( 11 ratings, average: 4.82 out of 5)

Since 2008, citizens have been able to take part in the “pension co-financing” program if they wish. The state doubled the contributions transferred to the funded pension. To date, the program continues to operate only for those who managed to submit an application before December 31, 2014.

- How the co-financing program works

- How to deposit funds under the co-financing program?

- Transfer of additional contributions by the employer

- Latest news and changes on the pension co-financing program

- How to withdraw money from the Pension Fund under the state co-financing program?

- How to withdraw savings from a non-state pension fund?

- How do the relatives of the deceased receive savings through the Pension Fund under the state program?

- Who can join the pension financing program

- How to get into the state co-financing program?

- How to exit the state pension financing program?

- What pension programs does the state offer in the future?

- Conclusion

How the co-financing program works

The goal of the state program was to encourage citizens to increase the funded pension part at the expense of their own income. Co-financing was primarily intended for employed participants in compulsory pension insurance who are entitled to receive an old-age insurance pension. The second mandatory entity of financing was the Pension Fund. Employers could participate in the program at their own request.

To encourage working people to save more actively for retirement, the following program provisions were implemented:

- a participant in the OPS creates a savings account in the state pension fund or in any non-state pension fund from the proposed list, and every year transfers an amount of 2,000 rubles or more to the account. and more, in parts or in full;

- the state annually indexes the contribution by 2 times in the amount of 2,000 to 12,000 rubles;

- if a citizen postpones retirement, the contribution will be additionally financed or increased by 4 times;

- the amount of financing is provided with a 13% tax deduction from the transferred amount to reduce personal income tax.

The right to dispose of savings is transferred to the Pension Fund or Non-State Pension Fund at the request of the participant. The Pension Fund sends funds to the State Management Company of Vnesheconombank. The NPF invests in profitable projects, annually distributing the profits among investors.

Employers can replenish the funded part of an employee’s pension from their own funds. As an incentive, the state provided tax breaks for them. The transferred contributions are reflected as expenses, which reduces the tax base.

Thus, the co-financing program created the conditions for the voluntary accumulation of funds for old age with the help of the Pension Fund, rather than deposits, investments or the purchase of assets.

If a program participant made a contribution of 12,000 rubles during the year, then the state credited 24,000 rubles to the savings account. You can add more, but the indexing size will not increase. The minimum contribution to double your savings is 2000 rubles.

How does the pension co-financing program work?

Any citizen could take part in this program. The transferred amount ranges from 2000 to 12 thousand rubles. guaranteed to double per year. If there is less money, the contribution is not taken into account.

Special opportunities are open to those people who have an insurance pension. If a person applies to the Pension Fund to receive a pension, then enrollment will be increased 4 times. Moreover, all finances can be invested using any option for storing the savings portion. Part of the money (about 15%) is used to pay for services and expenses for maintaining the fund.

An employer can become an active participant in the program. Then he has the opportunity to reward his staff. The amount of payments transferred within the program is included in expenses when calculating profits.

A special feature is that when signing an application from 2008 to October 2013, double credits can be received in one payment. You can withdraw it every 5 years.

Co-financing of pensions in 2020 has been extended. Only those citizens who have SNILS can take part in it. The pension fund said applicants are required to spend the selected amount by December 30 this year. Then government agencies will be able to double the amount. If in the period from November 5 to December 31, 2014, a person wrote an application, then the amounts paid will not increase in the future.

How to deposit funds under the co-financing program?

Despite the fact that it is no longer possible to join the financing program if an application has not been submitted, pension replenishment continues in 2018.

Benefits under the state program are increased by those who submitted applications before December 31, 2014.

To confirm the application, participants were required to make a minimum payment by January 31, 2015.

Transfer of additional funds to a pension savings account is carried out one-time or in equal payments throughout the year. The minimum voluntary contribution is 2000 rubles, the maximum payment is not limited in any way.

Funds are transferred by the program participant in any of three ways:

- independently through a bank branch;

- remotely through the Pension Fund website with the generation of a payment document;

- through the employing organization.

The transfer of funds must be reported to the Pension Fund after payment is made before the 20th. To do this, you need to submit bank receipts or other payment documents to the branch.

