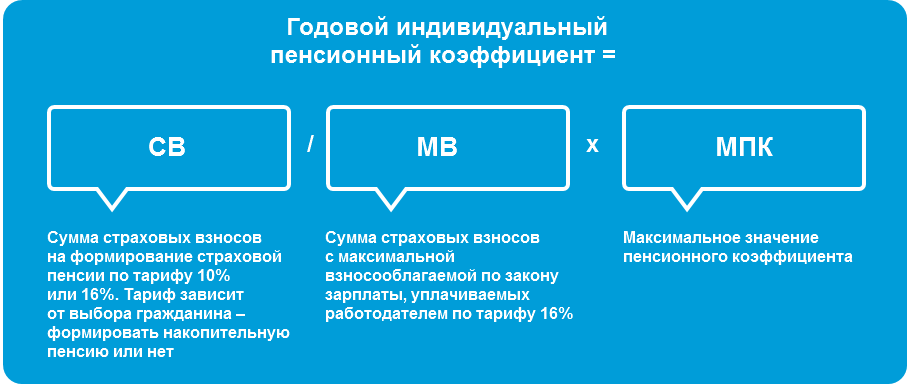

IPC calculation

On OSNO

All of the above rules apply to the general taxation system. But the basis for calculating contributions is income minus business deductions. Expenses are not deductible if an entrepreneur deducts expenses from income - the tax office sues. If OSNO is valid for an individual entrepreneur simultaneously with PSN or UTII, the calculation rule will apply as for PSN/UTII.

On PSN

PSN is a patent taxation system. It's a little more complicated. Here the pension amount will be calculated based on payments based on the amount of potential income. Potential income is specified in the Tax Code for each type of activity. However, the truth is simple: the more contributions, the higher the individual entrepreneur's pension will be.

Note ! In 2020, the fixed contribution will be 40,874. A gradual increase is planned every year.

Approximately how much can an individual entrepreneur receive?

Thanks to the pension calculator, which is located on the PFR website, you can roughly imagine what kind of pension existing entrepreneurs will receive if they continue to operate and regularly make insurance contributions.

For example, let’s imagine that an individual entrepreneur plans to work in the market for about 30 years, while receiving about 1.2 million rubles per year. According to the calculations of the calculator, an individual entrepreneur will be able to receive 12.6 thousand rubles per month in retirement. If you work for, for example, 40 years at the same level of income, you can count on pension payments in the amount of more than 15 thousand rubles.

Now let’s take into account bonuses and imagine that the individual entrepreneur does not immediately take advantage of his right to a pension. After working for 40 years and receiving 1.2 million rubles a year, a citizen decides to delay retirement for another 5 years. His pension instantly increases to 21.6 thousand rubles. If you come for a pension 10 years after the appearance of such a right, then the size of the individual entrepreneur’s pension will be more than 34 thousand rubles. And this is a good level, which is close to the average salary level in Russia.

It should be understood that calculations are made relative to current prices. At the time of retirement, the amount will, of course, be indexed to take into account inflation.

What is an individual pension coefficient

Is the length of service required for an individual entrepreneur’s pension and how to calculate it

Each entrepreneur, in the course of his business activities, earns his own pension coefficient. The individual pension coefficient, abbreviated as IPC, is fixed on the date from which payment officially begins.

2 types of IPC:

- IPKs – for periods up to 2020;

- IPKn – for periods after 2020.

The IPK will be equal to the sum of the IPKn and IPKs multiplied by the KvSP. It stands for the coefficient of increase in the IPC for a deferred assignment of a pension. For example, if an entrepreneur continues to work upon reaching retirement age, the period of “overtime” will be additionally taken into account. If this does not happen, then KvSP will not influence. The IPC depends on the total amount of contributions paid during the entire existence of the individual entrepreneur and on the length of service. The longer the length of service and the volume of contributions, the higher the accumulated points and coefficients, therefore, the higher the pension accruals will be.

Drawing conclusions

So, we can say that every individual entrepreneur, if he is interested in a good pension, should pay attention to several basic factors. Namely:

- Total work experience. The more years an individual entrepreneur works, the better, because each additional year, subject to deductions for contributions, brings him additional points.

- Amount of income. Although individual entrepreneurs pay fixed contributions, they also have a variable part, which depends on the amount of income. Accordingly, with a large income, there will be more contributions to the state, which means you can count on a good pension.

