What applies to non-insurance periods?

The non-insurance period can be called a period of time during which, due to socially significant reasons, an individual was not able to work. The Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, namely Article 12, contains an exhaustive list of non-insurance periods that can be included in the insurance period:

- completion of military service, as well as other service equivalent to it (coefficient 1.8);

- receipt of compulsory social insurance benefits during the period of temporary disability (coefficient 1.8);

- care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total (the coefficient for caring for the first child until he reaches the age of 1.5 years is 1.8; the coefficient for caring for the second child until he reaches the age of they are 1.5 years old - 3.4; the coefficient for caring for the third and fourth child until they reach the age of 1.5 years is 5.6);

- receipt of unemployment benefits, participation in paid public works and the period of moving or resettlement in the direction of the state employment service to another area for employment (coefficient 1.8);

- detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and serving their sentences in places of imprisonment and exile (coefficient 1.8);

- care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 (coefficient 1.8);

- residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total (coefficient 1.8);

- residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, but not more than five years in total (coefficient 1.8);

- the period of time included in the insurance period in accordance with the Federal Law “On Operational-Investigative Activities” dated August 12, 1995 No. 144-FZ (coefficient 1.8);

- the period of time during which persons who were unjustifiably prosecuted and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation (coefficient 1.8).

A mandatory legal requirement for calculating points for a non-insurance period is the presence of insurance coverage before and (or) after a socially significant period, i.e. a citizen cannot be unemployed and not registered with the Federal Labor and Employment Service.

Additional nuances

If the same time is associated with several places that are being counted, only one is chosen. To do this, the citizen draws up a written application. Breaks in work for calculating sick leave are practically irrelevant.

Any confirmation documents must include the following information:

- Work period.

- Description of the position.

- Address where duties were performed.

- Date of birth of the employee.

- FULL NAME.

- Number and date of issue.

The papers are usually transferred to the accounting department. Or another regulatory authority.

If the exact date is not indicated in the documents, then the countdown starts from the 15th. The average amount of compensation for temporary disability depends on the length of service during previous periods. The higher it is, the larger the payments. The highest rates are among those who, even with non-insurance periods, have worked for 5 years or more.

In any case, 100% will be paid to women who had maternity leave.

The more non-insurance periods, the lower the final amount of compensation will be.

Opening sick leave becomes an important point if your vacation coincides with illness. Without documents, it is impossible to confirm temporary disability. The validity of the documents begins from the first day of contacting doctors. And it doesn’t end until the issue itself is finally resolved.

Payment for sheets involves the following procedure:

- Calculate average earnings per day. We need to take the base for the previous two years, divide by the number 720.

- Next, calculate how much insurance experience you have.

- Benefits are being accrued, in a maximum of 10 days.

Features of accrual of insurance points

When calculating the coefficient for the non-insurance period, citizens who applied to the Pension Fund need to know that if they worked during such a period of time, then they have the right to choose the coefficient for calculating the pension: for the insurance period or for the non-insurance period.

For example, if the parent of a disabled child officially worked while caring for such a child, then he has the right to calculate and choose a more profitable option for himself. So, if one year of child care will bring 1.8 points, and one year of work will bring 4 points, then you can choose the more profitable option – 4 points.

The legislator also indicates that if several non-insurance periods coincide, the applicant must sum up the coefficients.

For example, if a parent is on legal leave to care for his first child and his second child is born, then it is necessary to sum up the coefficients: 1.8 + 3.4 = 5.2 points.

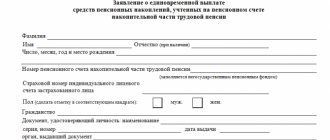

When a citizen applies to the Pension Fund, it is necessary to personally control the process of calculating and awarding points. If pension points are accrued incorrectly, they can be recalculated. To do this, submit an application in free form and documents confirming the disputed insurance and non-insurance periods.

When will refusal of payment for disability be legal?

In some situations, there is no payment for disability. usually due to the following situations:

- If the disease appeared during the validity of another document. For example, related to caring for a child or a sick relative.

- When problems arose during a vacation at your own expense.

- When illness coincided with maternity leave.

- When applying for sick leave. Then you can count on compensation in just a couple of days. This also applies if problems arose immediately after completion of training.

