The system of state, regional and local measures to support motherhood and childhood is aimed at encouraging the birth of every baby. The number and composition of possible benefits and compensation for large families increases noticeably if a third child appears in the family.

Download for viewing and printing:

Decree of the President of the Russian Federation of May 5, 1992 N 431 “On measures for social support of large families”

Federal Law of June 14, 2011 N 138-FZ “On Amendments to Article 16 of the Federal Law “On Promoting the Development of Housing Construction” and “Land Code of the Russian Federation”

Support Features

There is no single law on the basis of which large families would receive assistance from the state. However, this issue is currently under consideration. Speaker of the Federation Council Valentina Matvienko noted at the beginning of 2020 the importance of adopting such a law. It will allow:

- unify the measures provided;

- make it easier for subsidy recipients to find information about their rights and benefits.

Ideally, it is planned to collect all federal preferences in one regulatory act. But in addition, regions will retain the right to use their fertility support measures for families with 3 or more children.

One-time payment to repay a mortgage loan

Payments for partial or full repayment of mortgage loans were introduced relatively recently. A family with three or more children requires a larger apartment, which forces families to use a mortgage.

The state provides several opportunities to save on this:

- use maternity capital. The certificate is issued at the birth of the second child;

- apply for a preferential mortgage at 6% per annum (there are offers at 4.5%). This is available to families who had a second or subsequent child in 2018 or later;

- receive a one-time payment of up to 450,000 rubles to repay the loan.

The last opportunity has appeared recently - applications for payments have been accepted since the end of September 2020. A family can receive a payment if a third or subsequent child is born in 2020 or later. In 2020, the program continues, and they even promise to expand it (to provide payments for those loans under the terms of which the family bought an apartment with finishing).

The amount of mortgage compensation at the birth of the 3rd child is equal to the amount of the loan balance, but not more than 450,000 rubles

.

This amount can only be used to pay off the mortgage loan. Of course, in most cases it will not be possible to close the loan completely. But you can pay part of it and then apply for refinancing. With its help, it will be possible to shorten the loan term by reducing the size of the monthly payment.

Who can receive

The problem of unifying the measures provided also lies in the fact that the concept of a large family from region to region can be interpreted somewhat differently. This usually concerns the number of children. In the constituent entities of the Russian Federation, where the demographic issue is not so acute, the number of minors may be more than 3.

In the generally accepted form, a large family is considered to be a family in which there are at least 3 children, all of whom must be minors. When the number of children under the age of 18 becomes less than 3, the status is lost, as is the right to receive benefits (for full-time education, the age increases to 23 years).

Satisfying the parameters set by the local administration is not the only requirement. It is important to formalize the status of a large family. This happens in social security agencies. One of the parents (mother or father - who collected the documents) is issued a certificate for a large family with its own serial number and description of the family members (children). The validity period is also indicated there (can be extended for a number of reasons).

Regional benefits

Let's consider what benefits citizens can enjoy upon the birth of a third child, in addition to acquiring land ownership.

At the local and regional level, citizens have the opportunity to implement the following areas:

- priority right to provide places in preschool institutions;

- discount on utilities or refund of funds paid for housing and communal services through local social security authorities (the discount can be up to 30%);

- provision of free meals in general education institutions and institutions of primary and secondary education;

- the gratuitous nature of drug provision for minors under 6 years of age;

- issuing free travel documents for minors, and in some regions - for all family members;

- monthly cash payments in the amount of the subsistence level until the third child reaches 3 years of age;

- regional maternity capital at the birth of the third or fourth child;

- free education for children in art, sports, and music schools;

- free provision of textbooks and other benefits.

Attention!

To find out what benefits are provided for the birth of a third child in your region, you need to contact the social protection authorities at your place of residence. Most social support measures are implemented through these institutions, and the composition of these measures can change annually by decision of local and regional authorities.

Another important support measure will be a discount when paying taxes on a vehicle owned by one of the parents. This preference is provided by the tax authority subject to confirmation of the birth of a third child.

