What benefits are available to old-age pensioners after 70 years of age?

Social support for pensioners, financed from the federal budget, applies to all older people. Regional authorities have the right to create additional privileges based on their financial capabilities. Benefits are provided in different forms:

- subsidies;

- pension supplements;

- discounts on taxes and services;

- monetization (replacing the provision of benefits in kind with money);

- compensation.

Social benefits for pensioners are provided through social protection authorities and the Pension Fund. Privileges extend to different areas:

- medicine;

- housing and communal services;

- social services;

- travel on public transport;

- taxation;

- Spa treatment;

- contributions for major repairs.

What benefits do pensioners have?

After reaching the age of 70, citizens retain all the benefits they received upon retirement.

This:

- relaxations in the field of tax deductions;

- compensation for transportation costs from their place of residence to their vacation spot in Russia and back (for pensioners living in the Far North);

- compensation or discounts for housing and communal services;

- additional rights in the world of work;

- travel benefits;

- benefits in the medical field;

- other subsidies (for example, in the Sverdlovsk region, pensioners are compensated for the cost of gasification at home, but not more than 35,000 rubles).

Pensioners are provided with a number of tax benefits:

- no land tax is charged on plots up to 0.6 hectares; if the area is larger, the owner will receive a discount;

- citizens do not pay property tax (the benefit applies only to 1 building of a certain type, for example, 1 apartment or residential building);

- Income tax is not withheld from pensions and social benefits.

If a person paid tax because he did not know about his right to a benefit, he can receive a refund when contacting the Federal Tax Service at his place of residence.

Receipt of housing and communal services benefits often depends on the economic situation of the pensioner.

A person receives a subsidy if he lives alone and does not work, or if payments constitute a significant part of his budget. Otherwise, the benefit is not provided.

The pensioner receives additional medical care:

- dental prosthetics at the expense of the budget (treatment remains paid);

- annual free treatment in a sanatorium or resort in the Russian Federation;

- in some regions it provides drug treatment at the expense of the budget.

In the transport sector, pensioners at the local level are provided with:

- discounts, or free travel on public transport, excluding taxis and minibuses, or monetary compensation for expenses (for example, in Veliky Novgorod);

- free travel on commuter trains and buses (sometimes the benefit is valid only in the summer);

- Pensioners from Crimea, the Far East and Kaliningrad are given a discount on air travel within Russia.

In the labor sphere, a pensioner has the right:

- on vacation at your own expense for up to 30 days at any time of the year;

- to give priority consideration to his wishes when setting the date of the next labor leave.

Also, a pensioner receives personal additional payments if his income is less than the minimum subsistence level established in the region. The supplement is only available to non-working pensioners.

Social benefits and privileges

The first thing that all pensioners can count on is an additional payment to their pension up to the level of the subsistence minimum (ML) established in the region of residence of the elderly person. It is provided:

- through the Pension Fund (law enforcement agency) from the federal budget, if the pension is less than the federal minimum wage;

- through social security authorities from the regional budget, when the pension does not reach the minimum wage established in the region of residence of the elderly person.

To receive the bonus, you must submit an application to the authorized body, attaching your work book. Please note that only non-working pensioners can claim the payment. When applying for a job, you must immediately notify of a change in your status.

Benefits and privileges for pensioners over 70 years of age are implemented through social security authorities. Here they can get:

- material assistance (food, basic necessities);

- financial support, no more than once a year, for the purchase of goods needed in everyday life (refrigerator, stove, TV).

To assign assistance, you must submit an application to the territorial department of social protection of the population in person or through a legal representative. The appeal will be reviewed by specialists within 10 days. After studying the financial situation of the citizen, the size and type of support is determined.

Through the Pension Fund for citizens who have crossed the 70-year mark:

- Additional monthly payment (DEMO). It is received by disabled people, veterans and participants of the Great Patriotic War, awarded the “Resident of Siege Leningrad” badge, prisoners, widows of fallen servicemen and WWII veterans.

- Monthly cash payment if the citizen is a federal beneficiary. Its size is determined for each category separately and revised annually.

- A set of social services. It includes the provision of a voucher to a sanatorium, payment for medications and travel to and from the place of treatment. Pensioners have the right to receive the entire set, or replace one or more services with monetary compensation.

- What is parfait - step-by-step recipes for preparing a light dessert at home with photos

- Rice soup

- Apple cider vinegar for weight loss

How to get free medicines for pensioners

As we said above, some categories of pensioners from the state are also entitled to payment for the purchase of certain medicines. However, as we have already said, generosity is not characteristic of the distributors of the treasury of the Russian Federation; as a result, not all pensioners are endowed with this benefit, but only those who are included in a certain list and meet very specific conditions.

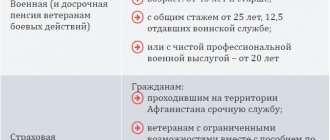

Let's look at who we are talking about in the table below.

