- home

- Reference

- Privileges

Elderly Russians with official pensioner status can count on various social support measures. They receive payments from the state and can also stop working.

They are offered numerous additional payments and benefits that can significantly reduce their financial burden. Such assistance measures also include tax breaks that allow reducing payments on various property.

List of relaxations

In 2020, the transition period continues, based on which the age at which citizens retire is changed. The procedure is currently performed by women aged 56.5 years and men aged 61.5 years.

Citizens who become pensioners automatically receive the opportunity to apply for various tax benefits. For them, the amount of land and property taxes is reduced. In many regions, transport tax payments are being reduced. If a person stops working, he does not pay personal income tax, since no income tax is charged on the pension.

Attention! Benefits can be not only federal, but also regional, and some require registration by the pensioner, so you must independently contact the Federal Tax Service with official applications for recalculation.

How to apply for a benefit: are supporting documents required?

So, how to apply for a tax benefit for pensioners on real estate? To do this, you should submit an application for a benefit to the tax authority (clause 6 of Article 407 of the Tax Code of the Russian Federation). The application form (KND 1150063) is given in Appendix No. 1 to the order of the Federal Tax Service of Russia dated November 14, 2017 No. MMV-7-21 / [email protected] With its help, you can inform controllers about your right to receive benefits for three types of taxes at once: property , transport and land. An application is filled out according to the algorithm described in Appendix No. 2 to the Federal Tax Service order No. MMV-7-21/ [email protected]

It is required to fill out only one copy of the application in any suitable way (clause 5 of the Procedure for filling out the application, approved by order of the Federal Tax Service No. ММВ-7-21/ [email protected] ):

- handwritten (print the form and fill it out by hand);

- on a computer (fill out the form using software that allows you to print an application with a two-dimensional barcode);

- electronic (through the taxpayer’s personal account).

The applicant has the right to attach documents confirming the right to the benefit. If documents are not attached to the application, the tax authorities themselves request the necessary information from the authorities, organizations, and officials who have this information. If, at the request of the tax authority, the documents are not received, the controllers inform the pensioner about this and about the need to provide documents confirming the right to the benefit (see also letter of the Federal Tax Service of Russia dated October 12, 2017 No. BS-4-21 / [email protected] ).

If you do not submit an application, tax authorities will provide a benefit based on the information they have. It does not matter at what level the benefit is provided - federal or municipal. This rule was introduced by law dated April 15, 2019 No. 63-FZ and applies to legal relations from the tax period of 2020 (see also letter of the Federal Tax Service dated June 25, 2019 No. BS-4-21 / [email protected] ).

Legislative regulation

According to legal requirements, different types of support for citizens are provided for by federal laws and local regulations.

At the country level, pensioners can count on tax benefits under the following provisions:

- Art. 217 Tax Code – exempt from paying personal income tax if a pensioner stops working;

- Art. 391 Tax Code – rules for calculating the tax base when calculating land tax;

- Art. 407 Tax Code – determination and calculation of property tax for pensioners.

In each subject of the Russian Federation, local authorities may additionally adopt various regulations according to which retired people can count on other support measures. Therefore, it is recommended to monitor these documents or contact Federal Tax Service employees directly to receive relevant and up-to-date information about the changes adopted.

Exemption of pensioners from personal property tax

The law that regulates the receipt of tax benefits is Article 407 of the Tax Code of the Russian Federation . It lists in detail who, when and under what conditions are entitled to tax breaks on the property tax of individuals. And a separate paragraph of this article (How to find out what kind of property tax benefit is available for pensioners in the regions? As noted earlier, local governments in the regions of the country and authorities of federal cities (Moscow, St. Petersburg, . Sevastopol) can independently establish additional property tax benefits for various categories of citizens, including pensioners. You can determine who is entitled to a local property tax benefit and in what amount in the following ways:

- By personally contacting the tax office at the location of the property.

- Through the MFC, authorized by the tax authority to provide information and services.