Forms of support

For large families, several forms of support are provided. They are usually divided into federal and regional. The former are used everywhere, while others are provided only in certain regions in accordance with local regulations. All benefits can be divided into several groups:

- material;

- housing and communal services;

- medical and social;

- labor

Moreover, the set of measures for citizens may vary from region to region. Other factors may affect eligibility. For example, it may be necessary to meet special conditions, confirm the need for financial support or provide a specific type of assistance.

Obtaining a land plot

Large families with a third child have the right to count on receiving a plot of land for building a household (IZHS). The procedure for providing such property depends on the region of residence of the family. The most developed program is considered to be in remote regions. For example, in the North they give out 2 hectares of land for individual housing construction. A similar rule applies in the suburbs of large settlements. There you can get up to 20 acres of land.

It is worth considering that the land plots are not equipped for living. Over the course of 2-3 years, the owner of the land must build a suitable place for living

house. He has no right to sell the plot.

For those families who do not want to take a plot, but want to purchase one more suitable for them, the region allocates so-called land capital. For example, in St. Petersburg its size in 2020 was 369,779.92 rubles.

Many regions are ready to give money instead of land, because there are simply no suitable plots of land owned by municipalities. And it is large families that will be given priority for receiving a plot.

Cash payments

The birth of a third child is accompanied by the receipt of certain financial income from the state or region of residence. Regardless of the subject of the Russian Federation, women who give birth to a third child receive:

- lump sum benefit at birth - from February 1, 2020 is 18,004.12 rubles, additionally the amount can be indexed in a specific region;

- monthly allowance - the amount depends on the amount of earnings and the age of the child (the maximum amount is due until the child is 1.5 years old). Read more about childcare benefits for children up to 1.5 years old in 2020 in our article >>.

These payments are provided to large families even without confirmation of status. Additionally, they can apply for maternity capital in the amount of 466,617 rubles, if they have not taken advantage of this right before.

In 2020, children born after January 1, 2020 can receive another monthly payment, provided that the family income per person does not exceed 2 subsistence levels in the region.

Specifically, large families can receive additional payments. They consist of the following types of support:

- EDV. It is provided for the 3rd and subsequent children, paid until they turn 3 years old. The size of the payment is determined by the cost of living per child in the family’s region of residence. This support format is available to low-income families who have documented their social security status. The payment does not occur everywhere, but only in a little over 40 regions.

- Regional maternity capital for the 3rd child. Not provided everywhere. It can be provided in different forms: for the purchase of housing, construction of a house, purchase of land, a car and for other needs. The type of support needs to be looked at by specific region.

- Child benefit. It is paid until the child turns 16 years old. People with many children can also apply for this form of support, but they will have to defend their right in social security. The size is determined individually in regions, based on family category and other factors. This benefit may be paid once a month or quarter.

All together allows you to receive quite impressive financial support. But you will have to process the payments yourself and collect supporting documents for each.

Status of a mother of many children: when is it assigned?

In order to receive benefits, individuals need to acquire the status of a parent with many children.

A woman with many children is one who has 3 or more children under the age of 18. Since the Russian Federation is not considered a country with a high birth rate, the requirement to have 3 or more children is justified, and this number of children, as well as the conditions and procedure for receiving state benefits, are established by the legislative norms of Russian regions, which may coincide with the norms other regions do not match. For example, if a family has three children, one of whom is in guardianship, it can be considered a large family in St. Petersburg, but not in the Leningrad region.

A mother from a large family can receive benefits if:

- Supports children with her husband, or alone.

- Lives with his children.

- Children must be minors, or under 23 years of age if a full-time student. Some regions set the age of 16 and 20 years for children if they are studying full-time.

- Has three or more children. In certain regions where the birth rate is relatively high, the minimum number is considered to be 4 or 5 children.

Sometimes difficulties arise when determining the status of a mother with many children, for example, if the father and mother are divorced, and the son or daughter lives with the father, and the other two children live with the mother and her new husband. In this case, a woman cannot acquire the status of a mother of many children, because the children live in separate families.

