What are these payments?

Contributions to the funded part of the pension are payments aimed at forming the funded part of the pension and accounted for in the funded part of the personal pension account of the insured person in the Pension Fund (Article 3 of Federal Law No. 167 of December 15, 2001; Clause 3 of Article 3 of Federal Law No. 424 of December 28. 2013).

Voluntary contributions to the funded part of the labor pension:

- payments paid by a citizen voluntarily from his own funds;

- deducted from the current salary by the employer.

Co-financing:

- employer contributions to the employee from the employer’s own funds;

- contributions from the citizen himself under the state co-financing program.

Under the state co-financing program, the state adds an amount equal to the voluntary contribution to the funded part of the pension. Payment ranges from 2,000 to 12,000 rubles per year.

Important! The program of state co-financing of pension savings is valid only for citizens who entered this program before January 1, 2020.

Voluntary contributions differ from the state co-financing program in that the employer has the right to make additional donations in favor of the employee. The state is limited by the payment range. himself and his employer are not limited by the amount of payments .

Additional insurance contributions for funded pension: what are the benefits?

The main advantage of implementing DSA is the opportunity to receive state co-financing of a pension. It must be borne in mind that such co-financing is carried out only if a person has sent an application to the state for payment of DSA no later than December 31, 2014.

If a citizen managed to submit an application for co-financing before 2015, then when an amount in the range of 2,000 to 12,000 rubles is deducted within the framework of the DSA during the year, the corresponding amount is doubled at the expense of the state. That is, when deducting DSV, for example, in the amount of 10,000 rubles. the state pays an additional 10,000, and in the end it comes out to 20,000. The maximum annual contribution for co-financing is 12,000 rubles, i.e. the total annual amount will be 24,000 rubles.

This increase occurs for 10 years from the year following the year of payment of additional contributions.

Funds within the framework of state co-financing can also be invested with the involvement of a non-state pension fund or a management company, along with money coming from the citizen himself or his employer.

If a person did not have time to apply for co-financing, he can take advantage of another advantage of the DSV - the opportunity to apply for a social tax deduction for him and return 13% of the contributions in the manner regulated by Art. 219 of the Tax Code of the Russian Federation. The maximum amount of expenses for social payments is 120,000 rubles per year, i.e. By making 120,000 additional “pension” contributions per year, you can return 15,600 rubles from them. tax This will also include amounts for direct contributions to non-state pension funds if they are made along with DSA (subclause 5, clause 1, clause 2, article 219 of the Tax Code of the Russian Federation).

Types of deductions

Additional contributions to the funded part of the labor pension are regulated by the Federal Law “On additional insurance contributions to the funded pension and state support for the formation of pension savings” dated April 30, 2008 No. 56-FZ.

Insurance

The citizen independently determines the amount of payment. The payment amount can be strictly fixed or be a certain percentage of the accrued salary. Payment is made by the employee himself or through the employer. The required amount is simply deducted from the salary and transferred to the Pension Fund.

We wrote in detail about what additional insurance contributions for the funded part of a pension are in this article.

From the employer

The employer has the right to decide to pay additional contributions for employees who are already making contributions. The amount of deductions is determined by the employer himself. When an employee is dismissed, payments stop.

Paying contributions for employees provides a number of benefits to the employer himself:

- additional payments are deducted from mandatory insurance contributions, but not more than 12,000 rubles per year for each employee;

- contributions are included in labor costs.

Reference! Personal income tax is not charged on additional contributions to the funded part of the pension.

The concept of additional insurance premium rates

It has been determined that material support for citizens in old age can be carried out in the form of payment of both the insurance and the insurance and funded parts of the pension.

An insurance pension should be understood as a monetary payment of a compensatory nature that citizens receive in connection with loss of ability to work. The formation of this type of security is mandatory and occurs through the employer’s payment of insurance contributions to the pension fund.