- Through the electronic service on

official website of the Federal Tax Service, indicating the type of tax “Personal Property Tax”, tax period, subject of the Russian Federation and municipality in which the property is located (see screenshot below). Through this electronic service, you can determine both local and federal benefits.

Examples of additional tax benefits in the regions

As an example, here are several local benefits provided in different regions of the Russian Federation in 2020:

- In St. Petersburg, individuals are exempt from paying property tax. persons who own residential premises in apartment buildings put into operation on the territory of St. Petersburg in 2020 or 2020, if the ownership of them was registered in the period from 04/01/2016 to 12/31/2016. The benefit is provided for period of no more than 3 tax periods or until 12/31/2019.

- In Krasnoyarsk The following categories of persons do not pay property tax:

- veterans entitled to benefits in accordance with Law No. 5-FZ of January 12, 1995 “On Veterans”>;

- heroes of Socialist labor, persons awarded the Order of Labor Glory, “For service to the Motherland in the Armed Forces of the USSR”

- disabled people of the third group;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention during the Second World War and others.

- In Tver The following citizens are exempt from paying tax:

- Heroes of the Soviet Union, Russian Federation, persons awarded the Order of Glory of three degrees;

- disabled people of groups I and II, disabled since childhood;

- WWII participants, combat veterans;

- pensioners receiving pensions in accordance with pension legislation;

- persons who have reached the age of 55/60 years (women/men), receiving monthly maintenance for life, etc.

The full list and amount of benefits provided can be clarified at the tax service offices at your place of residence or at the local administration, because categories of recipients and the amount of benefits provided may be adjusted periodically. All complete information on tax benefits is presented on

official website of the Federal Tax Service in the form of a reference section.

Who can apply

Pensioners who retired based on reaching a specific age are exempt from paying personal income tax on their state pension. Additionally, they receive benefits during the calculation of property and land taxes. At regional levels, senior citizens are often exempt from paying transport tax or can enjoy a significant discount.

Additional concessions on other types of fees are offered to labor veterans and disabled people. If a citizen continues to officially work even after receiving a pension, he still receives certain benefits for various fees.

Reference! Transport tax is a regional payment, so its size and the possibility of obtaining a discount are provided exclusively by local authorities.

Benefits for pensioners when paying property taxes

Benefits for pensioners when paying real estate taxes are provided for in subsection. 10 p. 1 art. 407 Tax Code of the Russian Federation. According to this rule, the following are entitled to benefits:

- pensioners receiving pensions in accordance with pension legislation;

- men aged 60 years and older and women over 55 years old, who, according to the legislation of the Russian Federation, are paid lifelong maintenance.

What is meant by the phrase “pension legislation”? Can only Russian pensioners apply for such a benefit, or do the number of property beneficiaries also include foreign citizens, as well as stateless persons, who are recognized as having the right to a pension on the same basis as Russians?

In the letter of the Federal Tax Service of Russia dated January 09, 2017 No. BS-4-21/ [email protected] this issue was resolved as follows. In the absence of a definition of the term “pension legislation” in the Tax Code of the Russian Federation, the application of property tax benefits does not depend on the basis on which the pension is assigned - under the legislation of the Russian Federation or another state.

Can foreign pensioners count on property tax benefits? The answer to this question is in ConsultantPlus. Get free trial access to the system and proceed to information from the Federal Tax Service.

Thus, both Russian pensioners and pensioners - foreign citizens who own real estate on the territory of the Russian Federation have the right to use the property tax benefit.

Types of tax breaks

The main types of benefits offered to pensioners include:

- reduction of the tax base when calculating land tax;

- exemption from payment of transport tax, but only for one car, and this support measure can be replaced by a discount;

- reduction of property tax payments;

- no personal income tax payment.

If a citizen is represented by the owner of several real estate properties, then he independently chooses for which housing the benefit will be used.

Property

Property tax is represented by a local fee, but pensioners receive exemption from its payment on the basis of federal legislation. After changing the age at which citizens retire, some adjustments were introduced to the Tax Code.