Not all pensioners who need it can receive medications for free

Table 2. Which categories of pensioners are entitled to receive benefits for the payment of medicines by the state

| Requirement | Category Description |

| Non-working disabled people of groups 1 and 2 | Thus, pensioners with disabilities of group 1 and group 2 who are not working can be exempted from the need to pay for medicines (disabled people of group 3 and working citizens with group 2 can only count on a 50% discount on the purchase of medicines). |

| Participation in World War II | If a pensioner was a participant in the Great Patriotic War and can confirm this, then he also has the right to this measure of state support. |

| Participation in disaster relief efforts | Persons who took part in the liquidation of radiation and man-made disasters have the right to receive free medicines from the state, since quite often all their illnesses are a consequence of participation in the mentioned liquidations |

| Presence of a certain list of serious diseases | Thus, the following ailments may be the reason for exemption from paying money for medicines: · diabetes; · asthma; multiple sclerosis; · other diseases, a full list of which can be found in Resolution No. 890. |

Unfortunately, only representatives of these categories can receive help from our state; all other pensioners, regardless of their age, are not entitled to help.

In order for a pharmacy to dispense free medications, you must obtain an appropriate prescription from a doctor.

The only exception, perhaps, will be a situation in which a pensioner receiving a minimum pension will be able to receive medicines at a discount of 50%.

In addition to the fact that a pensioner must belong to a certain category of citizens, the medicines that he can receive for free are also presented in a specific list, which is annually reviewed and approved anew by the Ministry of Health of our country. You can view the list you are looking for directly on the website of this organization.

In addition, if you are undergoing treatment, you can clarify information about the inclusion of a particular product that you need in the designated list. Provided that you are lucky and the remedy is on the list, then you will only need to do the following three steps:

- ask your doctor to write you a prescription;

- clarify which pharmacy operates in the state program and cooperates with pensioners receiving benefits;

- go there and get your prescribed medicine.

What documents are needed to apply for the benefit in question?

However, in order to get a prescription from a doctor, you first need to prove to him that you have the right to receive free medications.

To be able to pick up free medications from the pharmacy, confirm your rights by contacting the pension fund

The right sought is confirmed by the Pension Fund of the Russian Federation . Visit this institution and provide there documents according to the following list:

- passport of a citizen of the Russian Federation;

- insurance certificate;

- a document that confirms your membership in the category of benefit pensioners.

After the document verification is completed, the Pension Fund employees, provided that you really have the right to do so, will provide you with the appropriate certificate, upon presentation of which at the place of receipt of medical care, you will be able to receive a prescription for free dispensing of the medicine.

Subsidies for housing and communal services

If payment for utility services amounts to 22% or more of the income of a pensioner over 70 years of age living alone (if living together - average per capita income), he has the right to apply for compensation. For some regions the numbers may be different, for example:

- Moscow – 10%;

- St. Petersburg – 14%.

The privilege is granted to the owners of the premises, provided that there are no arrears in payment for housing and communal services for previous months. The footage of the living space is taken into account:

- for singles – 33 sq. m;

- for a family of two people – 42 sq. m.;

- for families with three or more residents - 18 sq. m. for each.

The subsidy is transferred in monetary terms to the applicant’s bank account. To obtain it, you need to contact social security, the Multifunctional Center (MFC) or through the State Services portal.

The benefit is valid for 6 months.

Then you need to resubmit the application and supporting documents:

- passports of all residents;

- certificate of family composition;

- certificate of income from each resident.

Benefits when paying for major repairs

According to the Housing Code, citizens over 70 years of age who live in apartment buildings are entitled to compensation for major repairs. The discount amount is 50%, and the following are entitled to receive it:

- unemployed pensioners living alone;

- a family consisting of non-working people of retirement age;

- a family consisting of non-working pensioners and (or) disabled people of group 1 or 2 (from January 1, 2020).

To obtain the privilege, you must contact social security or the Multifunctional Center. The following must be attached to the application:

- passport;

- a certificate of family composition or an extract from the house register;

- a receipt confirming payment for major repairs;

- certificate of title to residential premises;

- information about the personal account where compensation for major repairs will be credited;

- income certificate.

Please note that pensioners living in rural areas and who are homeowners have the right to receive compensation for the costs of gasifying their home.

To receive benefits, you need to contact the social security authorities with an application for financial assistance, presenting your passport, documents for the house, a project and the estimated cost of the work.

- How to oblige children to support retired parents

- 3 ages of women that are ideal for a man over 50 years old

- 10 reasons why your hands are shaking

Are there any privileges for paying contributions for major repairs?

The obligation to pay the corresponding line in receipts appeared in 2012. It affected all owners of housing located in apartment buildings. At the same time, the additional burden has hit the wallets of the elderly especially hard.

For this reason, in 2020, acts were adopted that establish the right of unprotected categories to receive a significant discount when contributing funds for major repairs of a building. Thus, old people can count on the following privileges:

- fifty percent discount on the monthly invoice for major repairs. It is worth noting that such a preference will be possible only if able-bodied relatives do not live with the elderly;

- 50% of the cost for disabled relatives of the elderly. Provided based on the presence of a 70-year-old person in the family living in the same living space as the applicants.

