Every citizen can send his funded pension not only to the state pension fund, but also to various non-state funds that offer higher profits and interesting terms of cooperation.

You can use this money only after reaching the age of a pensioner. The money is given in a lump sum or paid monthly for the rest of your life, and there is also the option of a term program where the money is paid over a specific period of time.

If citizens cooperate with a non-state pension fund for no more than 5 years, then funds are usually issued as a lump sum payment based on the investor’s application.

Rules for filing an application for a one-time payment of pension savings

A one-time payment of funds allows you to receive a large amount that has been accumulated over a long period of time when insurance premiums were transferred. Savings are formed for every officially working citizen.

Money can be transferred not only by the employer, but also by the direct employee , if he cares about his secure old age. You can receive money after reaching the age of a pensioner or when registering a disability group in which a person cannot continue to work.

Funds are paid based on an application drawn up by the direct depositor.

The text contains the following data:

- information about the applicant, provided by his full name, passport details, date and place of birth, citizenship, gender, registration address and SNILS number;

- citizen's contact phone number;

- information on the assignment of an old-age pension;

- the method of receiving money from the fund, for example, if it is planned to transfer it to a bank account, then its details are indicated;

- date of application;

- the exact number of the pension account on the basis of which the applicant is identified;

- depositor's signature.

Attention! If the investor died before applying for his savings, then the legal successors specified in the will or determined on the basis of legal requirements have access to these funds.

You can bring an application to the fund yourself or use the help of a representative. In the latter case, the authorized person must have a power of attorney certified by a notary.

Sample application for a one-time payment of the funded part of a pension:

What is it for?

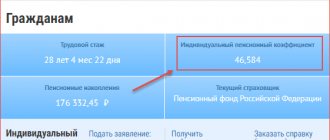

Only pensioners can apply for the funded part of their pension (women over 55 years old, men over 60 years old).

The statement is for them the main legal “bridge” that will lead to material well-being.

Well-being comes from transfers from employers of future retirees, which accrue 22% of the employee’s monthly earnings. The share of the funded part of the pension from employer contributions is 6%. It is worth noting that the following can also count on a funded pension:

- persons who allocated material assets of maternity capital to form savings.

- Participants in co-financing pension payments.

How to write?

The form has a clear, specific design style. To fully convey all the information, you will need to write the following data:

- the name of the NPF or management company to which the application is being submitted;

- FULL NAME. citizen (as well as the full name of the representative, if he handed over the document);

- details: insurance number of an individual personal account, savings account numbers and details;

- name of the identity document;

- personal data: contacts (phone numbers), registration and current residence addresses, date of birth and gender;

- a list of pensions that have already been assigned;

- work status information;

- date and signature. The priority when writing an application is compliance with the established format of such documents, as well as the reliability of the information transmitted.

Otherwise, the application will be rejected and you will have to start the entire application process all over again.

What is submitted with the document?

A package of documents is submitted along with the application. It includes:

- passport;

- a document confirming the conclusion or dissolution of a marriage;

- certificate of compulsory pension insurance;

- citizen’s details for transferring payments (usually bank account number).

IMPORTANT! If the application was submitted by an authorized representative, then along with all the necessary papers you must also provide a document confirming the authority of the representative.

Where and when to submit?

The collected package of documentation and the written application are transferred either to the management company or to the non-state fund in which the citizen’s savings were formed. You can submit papers in person, by postal order or through the MFC.

The application is usually submitted personally by the citizen or his authorized representative. It is worth noting that you can submit an application no earlier than 30 days before retirement.

If the application is submitted after reaching the legal age, the funded part of the pension is calculated from the date of its submission.

Who receives the lump sum payment?

All savings are paid to citizens at a time only in certain situations, which include:

- the citizen registered a disability group before retirement, and therefore cannot continue working;

- a person requires financial support due to the loss of a breadwinner;

- the investor was unable to apply for a regular old-age pension because he did not have the required length of service and the number of points;

- the amount of financial support reaches no more than 5% of insurance payments, but a person must transfer funds to a pension account in the period from 2002 to 2004;

- persons who participated in the state program for co-financing pensions, which was carried out until 2014, receive a one-time payment;

- Citizens whose monthly payment is less than 5% of possible charges can count on this amount.

Important! In 2020, money for a funded pension is paid only once every 5 years, although previously it was paid out annually.

A one-time payment is offered to pensioners who are disabled. To do this, they must reach the age of a pensioner, and they must also have at least 5 years of experience. Funds are paid based on an application submitted to the branch of the Pension Fund or Non-State Pension Fund.

What is SPV?

Urgent pension payments are made from previously made contributions to the insurance accumulation fund, which are not classified as mandatory payments. Insured persons entitled to such payments can receive funds on a monthly basis. They independently determine the time period for their implementation, which cannot be less than 10 years.

Formation

SPV can be received only by those pensioners who previously carried out financial transactions related to depositing funds into a special account that has a savings status. Such contributions can be made:

- by the employer in the form of regular deductions from the employee’s salary;

- the applicant for the formation of a funded pension;

- by the state under a co-financing program;

- the applicant at the expense of maternal or family capital redirected to provide a funded pension.