Benefits can be used not only by current pensioners, but also by persons who retired early on the basis of length of service or other reasons. Exemption from payment of the fee is granted only for one property. If a citizen is represented by the owner of an apartment, garage or summer house, then he independently determines which property the benefit will apply to. For these purposes, the most expensive real estate is selected.

To receive such a benefit, you only need to submit an application to representatives of the Federal Tax Service once, indicating the selected object. Although tax officials now independently track the age of owners, they rarely take into account eligibility for benefits.

Important! The application can be submitted in paper or electronic form.

In order for the benefit to be taken into account in the current year, the document must be submitted before April 1 of the given year. The direct fee is paid by December 31 of the current year. To do this, the citizen receives a special notification from the Federal Tax Service containing information about the amount of the fee. If, when drawing up an application, a pensioner does not indicate a specific property, then he receives an exemption from paying the fee for the most expensive property.

Land

At the federal level, land tax benefits are offered to both pensioners and pre-retirees. It is valid in all constituent entities of the Russian Federation, and is also presented in the form of a special deduction equal to the cost of 6 acres of land.

Therefore, citizens are exempt from paying a fee for this area. If a person is represented by the owner of a territory whose size does not exceed 6 acres, then he is completely exempt from paying this type of fee. If his plot is 8 acres in size, then he will have to pay tax only on 2 acres.

To receive this relief, you do not need a pensioner’s certificate, since you only need to reach the age of 55 years for women or 60 years for men. But for this you will have to submit an application to representatives of the Federal Tax Service yourself. Municipal authorities may establish additional relaxations on land tax.

For example, on the basis of Art. 387 of the Tax Code, Muscovites who have the title of Hero of the USSR or the Russian Federation, as well as those represented by holders of the Order of Glory, receive a complete exemption from paying tax on one plot of land. Chernobyl victims, as well as veterans and disabled people of the Great Patriotic War, do not have to pay a fee on a plot of land whose value does not exceed 1 million rubles.

Reference! In St. Petersburg, a complete exemption from land taxes is offered for all pensioners and pre-retirees, but this only applies to plots whose size does not exceed 25 acres.

Transport

It is represented by a regional fee, so the decision regarding the registration of benefits or obtaining an exemption is made only by local authorities. Therefore, citizens have to independently contact representatives of the local administration and employees of the Federal Tax Service in order to receive up-to-date information about the relaxations regarding this type of fee.

For example, the capital does not offer any benefits for pensioners represented by car owners. But Heroes of the Russian Federation and the USSR, veterans and disabled people of the Second World War, former prisoners of concentration camps, Chernobyl survivors and other persons with the appropriate official status receive an exemption from transport tax per car.

In St. Petersburg, pensioners are completely exempt from paying car taxes. But there are restrictions, since such a relaxation is offered exclusively for domestic cars, the power of which does not exceed 150 hp. With. Pensioners who are additionally included in another preferential category, for example, are disabled or veterans, receive an exemption when paying a fee even for a foreign car, and its power is also not taken into account.

Even more information about transport tax in the video:

Personal income tax

This fee is paid for the income received by the citizen. If a pensioner stops working, he receives only a pension, on which income tax is not paid. If a person continues to work, then the employer pays the standard 13% to the budget for him.

Attention! Working pensioners can count on a property tax deduction, and it is also issued for non-working senior citizens for the last three years of work.

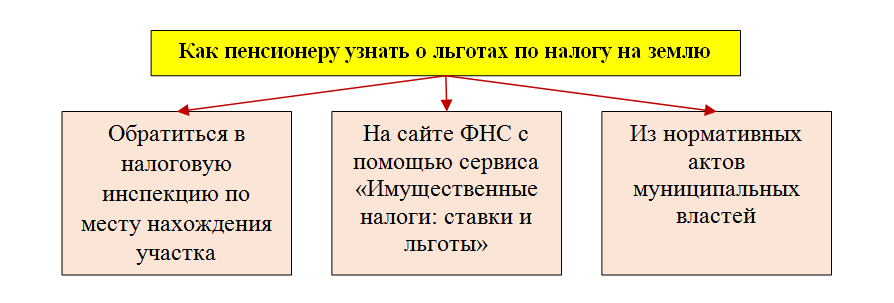

Additional tax benefits for land

An additional land tax benefit for pensioners in 2018 may be provided by local authorities. How can a pensioner find out about this?