For citizens who entered the program before January 31, 2015, the procedure for transferring and indexing savings proposed by the state will remain in place for 10 years from the date of filing the application and making the first payment. The creation of savings shares will continue through the Pension Fund or Non-State Pension Fund. Citizens who submitted applications after January 31, 2020 cannot count on indexation of pension savings. But they have the right to make payments to increase their funded pension.

Transfer of additional contributions by the employer

To replenish the funded part through the employing organization, you need to write an application in free form, indicate the amount and payment options. Deductions through accounting can be made in a fixed form or as a percentage of wages.

Employers must transfer the contributions of the employee who submitted the application, starting with the first days of the following month. If part of the company’s team expresses a desire to transfer funds to savings accounts, the employer is obliged to perform the following tasks:

- prepare an order or annex to the collective agreement;

- send a collective notice to the Pension Fund by the 20th of each quarter (when the organization has more than 25 participants in the state program);

- submit a report on additional contributions to the funded part in the register form.

In addition, the program participant should know that the employer is required to formalize financing at his own expense and payments from the employee’s salary in separate documents. Payment documents must indicate the number, amount and account to which the money is transferred. When an employee resigns, the transfer of additional contributions stops automatically; there is no need to write a separate application for this.

Transfer of additional contributions by the employer

In order for the accumulated portion to increase through deductions through the employing institution, you must submit an application in free form, where you need to note the amount of deductions and the method of payment.

Attention! Accounting employees can arrange for the deduction of contributions either in a permanent form or as a percentage of salary.

The employer is obliged to transfer the accepted amount as soon as his employee has written an application. The money should be transferred early next month.

You can write an application so that the employer makes contributions

If some employees of the organization want to contribute money to the savings account, the employer must resolve the following issues.

- Develop an order or annex to the collective agreement.

- Send a collective application to the Pension Fund by the 20th of each quarter (if the institution has more than 25 participants in the state program).

- Provide reporting in register form on additional contributions to the accumulated portion.

In addition, a citizen participating in the program should know that the employer must arrange financing from his own funds and payments from the employee’s salary. Payment receipts must contain information about the number, amount and account to which funds are being deposited.

Attention! If a citizen decides to leave work, the transfer of additional contributions is automatically completed; writing an application for this is not required.

If a citizen resigns, deductions automatically stop

Latest news and changes on the pension co-financing program

The government began to wind down the state program for financing pensions after 2014. The first crisis phenomena that slowed down economic growth appeared back in 2013. After the fall in energy prices, the collapse of the ruble, and the introduction of “Crimean” sanctions, the country’s economy was supported by existing reserves.

In 2014, the government began to look for opportunities to raise funds, which influenced many social initiatives. First of all, decisions on savings affected the co-financing system.

The state program did not stop, but the deadline for entry was set - December 31, 2014. After this date, it is impossible to receive co-financing.

Today, the opportunity to double pension savings is used by those who managed to apply, but the number of participants is decreasing every year. The number of such citizens is decreasing for a number of reasons:

- some people have retired and receive payments from the funded part;

- Those who missed the minimum annual contribution or did not submit an application on time are excluded from the program (participation must be confirmed annually);

- from 2020, a limitation on the duration of participation will be introduced. The state offers co-financing only for 10 years from the date of inclusion of a citizen in the state program.

Payers who submitted applications first in 2008 are no longer entitled to indexation or doubling in 2020. Other citizens have the right to receive bonuses if they comply with the terms of the program. In addition, the state did not double the pension savings of those who joined the program at the very end from November 5 to December 31, 2014.

Employed pensioners found themselves in more favorable conditions. The state proposed to increase their contributions to the funded part by 4 times. Thus, the annual contribution is 12,000 rubles. should turn into a savings portion of 60,000 rubles.

The latest changes made to the April 2008 Law on co-financing of pensions can be found by studying the following regulations:

- Federal Law No. 360 dated November 30, 2011;

- Federal Law No. 345 dated November 4, 2014.

Changes have been made to the legislation on the rules for joining the state program, its duration and reporting features. There were no major innovations in 2020. The participant has the right to independently set the amount of the contribution, the method of transferring money, the management organization, the option for receiving savings, and choose directions for disposing of the account in the event of his death. The law introduces restrictions on the amount and method of receiving savings by heirs.

Deduction for pension co-financing

Another advantage for participants in the Pension Co-financing Program is the right to compensate part of the funds spent by returning personal income tax. Compensation is carried out within the framework of the tax deduction procedure.