Housing and communal benefits

The housing issue is the most pressing topic for almost all categories of citizens. It is especially acute for families with a large number of children. The state immediately provides a set of possible support measures for them.

Housing certificates are not provided to families only with the status of large families. However, they can become participants in relevant programs for other reasons (young family, people in need). Specifically for large families, the following support measures are provided:

- Provision of land. A similar practice exists in many regions. The plot is granted to all family members upon the birth of their 3rd child. The subsidy is issued to local authorities involved in the distribution of land. A family living in a particular region for at least 5 years can apply for an allotment (in some regions of the Russian Federation this parameter can be reduced/increased). Additionally, local authorities can legally establish the categories of land available for transfer (for example, residential or for agriculture). Read more about the provision of land plots to large families in 2020 in our article >>.

- Preferential terms of mortgage lending. Those large families in which the third child was born no earlier than 2020 can apply for them. The subsidy itself consists of reducing the interest rate on an existing or newly issued housing mortgage to 6% per annum for the entire loan term. The difference between the basic and preferential rates is paid by the state from the federal budget. This allows you to significantly reduce the financial burden.

In the regions, families with many children are often provided with discounts on utility bills and the purchase of fuel for heating their homes. Local authorities usually compensate from 30 to 50% of the cost calculated according to the standards.

Standard tax deductions

Among other things, families with children have the right to receive tax deductions. For children, a standard deduction is provided - a refund of personal income tax paid (at a rate of 13%) for a certain amount.

One of the parents (guardians/trustees) can receive a deduction if the other parent (guardian/trustee) refuses to receive this deduction. Also, parents (including adoptive parents, guardians and trustees) have the right to divide the amount of the provided deduction among themselves into equal parts.

If the spouses have children from their first marriage

, for example, one child, and married to another person they have two children, the first child is also taken into account when receiving deductions and benefits. Therefore, the deduction is issued for three children.

The amount of tax deduction for the first and second child in 2020 is 1,400 rubles for each of them. The amount of tax deduction for the third and subsequent children is 3,000 rubles for each

.

What is a tax deduction? This is the amount of income tax that was paid in the reporting tax period, and by which the tax base can be reduced for calculating personal income tax. Tax base is the total amount of income of the taxpayer, which is taxed at a rate of 13%. In fact, this is wages for those taxpayers who are officially employed.

The amounts of standard tax deductions are the same for all regions of the Russian Federation. You can apply for them by filling out a declaration in form 3-NDFL yourself or through your employer

. It is necessary to provide documents confirming the right to receive a deduction. These include birth (or adoption) certificates of children.

A standard deduction of 3,000 rubles for a third child will provide savings on personal income tax in the amount of 390 rubles per month

, or 4,680 rubles per year. This is not so small as to ignore this possibility.

You can also apply for an income tax refund if children (including adopted children) are studying full-time: cadets, interns, residents, graduate students, students under the age of 18. But this is already a social tax deduction, and it is limited in amount.

Medical and social

Some of the support measures provided to large families are outlined in Decree of the President of the Russian Federation No. 431 of May 5, 1992. In particular, they relate to the following medical and social subsidies:

- receiving prescription medications for the treatment of young children (under 6 years old) without waiting in line or paying;

- free travel for schoolchildren in public city transport (if required, in suburban and regional transport);

- the right to enroll in kindergarten and school without waiting in line;

- support for schoolchildren in the form of free lunches, reimbursement of costs for the purchase of school and sports uniforms, and shoes.

In the regions, such children may also be provided with free trips to sanatoriums and camps if they have health conditions.

Link to document: “On measures for social support of large families”

Social benefits include benefits associated with farming. People with many children can be allocated their own land for this purpose and be provided with interest-free loans for the development of such a farm.

A pleasant surprise for children from large families is the distribution of gifts in honor of the New Year. For such kids, special matinees are held in different cities with Santa Claus, an entertainment program and, of course, sweet gifts.

What types of benefits are available to large families?