- Late appeal. And finally, you shouldn’t immediately stop business and run for a pension as soon as the opportunity arises. Sometimes it is better to work further, hoping that during this time the amount of payments will increase significantly.

Additional odds

Do self-employed citizens have length of service and how does this affect their pension?

The basic calculation formula for 2020 takes into account only 4 indicators. One of them = MPC.

Note ! To apply for a pension, you must reach the minimum pension coefficient (MPC). In 2019, it is set at 13.2 points, and annually this figure will increase by 2.4 points until the MPC reaches 30. The cost of one such point for 2020 is 87 rubles.

Preferential coefficients:

- Military service – 1.8 points;

- Parental leave – 1.8 points per year minimum. For each child, the number of points increases, and the maximum vacation period in total is 6 years.

- Years spent caring for close relatives with disabilities or incapacitated relatives over 80 years of age, caring for a child with 1 degree of disability over 18 years of age - 1.8 points per year.

How are pension points calculated for the self-employed?

Unlike individual entrepreneurs, who are required to pay all types of contributions to the Federal Tax Service, such an obligation is not provided for the self-employed. They only pay taxes:

- In cooperation with individuals – 4% of the amount of income;

- When working with organizations – 6%.

Thus, the self-employed do not have an insurance period for calculating pensions, therefore, IPCs are not formed. Upon reaching retirement age, a person who has worked all his life as a self-employed person will only be able to claim a social pension, not an insurance pension.

An alternative option is independent (voluntary) deduction of contributions. Also, self-employed people can transfer money for the funded part of their pension to non-state pension funds, and upon reaching a certain age, receive guaranteed payments.

To take care of their pension, self-employed people can save money in bank deposits. The annual return on them is on average 5% of the amount, but in 2-3 decades you can accumulate enough money for a comfortable old age.

Rules for registering an old-age pension for individual industrial complexes

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

Reaching the minimum retirement age when an individual entrepreneur can receive an old-age pension is not enough. It is necessary to accumulate a minimum amount of IPC. A pleasant moment: when calculating the IPC, the time of service in the army, the time of caring for a child of no more than 6 years in total, the time of caring for sick incapacitated relatives and the time when the individual entrepreneur was officially listed as unemployed will be taken into account.

Insurance pension

In practice, the retirement age will be raised gradually.

Entrepreneurial experience in 2020 is at least 10 years. That is, upon the onset of old age, at least 10 years of life, an individual must work as an individual entrepreneur. If an individual entrepreneur is disabled, then the right to a pension or disability benefit is retained. If physical a person opens his own individual entrepreneur less than 10 years before the retirement age - he will be entitled to a pension calculated from his work experience without the status of an entrepreneur.

Note ! These benchmark figures may be reduced for representatives of small nationalities and residents of the far north.

To receive a pension, an entrepreneur must appear at the Pension Fund and present:

- birth documents of children;

- personal passport;

- work book;

- insurance certificate;

- certificate of payment of the single tax on imputed income;

- certificates of payment of mandatory insurance contributions and taxes. A sample of certificates is available on the official website of the Pension Fund.

What other factors affect retirement?

If an individual entrepreneur wants to significantly increase the size of his pension, then he needs to delay applying for pension money a little. In other words, a citizen already has the right to receive a pension, but does not apply for it, but continues to work and feed himself without government assistance.

And the longer a citizen survives on self-sufficiency, the larger the pension he will then be assigned. The thing is that for such cases an increase in the parameters of the above formula is provided.

For example, if a citizen decides to wait 5 years after receiving the right to a pension and only then comes to receive it, then during the calculation they will add 36% to the basic payment. The amount of accumulated points increases by 45%.

If a citizen shows restraint and does not apply for pension money for 10 years, then the basic payment in his case will more than double. The amount of accumulated points will be increased by 2.3 times.

Such bonuses significantly increase the final amount of pension payments. They appeared for a reason. The state is interested in ensuring that citizens remain in the labor market as long as possible and do not rush to get a pension. Against the backdrop of a declining working-age population, this problem is becoming truly acute.

Beneficial bonuses can encourage citizens to continue working. Potential retirees will know that if they work a little longer and then come to claim their pension, its amount will be significantly larger.