Methods for obtaining the necessary information are listed in the figure:

How the geographical location of a land plot and the status of a pensioner can influence the amount of land tax, we will show with examples:

Example 1

Two retired friends - Stepanov P. A. and Trifonov A. G. (both veterans of the Great Patriotic War) - live several kilometers from each other. Their land plots are equal in area, but belong to different territories:

- P. A. Stepanov’s land plot is located on the territory of the Malopurginsky district of the Udmurt Republic;

- the land of A. G. Trifonov is located within the boundaries of the city of Agryz in the Republic of Tatarstan.

Although both plots are the same in area, pensioners pay land tax differently:

- Stepanov P.A. in 2020 pays land tax taking into account the federal benefit for a plot area of 9 acres (15 - 6). There are no additional local benefits for this category of pensioners.

- Trifonov A.G. does not pay tax on his land - war veterans in this area are completely exempt from land tax (Article 3 of the decision of the Council of the Municipal Municipality “City of Agryz” dated November 15, 2010 No. 3–2).

Example 2

Let's change the conditions of the previous example. Let's say that the retired friends are not war veterans, but both have the status of honorary citizens in their municipal areas. In this case, the situation with the payment of land tax will change dramatically:

- Stepanov P.A. will not pay for the land in full - such a benefit is provided for honorary citizens of the Malopurginsky district (clause 4 of the decision of the Council of Deputies of the Malopurginskoe municipality of October 30, 2014 No. 17.3.94).

- Trifonov P.A. will have to pay land tax - in his area there is no additional benefit for honorary citizens. Although he can take advantage of the federal benefit (in the form of a deduction for 600 sq. m.).

Examples show that nuances of local legislation can significantly adjust the tax obligations of pensioners. You just need to know about your rights to benefits and report this to the tax office in a timely manner. We'll tell you how to do this below.

Registration procedure

Federal Tax Service employees do not process benefits, so pensioners must take care of receiving benefits on their own. For this purpose, a special application is drawn up and submitted to representatives of the tax service. When visiting a Federal Tax Service office in person, you must have a passport and a pensioner’s certificate with you.

The procedure can be performed through the service’s personal account . After registration, the information in the application is entered automatically, so you just need to indicate the object for which the benefit will be issued.

Documents proving the citizen’s right to benefits are attached to the application.

These include:

- copy of the passport;

- a certificate from the Pension Fund, which confirms that the applicant is represented as a pensioner or pre-retirement person;

- papers for land, real estate or car.

Representatives of the Federal Tax Service request the missing documentation from other government agencies. The application is drawn up in the prescribed form, so a sample and form can be found on the service’s website or asked from the organization’s employees. The application is considered within 30 days, after which the pensioner is notified of the decision.

If the decision is positive, the citizen can request a recalculation of the overpaid tax for the previous three years.

What determines the amount of land tax

What the land tax will be in the Moscow region depends on 3 indicators: the intended purpose of the site, its cadastral value, and a coefficient that takes into account the full months of ownership of the property.

Art. 7 of the Federal Law of the Russian Federation (hereinafter referred to as the Federal Law of the Russian Federation) “Land Code of the Russian Federation” dated October 25, 2001 No. 136-FZ identifies 7 categories of land according to their intended purpose:

- settlements;

- Agriculture;

- special purpose - lands occupied by:

- industrial infrastructure facilities;

- communications;

- objects for ensuring the country's security;

- specially protected natural areas;

- funds:

- forest;

- water;

- government reserves.

The cadastral valuation of an object should be found on the website of the Federal Service for State Registration, Cadastre and Cartography - rosreestr.ru or make a written request to the territorial office of the mentioned department in order to find out the information of interest.

- Cancellation of pension indexation in February and April 2020

- Candied watermelon rinds - step-by-step recipes for cooking at home with photos

- Oatmeal with milk