Important! Citizens of retirement age who have reached 80 years of age may not pay for major repairs at all. This right is granted to them in accordance with current legislation.

Tax benefits

Elderly people over 70 years old have preferences and guarantees in the field of taxation. This is a complete or partial tax exemption:

- Property. Provided for one property of the same type (one house, one apartment, one garage).

- Land. A tax deduction is provided for one plot of land owned by a pensioner. The amount is equal to the cadastral value of 6 acres.

- Transport. Only pensioners in some regions are exempt from paying. The discount depends on the power of the car.

- Income. Pension security and social benefits are not subject to income tax (NDFL).

In addition to tax breaks, pensioners are provided with a tax deduction when purchasing a home. The amount is returned at the rate of 13% of the money paid, but not more than 2 million rubles. (3 million rubles if a loan was issued for the purchase of real estate).

Tax benefits

The Tax Code provides for pensioners an exemption from property tax for individuals. persons (Article 407 of the Tax Code of the Russian Federation). 1 object from each type of property is exempt from taxation - an apartment, a private house, a garage, etc. If there are several similar property objects, a notification about the object selected for exemption must be sent to the Federal Tax Service by November 1 of each year. If this is not done, the benefit will automatically be provided for the object with the maximum accrued tax amount.

Benefits are available to pensioners when purchasing property.

Buying an apartment, a summer house, a plot of land, independently building a house - for all this, a pensioner can receive a personal income tax deduction, and under special conditions: not only for the current year, but also for the three previous ones. Such rules allow working pensioners who still transfer personal income tax from their salaries to take advantage of the deduction, and return previously paid income tax to those who purchased property in the year they ended their working career. The benefit is issued by sending the following business papers to the inspectorate:

- title documents for property;

- purchase and sale agreements and payment documents confirming the transaction amount and the fact of payment;

- declaration 3-NDFL;

- income certificates.

Employed pensioners additionally submit an application to send a notice to the employer, who, after receiving it, will begin to apply the deduction when calculating wages. Instead of applying, those who are not working leave the details of their current account, to which compensation will be transferred directly from the Federal Tax Service.

Regional authorities have the right to establish benefits for pensioners on land and transport taxes. For example, in the Novosibirsk region, taxpayers of retirement age are entitled to a 50% discount when paying land tax, and in St. Petersburg, pensioners are exempt from taxation if their plot is less than 25 acres.

The size of the transport tax benefit also varies by region - in the Novgorod and Leningrad regions it is an 80% discount on cars up to 100 l/c, and in the Altai and Krasnoyarsk territories pensioners do not pay tax at all for vehicles of the same power. You can find out about tax preferences in your region by contacting your local municipality.

Medical preferences

Elderly people over 70 years of age have the right to free services and treatment in clinics at their place of residence. Former military retirees can receive services in the medical institutions where they were served during their service. Additionally, citizens of retirement age are entitled to:

- free issuance of medicines and medications (according to the list of the Ministry of Health) with a doctor’s prescription;

- health improvement and rehabilitation in sanatoriums;

- placement in permanent residential institutions (nursing homes, boarding schools) on a temporary or permanent basis;

- Dental prosthetics (except for expensive materials).

To receive services, you need a passport and a certificate of compulsory health insurance. Please note that in some cases other documents may be needed to apply for benefits - a pension certificate, a certificate of chronic diseases.

Taxation

Often, older people do not know that they can save on something or avoid making payments. This also applies to taxation. The fact is that preferences through the Federal Tax Service of the Russian Federation are of a declarative nature and are provided only after a personal visit to the inspectorate and the formation of an application. Privileges are not set automatically.

After 70 years of age, a citizen has the right to:

- exemption from transport tax. In this case, there is a limitation regarding the power of the power unit. In order not to pay the amount specified by law, the applicant must have a car with a power not exceeding 100 hp. With.;

- discount on land tax (10 thousand rubles per notification);

- exemption from property tax. It is worth remembering that we are talking about one of the objects owned by the applicant. The housing in respect of which the application will be submitted is determined by the applicant independently at his own discretion;

- exemption from personal income tax.

Privileges and benefits for pensioners of Moscow and the Moscow region

Residents of the capital and region over 70 years of age have similar benefits and preferences that are entitled to pensioners living in other regions. The contribution for major repairs in Moscow is also 50%, but it is already included in the payment receipt.

To receive local privileges and assistance, you must apply for a social card through.

Benefits for Moscow pensioners are presented as:

- Free travel on city public and suburban railway transport. This includes trolleybuses, buses, trams, metro, and electric trains.

- Free travel on trains in Moscow and adjacent regions.

- Regional surcharge. Muscovites receive a pension supplement up to the social standard (17,500 rubles).

- Annual payment in the amount of 2 thousand rubles. You can spend the money on buying groceries at the Pyaterochka chain of stores.

- Compensation for landline telephone. Amounts to 250 rubles.

- Payments related to significant events, for example, the anniversary of marriage.

- Free training. For elderly citizens, special programs are being developed and courses are being organized where one can learn computer literacy, learn a foreign language, or acquire an additional profession or skill.