Pension calculation

The size of an individual entrepreneur’s pension can be calculated using a simple formula. The number of points collected must be multiplied by the cost of one and a fixed share added. To determine your personal coefficient, it is better to consult the Pension Fund.

If an individual entrepreneur does not have enough length of service and paid contributions for full insurance pension payments, he will receive only a basic pension. Savings allow you to increase your insurance share or provide an additional part of your pension.

The main conditions for receiving an individual entrepreneur's pension include:

- Reaching the age fixed for the legal transition to retirement is 55 years for women and 60 for men.

- Insurance experience of at least 9 years.

- IPU from 13.8 points.

Important! Every year until 2024, the insurance period will increase by a year until it reaches 15 years.

Important nuances for the simplified tax system and UTII

The calculation of pension payments for individual entrepreneurs working under the simplified tax system is carried out according to the usual standards. A simplified form of taxation provides for the payment of insurance-type contributions within the framework of pension insurance.

Individual entrepreneurs using simplification work under the following conditions:

- They pay a single tax instead of income tax, property tax and VAT.

- Reports are submitted once a year.

- They have the right to tax holidays.

- They may have representative offices in other regions.

Tax rules have been simplified for individual entrepreneurs who receive an annual income of up to 60 million rubles, and if the organization has less than a hundred employees. Pension contributions for employees are paid by individual entrepreneurs. There are two options for using this system. The first involves an income tax of 6%, the second - payment of a tax on income minus expenses of 5 - 15% (the figure depends on the region).

An individual entrepreneur’s pension on UTII also depends on the amount of contributions. The system used in such cases is beneficial to individual entrepreneurs with impressive amounts of income. The tax amount here is set without taking into account profits, the rate is 15%. Pension payments are calculated in accordance with a deflator coefficient that changes every year. Reports are submitted quarterly; you don’t have to use cash registers or open a current account.

Pension provision for hired employees

Individual entrepreneurs can use the labor of hired employees only after concluding an employment agreement or civil law contract. An entrepreneur is obliged to pay contributions for his employees in the amounts established by Russian legislation. For people applying for their first job, the individual entrepreneur must issue insurance certificates of an approved form.

The insurance experience of such employees is confirmed by specialized accounting data. We are talking about information located on the employee’s personal account with the Pension Fund. After signing an agreement with an individual entrepreneur, a person is given 30 days to register with the fund.

Important! The pension is calculated according to the individual entrepreneur’s reports for hired employees and for himself.

An entrepreneur submits reports for hired personnel as an organization. To report for yourself, you need to submit a statement in the prescribed format and copies of documents confirming payment of contributions. If you have a current account, payment orders and special statements are considered as such confirmation. If you don’t have an account, you can prove payments with bank receipts.

The insurance experience of employees working under employment agreements with individual entrepreneurs takes into account the periods of payment of contributions for them. Working periods can be confirmed by contractual agreements with notes from the employer. Contributions are credited separately for each citizen.

Payments to individual entrepreneurs without employees

Calculating an individual entrepreneur's pension without hired employees is even easier. For them, fixed amounts of contributions for pension insurance have been established. Payments are made on the following basis:

- For individual entrepreneurs with an annual income of up to 300 thousand rubles, the contribution to compulsory pension insurance is determined in the amount of 26,545 rubles.

- Other entrepreneurs will have to pay another 1%.

- In the first option, payments should be made before the end of the year, in the second - before July 1 of the coming year.

- The total amount of such contributions should not exceed eight times the fixed contribution.

- Compulsory medical insurance pays 5,840 rubles annually.

The basic part of an individual entrepreneur's pension can be increased if there are disabled citizens in his family who are dependent on him. This fact must be documented.

Calculation example

If an individual entrepreneur has an income corresponding to the national average (about 42 thousand rubles), then for the year the amount will be 504 thousand rubles. We round the amount to 500 thousand. Pension payments for 2020 will be equal to:

26,545 +1% x (500,000 – 300,000) = 28,545 insurance

(28,545 / (1,021,000 x 16%)) x 10 = (28,545 / 163,360) x 10 = 1.75 points in odds.

By the time he retires in 35 years, this individual entrepreneur will receive 35 x 1.75 = 61.25 points, earning the right to payments. Taking into account the fixed part, the pension amount will be 4,982.90 + 61.25 x 81.49 = 4,982.90 + 4,991.27 = 9,974.17 rubles.