Who is entitled to deduction

The criteria for applying for a deduction when co-financing a pension are similar to the general procedure. You can receive tax compensation:

- persons who are officially employed (there is a valid employment contract between the citizen and the employer);

- citizens who have taxable income, from which the employer monthly transfers a set amount of personal income tax to the budget.

It should be noted that self-employed persons, in particular individual entrepreneurs, can also form the funded part of their pension. If an entrepreneur is a participant in the Co-financing Program, he also has the right to apply for a deduction in the prescribed manner. This rule applies only to those entrepreneurs who pay personal income tax at a rate of 13% (individual entrepreneurs on OSNO). “Special regimes” who use UTII, simplified tax system, PSN, unified agricultural tax do not pay personal income tax, and, therefore, cannot claim a deduction.

How to withdraw money from the Pension Fund under the state co-financing program?

As the government's pension doubling program ends, many participants are planning to get their contributions back. To do this, you must submit a separate application to the Pension Fund to apply for an old-age savings benefit.

Pension Fund inspectors, as a rule, offer to submit a request for three options for receiving benefits, and then choose one of them:

- one-time refund of the entire amount;

- lifetime payment;

- a breakdown of savings into equal parts that will be paid within the time period established by the participant.

The last option is considered the most popular, broken down over the next few years. A lifetime payment is unprofitable, since in this case the increase in pension will be no more than 100 rubles. per month.

How to withdraw savings from a non-state pension fund?

Citizens who transferred savings to a non-state pension fund have the right to apply to it for benefits after retirement. An application for transfer of savings is submitted in two cases:

- old age pension insurance is issued (repayment of contributions should be expected 2 months after submitting the request);

- the program participant retired early.

The funded part can be received before the established age if the citizen has the right to early retirement.

The application must indicate the method of receiving money: a one-time payment, an urgent or unlimited option. Full or partial payment is transferred after 2 months. Payments under the unlimited option are extended over 19 years. With the urgent option, savings are issued for a period of at least 10 years. A lump sum payment is transferred once every 5 years and can be up to 5% of the insurance portion.

If a participant in the state program applied for an urgent payment of savings, then in the event of his death, the heirs can count on receiving the rest of the funds. The legal successor is determined by the will. If there is no will, a close relative has the right to apply for benefits.

To receive savings, the heir applies to the NPF within 6 months from the date of death of the program participant. The applicant confirms with documented family ties and the fact of death. The NPF makes the decision to transfer funds within 1 month, and makes payments after the 15th.

How to receive funds from a non-state pension fund?

Persons who transferred funds to a non-state pension fund can go there to apply for payments after going on a working holiday. It is possible to submit an application for the provision of the accumulated portion in two cases.

| Happening | Description |

| Registration of insurance coverage for old age pension | Refunds should be expected within 2 months after submitting the request. |

| A participant in the state program retired early | In this case, you can contact the NPF to receive funds in any way. |

If a citizen retired early, he can apply to a non-state pension fund to pay out his savings

It is possible to return the accumulated funds before reaching the accepted age limit in the case when a citizen can legally take a working holiday ahead of schedule.

The application indicates the option for receiving funds: a lump sum payment, an urgent or unlimited payment method. The full amount or part of it will be transferred after 2 months. Payments using the open-ended method will be made for 19 years. The term method involves payment of funds over a period of 10 years. A one-time transfer of money is carried out once every 5 years, and the amount will be equal to 5% of the insurance portion.

Attention! If a citizen participating in the state program has written an application for an urgent return of funds, then in the event of his death, the heirs have the right to payment of the remaining funds. The person who can receive the funds will be named in the will. If there is no will, the next of kin of the deceased may apply for funds.

If a citizen participating in the state program has written an application for an urgent return of funds, then in the event of his death, the heirs have the right to receive the remaining funds. The person who can receive the funds will be named in the will. If there is no will, the next of kin of the deceased may apply for funds.

If a citizen dies, his heirs can receive the funds

In order to receive money, the heir comes to the NPF within six months from the death of the citizen who participated in co-financing. Submission of an application must be accompanied by confirmation of relationship with the participant and the fact of death.

Attention! The NPF will consider the application for a month, then make a final decision; the receipt of funds can be expected after the 15th.

How do the relatives of the deceased receive savings through the Pension Fund under the state program?