A Moscow family is recognized as having many children if three or more children were born and/or raised in it, including adopted children, as well as stepchildren. A family will be considered large until the youngest child reaches the age of 16. But if the youngest child studies in a general education institution, then the family will be considered large until the youngest child reaches the age of 18.

In 2020, the following benefits have been established for Moscow large families:

and types of social support:

- cash payments made one-time, monthly and annually;

- providing in-kind assistance;

- provision of various benefits.

Let's take a closer look at the benefits and types of social support for large families in Moscow.

Labor benefits

Parents from large families are often forced to work hard to support their children. In order to somehow help and protect them, the Labor Code provides for the following preferences:

- assistance in finding employment - in employment centers they are first of all offered lucrative vacancies, often provided with part-time or remote work positions;

- additional leave - it is provided once a year in the presence of special family circumstances, can last up to 2 weeks, is agreed in advance with the management, but is not paid by the employer;

- additional day off - provided every week, but only to those parents with many children who work officially and whose working week is at least 40 hours (otherwise it will not be possible to get a day off);

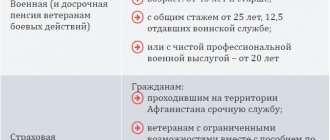

- early retirement - this form of support is especially relevant in anticipation of an increase in the retirement age; mothers of many children will presumably have their retirement age reduced (will depend on length of service or age), but this benefit is provided only to mothers.

In case of downsizing and liquidation of a company without other indications, privileges for large families are not provided. The number of children does not affect the amount of wages.

Tax deductions for children cannot be considered a special privilege, since they are provided to parents regardless of the number of children. Their number only affects the size of the benefit.

Read: Regional maternity capital for a third child

In-kind assistance and benefits

Moscow large families are provided with the following types of benefits and in-kind assistance:

- free provision of baby food for children under seven years of age;

- providing medicines to children under 18 years of age;

- providing medicines to mothers who gave birth and raised 10 or more children;

- free travel on all types of city passenger transport (except taxis and minibuses) for children under 16 years of age (and for students under 18 years of age);

- free travel on public transport for one of the parents.

Who is entitled to benefits in Moscow?

Federal legislation provides uniform rules for assigning the status of large families.

In accordance with Presidential Decree No. 431, which defines the powers of regional authorities, the conditions for obtaining rights to benefits for large families in Moscow may differ from the conditions relevant for other subjects of the federation. The main regulatory document in the capital region is the law “On Social Support...”, according to which a family must have at least three children to obtain the status of a large family. The status and acquired rights are retained by citizens until the youngest child comes of age. An extension of the validity period of benefits may take place provided that one or more children continue their studies at a university. In this case we are talking about 23 years of age.

Families who have adopted a specified number of children can also take advantage of benefits for families with many children. To provide privileges in accordance with the legislation of Moscow, recipients must live together and be registered in the capital region.

Regional payments

Depending on the location of the region of residence of a large family, the number of payments and their size may vary significantly. For example, in Moscow and the Moscow region

there is no regional maternity capital for the third child. But residents of these regions can count on two lump sum payments:

- young parents (under 30 years old) – 148,890 rubles;

- for the third child (residents of Moscow) – 15,312 rubles.

various types of compensation payments in Moscow

– due to the increase in the cost of living (1,268 rubles), expenses for housing (1,103 rubles), telephone costs (264 rubles), etc.

In St. Petersburg

There are also one-time payments for the birth of a third child.

In 2020, its size was 53,900 rubles. You can only spend it on purchasing goods for the child. Maternity capital in the Leningrad region

reaches 117,360 rubles.

The further away the region is located, the lower the cost of living. It is worth considering that the amount of maternity capital also changes. So, in the Novosibirsk region

parents receive 100,000 rubles.

In Tyumen

- 40,000 rubles.

In the near future, the Government of the Russian Federation plans to equalize the size of some social payments for the birth of a third child across all regions.

Labor support for single mothers of many children.