The main thing is to fill out all the cells on the sheet without going beyond the boundaries. Start with the first available free space. Use only black ink and block letters, even when filling out by hand. Or you can use modern technology.

Typically, information on non-insurance periods is filled out only by employers or their authorized representatives. It is important to prepare supporting documents correctly. The main requirement is that it can be seen that the information is related specifically to a specific citizen.

Entries in the work book must also comply with the rules and requirements of the law. The condition applies to any securities that continued to be valid for a specific period of time.

Converting salary into points

For your convenience, we have compiled a table for converting your salary into points, as well as converting points into real money that you will receive upon retirement.

The cost of the point is taken in 2020 prices (RUB 87.24)

From the table you will see what increase to your future pension you earned by working conscientiously all this year.

Table 4. Number of points depending on salary:

| Monthly salary, rub. | Salary per year, rub. | Number of points | Cost of points earned (increase in pension) |

| 10 000 | 120 000 | 1,043 | 90,99 |

| 11 280 | 135 360 | 1,177 | 102,68 |

| 15 000 | 180 000 | 1,565 | 136,53 |

| 20 000 | 240 000 | 2,087 | 182,07 |

| 25 000 | 300 000 | 2,609 | 227,61 |

| 30 000 | 360 000 | 3,130 | 273,06 |

| 35 000 | 420 000 | 3,652 | 318,60 |

| 40 000 | 480 000 | 4,174 | 364,14 |

| 45 000 | 540 000 | 4,696 | 409,68 |

| 50 000 | 600 000 | 5,217 | 455,13 |

| 60 000 | 720 000 | 6,261 | 546,21 |

| 70 000 | 840 000 | 7,304 | 637,20 |

| 80 000 | 960 000 | 8,348 | 728,28 |

| 100 000 | 1 200 000 | 9,13 | 796,50 |

| 120 000 | 1 440 000 | 9,13 | 796,50 |

| 150 000 | 1 800 000 | 9,13 | 796,50 |

| 200 000 | 2 400 000 | 9,13 | 796,50 |

| 300 000 | 3 600 000 | 9,13 | 796,50 |

conclusions

- Pension points are the amount of funds transferred into a certain cash equivalent that the employer pays for his employee to the pension fund. The amount of your pension benefit will depend on the number of points.

- The minimum pension amount for 2020 is 13.8. This figure is growing every year. The plan is to increase it to 30.

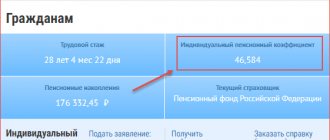

- By registering on the State Services website, you can find all the information you need about the number of your pension points and work experience.

- A number of citizens have additional reasons why they may be assigned points for a pension: wives of military personnel, consuls; persons caring for the disabled or elderly; mothers of one or more children; conscripted military personnel; citizens who have postponed their retirement.

- If there is a shortage of pension benefits to receive an insurance pension, you can buy them by making voluntary contributions to the Pension Fund.

- A dismissed pensioner will receive a recalculation of points no earlier than three months after submitting an application for calculation.

Features of non-insurance experience

The Pension Fund of the Russian Federation reminds that you can obtain complete and up-to-date information about your formed rights in your personal account on the official website of the Pension Fund of Russia, on the government services portal, in the mobile application of the Pension Fund of Russia, as well as in the client service of the MFC. This must be done regularly, since accounting for non-insurance periods has its own characteristics.

For example, periods of child care will be taken into account in non-insurance periods only if they were preceded and (or) followed by periods of work and (or) other activities (regardless of their duration), for which insurance premiums for compulsory pension insurance were paid. If a person has not worked before or after maternity leave, then he will not receive points for caring for children.

At the same time, all non-insurance periods - caring for children under 1.5 years of age, caring for disabled citizens, military service on conscription - are not counted in the insurance period, which gives the right to assign an early insurance pension for long-term work:

- 42 years for men;

- 37 years for women.

That is, you need to work for 44 years, excluding military service. But when calculating the amount of the insurance pension, all annual pension coefficients are summed up, including for non-insurance periods.

Source:Go

What determines the size of the pension?

When formulating pension payments, the following factors are taken into account:

- work experience;

- valorization amount;

- estimated pension capital;

- the amount of insurance contribution by the employer.