Funds deposited into the account of the insured person are not subject to indexation. Their value can be increased by investing funds in financial markets, which is the main service of funded pension structures.

Where and how is it issued?

The rules for receiving a lump sum payment include:

- the application and other documentation are submitted exclusively to employees of the institution in which the savings were formed;

- You can contact state or non-state PFs;

- the application is submitted directly when visiting the organization or by mail, and you can also use the help of MFC representatives;

- it is possible to submit an application through the State Services portal;

- In addition to a correctly drawn up application, other documentation is prepared, which includes the pensioner’s passport, as well as a certificate from the Pension Fund, which confirms the registration of an old-age pension;

- it is allowed to use the assistance of a representative who has a notarized power of attorney;

- Fund representatives may require additional documentation from the client confirming certain circumstances under which the payment is made.

After submitting all the papers, representatives of the fund review the application and inform the citizen about the decision made. To do this, a written notification is sent by mail.

If a positive decision is made, a lump sum payment is transferred within 60 days to the account specified in the application. If this information is missing in the application, then the money can be received through post offices or a bank cash desk.

Reference! Citizens can apply for a new lump sum payment only after 5 years.

What is an urgent pension payment and who can receive it: instructions

Reading time: 2 minutes(s) To make citizens more interested in their future pension, there is a so-called funded part of the pension. One of the financial support measures that you can use if you have a funded part of your pension is an urgent pension payment. What is this payment and how can I use it? Which pensioners can count on it and what documents are needed for this? You can read about all this in the following material.

What is an urgent payment of the funded part of a pension?

A fixed-term pension payment is a cash payment to a pensioner, which is carried out by the Pension Fund. It is formed from the funded part of the pension at the expense of

- voluntary transfers of citizens,

- transfers from the state as part of the co-financing program,

- additional transfers from the employer to the funded part of the pension,

- for women - maternity capital funds, if they were aimed at increasing the funded part of the pension,

- profit received by a citizen from investing his funds in various funds.

Conditions of appointment and amount of urgent payment

To receive an immediate payment, a person must reach retirement age or retire early. The size of the urgent payment depends on the amount of funds in the funded part of the pension. If in the future the funded part continues to increase, then the urgent payments will also be recalculated.

How to apply for and receive an urgent payment?

To start receiving an urgent payment, a citizen needs to contact the Pension Fund at his place of residence, or submit an application online. You can receive payments in several ways:

- through the bank

- via post office

- personal delivery

What documents are needed

- Statement

- A document on the amount of additional insurance deposits for a funded pension, employer contributions, contributions from co-financing, the formation of pension savings and savings from investing.

- Passport

- Employment history

- SNILS

The application is submitted to the Pension Fund or via the Internet on the fund’s website. The application must include the following information:

- personal and contact information

- passport details

- address and name of the institution where the application is sent

- applicant's account number

- the reason why the document was created

- date and signature

The period for which an urgent pension payment is assigned is determined by the citizen himself. But it must be at least 10 years old.

A sample application for urgent payment can be downloaded here: https://yadi.sk/i/hAMxKg3L3RCcWr

Payment procedure and terms

After submitting your application, the Pension Fund will review your application and you will receive a response within 10 days. In case of a positive decision, funds will be credited from the moment of application. Payments are made for the entire period of time specified by the applicant.

In case of refusal, the citizen is given a period of three months to collect the missing documents. In this case, payments will be assigned from the time all necessary documents are collected.

Any citizen of retirement age who has additional transfers on his personal account, i.e. the funded part of the labor pension has the right to an immediate pension payment. The calculation and transfer of this payment can be carried out by both the Pension Fund of the Russian Federation and non-state pension funds. In 2020, citizens can also apply for an urgent pension payment.

Did this article help you? We would be grateful for your rating:

7 2

What pension savings are subject to urgent payment?

Accumulative pension funds that were transferred to the Fund by the insured person on a voluntary basis are subject to urgent payment, in addition to mandatory payments. Payments are made not only from funds transferred to the individual account, but also from income received through transactions on trading markets in which investments were involved.

Issues related to urgent payments to the population in the field of pension savings are regulated by the Federal Law “On the procedure for financing payments from pension savings” dated November 30, 2011 No. 360-FZ (as amended on June 29, 2015). It regulates the procedure for ensuring payments made from pension savings. Financial payments are controlled and regulated at the regional level. Representatives of local authorities have the right to establish their own requirements and restrictions, stipulated by the regulations put into effect.

What it is?

According to the new legislation, the labor pension was divided into two separate types of pension provision: insurance and funded.

A funded pension is a monthly financial support that is paid from a special personal account and established for citizens upon reaching retirement age.

The basis for receiving this type of payment is the relevant Federal Law No. 424 of December 28, 2013. A one-time payment of a funded pension is a one-time payment of all pension savings. And calculating a lump sum payment of a funded pension is calculating the amount of payment that a person claims at a time.