Single mothers with many children are helped not only with cash benefits, but also with benefits at work:

- the employer does not have the right to force a single mother with many children to work more than the norm,

- Also, such a mother can refuse business trips, work at night and on weekends,

- It is possible to obtain sick leave to care for the baby. In this case, in the first two weeks the employer must pay 100% of the salary. If the disease lasts longer - only 50%. Up to 7 years, each day of hospital stay will be paid. But if the child is old enough (over 15 years old), then the accountant will count only the first 15 days of sick leave.

- employees of this category cannot be dismissed unless a gross violation of internal discipline has been recorded,

- if there is a child under 14 years old, the mother can apply for a reduced working day,

- such mothers are provided with an additional 2 full weeks of unpaid leave,

- upon application, they are required to provide a tax deduction in the amount of 2,800 rubles. for the first and second child, 6,000 rubles for the third and subsequent children,

- early retirement if the total insurance period exceeded 15 years.

Attention! This benefit is provided until the total salary, starting from the beginning of the month, exceeds 3,500,000 rubles.

Sanatorium for large families: how to get it for free for low-income people 2020.

Other benefits for single mothers of many children.

The strongest support occurs until the child is three years old. Almost all other benefits have a municipal basis.

The support that is available in one region may not be valid in another.

Most often these benefits relate to:

- provision of free meals in educational institutions,

- free travel on surface and underground transport,

- school enrollment;

- free distribution of medicines,

- compensation of 50% of the rent,

- issuing funds as compensation for a school uniform,

- services in public medical organizations,

- the right to be one of the first to enter a preschool institution and receive a 50% compensation payment,

- sanatorium-resort recovery,

- discounts in sections and circles,

- in some regions it is possible to receive support in kind (clothing, food, etc.),

- free visits to parks, museums, etc. (no more than once a month),

- providing free legal support.

Whether these benefits are valid or not in the region depends, first of all, on the demographic situation in the region and on the size of the local budget.

Not every budget can afford large expenses.

Benefits

At the federal level, the following types of material support are provided:

- child care benefits,

- compensation for rising cost of living,

- compensation for rising food prices (for children under 3 years old),

- subsidies for landline telephone payments.

In addition, all regions can supplement the list of subsidies based on specific opportunities. Also, families raising 7 or more children have the opportunity to qualify for a one-time payment in the amount of 100 thousand rubles. (and receiving the Order of Parental Glory). If there are 10 children or more, additional compensation is provided, incl. to retired mothers, and annual holiday cash gifts (on Family Day and Knowledge Day).

You can find out about the full list of payments due from your local social security offices.

Benefits and payments for large families in Moscow 2020

The mother of a large Moscow family must understand the benefits provided by law for large families, so as not to miss the opportunity to save on expenses, take care of rest, entertainment and even the cultural development of her children. Indeed, in addition to the federal ones, the Moscow city law establishes additional benefits for large families.

The main document, which lists all payments due to large families in Moscow, is Moscow City Law No. 60 of November 23, 2005 “On social support for families with children in the city of Moscow.” Please note that changes and clarifications are made from time to time, so please use the most current version of the law.

How to confirm your rights to benefits

To take advantage of benefits and compensation, you first need to confirm your rights to them - obtain a certificate for a large family in Moscow. The procedure for issuing this document is determined by Decree of the Moscow Government dated June 29, 2010 No. 539-PP.

To obtain a certificate you will need:

- statement;

- identity documents of both parents or adoptive parents, the only parent or adoptive parent or guardian (trustee), with a mark on the place of residence in the city of Moscow;

- If your identity documents do not indicate your place of residence in Moscow, you must additionally submit one of the following documents:

— a single housing document;

- house book or extract from it;

— a copy of the financial personal account of the tenant of the residential premises;

- a certificate issued by an organization that has a housing stock with the right of economic management or with the right of operational management (residential complex, housing cooperative, HOA, hostel, etc.);

- children's birth certificates;

- a document from a housing organization about the children’s place of residence in Moscow;