The Pension Fund accumulates funds and converts them into pension points that make up the individual pension coefficient (IPC), reflecting the scope of the corresponding rights of a particular citizen.

Reference! Persons duly registered as individual entrepreneurs, as well as a number of certain categories of citizens (privately practicing notaries and lawyers), make insurance payments for themselves independently in accordance with the approved tariffs.

A funded pension is a separate type of payment paid to citizens. It is formed only if there is an appropriate expression of the will of the citizen himself.

The source of formation are:

- Insurance contributions from the employer. If an employee decides to form a funded pension along with an insurance pension, then in this case an amount of 6% of his salary is allocated monthly for these purposes.

- Investment income. It arises from the investment of funds generated by insurance transfers in various profitable projects, shares and other securities.

At the same time, citizens and employers have the opportunity to send additional funds in the form of voluntary contributions towards the formation of a funded pension. Such a decision is completely voluntary and is carried out at the expense of the interested party’s own resources.

Thus, additional insurance premiums are compensatory payments that are paid by the insured person at the expense of funds belonging to him on the grounds and in the manner established by law.

Who pays and when - algorithm of actions

On one's own

- A working citizen submits an application in the form DSV-1 to the nearest branch of the Pension Fund. This form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 28, 2008 No. 225p, as amended. from 06/09/2016. The sample is taken at the Pension Fund office or downloaded from the Internet. The form states:

- Full name of the applicant;

location;

- personal account insurance number (SNILS).

- After 10 days, the citizen receives a notification from the Pension Fund of the Russian Federation about the consideration of the application. The notification is sent by mail; if the application is submitted electronically, the notification will be in electronic form. The electronic version is located in the applicant’s personal account on the State Services portal or the website of the Pension Fund of the Russian Federation.

- The citizen independently determines the amount of payments and pays them in any way convenient for him.

The application is submitted in person, through the employer, the MFC or the State Services portal on the Internet.

Payment documents are generated in your personal account on the Pension Fund website in the “Electronic Services” - “Generation of Payment Documents” section.

- When you select the “insured person” button, a payment receipt for the State Co-financing Program is generated. You must select your region of residence and enter your full name, address, SNILS and the required amount. Next, click the print receipt button. Additionally, you can simply print out the details.

- When you select the “policyholder” button, “Payment as part of co-financing” is selected in the drop-down menu, and in the next list, “Employer making payment of DSA withheld from salary.” The region is selected in the same way, the full name, address, SNILS and payment amount are entered. After this, a receipt or details are printed.

Note! The amount and deadline for making payments are not strictly defined, so a citizen has the right to make contributions of any size at any time. The Pension Fund privately recommends paying no more than once a month and at least once a year.

Copies of payment receipts are submitted to the local authority of the Pension Fund by the 20th day of the month following the expired quarter. It is necessary.

From earnings through an employer

A citizen submits an application in form DSV-1 to his employer. He forwards the received application within 3 working days to the local branch of the Pension Fund.

- Together with DSV-1, the employee submits a free-form application, where he indicates the amount of additional contributions in the form of a fixed amount or a percentage of the accrued salary. Changes in the amount of deductions, suspension or resumption of payment are made at the request of the employee.

- The employer calculates, withholds and transfers the relevant contributions. Payments are calculated and transferred monthly, starting from the next month after receipt of the application. Payment details on the Pension Fund of Russia website are located on the “Policyholder” button, in the drop-down menus “Payment as part of co-financing” and “Employer paying DSA from salary.”

Payment is made to the Pension Fund account in a single payment for all employees. Payment is due by the 15th of the next month. At the same time, a separate register for additional contributions is formed.The register contains:

- the total amount of funds transferred;

number and date of the payment order;

- SNILS numbers and full names of employees;

- the amount of payment for each employee;

- payment period.

- The employer provides a register of persons for whom additional contributions were paid to the Pension Fund department by the 20th day of the month following the quarter in which payments were made. The register is compiled according to the DSV-3 form.