You can add points to the amount of work experience that depend on this value. By law, the pension amount is calculated by multiplying the number of points by the price of one and adding other values (increasing factor, fixed payments).

Until 2020, pension amounts were calculated as follows: the insurance portion was divided by the cost of the point.

How many points do you need to retire?

To receive pension insurance payments, you must meet one more rule. Legislation for 2020 established a requirement for a minimum insurance period of 10 years .

There are also requirements for points - the minimum number is 16,2.

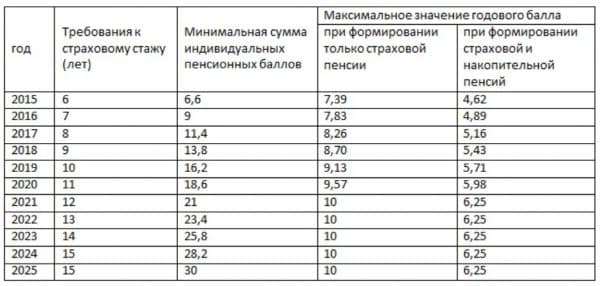

Features of calculating pensions in 2024

Every year the legislation puts forward new requirements and rules. Pension laws are changing completely. Even the formula for calculating points, as mentioned above, has completely changed. In 2014, in order to receive the insurance portion upon retirement, you must have at least 15 years of work experience.

To understand the speed of change, we suggest that you familiarize yourself with the data in the table, which shows the year of the pension reform and the length of service in years:

| Year of reform | Number of years of experience |

| 2015 | 6 |

| 2016 | 7 |

| 2017 | 8 |

| 2018 | 9 |

| 2019 | 10 |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

This table was taken from the website of the Pension Fund of the Russian Federation; on it you can see that every year from January 1, the work experience requirements increase by 1 year.

As of 2024, the minimum IPC for retirement should be 28.2, and the maximum 10 points per year. Men born in 1966 will be able to retire in 2024 at the age of 58 , and women born in 1971 at the age of 53 .

Sources

- https://journal.tinkoff.ru/guide/skolko-pensiya/

- https://pfrf-kabinet.ru/grazhdanam/pensionnye-bally.html

- https://www.klerk.ru/buh/articles/490904/

- https://bankiros.ru/wiki/term/pensionnye-bally

- https://promdevelop.ru/rabota/kak-nachislyayutsya-pensionnye-bally-skolko-nuzhno-nakopit-ballov-dlya-pensii-i-kak-ih-rasschitat/

- https://azbukapensii.ru/5-sposobov-uvelichit-pensionnye-bally-kak-nachisljajutsja-v-2018-godu.html

Concept

The insurance period is the total duration of all periods of labor and (or) other activity of a person.

A mandatory condition is the payment of insurance contributions during these periods to the Russian Pension Fund.

Labor (or other) activities not only on the territory of the Russian Federation, but also in other states can be counted in the insurance period. It is important:

- Compliance of activities abroad with current Russian legislation or its reinforcement by international treaties

- Mandatory insurance payments to the Pension Fund.

It is worth adding to this wording that contributions to the insurance part are not always tied to the formalization of the employment relationship. Let's give an example: an individual entrepreneur is not bound by an employment relationship, but independently transfers insurance premiums for himself to the pension fund account. His insurance period will include those time periods for which he transferred money. These periods will be calculated in proportion to the deposited funds.

Pension points for working pensioners

Most Russian citizens are in no hurry to leave work upon reaching retirement age. And in this case, it is important to understand how pension points are calculated for working pensioners.

Russians who continue to work after reaching retirement age have the opportunity to continue accumulating pension points. In one year they will be able to earn no more than three points, and this value has not changed for several years.

To accumulate maximum points, a pensioner must have a salary that will not be less than 24 thousand rubles per month. And in case of income above this amount, the person will be awarded the same three points.

To calculate the amount of the pension increase, the sum of points accumulated by the pensioner over his entire life and the value of the point at the time of the formation of the benefit are taken into account. Let's look at an example. A working citizen who is at retirement age earns 3 pension points per year. In 2020, 1 point is equal to 87.24 rubles. This means that for each year worked, the pensioner will receive an increase in the amount of 3 * 87.24 = 261.72 rubles. The amount is small but stable.