The savings of a deceased participant in the co-financing program can be taken by his legal successors - these are children, spouses, grandchildren, parents, brothers, sisters. Payment of savings is made after the death of a citizen in the following cases:

- before the appointment of a pension benefit, before its recalculation taking into account voluntarily contributed money;

- after submitting an application for urgent benefits (it is completed by everyone, provides for the issuance of the balance from the funded part, and does not take into account maternity capital allocated for the social benefits of the deceased);

- after the pension has been assigned, if the lump sum has not been issued.

In this case, close relatives of the deceased have the right to take away the savings within 4 months. This right applies only to relatives who lived with the deceased citizen or were dependent on him, regardless of their place of residence. If there are no such relatives or children, the savings go to the inheritance.

To receive the deceased's pension savings under the co-financing program, legal successors must complete a number of steps:

- prepare documents confirming relationship;

- contact the Pension Fund strictly 6 months after the death of the state program participant (if the deadline is missed, the issue will be resolved only in court);

- deliver the documents personally to the Pension Fund or send by registered mail (required with an inventory and notification);

- wait for the fund's decision within the month following the day the request was submitted. Within 5 days from the date of the decision, the Pension Fund sends notification of a positive or negative decision to the relatives who applied.

- Funds must be transferred by the 20th day of the month following the month the notification was sent. The transfer is made in the manner indicated by the program participant in the application.

It is important to remember that the relatives of a deceased participant in the state program will not receive anything if he initially applied for a lifetime payment of the funded portion, that is, the benefit was paid monthly in equal installments.

How to get money for pensioners

Funds co-financed by the state are assigned jointly with the old-age or disability insurance pension in the form of a funded benefit. After the rights to assign the software arise, you can apply for its registration and assignment to an employee of the authorized organization.

- Bronchial asthma

- Recalculation of pension based on length of service

- First aid for stroke

The pension capital placed on the personal account of a participant in the compulsory insurance system with the Pension Fund of the Russian Federation is paid out together with investment income - additional savings, including state co-financing of pensions. Options for receiving funds:

- One-time transfer. Additional savings are transferred to the recipient at a time, provided that on the date of appointment their size does not exceed 5% of the volume of the entire insurance pension, including the total amount of the funded part of it and the fixed payment.

- Urgent translation. The duration of such accruals is determined by the recipient pensioner, but cannot be less than a 10-year period.

- In the form of a funded pension. Its size, as a rule, is lower than that of the urgent payment, because it is calculated based on the expected accrual period - for 2020. It is 246 months. Transfers will be for life.

Where to contact

You can apply for the due insurance software along with accumulated funds, including co-financing, by contacting an employee of one of the authorized authorities:

- local branch of the Pension Fund;

- multifunctional center (hereinafter referred to as MFC);

- by sending it by registered mail with notification;

- remotely – on the government services portal gosuslugi.ru or the official website of the Pension Fund of Russia;

- through your legal representative.

Application processing time

Documents and an application submitted by a person for the appointment of insurance benefits and funded payments are considered within a certain period. It directly depends on the method of transferring software:

- for urgent payments – up to 10 working days;

- for a one-time transfer – up to 1 month;

- when assigning an insurance pension and a joint payment to it - up to 10 working days, the Pension Fund will begin to accrue benefits within 2 months from the date of the positive decision.

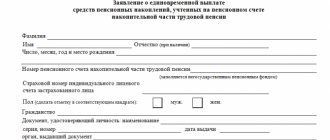

List of required documents

To apply for a pension benefit and accrue savings payments, you will need to provide a package of relevant documents:

- a completed application - the form can be found on the website of the authorized organization via the Internet or at the information stand by contacting there through the local branch;

- passport of a citizen of the Russian Federation;

- individual personal account insurance number (hereinafter referred to as SNILS);

- papers proving the right to establish pension payments - work book and/or a copy thereof, documents confirming work experience, salary, certificates of dependents, etc.

Who can join the pension financing program

The state program for co-financing pension savings of citizens has been stopped. Today, savings are doubled only in the accounts of people who managed to submit an application before November 5, 2014. This measure of state support was the best option for citizens born before 1967, since they did not have a funded part of their pension. For younger retirees, the program is not beneficial.

The following can apply for inclusion in the state program for co-financing pension savings:

- citizens entitled to pension insurance;

- people aged 55/60 who are officially employed but do not yet receive social benefits and pensions;

- unemployed pensioners.