The bank's stamp must be affixed to the document as confirmation of payment of contributions.

Reference! The amount of withheld and transferred additional contributions is indicated on the payslip when issuing wages. When an employee is dismissed, the corresponding payments stop.

Additional employer contributions

The employer has the right to make additional contributions in favor of those employees who are already making additional payments towards the funded part of their own pension. The decision on additional payments is formalized by a separate order , or an additional clause is added to the collective or employment agreement.

The amount of payments is determined by the employer on a monthly basis and is paid from the organization’s profits. Payment details on the Pension Fund website are located on the “Policyholder” button, in the drop-down menus “Payment as part of co-financing” and “Employer paying employer contributions in favor of the insured persons.”

Payment is made to the Pension Fund account in a single payment using a separate payment order. Payment is due by the 15th of the next month. A register regarding employer contributions is also formed. The form is identical to the register form for contributions withheld from salaries.

A register of persons in respect of whom additional contributions were made at the expense of the employer is provided to the local Pension Fund department. Deadline: until the 20th day of the month following the quarter in which payment was made. The register is compiled according to the DSV-3 form. When an employee leaves, the employer stops making payments.

Formation

In 2020, contributions to the funded part of the pension are optional, that is, a person has the right to send all funds to the insurance fund. Along with this, there are several ways to form a funded pension. These include:

- Transfer of additional insurance contributions at the initiative of the employee or the employer;

- Participation in state pension co-financing programs;

- Transfer of funds from maternity capital is acceptable for mothers of two children born after 2007.

Despite the fact that many citizens do not see the point in a funded pension, it can be used wisely to increase the amount in the account. To do this, you should choose a reliable but profitable fund.

Good to know! In case of early transfer from one non-state fund to another, the earned interest is lost, but the base amount is retained in its base form. Once every five years, it is permissible to change organizations without losing what you have accumulated.

Maximum and minimum amounts

The formation of the funded part of a pension is an ambiguous process, since it is important to take into account a number of nuances.

Firstly, in order to receive your savings upon retirement, you need their amount to be at least 5% of the insurance amount. Secondly, there are no restrictions on the amounts received by the fund towards the funded pension. If non-state funds establish their own programs for stimulating and increasing deposits, then the government department doubles contributions if the amount of funds received is at least two thousand. Note that the maximum doubling offered by the Pension Fund is twelve thousand rubles.

It is important to know! The program for doubling contributions conducted by the Pension Fund takes into account only contributions made personally by a citizen. Transfers from the employer are not taken into account.

Tariffs of additional insurance premiums

The DSA interest rate is determined in accordance with the working conditions of citizens. Thus, an expert assessment of the harmfulness and severity of the place of duty is necessary. Let us note that in accordance with Federal Law No. 426 on working conditions, if deficiencies have been identified, then before the next inspection the employer is obliged to do everything possible to eliminate them.

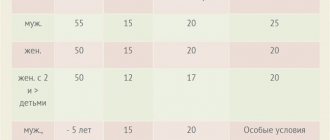

The percentage of wages transferred as an additional insurance premium depends on the degree of harmfulness and severity of working conditions. Let's look at the indicators in the table.

| Working conditions | Grade | Contribution amount, % |

| dangerous | 4 | 8 |

| harmful | 3,4 | 7 |

| harmful | 3,3 | 6 |

| harmful | 3,2 | 4 |

| harmful | 3,1 | 2 |

| acceptable | 2 | |

| optimal | 1 |

Based on the table, we can conclude that if, as a result of an audit, an enterprise is assigned an acceptable or optimal level of working conditions, then there is no need to transfer additional insurance premiums.

Good to know! An inspection of working conditions is carried out by the authorized body at least once every five years, but at the request of employees it can be initiated ahead of schedule.

Federal Law of December 28, 2013 N 426-FZ “On special assessment of working conditions”

Read also: Law on internship in 2020