Periods for calculating the insurance period

The insurance period includes periods of work and other activities on the territory of the Russian Federation, provided that during these periods insurance contributions were paid to the Pension Fund of the Russian Federation. These are the so-called periods included in the insurance period. Insurance premiums for a citizen are paid by his employer. Therefore, the main feature of these periods included in the insurance period is that the citizen worked officially during these periods.

We invite you to read: Sick leave experience in 2020: how to calculate the insurance period

However, there are other periods when a citizen did not work and insurance contributions to the Pension Fund were not paid for him. Such periods can be counted towards the insurance period. These are the so-called “non-insurance periods” that are counted towards the insurance period. Those. When assigning an insurance pension, these non-insurance periods are also taken into account.

The concept of insurance experience is broader than labor experience. In the latter, a properly formalized employment relationship with the employee is accepted. To calculate the insurance period, you need to take into account:

- The time of military and equivalent service. Applicable to the penal system, police service, state drug control, fire service, etc.

- Time of forced incapacity for work with the obligatory condition of issuing sick leave, the payment of which also depends on the calculation of the insurance period.

- Child care (including guardianship) up to one and a half years old. If there are several such leaves, only 4.5 years will be included in the insurance period, even if the total was more.

- Periods of registration at employment agencies and receiving unemployment benefits, as well as periods of moving to a new place of work with a referral from a state employment agency.

- Terms of care for disabled people of group I, children with disabilities, as well as for elderly people aged 80 and older.

- Periods of unjustified detention in places of detention, as well as the time of repression during further rehabilitation.

- Cases when spouses of military personnel stayed at the place of service of the spouse liable for military service, without being able to get a job. Only 5 years of insurance experience are taken into account, even if there are more of them in total.

- Spouses of Russians sent by the state to work in other countries for diplomatic, business or representative purposes have the same rights.

- A maximum period of five years of such stay abroad can be counted in the calculation.

All eight cases presented above will be included in the insurance period under one condition: if immediately before or immediately after the indicated periods, work or other activities were carried out, from which insurance funds were transferred to the Pension Fund.

Who can I refuse a pension and what to do if I refuse?

If a citizen has not earned the required amount of IPC for his work activity, he will be denied an insurance pension. Once he reaches retirement age, he will only be able to claim social benefits. If you understand that PB is not enough to receive a decent pension, you can arrange for caring for a disabled person and receive up to two points annually (you cannot be officially employed or be on the labor exchange), or buy the necessary work experience.

Maximum points

At the end of each year, pension points are credited to the individual personal accounts of Russians, the number of which depends on the size of their salary. However, there is a limitation. No matter how high your salary is, you will not receive more than the maximum points.

Table 2. Maximum points:

| Year | Maximum points per year |

| 2015 | 7,39 |

| 2016 | 7,83 |

| 2017 | 8,26 |

| 2018 | 8,7 |

| 2019 | 9,13 |

| 2020 | 9,57 |

| 2021 onwards | 10 |

When do they recalculate a dismissed pensioner?

In 2020, the indexation of pensions was canceled for those citizens who continued to work after the benefits were calculated. In order for the amount of the payment to increase, you must apply for a calculation and become unemployed. If you are dismissed before August 1, the IPC will be recalculated. If a pensioner submits an application for dismissal before June 1, 2020, his insurance pension will be increased by approximately 304 rubles. A more accurate amount can be calculated using the IPB for 2020 and the current year.

Dependence of the minimum annual IPC amount on the insurance period

It now takes about 3 months to fully index pensions. Unfortunately, during these months, while information about a change in the pensioner’s status is received by the Pension Fund and processed there, no compensation is paid.

Upon repeated official employment, the pension amount will not be reduced, but indexation will not be carried out again until the moment of dismissal.

How much is a pension point worth in 2020?

The cost of 1 pension point in 2020 is 93 rubles . A fixed payment supplementing the amount of the insurance pension in 2020 is 5,686 rubles. 25 kopecks In the future, the value of the pension point, together with the additional amount, will be indexed by the state, taking into account inflationary processes and changes in the level of wages.

Dynamics of pension point value

| Year | Cost of pension point, in rubles |

| 2015 | 71,41 |

| 2016 | 74,27 |

| 2017 | 78,58 |

| 2018 | 81,49 |

| 2019 | 87,24 |

| 2020 | 93 |