If citizens work and receive a pension at the same time, then they do not have the right to join the state program. People who did not have time to submit an application before January 31, 2020 can take part in the state program and increase the funded part. But the state will not index the savings of new participants.

Who could take part in the state pension co-financing program

Every citizen participating in the pension insurance system could join the program. In fact, all officially working Russians, entrepreneurs, etc. fall into this category. If the participant had the right to an insurance pension and did not apply for it or other types of pension payments, then special conditions are provided for him - the amount of co-financing is equal to personal contributions increased by 4 times .

Participation in the program was accepted by persons meeting the following conditions:

- The application for connection to the project was submitted until December 31, 2014. It could be issued through the State Services service, by personally contacting the Pension Fund and in other ways.

- The first voluntary contribution in the amount of 2000 rubles. made before January 31, 2020. If it was done later, then even if the application was submitted, the person could no longer take part in the project.

- No more than 10 years have passed since joining the project. It is during this time that co-financing is provided by the state.

To receive co-financing, it is additionally necessary that the additional amount. contributions for last year were more than 2000 rubles. If it turns out to be lower, the state will not credit the co-financing amount to the person’s personal account.

How to get into the state co-financing program?

To become full participants in the program under the terms of “doubling contributions,” citizens had to submit applications by the end of 2014 and make the first payment by January 31, 2015. If the application was submitted, but the savings were not transferred, then the right to create individual contributions remains with the person, but he will no longer receive a budget supplement.

To become a participant in a self-financing pension you must:

- prepare an application and send it to the Pension Fund branch at the place of registration of the citizen (you can submit an application through the MFC, the State Services portal or your employer, who will transfer the documents to the Fund within 3 days);

- open a personal pension account if it is not registered (for this a separate application and a package of papers are submitted, you will need a passport, SNILS);

- wait for written notification from the Fund’s employees, who are given 10 days to consider the application.

How to exit the state pension financing program?

The state has established a 10-year period of support for participants in the program for the formation of the funded part. Any citizen who has previously submitted an application for co-financing has the right to suspend his participation for 10 years and, if necessary, resume again.

To suspend participation, a corresponding application must be sent to the Pension Fund, but this does not mean that the citizen will receive pension savings back. He will be able to receive funded benefits only after receiving a legal old-age pension. To do this, you must send a separate application to the Pension Fund or Non-State Pension Fund.

What pension programs does the state offer in the future?

As part of the new pension reforms, it is proposed to introduce individual pension capital. It is believed that this option will be a better alternative for co-financing pensions. Under the new program, citizens will be able to independently accumulate pension benefits. At the same time, the level of civil responsibility should rise. As a result, everyone will receive as much as they have accumulated during their lifetime.

Experts note that it is not yet possible to link the IPC with corporate programs for creating a funded part, in which millions of Russians participate. Pension contributions for this category of citizens annually amount to more than 6 trillion. rub. This is due to the fact that corporate programs have their own individual characteristics.

In addition, to become interested in IPC, many will have to give up current needs in favor of a future pension. The average salary in the country is about 30-36 thousand rubles. More than 70% of working citizens receive much less. According to the analysis of financial experts, to create long-term savings in the current conditions, you need to have an income of at least 60 thousand rubles. Consequently, less than 30% of citizens will be able to take part in the IPC. Most likely, many of them will choose deposits, long-term securities and other financial instruments.

To motivate the IPC project, government experts suggest:

- abolish personal income tax on payments for non-state pension funds (today only contributions transferred to the Pension Fund are not taxed);

- increase the social deduction for personal income tax refund from 120 to 400 thousand rubles;

- equate contributions to the IPC to labor costs, then they will reduce the tax base;

- redirect additional contributions for harmful and dangerous work to corporate pension funds;

- establish other types of tax benefits.

According to studies, without serious offers and benefits, less than 2% of citizens will participate in the IPC program. It has not yet been decided whether the project will be voluntary. According to the new pension program, each employee will be required to transfer from 1 to 6% of their salary to the funded part. Perhaps the reform will be carried out using an “automatic subscription”, and employers will be required to transfer funds. If a citizen wants to leave the IPK, he will write a statement.

The government has not yet made a decision on the future option for co-financing pensions, but the planned innovation will most likely be introduced in the mid-20s. According to citizen reviews, the program to double retirement savings disappointed many.