- photographs of both parents (adoptive parents) or the only parent (adoptive parent, guardian, trustee) size 3 × 4;

- certificate of paternity (if available);

- a document confirming the absence of the second parent, if the applicant is the only parent;

- a certificate of study in an educational organization that implements basic general education programs (school, lyceum and other educational institutions), if the family has children over 16 years old who are studying at school;

- a decision (extract from the decision) on establishing guardianship (trusteeship) over a minor, if the applicant is a guardian (trustee);

- certificate of adoption or a court decision on adoption that has entered into legal force, if the applicant is an adoptive parent;

- a document confirming the fact that the child is being raised in the applicant’s family, if the family is raising children from previous marriages of spouses or children born before marriage;

- certificate of name change, if one of the family members changed their full name.

There are two ways to apply for a large family certificate:

- personally in any of ;

- online on the official website of the Moscow Mayor mos.ru.

What do Moscow benefits include in 2020?

1. Compensation payments in the amount of 1,103 rubles. per month are set for families with three or four children, 2,205 rubles. - with a large number of children to reimburse utility bills and housing costs.

2. At the birth of a child, a compensation payment in the amount of 15 thousand 312 rubles (one-time) is provided.

3. Benefit in the amount of 10,560 rubles. per month paid for each child under 3 years of age and 4,224 rubles. for each child over 3 years of age (up to 18 years of age), but only when the family income does not exceed the subsistence minimum for one person.

4. Compensation payment for the increase in the cost of products in the amount of 713 rubles. per month is provided for each child up to three years of age.

5. Compensation for the increase in the cost of living in the amount of 1,268 rubles. per month is provided for families with three or four children, and if there are more children, then 1,584 rubles. It is provided for children up to 16 years of age, and if they are studying, up to 18 years of age, regardless of the amount of family income.

6. 264 rub. per month in the form of compensation for using the telephone.

7. 10,560 rub. once a year they pay for the costs associated with the purchase of clothing for each student.

8. Families with five or more children are entitled to a monthly compensation payment of 1,901 rubles. for the purchase of children's goods.

9. Families with ten or more children are paid an additional monthly benefit in the amount of 1,584 rubles.

10. Children of a large family and one of their parents are provided with free travel on public transport. There are rumors that a bill is being prepared to provide free travel to both parents.

Free medicines and dairy products with prescriptions

Benefits for large families in Moscow provide for the receipt of free medicines according to doctor's prescriptions for children under 18 years of age (federal benefit - only up to 6 years of age). Dairy products for preschoolers under 7 years of age are also available free of charge with a doctor’s prescription.

No queue to kindergarten

Children from large families are admitted to kindergartens first. In addition, they are provided with a significant discount when paying for kindergarten - they are compensated for 70% of the cost of staying in it. This benefit does not apply to private preschool institutions.

Land plot - reality or myth?

One of the most significant types of in-kind assistance to large families is the opportunity to receive a free plot of land, which is provided for by Federal Law No. 138 of June 14, 2011. Plots for large families are allocated from lands in state or municipal ownership. But due to the lack of free land in Moscow, they are not allocated, and the issue of compensation payments for them is still under discussion.

Free parking permit

Another important type of in-kind assistance is free parking. According to Moscow Government Decree No. 289-PP dated May 17, 2013, a large family has the right to obtain a parking permit for a year. In addition, one of the parents in a large family is exempt from paying transport tax (Article 4 of Moscow Law No. 33 of 07/09/2008).

Pleasant benefits

Pleasant benefits include the opportunity to visit any municipal bathhouse in the capital for free, as well as once a month for free to go to a zoo, a botanical garden, a sports competition, a museum or an exhibition, and go on rides in the Park named after. Gorky or elsewhere. There is even an opportunity to buy discounted tickets to the Bolshoi Theater - for one certificate, a large family will be sold two tickets. The main thing is to find out on time the start date of sales for the performance you are interested in and arrive when the box office opens.

Knowing the benefits for large families in Moscow and being able to use them for the benefit of the children is a completely solvable task for their parents.